United States Pet Food Market Report Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States Pet Food Market Trends & Summary

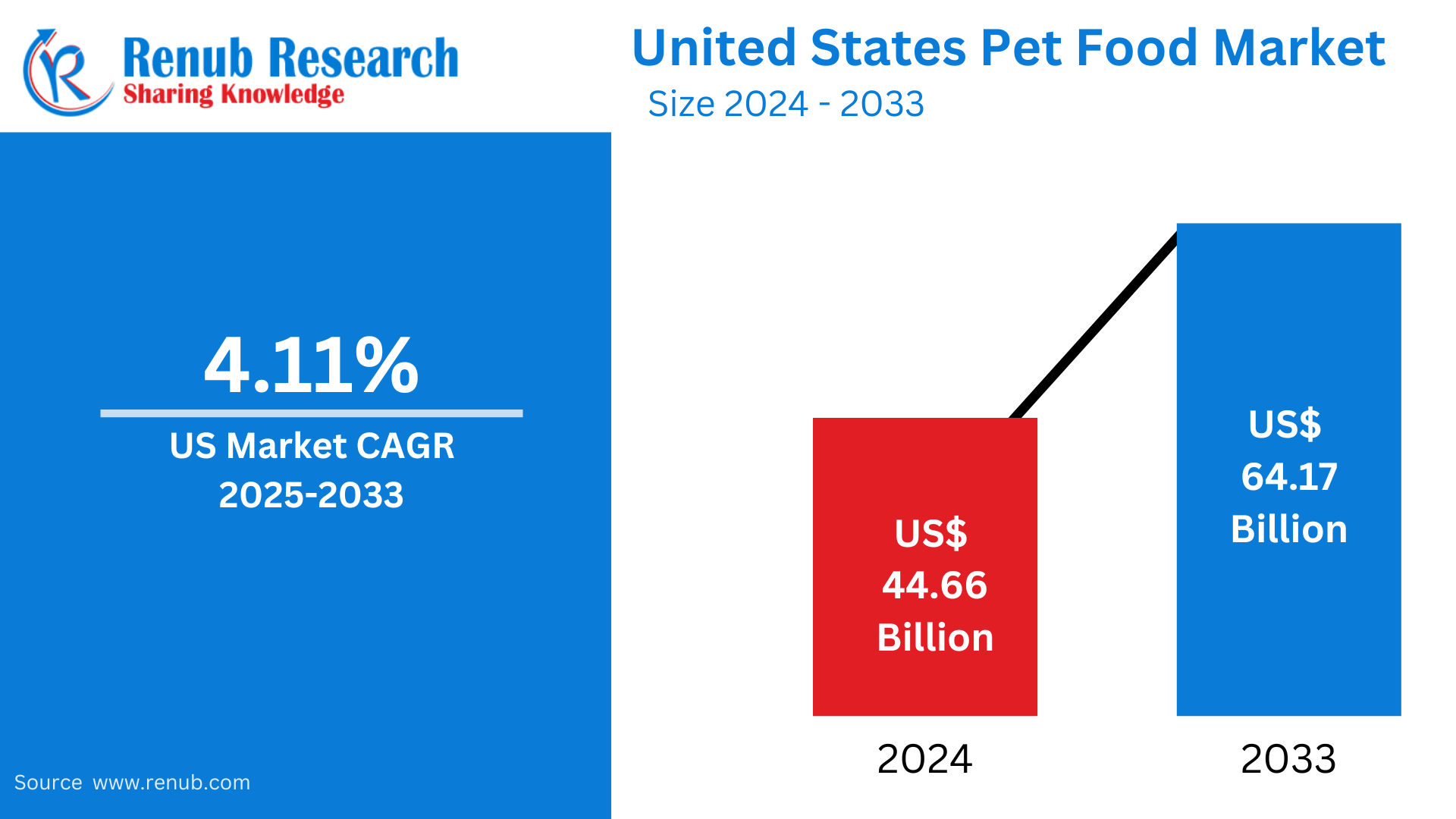

The United States pet food market is expected to grow at an impressive rate, reaching US$ 64.17 billion in 2033 from US$ 44.66 billion in 2024. This expansion is facilitated by a strong CAGR of 4.11% between 2025 and 2033. Growing pet ownership, the need for premium and organic pet food, and an increased interest in pet health and wellness are major drivers propelling this market growth.

