Global Digital Payment Market Size, Share, Growth & Forecast (2025-2033)

Buy NowDigital Payment Market Size and Forecast 2025-2033

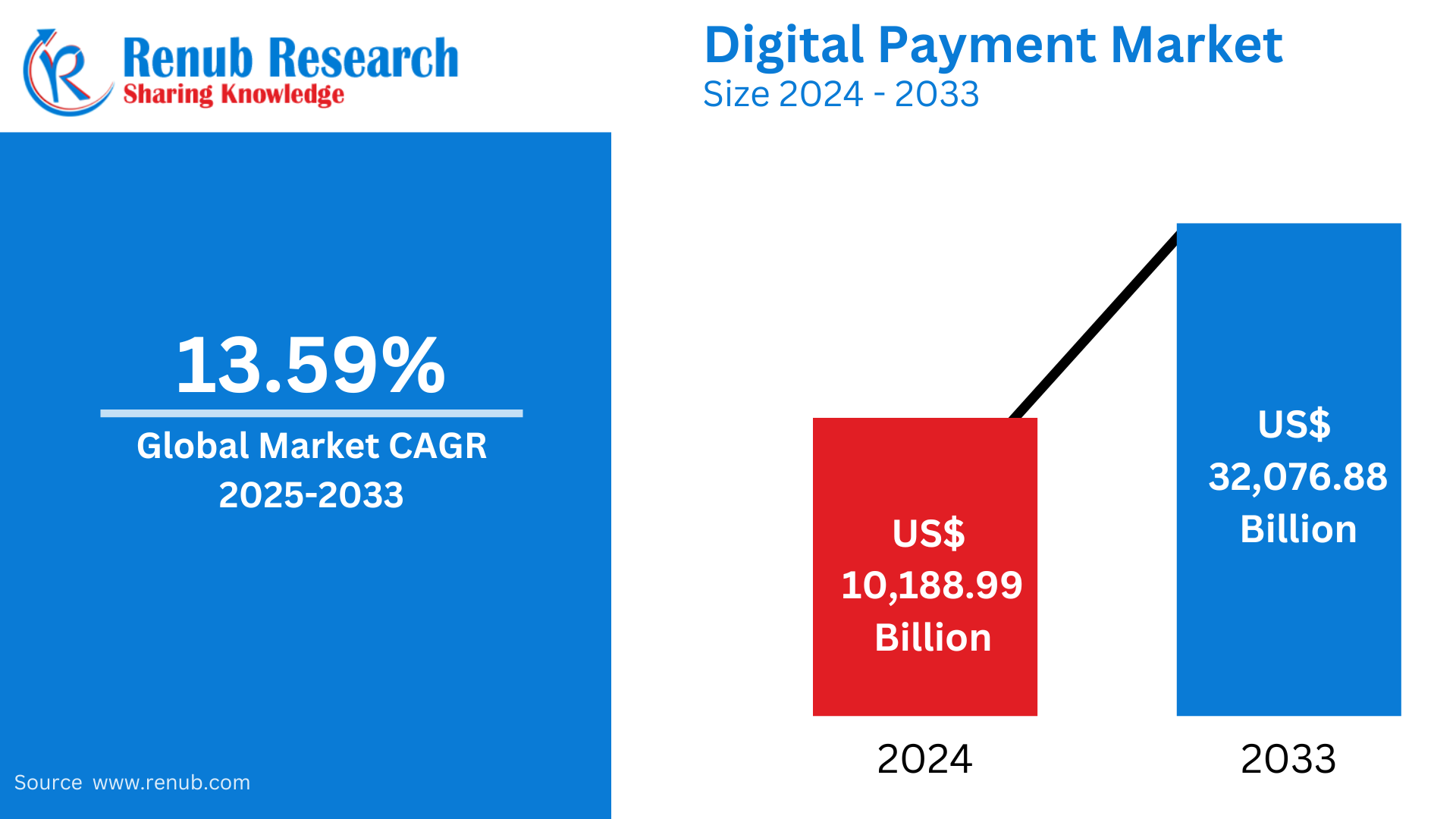

Digital Payment Market is expected to reach US$ 32,076.88 billion by 2033 from US$ 10,188.99 billion in 2024, with a CAGR of 13.59% from 2025 to 2033. Increases in internet penetration and mobile phone usage, the implementation of various government initiatives and policies, shifting consumer preferences for speed and convenience, the substantial growth of e-commerce, and ongoing global financial inclusion efforts are all contributing to the market's rapid growth.

