Bicycle Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowBicycle Market Trends & Summary

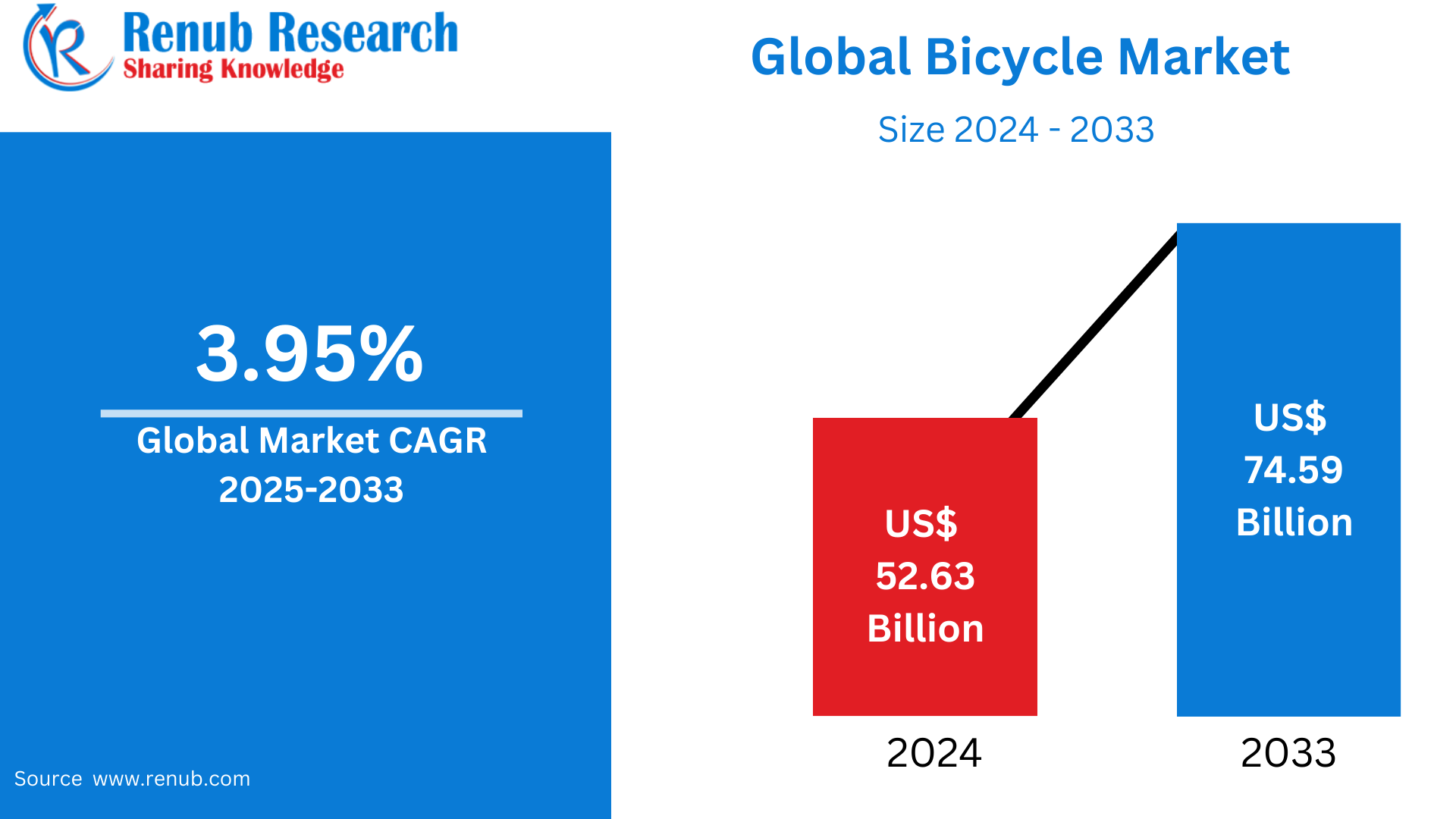

Bicycle Market is expected to reach US$ 74.59 billion by 2033 from US$ 52.63 billion in 2024, with a CAGR of 3.95% from 2025 to 2033. The main factors supporting the market share are the introduction of advantageous regulations by governmental organizations to reduce the amount of carbon emissions emitted by automobiles and the advancement of electric bicycles.

The report Bicycle Global Market & Forecast covers by Type (Road Bicycle, Hybrid Bicycle, All Terrain Bicycle, E-Bicycle, Other Types), Distribution Channel (Online Stores, Offline Stores), Countries and Company Analysis, 2025-2033.