United States Pet Food Market Report by Dog Food ( Dry Food, Wet Food, Snacks & Treats, and Others), Cat Food ( Dry Food, Wet Food, Snacks & Treats, and Others), Other Pet ( Dry Food, Wet Food, Snacks & Treats, and Others), Distribution Channel ( Supermarkets and Hypermarkets, Specialized Pet Shops, Online Sales Channel, and Others), and Company Analysis 2025-2033

United States Pet Food Market Outlooks

Pet food is specially prepared food aimed at addressing the dietary requirements of domesticated pets, e.g., dogs, cats, birds, and small mammals. Pet food is available in a range of forms, namely dry kibble, wet canned food, freeze-dried foods, and raw foods. Pet food is usually supplemented with essential nutrients, vitamins, and minerals to ensure pets' health and well-being. High-end pet food brands also focus on natural, organic, and grain-free ingredients to appeal to health-conscious pet owners.

In the United States, consumption of pet food is a dynamic market, fueled by rising numbers of pet-owning homes. Pet owners are currently spending higher amounts on quality, specialty pet food products that reflect their pet's individual health needs, such as weight management, allergies, or age. The pet humanization, wherein pet owners consider their pets as family members, has also contributed to the demand for high-quality, gourmet, and specialty pet food products, thereby driving overall market growth.

Growth Drivers in the United States Pet Food Market

Humanization of Pets

Growing pet humanization is a key driver of the U.S. pet food market. Pet owners are increasingly treating pets as family, resulting in high demand for high-quality and natural pet food brands. Brands selling organic, grain-free, or custom-formulated foods based on the pet's health requirements are in high demand. The same has contributed to growth in the specialty and gourmet pet food segment, with pet owners ready to spend more money on high-end products to secure the health and longevity of their pets. As of 2024, 66% of U.S. households, or 86.9 million homes, own a pet, including 65.1 million with dogs, 46.5 million with cats, and others with fish, small animals, and birds. High disposable income is driving market growth, with the American Pet Products Association (APPA) reporting $123.8 billion spent on pets in 2022, including $58.1 billion on pet food and treats. Higher expenditures on pet food and wellness items are also driving market growth.

Pet Health and Wellness Focus

U.S. pet owners are increasingly health-conscious about what they feed their pets, which is driving demand for functional and nutritional pet food. Products that address specific needs, including weight control, joint care, or food sensitivities, are becoming more popular. In addition, the increasing prevalence of pet obesity and chronic disease has fueled the need for veterinary-prescribed or therapeutic pet foods, adding to market growth for specialty pet food formulations. April 2024, Cymbiotika introduces a new pet line with four supplements: Probiotic+, Calm, Hip & Joint, and Allergy & Immune Health. Each product utilizes high-quality ingredients to ensure peak pet health, says the CEO and cofounder.

Rise of E-commerce and Online Platforms

The rapid growth of e-commerce has transformed the pet food market in the U.S. Online platforms offer convenience, subscription services, and access to a wide range of products. Many pet owners now prefer online shopping for its flexibility, doorstep delivery, and discounts. Big players such as Amazon, Chewy, and Walmart have invested in this trend, providing easy-to-use platforms with individualized suggestions, allowing consumers to shop for pet food frequently. October 2024, Stella & Chewy's is launched an e-commerce direct-to-consumer website with almost 100 freeze-dried raw products, treats, and kibble for pets.

Challenges in the United States Pet Food Market

Unpredictable Raw Material Costs

The raw material price fluctuations for pet foods pose challenges to the industry, including meat, grains, and other raw materials. Increased production costs due to supply chain losses, inflation, and weather-related disruptions can have a bearing on costs, prompting producers to either hike prices or lower margins. These price movements present challenges for brands, especially niche players, in keeping up competitive pricing without any compromise on quality, thus threatening market growth.