Digital Payment Global Market Report by Type (Digital Commerce, Digital Remittances, Mobile POS Payments), Offering (Cards, ACH Transfer, Digital Wallet, Other Payment Modes), End User (BFSI, Retail & e-Commerce, Transportation & Logistics, Healthcare, Telecom & IT, Media & Entertainment, Others), Countries and Company Analysis, 2025-2033.

Global Digital Payment Market Overview

The global digital payment sector has undergone substantial growth over the past decade, spurred by breakthroughs in technology, growing smartphone usage, and a shift toward cashless transactions. Customers can conduct financial transactions through electronic devices, mobile applications, and internet platforms thanks to digital payments. Peer-to-peer (P2P) transfers, contactless payments, online banking, and mobile wallets are just a few of the segments that make up this industry. Because they are quick, easy, and secure, digital payment solutions are becoming more and more common in both developed and emerging economies. The growing e-commerce industry, where digital payments are essential to enabling safe and easy online transactions, is another factor contributing to this increase.

Through programs that promote financial inclusion and lessen the need for cash, governments and financial institutions are aggressively encouraging the adoption of digital payments. The emergence of blockchain technology and digital currencies is further changing the scene by enhancing transaction transparency and creating new avenues for international payments. But there are still issues including privacy issues, cybersecurity risks, and legal restrictions. With major firms like PayPal, Visa, and Mastercard as well as more recent arrivals like Apple Pay and Google Pay pushing the envelope of innovation, the digital payment sector is still expanding quickly in spite of these challenges. In the upcoming years, the market is anticipated to continue developing and growing as more customers and companies adopt cashless solutions.

According to the US Census Bureau, In Q4 2022, e-commerce sales amounted to 14.7 percent of total revenues. Wallets, which are led by Amazon Pay, Apple Pay, Google Pay, and PayPal, are predicted to make up approximately one-third of regional e-commerce spending in the US in three years after surpassing credit cards in 2022.

Demand for e-commerce is rising as more people use e-commerce websites to order necessities like food, clothing, and other things. The majority of customers favor digital payment methods. Launched in January to reflect the level of payment digitalization in India, the Reserve Bank of India's (RBI) digital payments index (DPI) for September was 304.06, up from 270.59 in March. This indicates the swift uptake and expansion of digital payments throughout the nation.

Growth Drivers for the Digital Payment Market

Introduction of various government projects and policies

The environment surrounding digital payments is being significantly shaped by government policies and initiatives. Several governments across the globe are realizing the benefits of digital payments in terms of economic efficiency, transparency, and financial inclusion. They are also initiating programs to stimulate the adoption of digital payment methods by developing supportive regulatory frameworks and infrastructure, which give incentives for both users and digital payment businesses. Governments are also digitizing their own payment systems for subsidies and services, which is supporting the market's expansion. These policies not only directly increase the volume of digital transactions but also build public trust in digital payment systems.

Consumer preferences for speed and convenience are evolving

The market is expanding due in large part to the increased consumer preference for speed and ease of transactions. Because digital payments eliminate the need for in-person bank visits and line waiting, they are ideal for meeting the changing needs of consumers due to their instant processing and accessibility. Additionally, digital payment platforms typically offer other functionalities, such as easy tracking of spending, rapid notifications, and interaction with budgeting software, which add to their appeal. Additionally, a lot of service providers are creating user-friendly interfaces, which is pushing digital payment options even among less tech-savvy customers. Furthermore, e-commerce's explosive rise is driving market expansion since it necessitates smooth online payments to enhance the whole shopping experience.

Increasing internet penetration and mobile phone usage

Globally, mobile phone usage and growing internet connectivity are key factors propelling the market's expansion. The widespread proliferation of mobile phones has led to the development of a multitude of payment applications and mobile wallets, making digital payments a convenient option for a wide range of transactions. In addition, the market is expanding because to the convenience that mobile phones offer, which has prompted small enterprises and individual consumers to embrace digital payment options. Furthermore, the integration of payment systems with social media platforms and other widely used apps, which further streamlined the process, making digital transactions a part of everyday online interactions, is supporting the market growth.

