Global Consumer Electronics Repair And Maintenance Market Size and Growth Trends and Forecast Report 2025-2033

Buy NowConsumer Electronics Repair And Maintenance Market Size

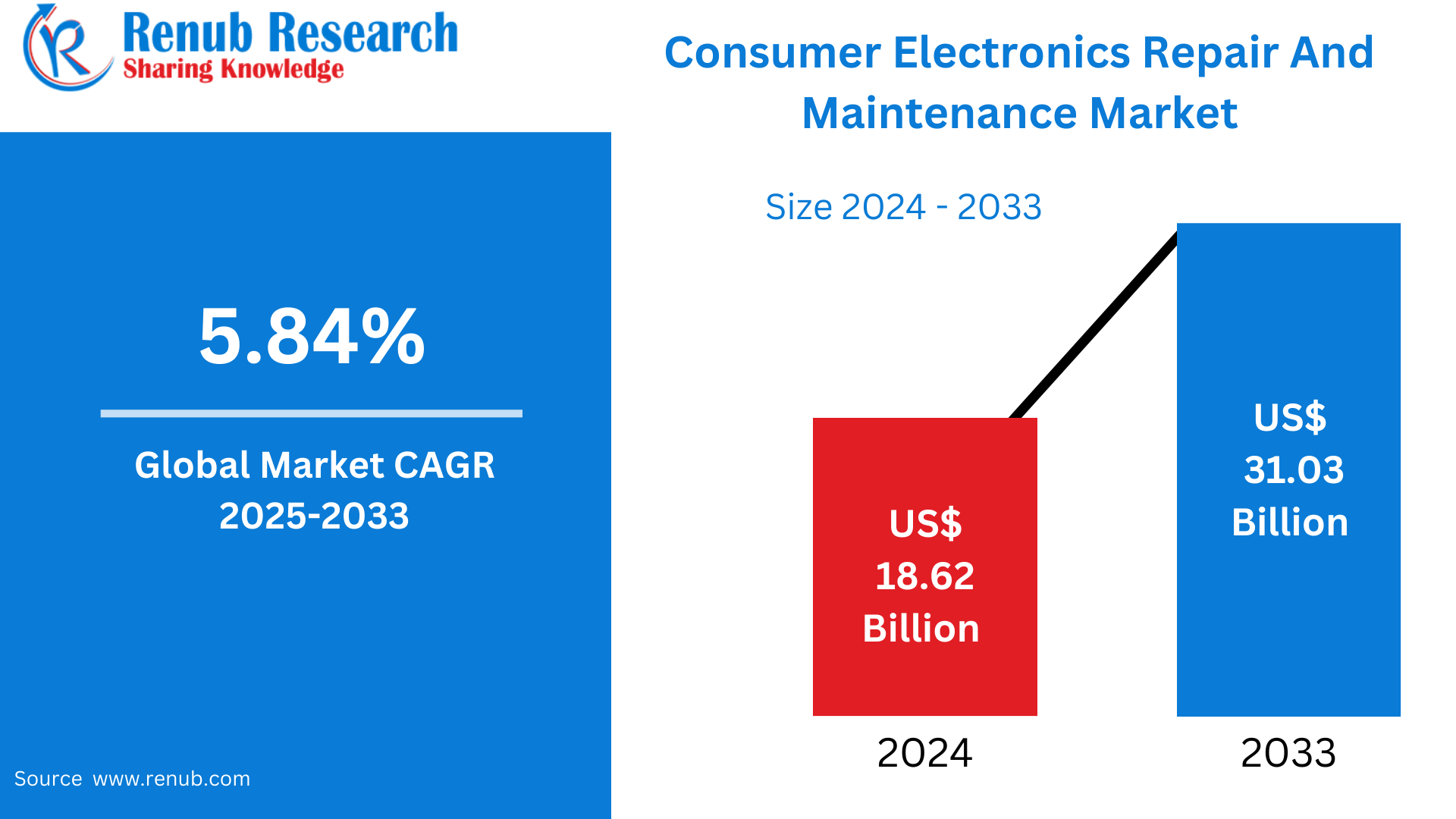

The size of the global consumer electronics repair market was US$ 18.62 billion in 2024 and is expected to increase steadily to reach US$ 31.03 billion by 2033, this growth is represented by a compound annual growth rate (CAGR) of 5.84% between the periods 2025-2033, due to expanding demand for longer device lifecycles, affordable repair services, and growing awareness of sustainability and electronic waste reduction globally.