Regulatory Compliance and Quality Standards

Tight regulations and quality controls in the U.S. are challenging for pet food companies. Organizations such as the FDA and AAFCO require extensive testing, labeling, and ingredient safety measures, which add to the cost of production and make product development difficult. Non-compliance might result in recalls, litigation, and reputational loss. The smaller manufacturers, in this case, might find it difficult to deal with these stringent guidelines, which restrict their capacity to compete in the market.

United States Dog Pet Food Market

The United States dog pet food market is the largest pet food segment, propelled by the premiumization trend and the strong incidence of dog ownership. Pet owners are becoming more particular in choosing products suited to their pet's needs, i.e., size, age, or special diets. Functional foods, particularly joint and weight control foods, are on the rise. Moreover, raw and freeze-dried diets, which replicate a natural dog diet, have been increasingly in demand. The growth of the dog food segment is driven by pet owners' willingness to spend on high-quality, healthy food for their pets. In 2023, Royal Canin introduced the SKINTOPIC range for dogs with atopic dermatitis, and Mars Incorporated strengthened its premium portfolio by acquiring Champion Pet Food. Growing research and development investments are being seen, for example, Mars's 2023 collaboration with the Broad Institute to develop an open-access dog and cat genome database for more accurate precision medicines and diets.

United States Dog Dry Food Market

Dry dog food, or kibble, is still a leading segment in the U.S. pet food market because of its convenience, low cost, and long shelf life. This segment appeals to broad tastes, from simple formulas to premium and grain-free varieties. Most dry dog foods are fortified with vitamins, minerals, and probiotics for added nutritional benefit. Owners love the convenience of storage and feeding that kibble offers. Increasing demand for custom formulas, such as breed- or life-stage-specific dry food, is also fueling growth and innovation in this category. December 2024, Kismet, a high-end pet lifestyle company, has introduced its dry foods and treats on Chewy, bringing its products to pet families nationwide.

U.S. United States Cat Food Market

The United States cat food market is growing, fueled by increasing cat ownership and growing attention to feline-specific nutritional requirements. Wet cat food, which is known for its palatability and hydration value, is especially well-liked, but dry cat food is still a convenient and affordable option. Pet owners are increasingly looking for high-protein, grain-free, and natural foods to satisfy their cats' nutritional requirements. Cat food that is specifically designed for particular health issues, such as urinary tract health or weight management, is also becoming popular, which adds to the overall growth of this category. February 2025, Fancy Feast launched Gems, a new offering to enrich the eating experience for cats. Based on research from Purina scientists, Gems offers a pyramid of paté with gravy on top, enabling cats to savor every bite and making it easy, mess-free packaging for the owner.

United States Cat Snacks & Treats Food Market

The U.S. cat snack and treat market is growing at a very rapid pace, driven by the increasing trend of pet owners rewarding their cats and employing treats for training or bonding. Product lines like dental chews, high-protein treats, and grain-free snacks are in vogue. Functional treats, which offer health advantages such as dental care, hairball management, or joint support, are becoming popular among health-conscious cat owners. Moreover, freeze-dried and gourmet treats are becoming increasingly popular as pet owners opt for top-tier alternatives to spoil their cat pets. Oct 2023, CULT Food Science Corp. has brought out Noochies! Freeze Dried Cat Snacks, North America's first vegan cat treats, completely devoid of animal ingredients.

United States Specialized Pet Shops Market

Specialized pet stores in the U.S. are essential to the pet food industry as they provide a carefully curated array of premium, natural, and specialty foods. Specialized pet stores tend to offer individualized recommendations, expert guidance, and a distinctive shopping experience that is different from the mass retailers. Consumers shop at specialized pet stores to source high-quality, niche foods like raw diets, therapeutic foods, and green-friendly foods. The increasing need for customized pet care options has supported these stores' viability, as much as the growth of e-commerce.