Challenges in the Digital Payment Market

Cybersecurity and Fraud Risks

The growing use of digital payments presents serious concerns due to the increased danger of fraud, data breaches, and cyberattacks. Payment systems can be the target of hackers who want to steal private client data, which can cost service providers money and harm their reputation. Businesses and financial institutions place a high premium on transaction security and the protection of financial and personal information. The broad adoption of digital payment systems might be hampered by fraudulent activities including identity theft and payment fraud, which can erode consumer confidence. To reduce these risks and guarantee safe transactions for clients, service providers must consistently invest in multi-factor authentication, enhanced encryption, and other cybersecurity measures. It is still crucial to maintain strong security procedures as the market grows.

Technological Integration

For companies, especially small and medium-sized firms (SMEs), integrating digital payment systems with legacy infrastructure is a major difficulty. Many SMEs use antiquated, conventional payment processing methods that might not work with contemporary digital alternatives. Upgrading to new payment systems frequently entails high expenses for maintenance, training, and software and hardware changes. Businesses with minimal resources may be discouraged from implementing digital payment solutions due to these costs. Furthermore, it takes technical know-how and careful planning to integrate new technology with current platforms in a seamless manner, which can be a challenge for smaller companies without dedicated IT departments. Therefore, the adoption of digital payment systems may be slowed by the expense and complexity of technological integration.

United States Digital Payment Market

Due to the extensive use of internet banking, contactless payments, and mobile wallets, the US has one of the biggest and most developed digital payment markets in the world. Digital payments have emerged as the preferred mode of payment due to the widespread use of smartphones and the internet, especially in retail, e-commerce, and peer-to-peer (P2P) transfers. The market is dominated by big businesses like Visa, Apple Pay, Google Pay, and PayPal, who provide customers with quick, easy, and safe payment methods. Through programs encouraging innovation and financial inclusion, the US government has also aided in the expansion of digital payments. But there are still a lot of obstacles to overcome, like cybersecurity threats, data privacy issues, and the requirement for regulatory compliance. Nevertheless, as more companies and customers adopt cashless transactions, the market is growing.

United Kingdom Digital Payment Market

The market for digital payments in the UK is growing quickly due to the growing popularity of internet banking, mobile wallets, and contactless payments. Consumers in a variety of industries, such as retail, e-commerce, and transportation, are increasingly choosing digital payments due to the widespread use of smartphones and the internet. In addition to conventional payment processors like Visa and Mastercard, services like PayPal, Apple Pay, and Google Pay are frequently utilized. Through regulatory efforts including encouraging financial inclusion and bolstering creative payment methods, the UK government has aided the expansion of cashless transactions. As consumers and businesses embrace the convenience and security of digital payments, the sector is expected to continue growing despite obstacles like cybersecurity concerns and changing regulatory frameworks.

India Digital Payment Market

India's digital payment business is expanding quickly because to government initiatives, growing smartphone usage, and an increasingly tech-savvy populace. The adoption of digital payments has been further expedited by the nation's drive towards a cashless economy, which has been fueled by the Digital India campaign and the launch of platforms like UPI (Unified Payments Interface). Both in urban and rural areas, mobile wallets, QR code payments, and P2P transfer platforms are growing in popularity. With safe and practical payment methods, major firms like Paytm, PhonePe, and Google Pay control the market. The sector is still booming despite obstacles including cybersecurity issues and some areas' inadequate digital infrastructure, as more companies and customers seek out quicker, more effective payment methods.

United Arab Emirates Digital Payment Market

The United Arab Emirates' goal towards a cashless society and its tech-savvy populace are driving the country's rapid growth in the digital payment business. Digital payment methods are becoming more and more popular as a result of government programs like the Dubai Smart City project, the extensive usage of smartphones, and high internet penetration. Online banking, contactless payments, and mobile wallets are quickly taking the lead as the most popular payment options, especially in the retail, e-commerce, and hospitality sectors. The market is dominated by major players like Apple Pay and Samsung Pay as well as regional providers like Payit and Beam. Through policies that promote innovation and financial inclusion, the UAE government has aided in the expansion of digital payments. The market is anticipated to keep growing as more companies and consumers use digital payment systems, despite obstacles including cybersecurity worries.

