Global Dog Food Market – Growth Trends & Forecast 2025–2033

Buy NowDog Food Market Size and Forecast 2025-2033

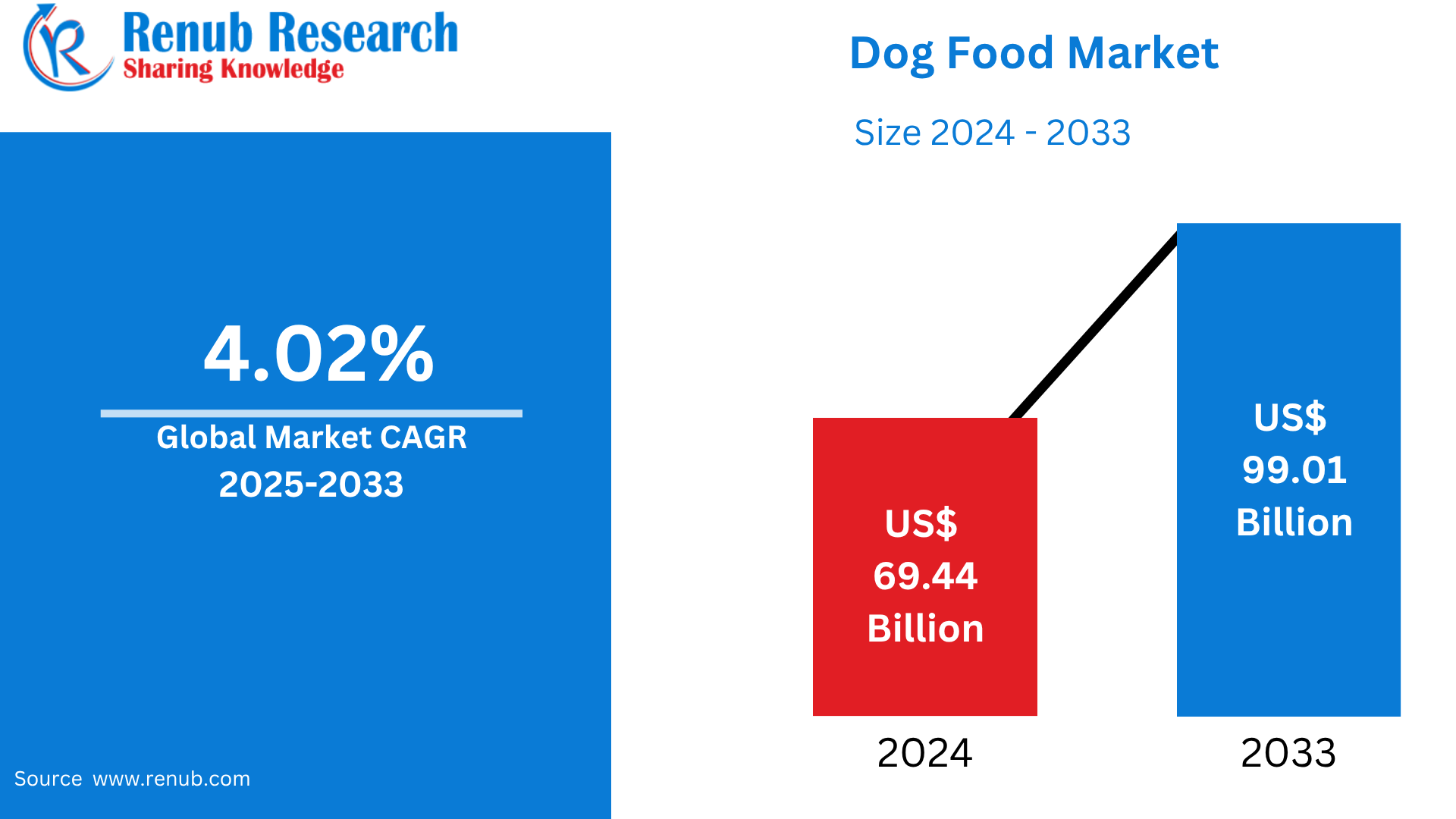

Dog Food Market is expected to reach US$ 99.01 billion by 2033 from US$ 69.44 billion in 2024, with a CAGR of 4.02% from 2025 to 2033. High rates of pet ownership, the growing humanization of pets, the growing desire for natural and high-quality ingredients, and the growth of e-commerce are the main factors driving the industry in the area.

