Energy Drinks Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowEnergy Drinks Market Trends & Summary

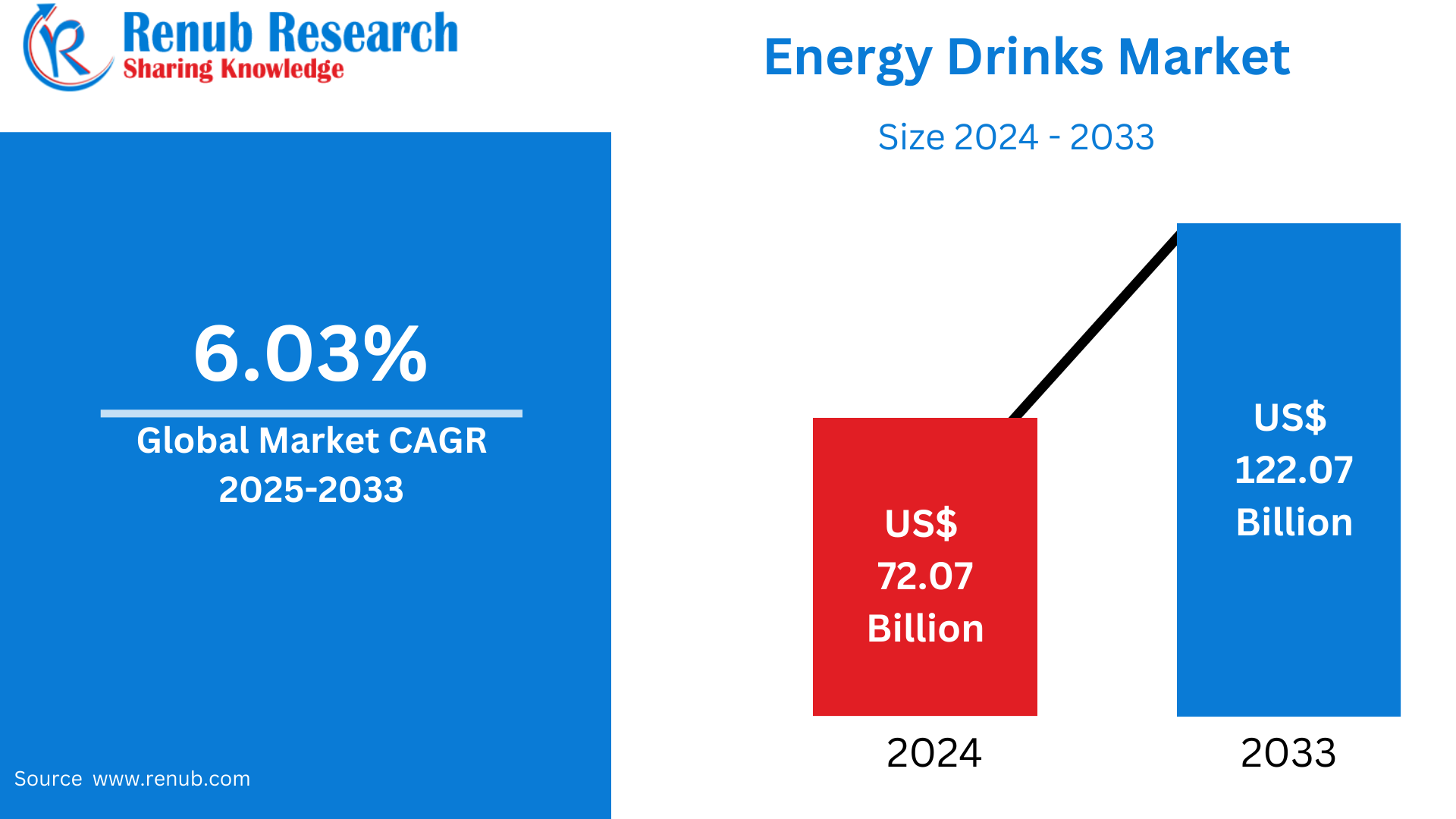

Energy Drinks Market is expected to reach US$ 122.07 billion by 2033 from US$ 72.07 billion in 2024, with a CAGR of 6.03% from 2025 to 2033. Growing health-conscious customers, hectic lives, the growth of e-commerce, the impact of sports and gaming, and new product offers with practical uses are all contributing factors to the market expansion for energy drinks.

