Global Diabetic Food Market: Trends, Growth, and Forecast (2025–2033)

Buy NowGlobal Diabetic Food Market Size and Forecast 2025-2033

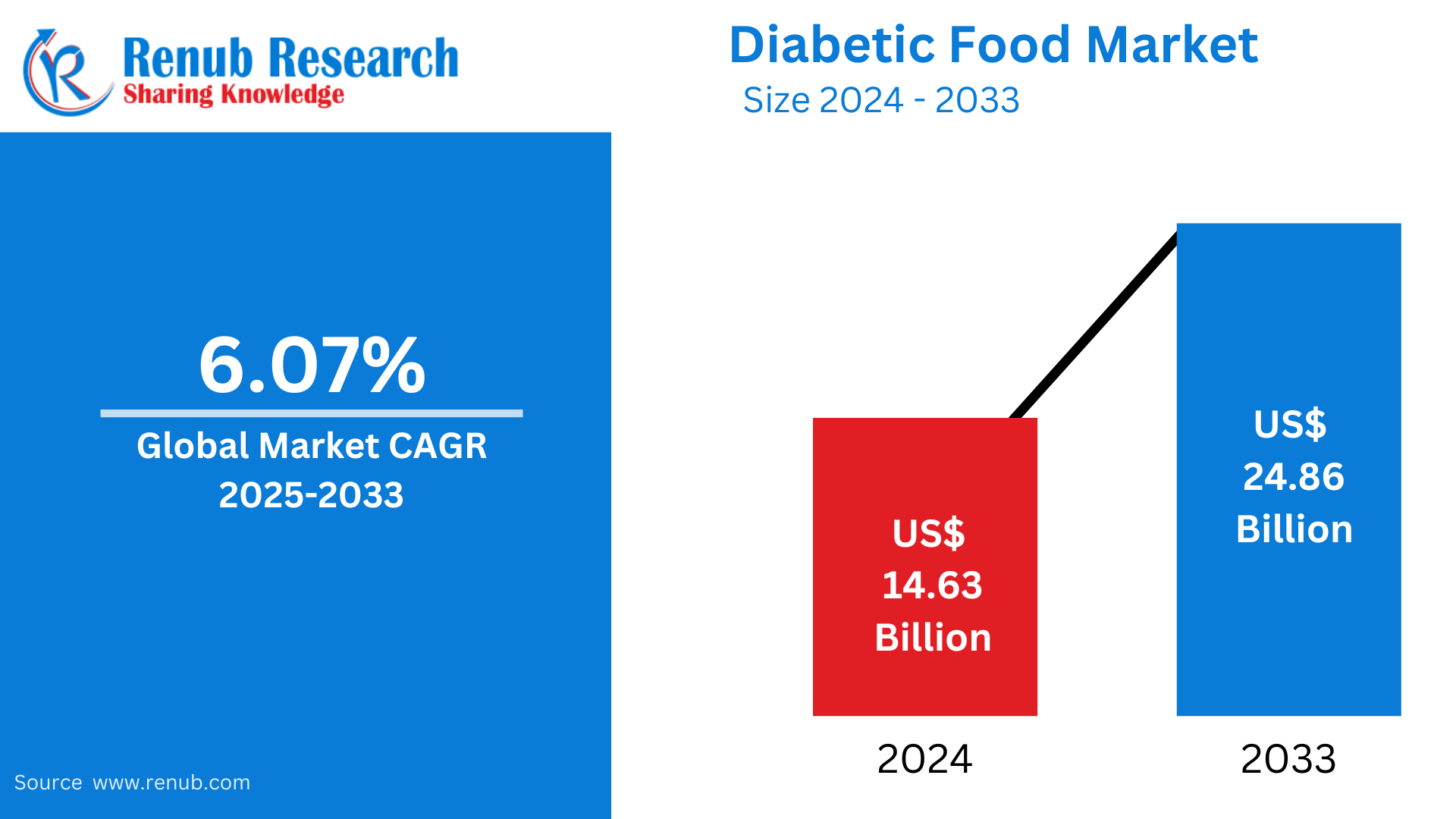

Diabetic Food Market is expected to reach US$ 24.86 billion by 2033 from US$ 14.63 billion in 2024, with a CAGR of 6.07% from 2025 to 2033. The market is expanding quickly due to a number of factors, including the rising incidence of diabetes, consumers' increased awareness of nutrition and health, recent developments in food technologies, government efforts and regulations, and shifting consumer lifestyles.