Global Bicycle Industry Overview

Urbanization, growing environmental consciousness, and a growing desire for sustainable mobility have all contributed to the continuous rise of the bicycle business worldwide. Bicycles are seen to be a more environmentally friendly option than vehicles since they lower carbon emissions and encourage healthy living. Traditional motorcycles, electric bikes (e-bikes), and accessories are only a few of the several segments that make up the business. Thanks to developments in battery technology, e-bikes in particular have grown significantly and are now a cost-effective choice for both leisure and commuting users. As more individuals choose outside activities and personal transportation in reaction to the COVID-19 epidemic, cycling has also become increasingly popular.

With China and India producing and using a big number of bicycles, Asia-Pacific continues to be the largest bicycle market. On the other hand, due to established cycling cultures and rising interest in sustainability and health, North America and Europe place a greater emphasis on high-end bikes and e-bikes. From producers to retailers, a variety of parties are involved in the bicycle industry's supply chain, and the market has changed as a result of the growth of direct-to-consumer business models via internet platforms. The sector is well-positioned for future growth in both established and emerging nations thanks to rising investments in infrastructure, such as bike lanes and cities that are bike-friendly.

With governments all over the world investing heavily in cycling facilities, infrastructure development has emerged as a key factor in the growth of the bicycle market. The Netherlands showed their commitment in November 2022 by committing over USD 1.2 billion to the construction of bike infrastructure. In a similar vein, the French government announced in May 2023 a comprehensive investment plan of EUR 2 billion through 2027 to improve cycling infrastructure and encourage the use of bicycles. The goals of these initiatives are to build linked bicycle networks in cities, enhance bike parking facilities, and extend designated bike lanes.

Trends in the bicycle business are still being driven by product innovation, with manufacturers concentrating on creating customized bikes for various consumer groups. To improve the riding experience, the industry has seen a boom in the creation of ergonomic features, lightweight materials, and aerodynamic designs. For example, the Giant Group introduced its Momentum brand of e-bikes in Germany in 2023. The PakYak E+ was designed for adventurous light load hauling, while the Voya E+ was designed for urban commuting. The industry's reaction to the various demands and preferences of its clientele is reflected in these advances.

Growth Drivers for the Bicycle Market

Increasing Attention to Wellness and Health

Cycling helps increase muscle strength, burn calories, and improve fitness levels. People are using sports like cycling to be active and maintain their fitness as they grow more health conscious. For example, Samagra Shiksha in Delhi has started a wellness club to teach students in grades 9 through 12 in government-run schools how to live healthy lifestyles. In addition, more individuals are using cycling to lower their risk and enhance their health as cardiovascular illnesses become more common. For example, recent research from the World Health Federation states that 20.5 million fatalities in 2021 were caused by cardiovascular diseases, which still affect over half a billion people globally. Bicycles are therefore widely used for fitness purposes all around the world.

Increasing Cycle Events

Bicycles are becoming more and more popular in trekking and leisure activities due to people's growing desire for adventurous pursuits, which is fueling the market's expansion. The demand for bicycles is also rising as a result of the participation and promotion of cycling by several public figures and celebrities. Additionally, by motivating individuals to establish objectives and prepare for a particular event, these activities advance fitness and health. After finishing the race, participants frequently report feeling more fit and accomplished. For instance, about 96% of respondents to 2022 research conducted by the Allgemeiner Deutscher Fahrrad-Club (ADFC) stated that "they rode the bikes in Germany."

Additionally, according to the Irish Sports Council, Sport Ireland gave Cycling Ireland about €520,000 in 2022 with the goal of encouraging patrons to participate in a variety of cycling-related events throughout the nation. The event's ultimate goal was to increase awareness of and acceptance of bicycles throughout the city. The market share of bicycles is supported by such awareness-raising campaigns.

Increasing Use of E-Bikes

Electric bicycles, or e-bikes, are becoming a more popular mode of transportation among customers due to rising gasoline prices and growing traffic in cities. It is anticipated that traffic density would increase as more people relocate to cities, making transportation even more difficult. According to UN estimates, 68% of people on Earth will reside in cities by 2050, which will worsen traffic. With the help of e-bikes, a wider spectrum of people—including those with physical restrictions or lower fitness levels—can now ride bikes. Riders can go farther and climb hills more easily with electric help. With programs like World Bicycle Day (June 3rd), which is supported by the UN and WHO, governments are encouraging this change and helping the e-bike sector expand.