Consumer Electronics Repair and Maintenaince Market Report by Product (Home Appliances, Personal Devices, Entertainment Devices), Service Provider (Authorized Service Centers, Independent Repair Shops), End User (Residential, Commercial), Countries and Company Analysis, 2025-2033.

Consumer Electronics Repair And Maintenance Market Outlooks

Consumer Electronics Repair and Maintenance entails inspecting, diagnosing, servicing, and rehabilitating electronic gadgets like smartphones, laptops, TVs, audio equipment, gaming machines, and domestic appliances. The aim is to make these products operate optimally and prolong their usable life. Services can extend to hardware replacement, software fixes, cleaning, refurbishment of parts, and fault troubleshooting for wear, electrical, or physical damage.

Worldwide, this sector is essential in minimizing electronic waste, saving resources, and providing customers with affordable options for replacing faulty devices. Both developed and developing nations have repair and maintenance services that sustain the circular economy and close the digital divide by making technology accessible and functional for increased durations. With growing environmental consciousness and the rising expense of new devices, businesses and consumers alike are resorting to professional repair services. Furthermore, right-to-repair campaigns and green legislation are also increasing the demand for repair services globally.

Drivers of Growth in the Consumer Electronics Repair and Maintenance Market

Increased Electronic Waste and Environmental Consciousness

The global increase in electronic waste is compelling consumers and governments alike to find eco-friendly alternatives. Repair and maintenance services provide a sustainable alternative by lengthening the life of devices and keeping them out of landfills. Increasing concern over the environmental effects of waste electronics, in conjunction with increased e-waste management regulations, is motivating consumers to repair devices instead of replacing them. This transition enables a circular economy, reduces carbon footprints, and creates demand for professional repair technicians and certified service centers, turning sustainability into a driving force behind growth in the global electronics repair and maintenance industry. 62 million tonnes of e-waste were generated in 2022, up by 82% from 2010, with an estimated growth to 82 million tonnes by 2030. The waste contains billions worth of valuable resources, but recycling covers only 1% of rare earth element demand. The 62 million tonnes could fill 1.55 million 40-tonne trucks, which could go around the equator.

Cost-Effectiveness in Relation to Device Replacement

Replacement of high-end consumer electronics comes at a price. For many homes and enterprises, fixing faulty products is an inexpensive alternative. Increasing the price of new home appliances, smartphones, and laptops is forcing customers to look for inexpensive repairs as an alternative. Furthermore, frugal customers in the emerging economies rely more and more on maintenance services to maintain their electronics and maximize their lifecycles. This trend, along with access to low-cost spare parts and technician services, is increasingly making repair and maintenance a more viable and cost-effective option, thus powering market growth in both developed and developing markets.

Government Support and Right-to-Repair Initiatives

Right-to-repair initiatives by government are also responsible for driving growth in the consumer electronics repair market. Policies allowing consumers and third-party technicians access to manuals, diagnostic equipment, and spare parts have diminished manufacturer dominance of repairs. The U.S., the EU, and India are adopting or proposing legislation to aid independent repair enterprises and empower consumers. These reforms are reducing entry barriers for small repair shops, increasing consumer confidence, and promoting responsible consumption patterns, which in aggregate propel growth in the global repair and maintenance services market. In March 2023, The European Commission set out a proposed Directive on the "Right to Repair" to apply to regulated products such as household appliances, TVs, welding equipment, vacuum cleaners, servers, data storage products, and mobile phones. The proposal seeks to encourage repair and reuse through a number of measures.

Challenges in the Consumer Electronics Repair and Maintenance Market

Restricted Availability of Spare Parts and Technical Information

One of the largest challenges in the repair market is limited access to necessary spare parts and repair guides. Most manufacturers continue to closely manage their supply chains and restrict the availability of proprietary components, to the detriment of third-party repair operators and at higher repair costs. This denial of access discourages competition as well as postpones delivery of service, frustrating customers. The problem is particularly acute in areas without regulatory enforcement of right-to-repair legislation. If left unresolved, these hindrances can hamper market development and diminish the overall effectiveness of repair and maintenance services globally.