The report Energy Drinks Global Market & Forecast covers by Product Type (Green Tea, Black Tea, Oolong Tea, Others) Packaging (Plastic Containers, Loose Tea, Paper Boards, Aluminum Tea, Tea Bags, Others) Application (Residential, Commercial) Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Stores, Others) Countries and Company Analysis, 2025-2033.

Global Energy Drinks Industry Overview

The growing need for instant energy solutions, particularly among young adults and working professionals, has propelled the global energy drink industry's significant expansion during the last ten years. From conventional energy drinks to more specialized alternatives like sugar-free, organic, and functional beverages, the industry is distinguished by a wide variety of items. Busy lives are connected to this rise in popularity, as customers look for easy solutions to increase energy, sharpen their attention, and improve their physical performance. Energy drinks containing extra vitamins, electrolytes, and natural ingredients have been developed in response to customer demand for better options as a result of growing health consciousness.

The quick expansion of e-commerce, which has made energy drinks more widely available, and the growing sway of the gaming, fitness, and sports communities are major factors propelling the worldwide market for energy drinks. Brands are using specialized marketing techniques to target these markets as e-sports competitions and sports sponsorships continue to expand. Further driving market expansion is innovation in tastes, formulas, and packaging. Manufacturers are reacting to market problems by producing functional beverages that provide hydration, concentration, and prolonged energy without adverse side effects, despite worries about the health implications of high caffeine and sugar levels.

In response to growing consumer health consciousness, the industry is seeing a noticeable trend toward healthier and more natural formulas. About 72% of UK customers stated in 2023 that they preferred energy drinks with natural components and related health advantages. In certain markets, this tendency is quite pronounced; in 2023, 81% of New Zealanders said they preferred organic food. In response, producers are lowering or doing away with chemical additives while introducing natural components like guarana, yerba mate, and green tea extract.

The industry is expanding geographically, especially in developing nations where consumption is being driven by urbanization and shifting lifestyles. In 2023, 652 million people lived in cities across Africa, opening up new markets for energy drinks. As demonstrated by Qatar, where 91% of customers participated in esports in 2022, the gaming and esports sector is also propelling growth in unanticipated markets. In order to satisfy a wide range of regional tastes while preserving worldwide brand consistency, energy drink firms are being forced to modify their product offerings and marketing methods in response to these demographic and lifestyle shifts.

Growth Drivers for the Energy Drinks Market

Urbanization and Hectic Lifestyles

The desire for quick, easy energy solutions has increased as urbanization develops and more people take on demanding personal and professional life. Energy drinks are becoming a popular choice for people who struggle to manage their hectic schedules, engage in strenuous physical activity, or work long hours. These drinks are particularly well-liked in hectic metropolitan settings because they offer a quick and convenient means of reducing weariness, boosting alertness, and improving productivity. People may readily take energy drinks during work breaks or while commuting, which fits in well with their on-the-go lifestyle. Energy drinks are becoming a necessary component of everyday routines for many people who want to maintain high energy levels and stay focused as urban populations grow and job demands increase.

Expanding Fitness and Sports Sector

Energy drinks are frequently used by athletes, fitness enthusiasts, and energetic people to improve their stamina and physical performance. These drinks are said to offer the nutrients and stimulants required to enhance exercise capacity and encourage recovery after a workout. There is a significant demand in this market since energy drinks are linked to improved sports performance and the desire to reach optimal physical condition. Because of this, energy drink producers deliberately target sporting events and fitness groups, using athlete endorsements to boost their brand recognition and appeal to this particular demographic.

Raising Awareness of Health and Wellbeing

Customers are prioritizing items that support their well-being objectives as a result of the growing knowledge of health and wellbeing. As a result, demand for healthy alternatives has shifted in the worldwide energy drink industry. These days, consumers are looking for energy drinks with natural components, less sugar, and extra vitamins or antioxidants. In response to this trend, manufacturers have launched drinks that provide more than just an energy boost. they include formulas that use organic components, herbal extracts, and adaptogens; they are thought to be better options than conventional energy drinks that contain artificial chemicals and a lot of sugar.

Challenges in the Energy Drinks Market

Consumer Shift Toward Healthier Alternatives

There is a discernible trend toward natural and functional beverages as consumers place a higher priority on health and wellbeing, which presents a problem for conventional energy drink producers. Alternatives with less sugar, no chemical additives, and natural constituents including vitamins, minerals, and plant-based extracts are in high demand. Demand for drinks that provide practical advantages like improved hydration, sharper thinking, and longer-lasting energy without the drawbacks of high caffeine and sugar levels is being driven by this trend. To meet the needs of the expanding health-conscious consumer segment, energy drink companies must respond to this change by coming out with better options, including organic energy drinks or ones with less ingredients.