Diabetic Food Global Market Report by Products (Confectionery, Snacks, Bakery Products, Dairy Products, Others) Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Online, Others) Countries and Company Analysis, 2025-2033.

Diabetic Food Market Overview

The rising incidence of diabetes and increased understanding of the need of specific diets for managing the condition are driving the substantial rise of the worldwide diabetic food market. The need for food products that meet the unique nutritional requirements of people with diabetes is increasing as the number of diabetes cases globally, especially in industrialized and developing nations, rises. Diabetic foods are made to supply vital nutrients and assist control blood sugar levels. This includes foods fortified with vitamins, minerals, and antioxidants, as well as low-sugar, low-carb, and high-fiber substitutes. The market is expanding as a result of the growing number of consumers who are concerned about their health and the use of preventive healthcare.

Innovations in product development and growing availability also assist the diabetic food market. Sugar-free snacks, drinks, and meal replacements are among the diabetic-friendly products that major food producers are progressively providing. Functional foods, which provide health advantages beyond basic nourishment, are becoming more and more popular. The kinds of diabetic foods that are offered in various markets are greatly influenced by regional differences and cultural preferences. The Asia-Pacific region is expanding quickly as a result of rising diabetes incidence and increased awareness of diabetes management, even though North America and Europe still maintain the highest market shares. Broader market adoption is nevertheless hampered by issues like exorbitant product pricing, a lack of uniform laws, and inadequate consumer education in some areas.

The demand for diabetic food has increased overall due to the rise in diabetes among the population. About 37.3 million Americans, or roughly one in ten, received a diabetes diagnosis in 2021, according to the Centers for Disease Control and Prevention's "The National Diabetes Statistics Report," which was released in January 2022. These elements are probably going to support the expansion of the market as a whole.

Low-fat dairy products, dietary beverages & snacks, low-calorie sugar jellies, ice creams, diabetic baked goods, and confections are just a few of the products that diabetic food manufacturers are introducing to break into different market segments and drive demand over the course of the forecast period. For example, the Indian firm Lo! Foods increased the range of products it offered in July 2021. The new line of products has a 50% lower glycemic index, is sugar-free, and has fewer carbohydrates. The items are appropriate for diabetic customers and have been evaluated with blood sugar meters and Continuous Glucose Monitors (CGMs).

Growth Drivers for the Diabetic Food Market

Increased public awareness of nutrition and health issues

The market is expanding as a result of increased public knowledge of nutrition and health brought about by widespread media coverage, health campaigns, and educational programs by governments and health organizations. Customers are better aware of the dietary needs for diabetes management, including the need for balanced nutrition, low-glycemic-index items, and less sugar. Consumer behavior has changed as a result of this awareness, with a growing desire for healthier food options. Additionally, people with diabetes are actively looking for food items that meet their unique dietary requirements without sacrificing flavor or diversity. It has sparked innovation in the food sector, resulting in the creation of numerous diabetic-friendly items, such as meal replacements, snacks, and drinks that are high in other vital nutrients but low in sugar and carbs.

Diabetes is becoming more common

The market is expanding due to the increased prevalence of diabetes brought on by factors such the aging population, urbanization, obesity, and physical inactivity. It has increased the need for foods low in sugar, carbs, and glycemic index that are suitable for diabetics. Additionally, these foods aid in blood glucose regulation, a vital component of diabetic treatment. Aside from this, the market is expanding favorably due to the recent creation of a range of items, such as sugar-free candies, low-carb meals, and beverages designed to satisfy the needs of diabetic patients. The market is also expanding as a result of the expanding consumer base for these goods, which is encouraging businesses to concentrate on developing innovative diabetic foods.