Dog Food Global Market Report by Type (Wet Food, Dry Food, Snacks/Treats), Distribution Channel (Supermarkets &Hypermarkets, Specialty Stores, Online, Other distribution channels), Countries and Company Analysis, 2025-2033.

Global Dog Food Industry Overview

The growing demand for high-quality dog food, especially in urban areas, is the main factor driving the worldwide dog food industry. Furthermore, the growth of pet specialty shops and e-commerce makes buying easier, increasing accessibility and stimulating market demand. In addition, the market demand for functional and fortified meals is being greatly boosted by the increased understanding of pet nutrition and health. Additionally, the industry is stimulated by the variety of customer tastes drawn to novel flavors, textures, and specialist diets including breed-specific and grain-free formulations. For example, Meatly and The Pack introduced "Chick Bites," the first commercially accessible lab-grown meat dog treats, in the UK. Reducing the environmental effect of pet food production is the goal of this program. Additionally, pet owners can now afford more upscale and personalized dog food thanks to their growing discretionary income, which fuels market expansion.

The growing practice of adopting pets from shelters and rescues is driving the expansion of the dog food industry in the United States since it raises the need for wholesome food. Additionally, consumers who care about the environment are drawn to sustainable and eco-friendly pet food alternatives, such formulae made from plant or insect protein, which increases the market share of dog food. At the same time, sales of specialty and therapeutic pet food are driven by prescription diets and veterinarian advice, which increases market demand.

Additionally, convenience and customization provided by subscription-based pet feeding services are driving market expansion. Additionally, businesses are being pushed to employ traceable, premium ingredients due to growing concerns about food safety and transparency, which is helping the industry grow. In addition, pet owners' purchase decisions are greatly influenced by social media and influencer marketing, which drives the industry.

Key Factors Driving the Dog Food Market Growth

Growing Interest in Nutritious Dog Food

One of the main factors improving the outlook for the dog food business is pet owners' health-conscious attitudes. Because they are worried about their dogs' health and are looking for solutions that address certain issues like obesity, diabetes, and food allergies in pets, dog owners spend the majority of their pet budget on dog food. In addition, producers are spending more money growing their businesses to provide a variety of specialty goods, including ones with practical advantages like improved coat condition, digestive health, and immunity. To increase output by 66%, Nestlé, for example, announced in October 2023 that it would be establishing two additional manufacturing units at its Purina pet food facility in Hungary.

With the expansion, the facility's yearly production capacity will rise from around 150,000 metric tons to 250,000 metric tons. Additionally, as dogs prefer goodies over other pets, several manufacturers are now providing distinct treats. Dog food treats serve three primary roles, including incentive systems, dental care, and training. In the upcoming years, it is expected that the development of novel and healthful dog food varieties would increase the market share of dog food.

Developments in Technology

The market as a whole is looking well because to continuous technological developments in dog food production and packaging. A greater range of pet foods with better nutritional content and longer shelf lives are being produced thanks to the use of contemporary technologies into manufacturing procedures. For example, during Global Pet Expo 2024, which took place in Orlando from March 20 to 22, BrightPet Nutrition Group debuted a new brand presence for its Blackwood pet nutrition line. In addition to a new identity for Blackwood's Oven Baked Bites, the redesign comes before the firm introduces a number of new products later this year, including new meal toppers, freeze-dried, single ingredient treats, and granola treats.

With improved formulas, the new packaging designs for the Blackwood collection seek to convey to customers freshness, quality, and health advantages. In addition, a number of prominent market participants are reducing their environmental effect by using sustainable packaging materials, such as recyclable or biodegradable plastics, which is helping the dog food market prediction.

Growing Numbers of Dog Owners

The growing trend of dogs becoming family members is driving significant development in the worldwide dog food industry. This change has led to a significant rise in pet ownership throughout the world. Out of all pets, dogs are the most commonly adopted pets worldwide by pet owners. In 2022, pet food makers had the highest market value of USD 80.03 billion, which accounted for the whole global dog market share. Additionally, a prognosis indicates that in 2029, the market value would rise to USD 156.60 billion. Additionally, as dogs make up a larger portion of the population and their nutritional needs surpass those of other pets, dog owners have shifted from cooking at home to using commercial pet food alternatives.