Rising Intense Competition

Busy lives, more health consciousness, and a growing desire for functional beverages that provide rapid energy and mental alertness are driving the energy drink industry in the United States. Energy drinks are extensively used for their convenience and performance-enhancing qualities, making them popular among young adults, professionals, and fitness fanatics. A combination of well-known international brands and up-and-coming companies offering natural, low-sugar, and clean-label substitutes are present in the market. Marketing tactics frequently target tech-savvy, energetic consumers, such as athletes and gamers. Companies are concentrating on product innovation, such as plant-based formulations and additional health advantages, as the industry grows in order to satisfy changing consumer tastes. Demand is still high despite regulatory scrutiny and health concerns, driven by changing lifestyles and the need for better everyday performance.

United States Energy Drinks Market

The market for tea in the US has grown steadily due to rising customer demand for wholesome drinks with a wide variety of flavors. Due to its supposed health benefits, such as antioxidants and weight-management capabilities, tea—especially green, black, and herbal varieties—is becoming more and more popular. The growth of the industry, especially in cities, has been greatly aided by the popularity of specialized tea blends and ready-to-drink (RTD) tea. Additionally, as customers grow more conscious of sustainability and sourcing, there is an increasing demand for premium and organic teas. With over 159 million Americans consuming tea on any given day, the Census indicates that the US tea market is driven by an increasing number of health-conscious consumers. Growing consumer knowledge of functional drinks like detox and wellness teas is also advantageous to the business. However, coffee and other beverage categories compete with the U.S. tea business, making it difficult to grow its customer base.

United Kingdom Energy Drinks Market

The market for energy drinks in the UK is expanding steadily due to rising customer demand for fast energy boosts and improved mental clarity. Energy drinks have been more popular among professionals and young adults due to urbanization, hectic lives, and increased disposable incomes. Energy drink usage is on the rise as consumers look for beverages that improve performance and are convenient. Traditional energy drinks, sugar-free varieties, and those with extra functional components like vitamins and electrolytes are among the wide variety of goods that define the industry. Health-conscious customers are drawn to innovative flavors and formulas, which forces firms to launch new varieties to satisfy changing consumer tastes.

Energy drinks are becoming more widely available in gyms, convenience stores, and online platforms in the UK, expanding their distribution channels beyond traditional retail locations. Customers can now easily buy energy drinks because to this accessibility, which has further stimulated market expansion. Nonetheless, the business is confronted with obstacles pertaining to health issues, including the high levels of sugar and caffeine. Regulators are keeping a careful eye on these matters, and some areas have taken action to mitigate the possible health concerns connected to energy drink use. The market for energy drinks in the UK is nevertheless thriving in spite of these obstacles, thanks to constant innovation and customer preference adaption.

India Energy Drinks Market

India's market for energy drinks has grown significantly due to reasons including urbanization, increased disposable incomes, and growing health consciousness. Energy drinks are now readily accessible through a variety of retail channels, marking the market's transition from a niche to a mainstream product category. Young adults and professionals are increasingly using energy drinks as a result of consumers' need for beverages that offer rapid energy boosts and improved mental sharpness. Traditional energy drinks, sugar-free varieties, and those with extra functional components like vitamins and electrolytes are among the wide variety of goods that define the industry.

Both domestic producers and foreign brands are major participants in the Indian energy drink industry. To get a bigger piece of the expanding market, businesses are concentrating on distribution networks, marketing plans, and new product development. New brands and product variations have emerged in response to the growing popularity of energy drinks, meeting the varying demands and tastes of consumers.

Saudi Arabia Energy Drinks Market

Saudi Arabia's market for energy drinks is expanding significantly due to the country's youthful, urban population's growing interest in sports and fitness. Energy drinks are now more widely available nationwide because to the country's strong retail infrastructure, which includes large supermarket chains and convenience stores. Energy drinks are becoming more and more popular among young adults and professionals as a result of consumers' growing need for beverages that provide immediate energy boosts and practical advantages.

However, the industry confronts obstacles such health issues associated with high sugar and caffeine content, which is driving up demand for organic and sugar-free substitutes. Government rules have also affected market dynamics, such as a 50% sugar tax and limits on the number of energy drinks that each person is permitted to consume. Notwithstanding these obstacles, the Saudi Arabian market for energy drinks is still growing as businesses adapt to satisfy customer demands for more useful and healthful goods.