Consumers' shifting living habits

The prevalence of obesity and Type 2 diabetes is on the rise due to a persistent move towards more sedentary lifestyles, which are defined by a decrease in physical activity and an increase in the consumption of high-calorie meals. Additionally, the demand for better food options, particularly diabetic-friendly goods, is rising as a result of increased knowledge of these health hazards. In response to this trend, the diabetic food industry has developed a variety of quick and easy food options that meet the nutritional requirements of people with diabetes. These include prepared meals, snacks, and drinks that are quick to eat, nutrient-dense, and low in sugar and carbs. The market is also expanding as a result of the growing trend of personalized nutrition, in which people look for foods that address their unique health requirements, such as managing diabetes.

Challenges in the Diabetic Food Market

Stigma Around Diabetic Foods

The idea that diabetic foods are unpleasant, tasteless, or only suitable for people with diabetes is frequently the source of the stigma associated with them. Even those who are health-conscious or pre-diabetic may be deterred from buying diabetic meals since many customers identify them with a "medical" label. Resistance to implementing healthy dietary choices is exacerbated by the impression that diabetic foods are less appetizing than ordinary ones. Manufacturers must concentrate on enhancing the flavor, texture, and variety of diabetic-friendly products while highlighting their health advantages in order to combat this stigma. This stigma can also be lessened by informing customers about the significance of these foods for controlling blood sugar and enhancing general wellness.

Taste and Texture Preferences

Replicating the flavor and texture of everyday foods is one of the major obstacles in the diabetic food business. In order to cut calories and carbohydrates, diabetic-friendly products frequently include sugar replacements and other substances, which might change the mouthfeel and flavor when compared to conventional foods. Reduced consumer acceptance may result from this, particularly among people who are used to the flavor of everyday foods. Customers may be less satisfied with these products, which could influence their propensity to frequently use or switch to diabetic-friendly solutions. Manufacturers are attempting to enhance flavor, improve texture, and create better formulas that resemble traditional foods in order to increase acceptability. The broader public, not just people with diabetes, must embrace diabetic foods if these obstacles are to be overcome.

United States Diabetic Food Market

Due to the growing prevalence of diabetes and growing awareness of the significance of specific diets for controlling the condition, the market for diabetic foods in the United States is expanding quickly. The demand for diabetic-friendly products, such as low-sugar, low-carb, and high-fiber foods, has increased as more people try to manage their blood sugar levels. These goods are frequently found in food substitutes, snacks, drinks, and desserts. Furthermore, functional foods—like fortified vitamins and minerals—that offer extra health advantages are gaining popularity. However, issues including taste preferences, expensive products, and a lack of consumer education regarding diabetes diets continue to exist. Notwithstanding these obstacles, the industry is still growing due to advancements in product offerings and health-conscious consumers.

United Kingdom Diabetic Food Market

Growing diabetes prevalence and greater health consciousness are driving expansion in the diabetic food sector in the UK. The need for certain foods that assist control blood sugar levels, such as low-sugar, low-carb, and high-fiber items, is increasing as more people receive a diabetes diagnosis. In place of conventional high-sugar items, the market offers diabetic-friendly snacks, drinks, and prepared meals. The demand for diabetic products is also fueled by the growing number of health-conscious customers and the emphasis on preventative healthcare. Nonetheless, issues like expensive product costs and personal preferences still exist. With ongoing product development innovation and more diabetic food options available in mainstream supermarkets, the UK market is growing in spite of these obstacles.

India Diabetic Food Market

Due to the increased incidence of diabetes and growing awareness of the need of controlling blood sugar levels, the diabetic food industry in India is expanding significantly. Low-sugar, low-carb, and high-fiber foods are among the diabetes-friendly items that are in high demand because India has one of the highest diabetic populations in the world. These consist of ready-to-eat meals, drinks, and snacks that are easy and delicious substitutes for conventional foods while also assisting in blood sugar regulation. Furthermore, Indian consumers' growing emphasis on wellness and health is driving up demand for functional foods. Nevertheless, issues including exorbitant product prices, restricted supply, and a dearth of consumer information regarding diabetes diets still exist. Nevertheless, as consumer knowledge rises, the market keeps growing.