Digital Payment Market Segmentation

Type – Market breakup in 3 viewpoints:

- Digital Commerce

- Digital Remittances

- Mobile POS Payments

Offering – Market breakup in 4 viewpoints:

- Cards

- ACH Transfer

- Digital Wallet

- Other Payment Modes

End User – Market breakup in 7 viewpoints:

- BFSI

- Retail & e-Commerce

- Transportation & Logistics

- Healthcare

- Telecom & IT

- Media & Entertainment

- Others

Regional Analysis (North America, Europe, Asia-Pacific, etc.)

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- the Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Development & Strategies

- Product Portfolio

- Financial Insights

Company Analysis:

- ACI Worldwide Inc.

- Aliant Payment Systems Inc.

- Amazon.com Inc.

- American Express Company

- Apple Inc.

- Fiserv Inc.

- Mastercard Incorporated

- Novetti Group Limited

- Paypal Holdings Inc.

- Visa Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Type, Offering, End Use and Country |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in Report:

-

What are the primary factors driving the growth of the global digital payment market?

-

How do government policies and initiatives influence the adoption of digital payments globally?

-

What role does the increasing penetration of smartphones and internet connectivity play in the expansion of digital payments?

-

How does consumer preference for speed and convenience contribute to the market growth?

-

What challenges do businesses face when integrating digital payment systems with legacy infrastructure?

-

What are the key cybersecurity and fraud risks associated with digital payment solutions?

-

How are blockchain and digital currencies reshaping the digital payment landscape?

-

What is the impact of the rise of e-commerce on the digital payment market?

-

Which regions are expected to see the most significant growth in digital payments in the coming years?

-

How do key players like Visa, PayPal, and Apple Pay influence the competitive landscape of the digital payment market?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Digital Payment Market

6. Market Share

6.1 Type

6.2 Offering

6.3 End Use

6.4 Country

7. Type

7.1 Digital Commerce

7.2 Digital Remittances

7.3 Mobile POS Payments

8. Offering

8.1 Cards

8.2 ACH Transfer

8.3 Digital Wallet

8.4 Other Payment Modes

9. End User

9.1 BFSI

9.2 Retail & e-Commerce

9.3 Transportation & Logistics

9.4 Healthcare

9.5 Telecom & IT

9.6 Media & Entertainment

9.7 Others

10. Country

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 Australia

10.3.5 South Korea

10.3.6 Thailand

10.3.7 Malaysia

10.3.8 Indonesia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 South Africa

10.5.2 Saudi Arabia

10.5.3 UAE

11. Porter’s Five Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 ACI Worldwide Inc.

13.1.1 Overview

13.1.2 Key Persons

13.1.3 Recent Development & Strategies

13.1.4 Product Portfolio

13.1.5 Financial Insight

13.2 Aliant Payment Systems Inc.

13.2.1 Overview

13.2.2 Key Persons

13.2.3 Recent Development & Strategies

13.2.4 Product Portfolio

13.2.5 Financial Insight

13.3 Amazon.com Inc.

13.3.1 Overview

13.3.2 Key Persons

13.3.3 Recent Development & Strategies

13.3.4 Product Portfolio

13.3.5 Financial Insight

13.4 American Express Company

13.4.1 Overview

13.4.2 Key Persons

13.4.3 Recent Development & Strategies

13.4.4 Product Portfolio

13.4.5 Financial Insight

13.5 Apple Inc.

13.5.1 Overview

13.5.2 Key Persons

13.5.3 Recent Development & Strategies

13.5.4 Product Portfolio

13.5.5 Financial Insight

13.6 Fiserv Inc.

13.6.1 Overview

13.6.2 Key Persons

13.6.3 Recent Development & Strategies

13.6.4 Product Portfolio

13.6.5 Financial Insight

13.7 Mastercard Incorporated

13.7.1 Overview

13.7.2 Key Persons

13.7.3 Recent Development & Strategies

13.7.4 Product Portfolio

13.7.5 Financial Insight

13.8 Novetti Group Limited

13.8.1 Overview

13.8.2 Key Persons

13.8.3 Recent Development & Strategies

13.8.4 Product Portfolio

13.8.5 Financial Insight

13.9 Paypal Holdings Inc.

13.9.1 Overview

13.9.2 Key Persons

13.9.3 Recent Development & Strategies

13.9.4 Product Portfolio

13.9.5 Financial Insight

13.10 Visa Inc.

13.10.1 Overview

13.10.2 Key Persons

13.10.3 Recent Development & Strategies

13.10.4 Product Portfolio

13.10.5 Financial Insight

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com