Canada Pet Food Market, Size, Share, Insight, Growth, Forecast 2024-2030, Industry Trends, Top Companies Analysis

Buy NowCanada Pet Food Market Outlook

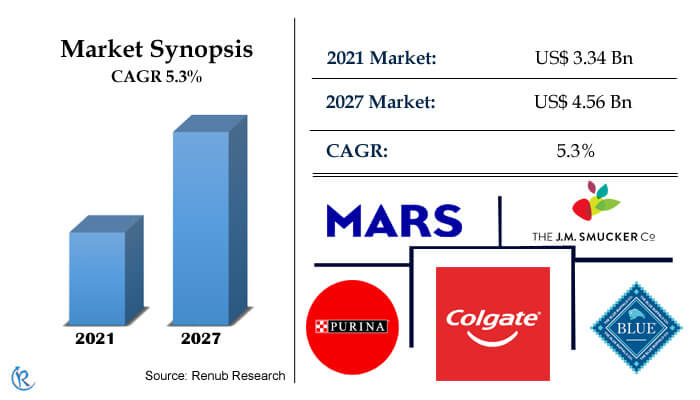

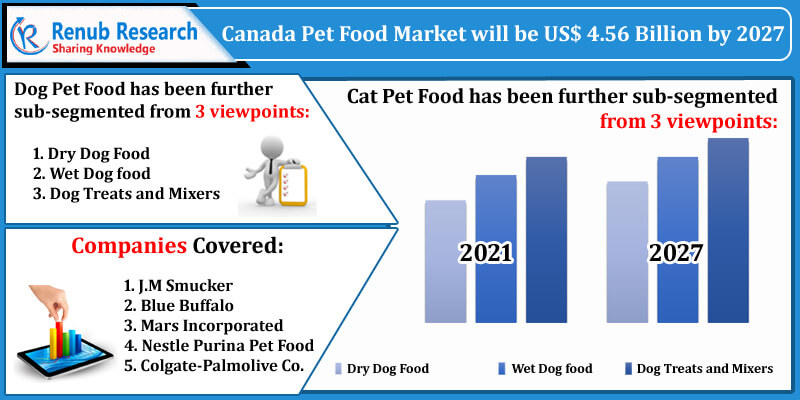

Canada Pet Food Market is expected to reach US$ 4.56 Billion by 2027. In Canada, Pets plays a vital role in people's heart. For years, pets, primarily dogs and cats, have been great companions for the Canadian people. In the last five years, the pet population has been rising due to ageing, and young people are adopting more pets and ownership for pet is becoming trends a nowadays. This is one of the growth factors for the pet food manufacturing company to launch new products in the Canadian market. For instance, from Jan 2016 to Dec 2020, 259 and 167 pet food products were launched in Canada, with the most significant number of introductions occurring in dog snacks and treats.

Canada Pet Food Industry is expected to grow with a CAGR of 5.3% from 2021 - 2027

According to our research Fish and Cats account for more than 8 Million of the total pet population, whereas Dogs account for more than 7 Million for the year 2020. Cats and dogs remain the primary focus of the pet food industry as tropical and other pet's likes, fish, indoor birds, small mammals, including guinea pigs, rabbit's ferrets and rodents, are not as popular amongst Canadian pet owners. Nevertheless, there is less interest in unusual pets, leading to slow but stable market growth in retail sales in other pet food. Growth in pet populations, ownerships, and pet food retail sales domestically and internationally allows Canadian pet food producers to maintain and increase their presence and distinct brand image within domestic and global markets.

Dog Food has the Highest Pet Food Market in Canada

Based on Food types, Dog food was the leading pet food with retail sales. Despite Cat population and ownership levels are more extensive than that of dogs. As pets' appropriate healthcare and nutrition are of primary concern, owners often seek pet food; treat containing more ingredients and proteins. Canadian pet owners are willing to spend on beauty products or accessories, such as toys and clothing, and personalized products and technology such as GPS trackers and smart dog houses.

Dry dog food was the largest market in total dog food sales. Dog treats and mixers attained growth and are expected to increase in the forecast period as owners offer their pet’s snacks. Whilst premiumization continues to drive growth, Canadian cat owners are value-conscious and less willing to pay a higher price for cat food than dog owners paying for dog food. Go! Solutions company launched Carnivore, a newly repositioned collection of protein-rich kibble for cats, formerly known as Go! Fit + Free.