United States Online Pet Food Market

The U.S. online pet food market has also grown very rapidly with the availability and convenience offered by e-commerce sites. Major retailers such as Chewy, Amazon, and Walmart dominate the market with great selections of products, competitive pricing, and subscription services. Internet platforms enable consumers to compare brands, read customer reviews, and enjoy doorstep delivery. Subscription formats, which guarantee constant replenishment of pet food stocks, have proved especially well-liked. The COVID-19 pandemic further hastened the move to online shopping, cementing e-commerce as a leading channel for pet food sales in the U.S.

United States Pet Food Market Segments

Animal Type: United State Food Market breakup from two viewpoints

Dog Food – Market breakup from 4 viewpoints

- Dry Food

- Wet Food

- Snacks & Treats

- Others

Cat Food - Market breakup from 4 viewpoints

- Dry Food

- Wet Food

- Snacks & Treats

- Others

Other Pet- Market breakup from 4 viewpoints

- Dry Food

- Wet Food

- Snacks & Treats

- Others

Distribution Channel – Market breakup from 4 viewpoints

- Supermarkets and Hypermarkets

- Specialized Pet Shops

- Online Sales Channel

- Others

Key Players Analysis:

- Business Overview

- Key persons

- Recent Development & Strategies

- Product Portfolio

- Revenue

Company Analysis:

1. J.M Smucker

2. General Mills (Blue Buffalo)

3. Tyson Foods

4. Colgate Palmolive

5. DS Holdings, Inc.

6. Central Garden & Pet

7. Nestle

8. Archer Daniels Midland

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Pet Type, Food Type and Distribution Channel |

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size of the U.S. pet food market by 2033?

-

What are the main growth drivers for the U.S. pet food market?

-

How does the humanization of pets influence the pet food market in the U.S.?

-

What are the challenges facing the U.S. pet food market in the coming years?

-

How does the rise of e-commerce impact the pet food industry in the U.S.?

-

Which animal types are the largest contributors to the U.S. pet food market?

-

What are the trends in dog food consumption in the U.S.?

-

How has the growing focus on pet health and wellness influenced pet food demand?

-

What types of pet food are gaining popularity in the U.S. market?

-

Which companies are leading the U.S. pet food market?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenge

5. United States Pet Food Market

6. United States Pet Food Market - Share Analysis

6.1 Pet Type

6.2 Food Type

6.3 Distribution Channel

7. Pet Type

7.1 Dog

7.2 Cat

7.3 Others

8. Food Type

8.1 Dry Food

8.2 Wet Food

8.3 Snacks & Treats

8.4 Others

9. Distribution Channel

9.1 Supermarkets and Hypermarkets

9.2 Specialized Pet Shops

9.3 Online Sales Channel

9.4 Others

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 J.M Smucker

12.1.1 Business Overview

12.1.2 Key persons

12.1.3 Recent Development & Strategies

12.1.4 Product Portfolio

12.1.5 Revenue

12.2 General Mills (Blue Buffalo)

12.2.1 Business Overview

12.2.2 Key persons

12.2.3 Recent Development & Strategies

12.2.4 Product Portfolio

12.2.5 Revenue

12.3 Tyson Foods

12.3.1 Business Overview

12.3.2 Key persons

12.3.3 Recent Development & Strategies

12.3.4 Product Portfolio

12.3.5 Revenue

12.4 Colgate Palmolive

12.4.1 Business Overview

12.4.2 Key persons

12.4.3 Recent Development & Strategies

12.4.4 Product Portfolio

12.4.5 Revenue

12.5 SPECTRUM BRANDS HOLDINGS, INC.

12.5.1 Business Overview

12.5.2 Key persons

12.5.3 Recent Development & Strategies

12.5.4 Product Portfolio

12.5.5 Revenue

12.6 Central Garden & Pet

12.6.1 Business Overview

12.6.2 Key persons

12.6.3 Recent Development & Strategies

12.6.4 Product Portfolio

12.6.5 Revenue

12.7 Nestle

12.7.1 Business Overview

12.7.2 Key persons

12.7.3 Recent Development & Strategies

12.7.4 Product Portfolio

12.7.5 Revenue

12.8 Archer Daniels Midland

12.8.1 Business Overview

12.8.2 Key persons

12.8.3 Recent Development & Strategies

12.8.4 Product Portfolio

12.8.5 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com