Energy Drinks Market Segments

Type – Market breakup in 2 viewpoints:

- Alcoholic

- Non-Alcoholic

Product – Market breakup in 3 viewpoints:

- Non-Organic

- Organic

- Natural

Packaging – Market breakup in 4 viewpoints:

- Plastic

- Glass

- Metal

- Others

End Users – Market breakup in 3 viewpoints:

- Kids

- Adults

- Teenagers

Gender – Market breakup in 2 viewpoints:

- Women

- Man

Distribution Channel – Market breakup in 5 viewpoints:

- Convenience Stores

- Foodservice

- Mass Merchandisers

- Supermarket

- Others

Country – Market breakup in 25 viewpoints:

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Developments

- Financial Insights

Company Analysis:

- Aje Group

- Red Bull

- Congo Brands

- Monster Beverage Corporation

- PepsiCo, Inc.

- National Beverage Corp

- Suntory Holdings Limited

- The Coca-Cola Company

- Campbell Soup Co.

- Amway Corporation

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Type, Product, Packaging, End User, Gender, Distribution Channel and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Energy Drinks Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Type

6.2 By Product

6.3 By Packaging

6.4 By End User

6.5 By Gender

6.6 By Distribution Channel

6.7 By Countries

7. Type

7.1 Alcoholic

7.2 Non-Alcoholic

8. Product

8.1 Non Organic

8.2 Organic

8.3 Natural

9. Packaging

9.1 Plastic

9.2 Glass

9.3 Metal

9.4 Others

10. End User

10.1 Kids

10.2 Adults

10.3 Teenagers

11. Gender

11.1 Women

11.2 Man

12. Distribution Channel

12.1 Convenience Stores

12.2 Foodservice

12.3 Mass Merchandisers

12.4 Supermarket

12.5 Others

13. Countries

13.1 North America

13.1.1 United States

13.1.2 Canada

13.2 Europe

13.2.1 France

13.2.2 Germany

13.2.3 Italy

13.2.4 Spain

13.2.5 United Kingdom

13.2.6 Belgium

13.2.7 Netherlands

13.2.8 Turkey

13.3 Asia Pacific

13.3.1 China

13.3.2 Japan

13.3.3 India

13.3.4 Australia

13.3.5 South Korea

13.3.6 Thailand

13.3.7 Malaysia

13.3.8 Indonesia

13.3.9 New Zealand

13.4 Latin America

13.4.1 Brazil

13.4.2 Mexico

13.4.3 Argentina

13.5 Middle East & Africa

13.5.1 South Africa

13.5.2 Saudi Arabia

13.5.3 United Arab Emirates

14. Porter's Five Forces Analysis

14.1 Bargaining Power of Buyers

14.2 Bargaining Power of Suppliers

14.3 Degree of Competition

14.4 Threat of New Entrants

14.5 Threat of Substitutes

15. SWOT Analysis

15.1 Strength

15.2 Weakness

15.3 Opportunity

15.4 Threats

16. Key Players Analysis

16.1 Aje Group

16.1.1 Overviews

16.1.2 Key Person

16.1.3 Recent Developments

16.1.4 Revenue

16.2 Red Bull

16.2.1 Overviews

16.2.2 Key Person

16.2.3 Recent Developments

16.2.4 Revenue

16.3 Congo Brands

16.3.1 Overviews

16.3.2 Key Person

16.3.3 Recent Developments

16.3.4 Revenue

16.4 Monster Beverage Corporation

16.4.1 Overviews

16.4.2 Key Person

16.4.3 Recent Developments

16.4.4 Revenue

16.5 PepsiCo, Inc.

16.5.1 Overviews

16.5.2 Key Person

16.5.3 Recent Developments

16.5.4 Revenue

16.6 National Beverage Corp

16.6.1 Overviews

16.6.2 Key Person

16.6.3 Recent Developments

16.6.4 Revenue

16.7 Suntory Holdings Limited

16.7.1 Overviews

16.7.2 Key Person

16.7.3 Recent Developments

16.7.4 Revenue

16.8 The Coca-Cola Company

16.8.1 Overviews

16.8.2 Key Person

16.8.3 Recent Developments

16.8.4 Revenue

16.9 Campbell Soup Co.

16.9.1 Overviews

16.9.2 Key Person

16.9.3 Recent Developments

16.9.4 Revenue

16.10 Amway Corporation

16.10.1 Overviews

16.10.2 Key Person

16.10.3 Recent Developments

16.10.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com