Canada Pet Food Market Size was US$ 3.34 Billion in 2021

Canada Pet food market was distributed primarily through store-based retail channels, while the remaining pet food sales were distributed via e-commerce and Veterinary clinics. With the emergence of covid-19 and more at-home living and working, e-commerce increased its distribution channel in 2020. The top five pet food companies in Canada are J.M Smucker, Blue Buffalo, Mars Incorporated, Nestle Purina Pet Food and Colgate-Palmolive Co.

Renub Research latest report “Canada Pet Food Market, By Animal Type (Dog Pet Food, Cat Pet Food and Others Pet Food [Bird, Fish $ Small Mammals/Reptiles]), Dog Pet Food (Dry Dog Food, Wet Dog Food and Dog Treats and Mixers Food), Cat Pet Food (Dry Cat Food, Wet Cat Food and Cat Treats and Mixers Food), Distribution Channels (Store-based Retailing, Online and Veterinary Clinics), Companies (J.M Smucker, Blue Buffalo, Mars Incorporated, Nestle Purina Pet Food and Colgate-Palmolive Co)” provides a detailed analysis of Canada Pet Food Industry.

Animal Type - Pet Food Market has been covered from 3 viewpoints:

1. Dog Pet Food

2. Cat Pet Food

3. Other Pet Food

• Bird Pet Food

• Fish Pet Food

• Small Mammals $ Reptiles Pet Food

Dog Pet Food has been further sub-segmented from 3 viewpoints:

1. Dry Dog Food

2. Wet Dog Food

3. Dog Treats and Mixers

Cat Pet Food has been further sub-segmented from 3 viewpoints:

1. Dry Dog Food

2. Wet Dog Food

3. Dog Treats and Mixers

Dry & Wet Pet Food has been further sub-segmented from 3 viewpoints:

1. Economy Food

2. Mid-Priced Food

3. Premium Food

Distribution Channels - Canada Pet Food Market has been further segmented from 3 viewpoints:

1. Store-based Retailing

2. Online

3. Veterinary Clinics

Company Insights:

• Overview

• Recent Development

• Financial Sales

Company Covered:

1. J.M Smucker

2. Blue Buffalo

3. Mars Incorporated

4. Nestle Purina Pet Food

5. Colgate-Palmolive Co.

Report Details:

| Report Features | Details |

| Base Year | 2021 |

| Historical Period | 2017 - 2020 |

| Forecast Period | 2021-2027 |

| Market | US$ Billion |

| Segment Covered | Animal Type, Dog & Cat Pet Food has been further sub-segmented, Dry & Wet Pet Food has been further sub-segmented, Distribution Channels |

| Companies Covered | J.M Smucker, Blue Buffalo, Mars Incorporated, Nestle Purina Pet Food, Colgate-Palmolive Co. |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Drivers

