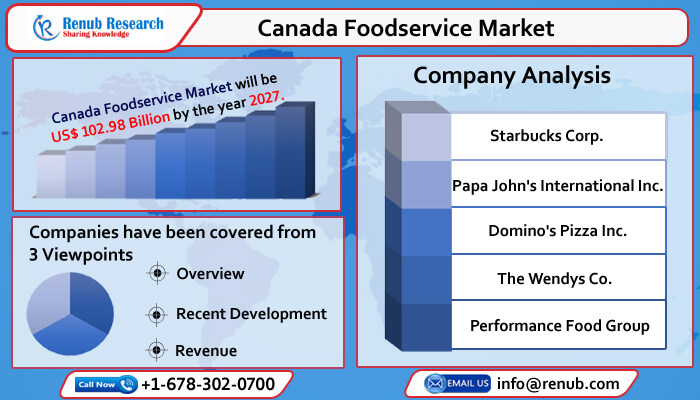

Canada Foodservice Market to Reach USD 102.98 Billion by 2027, Propelled by Rising Consumer Confidence and Strong Revival in the Canadian Economy

17 Jan, 2022

According to Renub Research, report titled “Canada Foodservice Market, Size, Forecast 2022-2027, Industry Trends, Share, Growth, Impact of COVID-19, Opportunity Company Analysis” the Canada Foodservice Market was USD 94.19 Billion in 2021. Over the years, the foodservice industry in Canada has revolutionized in size. Canadian consumers tend to spend a substantial amount of their earnings on foodservice owing to the four crucial factors of value, convenience, health, and sustainability that drive their choices. Thus, Canada has a potential market in the foodservice industry as it possesses a broad consumer base with a multicultural population of millions. Moreover, the millennials and generation Zers are the major fast-food spenders in the industry. The fast-food sector traditionally includes food and beverages items; however, with the evolution of time, plant-based products have also been added to the fast-food list.

Around the year, Canadians make millions of restaurant visits on any typical day. In addition, they have a more personal, direct, and frequent association with the foodservice industry. They stop for a coffee on their way to work, they go out for dinner to celebrate an anniversary, and they order in to feed a crowd. Moreover, some people interact with restaurants daily, and for others, a trip to a restaurant is a special treat. Whatever the occasion, good service, great food, and a safe and enjoyable experience add to the growth of the foodservice industry in Canada.

Full-Service Restaurants Grows with High Growth Rates:

The Canadian fast food industry is categorized into quick-service restaurants, full-service restaurants, caterers, and drinking places. Full-service restaurants are growing with high germination rates. Additionally, quick-service restaurants also hold a conspicuous share in the overall foodservice business in Canada. The relatable augmentation of the Canadian foodservice business is constantly supported by Canada's economy, operating at total capacity.

Provincial Boundaries of Canada Foodservice Industry:

Across Canada, the foodservice industry has embarked on concrete expansion plans to effectively perceive its presence in provinces like Newfoundland & Labrador, Prince Edward Island, Nova Scotia, New Brunswick, Quebec, Ontario, Manitoba, Saskatchewan, Alberta, and British Columbia.

Further, with moderation from the significant increases in recent years, Ontario is among Canada's fastest total foodservice market growth due to a thriving population and healthy job generation aggregates. Hence as per our analysis, the foodservice industry in Ontario will remain healthy during 2021-2027.

On the other hand, Quebec's foodservice industry flourished average annual market growth year on year. Growth was driven by the active consumer, business, and tourist spending at restaurants and drinking spots. Similarly, over the years, the fast-food market in British Columbia has also progressed amongst the highest growth figure in Canada.

Competitive Landscape:

The Canadian fast food industry is highly competitive. The significant players in the market comprise Starbucks Corp., Papa John's International Inc., Domino's Pizza Inc., The Wendys Co., and Performance Food Group. As per our analysis, these players have achieved popularity and will develop further.

Further, the players are also undertaking expansion strategies, rolling out innovative menus, and intensifying their portfolios to gain a stronghold in the market. For instance, in 2020, Tim Hortons launched three variations of new Dream Donuts across Canada. The three varieties constitute Dulce de Leche Crème, the Strawberry Confetti, and Chocolate Truffle.

The Impact of COVID-19 on the Canadian Foodservice Industry

The COVID-19 pandemic has created vital challenges for the foodservice market in Canada. The situation was unprecedented, with many foodservice businesses being forced to close and filed for bankruptcy during the pandemic. Therefore, exploring emergent evidence food service industries in Canada was struck by COVID-19. Although pandemic has had a destructive impact on the entire foodservice industry across Canada, the industry assumes it is poised to turn the corner as customers revert to dining out. The foodservice industry, which bore the brunt of COVID-related dine-in restrictions, quickly carved out its share of the recovery in the April-May-June quarter of 2021. Also, consumer spending jumped compared to the decline last year. As per this research report, Canada Fast Food Market was US$ 94.19 Billion in 2021.

Market Summary:

- Restaurant Type – We have covered Commercial (Quick Service Restaurants, Full Service Restaurants, Caterers and Drinking Places) and Non-Commercial.

- Province - In our report we have covered provincial outlook of Newfoundland & Labrador, Prince Edward Island, Nova Scotia, New Brunswick, Atlantic Region, Quebec, Ontario, Manitoba, Saskatchewan, Alberta and British Columbia

- Traffic - In our report we have studied the traffic patterns in Full Service Restaurants (Morning Meal, Lunch, Supper and PM Snack) and Quick Service Restaurants (Morning Meal, Lunch, Supper and PM Snack).

- Food Items – Our report covers food items like French Fries, Potato, Sweet Potato, Onion Rings, Breakfast Item, Burger, Sandwich, Subs, Chicken, Breads, Salad, Pizza, Panzerotti, Calzone, Cakes, Squares, Muffins and Vegetarian Item (Incl Eggs/Dairy as food items in the market.

- Beverage Items – We have studied beverage items like Coffee, Carbonated Soft Drink, Pop, Soda, Water (includes tap water), Hot Tea, Alcoholic Beverages, Fruit Juice, Iced Tea, Milkshakes, Smoothies, Milk and Hot Chocolate).

- Average Check Size – Per Person – We have covered Quick Service Restaurants, Full Service Restaurants (Midscale Dining, Casual Dining and Fine Dining) and Retail Foodservice with respect to Average Check Size – Per Person.

- Channel - We have studied aspects of Quick Service Restaurants and Full Service Restaurants through Delivery, Takeout, Drive Thru and Dine-in existing in Canada Foodservice Industry.

- Operating Ratios – We have covered Operating Ratios like Cost of Sales, Salaries & Wages, Repair & Maintenance, Rental & Leasing, Utilities, Advertising, Depreciation, Other and Pre-Tax Profit.

- Key Companies – The key players include Starbucks Corp., Papa John's International Inc., Domino's Pizza Inc., The Wendys Co. and Performance Food Group.

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com