Challenges in the Bicycle Market

High Cost of E-bikes

One major obstacle to the widespread adoption of electric bicycles, or "e-bikes," is their expensive cost, especially in poor nations. Due to its sophisticated technology, which includes electric motors, batteries, and controls, e-bikes are typically more costly than conventional bicycles. Increased production expenses as a result of these extra features are frequently passed on to customers. Even while e-bikes have advantages including longer travel times and simpler hill climbing, many prospective purchasers find their high cost prohibitive, particularly in areas with lower average earnings. Because of this, e-bikes are frequently viewed as a luxury good rather than a practical daily mode of transportation. Manufacturers may need to look for ways to lower production costs and provide more reasonably priced versions in order to boost acceptance.

Competition from Alternatives

Bicycles face fierce competition from electric scooters and ride-sharing services, especially when it comes to short-distance transport. For short, city trips, electric scooters are sometimes seen to be more practical since they provide effortless movement without the physical strain of riding. Furthermore, ride-sharing services—like renting an electric bike or scooter—offer a convenient, on-demand mode of transportation that does not need ownership or upkeep. In crowded places where parking availability and traffic congestion are major issues, these options are especially alluring. Although bicycles, particularly e-bikes, are environmentally friendly and have health advantages, the conventional bicycle industry is facing competition from electric scooters and ride-sharing services due to their popularity, ease of use, flexibility, and rapid availability.

United States Bicycle Market

The increased popularity of riding for exercise, commuting, and leisure has led to a broad bicycle market in the United States. Demand has been further increased by the growing emphasis on eco-friendly and sustainable modes of transportation, particularly for electric bicycles (e-bikes), which are convenient for commuting in cities. Strong infrastructure, such as bike lanes and cycling events, supports the well-established riding culture in many areas. But there are drawbacks to the industry as well, such competition from other modes of transportation like ride-sharing services and electric scooters. Seasonal variations in demand and the high price of e-bikes also hinder the growth of the sector as a whole. Notwithstanding these obstacles, government programs and a greater focus on leading a healthy lifestyle continue to fuel bicycle popularity in the United States.

Germany Bicycle Market

Germany's bicycle sector, which is distinguished by sturdy infrastructure and high consumer demand, is a pillar of the European cycling industry. Bicycles are a common form of transportation for both everyday commute and recreational activities, and cycling is ingrained in German culture. Particularly in the electric bicycle (e-bike) sector, which has emerged as a major force in recent years, the market has grown significantly.

With a significant market share, specialty merchants are essential to the German bicycle industry. With consistent production and sales numbers, the industry's tenacity is demonstrated even during recessions. In the future, it is anticipated that the German bicycle industry will keep growing due to continuous innovation, customer demand for environmentally friendly transportation, and encouraging government regulations that promote the development of cycling infrastructure.

India Bicycle Market

The market for bicycles in India is expanding significantly due to a number of causes, including growing health consciousness, rising fuel prices, and a preference for environmentally friendly modes of transportation. To meet the varied demands of consumers, the market is divided into several divisions, such as standard, premium, kids' bicycles, exports, and electric bicycles (e-bikes). Due to their cost and appropriateness for urban transportation, particularly in crowded cities, e-bikes in particular are becoming more and more popular. The government's efforts to support sustainability and cycling infrastructure support market growth even more.

The market is defined by a combination of well-known domestic companies like Hero Cycles, Avon Cycles, and TI Cycles as well as global names like Decathlon and Trek. Production is greatly boosted by manufacturing centers in areas like Ludhiana, with a sizable amount of output satisfying local demand. Traditional offline storefronts are being complemented by online shopping platforms, which are increasingly affecting consumer decisions. The Indian bicycle industry is expected to continue expanding due to changing customer tastes and favorable regulations, even in the face of obstacles including poor infrastructure and hefty import taxes.

United Arab Emirates Bicycle Market

The market for bicycles in the United Arab Emirates (UAE) is expanding significantly due to government campaigns that support cycling as a sustainable form of transportation as well as growing environmental and health consciousness. To promote cycling as a practical substitute for motorized transportation, the UAE government has been aggressively creating bicycle infrastructure, such as bike lanes and trails in places like Dubai and Abu Dhabi. Furthermore, the advent of bike-sharing schemes, like Abu Dhabi's ADCB Bikeshare, has increased cycling accessibility for both locals and visitors. These initiatives seek to improve environmental sustainability, encourage a healthy lifestyle, and lessen transportation congestion. Because of the growing demand for a variety of bicycles, particularly electric bikes, that satisfy a wide range of customer preferences, the bicycle market in the United Arab Emirates is expected to continue growing.