Furthermore, according to published statistics, there were 604.5 million dogs and 408.2 million cats in the globe in 2022. The market trends for dog food are greatly impacted by pet owners' increased knowledge of canine health.

Challenges in the Dog Food Market

Changing Consumer Preferences

Grain-free, organic, natural, and raw food diets are becoming more and more popular, and consumer tastes in the dog food industry are changing quickly. Dog owners are increasingly adopting human food trends for their pets and treating them like members of the family. This change calls into question conventional dog food recipes that include grains and processed products. To satisfy the new standards, manufacturers must rework their goods using different proteins, fewer additives, and clear labeling. Finding innovative, high-quality ingredients and modifying production methods, however, may be expensive and difficult. Companies also need to make sure that these new formulas still adhere to nutritional guidelines. While brands that change must contend with preserving product affordability, safety, and consistency in a cutthroat market, those that don't risk becoming obsolete.

Market Saturation and Competition

Due to the growth of businesses offering a wide range of products that cater to certain health needs, life phases, and dietary preferences, the dog food industry is becoming extremely saturated. Competition is heightened by this saturation, making it more challenging for tiny or new firms to get recognition and patronage. Bigger businesses control advertising and store space, which forces up-and-coming brands to stand out and innovate. To keep their market share, even well-established companies need to constantly adapt. Strong branding, distinctive value propositions, and open marketing are necessary to stand out in such a saturated industry. Long-term retention tactics are further complicated by the ease with which trends, reviews, or suggestions from influencers can affect customer loyalty. As a result, there is intense competition, narrow profit margins, and significant marketing expenses.

Dog Food Market Overview by Regions

The market for dog food differs by area, with Asia-Pacific seeing significant expansion due to expanding pet ownership, Latin America and the Middle East demonstrating growing interest in reasonably priced, nutrient-dense products, and North America and Europe leading in luxury product demand. The following provides a market overview by region:

United States Dog Food Market

Due to high pet ownership rates and the increasing humanization of dogs, the dog food business in the United States is both established and rising. Grain-free, organic, and breed-specific formulas are among the high-end, natural, and useful goods that consumers are increasingly looking for to promote the health and welfare of their dogs. Product innovation and marketing tactics are being influenced by the movement toward ethical manufacturing, sustainable sourcing, and clean labeling. Due to its ease and subscription-based business models, e-commerce is still growing in popularity among pet owners with hectic schedules. Consumer knowledge of food safety and transparency has also increased as a result of product recalls and regulatory scrutiny. Brands that put quality, trust, and customization first continue to find success in this dynamic and very interested market, even in the face of fierce competition.

United Kingdom Dog Food Market

The dog food industry in the UK is undergoing a dramatic shift due to shifting customer tastes and an increased emphasis on sustainability and pet health. Pet owners are increasingly looking for high-end, natural, and specialty solutions that address certain health issues, such digestive health and weight control. Reflecting larger environmental concerns, this change is accompanied by an increase in demand for sustainable ingredient sourcing and eco-friendly packaging. The retail industry is adjusting to these developments, with online platforms becoming more and more popular because of their convenience and individualized services, while traditional stores are increasing the variety of pet food they provide. The market is still expanding in spite of economic challenges, suggesting that the pet business in the UK is a robust and changing sector.

The rise in pet ownership, particularly in 2021, significantly fueled industry expansion. Approximately 2 million people in the United Kingdom adopted a pet during lockdown, according to the Pet Health of Animals Organization, suggesting a trend toward pet ownership. Customers are increasingly drawn to high-end, natural, and functional dog food, emphasizing health advantages like improved joint support and digestion. Additionally, the growth of e-commerce platforms has made high-quality dog food more accessible, which has accelerated market penetration.

India Dog Food Market

The market for dog food in India is expanding quickly due to factors including growing disposable incomes, urbanization, and pet adoption. The demand for premium, wholesome dog food products has increased as more urban people adopt dogs as part of the family. Commercial dog food is replacing traditional home-cooked meals as pet owners grow more concerned about the nutrition and health of their animals. The availability of specialty items that meet different dietary requirements, such as grain-free, high-protein, and organic alternatives, further supports this shift. E-commerce platforms, which offer ease and access to a variety of dog food items, are also growing in the industry.