4.2 Restraints

5. Canada Pet Food Market

5.1 Dog Pet Food

5.2 Cat Food

5.3 Others Pet Food

5.3.1 Birds Food

5.3.2 Fish Food

5.3.3 Small Mammals/Reptiles Food

6. Canada Pet Population by Animal Type

6.1 Dog

6.2 Cat

6.3 Birds

6.4 Fish

6.5 Small Mammals/Reptiles

7. Share Analysis - Canada Pet Food Market

7.1 Pet Food Market Share

7.1.1 Dog Food by product

7.1.2 Cat Food by product

7.2 Distribution Channel

8. Volume Share - Canada Pet Food Market

8.1.1 Pet Animal

9. Products - Canada Dog Pet Food Market

9.1 Dry Dog Food

9.1.1 Economy Dry Dog Food

9.1.2 Mid-Priced Dry Dog Food

9.1.3 Premium Dry Dog Food

9.2 Wet Fog food

9.2.1 Economy Wet Dog Food

9.2.2 Mid-Priced Wet Dog Food

9.2.3 Premium Wet Dog Food

9.3 Dog Treats and Mixers

10. Products - Canada Cat Pet Food Market

10.1 Dry Cat Food

10.1.1 Economy Dry Dog Food

10.1.2 Mid-Priced Dry Dog Food

10.1.3 Premium Dry Dog Food

10.2 Wet Cat Food

10.2.1 Economy Wet Dog Food

10.2.2 Mid-Priced Wet Dog Food

10.2.3 Premium Wet Dog Food

10.3 Cat Treats and Mixers

11. Distribution Channels - Canada Pet Food Market

11.1 Stores Base Retailing

11.1.1 Type – Store Base Retailing

11.2 Online

11.3 Veterinary clinics

12. New Product Launch - Canada Pet Food Market

12.1 Yearly Lunch

12.2 Top-Sub Categories

12.3 Top Packaged Types

12.4 Top Launch Type

12.5 Top Ingredients Types

13. Porters Five Forces

13.1 Overview

13.2 Bargaining Power of Buyers

13.3 Bargaining Power of Suppliers

13.4 Degree of Competition

13.5 Threat of New Entrants

13.6 Threat of Substitutes

14. Key Players Analysis

14.1 J.M Smucker

14.1.1 Overview

14.1.2 Initiatives & Strategy

14.1.3 Revenue

14.2 Blue Buffalo

14.2.1 Overview

14.2.2 Initiatives & Strategy

14.2.3 Revenue

14.3 Mars Incorporated

14.3.1 Overview

14.3.2 Initiatives & Strategy

14.4 Nestle Purina Pet Food

14.4.1 Overview

14.4.2 Initiatives & Strategy

14.4.3 Revenue

14.5 Colgate-Palmolive Co

14.5.1 Overview

14.5.2 Initiatives & Strategy

14.5.3 Revenue

List Of Figures:

Figure-01: Canada Pet Food Market (Million US$), 2017 – 2021

Figure-02: Forecast for – Canada Pet Food Market (Million US$), 2022 – 2027

Figure-03: Canada – Dog Pet Food Market (Million US$), 2017 – 2021

Figure-04: Canada – Forecast for Dog Pet Food Market (Million US$), 2022 – 2027

Figure-05: Canada – Cat Food Market (Million US$), 2017 – 2021

Figure-06: Canada – Forecast for Cat Food Market (Million US$), 2022 – 2027

Figure-07: Canada – Others Pet Food Market (Million US$), 2017 – 2021

Figure-08: Canada – Forecast for Others Pet Food Market (Million US$), 2022 – 2027

Figure-09: Canada – Birds Food Market (Million US$), 2017 – 2021

Figure-10: Canada – Forecast for Birds Food Market (Million US$), 2022 – 2027

Figure-11: Canada – Fish Food Market (Million US$), 2017 – 2021

Figure-12: Canada – Forecast for Fish Food Market (Million US$), 2022 – 2027

Figure-13: Canada – Small Mammals/Reptiles Food Market (Million US$), 2017 – 2021

Figure-14: Canada – Forecast for Small Mammals/Reptiles Food Market (Million US$), 2022 – 2027

Figure-15: Canada Pet Population by Animal Type Volume (Thousand), 2017 – 2021

Figure-16: Forecast for – Canada Pet Population by Animal Type Volume (Thousand), 2022 – 2027

Figure-17: Canada – Dog Volume (Thousand), 2017 – 2021

Figure-18: Canada – Forecast for Dog Volume (Thousand), 2022 – 2027

Figure-19: Canada – Cat Volume (Thousand), 2017 – 2021

Figure-20: Canada – Forecast for Cat Volume (Thousand), 2022 – 2027

Figure-21: Canada – Birds Volume (Thousand), 2017 – 2021

Figure-22: Canada – Forecast for Birds Volume (Thousand), 2022 – 2027

Figure-23: Canada – Fish Volume (Thousand), 2017 – 2021

Figure-24: Canada – Forecast for Fish Volume (Thousand), 2022 – 2027

Figure-25: Canada – Small Mammals/Reptiles Volume (Thousand), 2017 – 2021

Figure-26: Canada – Forecast for Small Mammals/Reptiles Volume (Thousand), 2022 – 2027

Figure-27: Product – Dog Pet Food Market (Million US$), 2017 – 2021

Figure-28: Product – Forecast for Canada Dog Pet Food Market (Million US$), 2022 – 2027