United Arab Emirates Diabetic Food Market

The United Arab Emirates' (UAE) diabetic food market is growing as a result of rising diabetes rates and a greater emphasis on leading a healthy lifestyle. Diabetes-friendly products, such as low-sugar, low-carb, and high-fiber foods, are becoming more and more popular due to the increased prevalence of diabetes cases, particularly in urban areas. These consist of meals, drinks, and snacks that satisfy local tastes for convenience and flavor while also assisting in blood sugar regulation. The demand for functional meals is also being driven by a greater understanding of the advantages of preventive healthcare. Nonetheless, issues like exorbitant product prices and a lack of consumer awareness regarding diet-based diabetes control continue to exist. Despite this, the UAE industry is still expanding because to growing health consciousness and creative diabetic food options.

Product Segmentation

Products

- Confectionery

- Snacks

- Bakery Products

- Dairy Products

- Others

Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Online

- Others

Regional Insights:

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

All the Key players have been covered from 5 Viewpoints:

- Overview

- Key Persons

- Recent Development & Strategies

- Product Portfolio

- Financial Insight

Company Analysis:

- Nestlé

- Unilever

- The Kellogg Company

- Conagra Brands, Inc.

- Tyson Foods

- The Hershey Company

- Hain Celestial Group

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Products, Distribution Channel and Country |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in Report:

-

What is the expected market size and CAGR of the global diabetic food market during 2025–2033?

-

What are the major growth drivers influencing the global diabetic food market expansion?

-

How is the rising global diabetes prevalence impacting the demand for diabetic food products?

-

Which product categories (Confectionery, Snacks, Bakery, Dairy, Others) are dominating the market, and why?

-

What are the most preferred distribution channels for diabetic foods across various regions?

-

What challenges are faced by manufacturers in terms of taste, texture, pricing, and consumer perception?

-

How do regional markets such as the United States, India, UAE, and the United Kingdom differ in consumer behavior and product demand?

-

Which key players are leading the global diabetic food market, and what are their latest strategies and innovations?

-

How are government initiatives, regulations, and public awareness campaigns shaping market dynamics?

-

What role does personalized nutrition and functional food innovation play in the future of the diabetic food market?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Diabetic Food Market

6. Market Share

6.1 Products

6.2 Distribution Channel

6.3 Country

7. Products

7.1 Confectionery

7.2 Snacks

7.3 Bakery Products

7.4 Dairy Products

7.5 Others

8. Distribution Channel

8.1 Supermarkets and Hypermarkets

8.2 Specialty Stores

8.3 Online Stores

8.4 Others

9. Country

9.1 North America

9.1.1 United States

9.1.2 Canada

9.2 Europe

9.2.1 France

9.2.2 Germany

9.2.3 Italy

9.2.4 Spain

9.2.5 United Kingdom

9.2.6 Belgium

9.2.7 Netherlands

9.2.8 Turkey

9.3 Asia Pacific

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 Australia

9.3.5 South Korea

9.3.6 Thailand

9.3.7 Malaysia

9.3.8 Indonesia

9.3.9 New Zealand

9.4 Latin America

9.4.1 Brazil

9.4.2 Mexico

9.4.3 Argentina

9.5 Middle East & Africa

9.5.1 South Africa

9.5.2 Saudi Arabia

9.5.3 UAE

10. Porter’s Five Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 Nestlé

12.1.1 Overview

12.1.2 Key Persons

12.1.3 Recent Development & Strategies

12.1.4 Product Portfolio

12.1.5 Financial Insight

12.2 Unilever

12.2.1 Overview

12.2.2 Key Persons

12.2.3 Recent Development & Strategies

12.2.4 Product Portfolio

12.2.5 Financial Insight

12.3 The Kellogg Company

12.3.1 Overview

12.3.2 Key Persons

12.3.3 Recent Development & Strategies

12.3.4 Product Portfolio

12.3.5 Financial Insight

12.4 Conagra Brands, Inc.

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Recent Development & Strategies

12.4.4 Product Portfolio

12.4.5 Financial Insight

12.5 Tyson Foods

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Recent Development & Strategies

12.5.4 Product Portfolio

12.5.5 Financial Insight

12.6 The Hershey Company

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Recent Development & Strategies

12.6.4 Product Portfolio

12.6.5 Financial Insight

12.7 Hain Celestial Group

12.7.1 Overview

12.7.2 Key Persons

12.7.3 Recent Development & Strategies

12.7.4 Product Portfolio

12.7.5 Financial Insight

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com