United Arab Emirates Dog Food Market

The market for dog food in the United Arab Emirates (UAE) is expanding significantly due to rising pet ownership, especially among expats, and a change in perspective toward considering dogs as members of the family. The demand for high-end, natural, and specialty dog food products—such as grain-free, organic, and raw diets—has increased as a result of this humanization trend. Customers are looking for solutions that support general well-being and address particular dietary requirements as they become more health conscious. Online buying is also on the rise in the industry, and e-commerce platforms are becoming more and more well-liked because of their accessibility and ease of use. Furthermore, the UAE's extensive digital infrastructure and high internet penetration rate foster the expansion of online pet food sales by providing discriminating pet owners with a multitude of choices.

Recent Developments in Dog Food Industry

- In June 2024, the investment firms 500 Global and First Move gave USD 500,000 as a startup investment to Notti Pet Food. With the money it has received, the business plans to develop new product lines and reach the markets of Singapore and the Philippines.

- Under their well-known pet health brand, Bowlers from Allana debuted Nutrimax, a fresh-new, innovative kind of dog food, in April 2024. The cutting-edge product line targets a pet market niche that is committed to offering complete, nutrient-dense meals that preserve exceptional food quality.

Market Segmentations

Type

- Wet Food

- Dry Food

- Snacks/Treats

Distribution Channel

- Supermarkets &Hypermarkets

- Specialty Stores

- Online

- Other distribution channels

Regional Outlook

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

All the Key players have been covered

- Overview

- Key Persons

- Recent Development & Strategies

- Revenue Analysis

Company Analysis:

- ADM

- General Mills Inc.

- Heristo Aktiengesellschaft

- Mars Incorporated

- Nestle

- PLB International

- Schell & Kampeter Inc.

- The J. M. Smucker Company

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Type, By Distribution Channel and By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Dog Food Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Dog Food Market Share Analysis

6.1 By Type

6.2 By Distribution Channel

6.3 By Countries

7. Type

7.1 Wet Food

7.2 Dry Food

7.3 Snacks/Treats

8. Distribution Channel

8.1 Supermarkets &Hypermarkets

8.2 Specialty Stores

8.3 Online

8.4 Other distribution channels

9. Countries

9.1 North America

9.1.1 United States

9.1.2 Canada

9.2 Europe

9.2.1 France

9.2.2 Germany

9.2.3 Italy

9.2.4 Spain

9.2.5 United Kingdom

9.2.6 Belgium

9.2.7 Netherlands

9.2.8 Turkey

9.3 Asia Pacific

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 South Korea

9.3.5 Thailand

9.3.6 Malaysia

9.3.7 Indonesia

9.3.8 Australia

9.3.9 New Zealand

9.4 Latin America

9.4.1 Brazil

9.4.2 Mexico

9.4.3 Argentina

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.2 UAE

9.5.3 South Africa

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 ADM

12.1.1 Overview

12.1.2 Key Persons

12.1.3 Recent Development & Strategies

12.1.4 Revenue Analysis

12.2 General Mills Inc.

12.2.1 Overview

12.2.2 Key Persons

12.2.3 Recent Development & Strategies

12.2.4 Revenue Analysis

12.3 Heristo Aktiengesellschaft

12.3.1 Overview

12.3.2 Key Persons

12.3.3 Recent Development & Strategies

12.3.4 Revenue Analysis

12.4 Mars Incorporated

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Recent Development & Strategies

12.4.4 Revenue Analysis

12.5 Nestle

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Recent Development & Strategies

12.5.4 Revenue Analysis

12.6 PLB International

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Recent Development & Strategies

12.6.4 Revenue Analysis

12.7 Schell & Kampeter Inc.

12.7.1 Overview

12.7.2 Key Persons

12.7.3 Recent Development & Strategies

12.7.4 Revenue Analysis

12.8 The J. M. Smucker Company

12.8.1 Overview

12.8.2 Key Persons

12.8.3 Recent Development & Strategies

12.8.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com