Figure-29: Product – Dry Dog Food Market (Million US$), 2017 – 2021

Figure-30: Product – Forecast for Dry Dog Food Market (Million US$), 2022 – 2027

Figure-31: Product – Wet Fog Food Market (Million US$), 2017 – 2021

Figure-32: Product – Forecast for Wet Fog Food Market (Million US$), 2022 – 2027

Figure-33: Product – Dog Treats and Mixers Market (Million US$), 2017 – 2021

Figure-34: Product – Forecast for Dog Treats and Mixers Market (Million US$), 2022 – 2027

Figure-35: Product – Canada Cat Pet Food Market (Million US$), 2017 – 2021

Figure-36: Product – Forecast Products - Canada Cat Pet Food Market (Million US$), 2022 – 2027

Figure-37: Product – Dry Cat Food Market (Million US$), 2017 – 2021

Figure-38: Product – Forecast for Dry Cat Food Market (Million US$), 2022 – 2027

Figure-39: Product – Wet Cat Food Market (Million US$), 2017 – 2021

Figure-40: Product – Forecast for Wet Cat Food Market (Million US$), 2022 – 2027

Figure-41: Product – Cat Treats and Mixers Market (Million US$), 2017 – 2021

Figure-42: Product – Forecast for Cat Treats and Mixers Market (Million US$), 2022 – 2027

Figure-43: Product – Stores Base Retailing Market (Million US$), 2017 – 2021

Figure-44: Product – Forecast for Stores Base Retailing Market (Million US$), 2022 – 2027

Figure-45: Distribution Channel – Online Market (Million US$), 2017 – 2021

Figure-46: Distribution Channel – Forecast for Online Market (Million US$), 2022 – 2027

Figure-47: Distribution Channel – Veterinary Clinics Market (Million US$), 2017 – 2021

Figure-48: Distribution Channel – Forecast for Veterinary Clinics Market (Million US$), 2022 – 2027

Figure-49: J.M Smucker – Global Revenue (Million US$), 2017 – 2021

Figure-50: J.M Smucker – Forecast for Global Revenue (Million US$), 2022 – 2027

Figure-51: Blue Buffalo – Global Revenue (Million US$), 2017 – 2021

Figure-52: Blue Buffalo – Forecast for Global Revenue (Million US$), 2022 – 2027

Figure-53: Nestle Purina Pet Food – Global Revenue (Million US$), 2017 – 2021

Figure-54: Nestle Purina Pet Food – Forecast for Global Revenue (Million US$), 2022 – 2027

Figure-55: Colgate-Palmolive Co – Global Revenue (Million US$), 2017 – 2021

Figure-56: Colgate-Palmolive Co – Forecast for Global Revenue (Million US$), 2022 – 2027

List Of Tables:

Table-01: Canada – Pet Food Market Share (Percent), 2017 – 2021

Table-02: Canada – Forecast for Pet Food Market Share (Percent), 2022 – 2027

Table-03: Canada – Dog Food Market Share by Product (Percent), 2017 – 2021

Table-04: Canada – Forecast for Dog Food Market Share by Product (Percent), 2022 – 2027

Table-05: Canada – Cat Food Market Share by Product (Percent), 2017 – 2021

Table-06: Canada – Forecast for Cat Food Market Share by Product(Percent), 2022 – 2027

Table-07: Canada – Pet Food Market Share by Distribution Channel (Percent), 2017 – 2021

Table-08: Canada – Forecast for Pet Food Market Share by Distribution Channel (Percent), 2022 – 2027

Table-09: Canada – Pet Volume Market Share by Pet Animal (Percent), 2017 – 2021

Table-10: Canada – Forecast for Pet Volume Share by Pet Animal (Percent), 2022 – 2027

Table-11: Distribution Channels – Store Base Retailing by Type, 2017 – 2021

Table-12: Distribution Channels – Forecast for Store Base Retailing by Type, 2022 – 2027

Table-13: Canada Pet Food – Yearly Lunch, 2016 – 2020

Table-14: Canada Pet Food – Top-Sub Categories, 2016 – 2020

Table-15: Canada Pet Food – Top Packaged Types, 2016 – 2020

Table-16: Canada Pet Food – Top Launch Type, 2016 – 2020

Table-17: Canada Pet Food – Top Ingredients Types, 2016 – 2020

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com