Rapid Technological Advancements and Product Complexity

New consumer electronics are increasingly smaller and more technologically sophisticated, with features such as AI chips, IoT connectivity, and sealed components. Whereas innovation enhances user experience, it makes it difficult to repair. Specialized education and sophisticated equipment are needed to maintain these sophisticated devices, increasing costs of operation and decreasing the number of trained technicians. Rapid product cycles also mean repair shops have to continuously update their skills and inventory. This complexity renders repairs more costly and time-consuming, and will cause some consumers to switch to replacements instead, thus presenting a major challenge to the market.

Consumer Electronics Home Appliances Repair and Maintenance Market

The home appliances market, encompassing refrigerators, washing machines, air conditioners, and microwaves, is a major component of the consumer electronics repair and maintenance market. As the price of large appliances continues to increase, families are turning more to repair services to lengthen the operational life of their equipment. Furthermore, warranty expiration and technical failure add to demand for experienced repair technicians. Several consumers are also embracing maintenance contracts to guarantee long-term appliance functionality. The growing trend for energy-efficient appliances, along with an emphasis on sustainability, is also further increasing the global home appliance repair and maintenance market.

Consumer Electronics Authorized Service Centers Market

Authorized service centers provide manufacturer-approved repairs, original parts, and trained professionals, hence being the go-to option for most consumers in search of dependable service. Such centers are known to keep good quality standards and typically offer warranty coverage on devices, promoting brand loyalty and customer retention. For sophisticated or high-end devices, the public generally finds authorized centers to be more reliable than third-party repair facilities. As more electronic manufacturers get into partnerships with approved service providers internationally, the industry is experiencing a steady rate of growth. Besides, certified centers assist in eradicating counterfeit components and remain compliant with the regulations, consolidating their market position within the global repair and maintenance market.

Residential Consumer Electronics Repair and Maintenance Market

The residential sector is a significant share of the electronics repair market since homes significantly depend on electronics like TVs, smartphones, laptops, and kitchen appliances. Regular use generates higher wear and tear, necessitating increased demand for timely repair and preventive maintenance. With the escalating cost of living, replacement is becoming prohibitive for most households, and hence they opt for repair. Remote work and online learning have also enhanced the need for keeping home electronics functional. With the growth in smart home uptake, demand for technicians to maintain connected devices and systems is further driving the residential repair and maintenance segment.

Commercial Consumer Electronics Repair and Maintenance Market

The commercial market comprises firms, learning institutions, healthcare organizations, and industrial complexes that use consumer electronics as a mainstay in operations. Devices like monitors, printers, projectors, and communication equipment need to be up and running to promote productivity. Regular maintenance and repair are necessary to prevent unnecessary downtimes with high costs. Most companies tend to have a yearly maintenance agreement with service vendors to maintain perpetual operation and lowest possible disruption. The increasing implementation of electronics within logistics, financial, and retail industries is making commercial repair needs more in demand. As manufacturers seek to improve asset life as well as capital spending, the market keeps developing steadily.

United States Consumer Electronics Repair and Maintenance Market

The U.S. dominates the worldwide repair and maintenance industry through technological advancement and increased consumer knowledge of the right-to-repair initiative. Various states have enacted or proposed bills that provide consumers with access to repair information and tools. Furthermore, the increasing cost of high-end electronics makes Americans reuse instead of replace. The nation boasts a strong chain of both authorized and independent shops. Environmental issues and increasing pressure for sustainable consumption are also shaping market behavior. These factors together present a positive backdrop for the development of repair services in the United States. Dec 2022, New York became the first state in the United States to signed law a right to repair for electronics. The law will take effect on July 1, 2023, and is the "Digital Fair Repair Act."

France Consumer Electronics Repair and Maintenance Market

France is a leader in fostering sustainable electronics consumption through measures like the repairability index. This index, which scores the ease of repairing a product, determines consumer buying choices and makes manufacturers design repair-friendly products. The government of France actively promotes local repair shops and has invested in repair training schemes. Consequently, there is an increasing culture of repair and reuse throughout the nation. Furthermore, increasing living costs and a focus on environmental stewardship are encouraging more consumers to repair their electronics, driving the repair and maintenance market in France.

India Consumer Electronics Repair and Maintenance Market

India's expanding middle class, combined with blanket smartphone and electronics penetration, is driving demand for repair. Consumers in rural and urban areas frequently prefer to repair electronics rather than replace them on a budgetary basis. The nation's huge pool of skilled technicians and pervasive network of informal repair centers offer cheap solutions to everyday faults. Government programs aimed at driving digital literacy and entrepreneurship have also stimulated the local repair ecosystem. With electronic consumption growing day by day, the demand for trustworthy, low-cost repair and maintenance facilities is growing as well, and India has become one of the fastest-growing markets in this arena. Aug 2024, Indian Govt introduced a 'repairability index' for mobile devices and electronic items, something which will enable customers to make a proper choice before they buy them. The project is set to tackle the increasing ewaste issue and prompt manufacturers to create more repair-friendly products.

Saudi Arabia Consumer Electronics Repair and Maintenance Market

Saudi Arabia is experiencing tremendous digital transformation through its Vision 2030 program, which focuses on technology uptake in various sectors. As consumer electronics are gaining use in households and companies, there is a rise in demand for repair and maintenance. The warm weather also adds to excessive wear on electronic products, making maintenance more frequent. Furthermore, the growing middle class and increasing concern for sustainable practices are pushing consumers to repair as opposed to replacement of devices. With the country investing in technology infrastructure and education, local and international service providers both have growing opportunities in the market for electronics repair.

Market Segmentations

Product

- Home Appliances

- Personal Devices

- Entertainment Devices

Service Provider

- Authorized Service Centers

- Independent Repair Shops

End User

- Residential

- Commercial

Countries

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

All companies have been covered with 4 Viewpoints

- Overview

- Key Persons

- Recent Development & Strategies

- Revenue Analysis

Key Players Analysis

- The Cableshoppe

- Redington Services

- Electronix Services

- B2X Care Solutions

- Encompass Parts

- uBreakiFix

- Asurion, LLC

- Best Buy Co. Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Product, By Service Provider, By End User, By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Consumer Electronics Repair And Maintenance Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Consumer Electronics Repair and Maintenance Market Share Analysis

6.1 By Product

6.2 By Service Provider

6.3 By End User

6.4 By Countries

7. Product

7.1 Home Appliances

7.2 Personal Devices

7.3 Entertainment Devices

8. Service Provider

8.1 Authorized Service Centers

8.2 Independent Repair Shops

9. End User

9.1 Residential

9.2 Commercial

10. Countries

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 South Korea

10.3.5 Thailand

10.3.6 Malaysia

10.3.7 Indonesia

10.3.8 Australia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 UAE

10.5.3 South Africa

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 The Cableshoppe

13.1.1 Overview

13.1.2 Key Persons

13.1.3 Recent Development & Strategies

13.1.4 Revenue Analysis

13.2 Redington Services

13.2.1 Overview

13.2.2 Key Persons

13.2.3 Recent Development & Strategies

13.2.4 Revenue Analysis

13.3 Electronix Services

13.3.1 Overview

13.3.2 Key Persons

13.3.3 Recent Development & Strategies

13.3.4 Revenue Analysis

13.4 B2X Care Solutions

13.4.1 Overview

13.4.2 Key Persons

13.4.3 Recent Development & Strategies

13.4.4 Revenue Analysis

13.5 Encompass Parts

13.5.1 Overview

13.5.2 Key Persons

13.5.3 Recent Development & Strategies

13.5.4 Revenue Analysis

13.6 uBreakiFix

13.6.1 Overview

13.6.2 Key Persons

13.6.3 Recent Development & Strategies

13.6.4 Revenue Analysis

13.7 Asurion, LLC

13.7.1 Overview

13.7.2 Key Persons

13.7.3 Recent Development & Strategies

13.7.4 Revenue Analysis

13.8 Best Buy Co., Inc.

13.8.1 Overview

13.8.2 Key Persons

13.8.3 Recent Development & Strategies

13.8.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com