Recent Developments in Bicycle Industry

- In March 2023, DOUZE Factory SAS, a cargo bike design and manufacturing firm located in France, announced a collaboration with Toyota to jointly develop and market a new line of electric cargo bikes.

- Trek Bicycle Corporation introduced two electric bikes in February 2023 that are intended to be used for both freight and children's transportation. Trek has made its foray into the freight e-bike market with the new Trek Fetch Plus 2 and Trek Fetch Plus 4. With the Trek Fetch Plus 4 adopting a less popular front-loader cargo bike layout and the Trek Fetch Plus 2 launching as a longtail cargo bike, these family-friendly cargo e-bikes have unique designs.

- The development of a Lithuanian plant in the Kėdainiai Free Economic Zone (FEZ) was announced by Pon. Bike in February 2023. The facility is expected to start operations in the summer of 2024. In addition to looking creative ways to assemble bicycles and produce electric bicycles, this development is anticipated to increase European manufacturing capacity.

- January 2023: At the Consumer Electronic Show (CES) 2023 in Las Vegas, Yadea, the top brand of electric two-wheelers worldwide, unveiled two new electric bike models. The models include Trooper 01, URider S, and Innovator, the corporation claims.

Bicycle Market Segments

Type – Market breakup in 5 viewpoints:

- Road Bicycle

- Hybrid Bicycle

- All Terrain Bicycle

- E-Bicycle

- Other Types

Distribution Channel – Market breakup in 2 viewpoints:

- Online Stores

- Offline Stores

Country – Market breakup in 25 viewpoints:

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- Turkey

- United Arab Emirates

All the Key players have been covered from 5 Viewpoints:

- Overview

- Key Persons

- Product Portfolio

- Recent Development & Strategies

- Revenue Analysis

Company Analysis:

- Accell Group NV

- Trek Bicycle Corporation

- Pon Holdings BV

- Giant Manufacturing Co. Ltd

- Bulls Bikes

- Pedego Inc.

- Benno Bikes LLC

- Hero Cycles Limited

- Ribble Cycles

- Riese Und Muller Gmbh

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Type, Distribution Channels and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Source

2.1.2 Secondary Source

2.2 Research Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Bicycle Market

5.1 Historical Market Trend

5.2 Market Forecast

6. Market Share Analysis

6.1 By Types

6.2 By Distribution Channels

6.3 By Countries

7. Type

7.1 Road Bicycle

7.2 Hybrid Bicycle

7.3 All Terrain Bicycle

7.4 E-Bicycle

7.5 Other Types

8. Distribution Channel

8.1 Online Stores

8.2 Offline Stores

9. Countries

9.1 North America

9.1.1 United States

9.1.2 Canada

9.2 Europe

9.2.1 France

9.2.2 Germany

9.2.3 Italy

9.2.4 Spain

9.2.5 United Kingdom

9.2.6 Belgium

9.2.7 Netherland

9.2.8 Turkey

9.3 Asia Pacific

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 Australia

9.3.5 South Korea

9.3.6 Thailand

9.3.7 Malaysia

9.3.8 Indonesia

9.3.9 New Zealand

9.4 Latin America

9.4.1 Brazil

9.4.2 Mexico

9.4.3 Argentina

9.5 Middle East & Africa

9.5.1 South Africa

9.5.2 Saudi Arabia

9.5.3 UAE

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 Accell Group NV

12.1.1 Overview

12.1.2 Key Persons

12.1.3 Product Portfolio

12.1.4 Recent Development & Strategies

12.1.5 Revenue Analysis

12.2 Trek Bicycle Corporation

12.2.1 Overview

12.2.2 Key Persons

12.2.3 Product Portfolio

12.2.4 Recent Development & Strategies

12.2.5 Revenue Analysis

12.3 Pon Holdings BV

12.3.1 Overview

12.3.2 Key Persons

12.3.3 Product Portfolio

12.3.4 Recent Development & Strategies

12.3.5 Revenue Analysis

12.4 Giant Manufacturing Co. Ltd

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Product Portfolio

12.4.4 Recent Development & Strategies

12.4.5 Revenue Analysis

12.5 Bulls Bikes

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Product Portfolio

12.5.4 Recent Development & Strategies

12.5.5 Revenue Analysis

12.6 Pedego Inc.

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Product Portfolio

12.6.4 Recent Development & Strategies

12.6.5 Revenue Analysis

12.7 Benno Bikes LLC

12.7.1 Overview

12.7.2 Key Persons

12.7.3 Product Portfolio

12.7.4 Recent Development & Strategies

12.7.5 Revenue Analysis

12.8 Hero Cycles Limited

12.8.1 Overview

12.8.2 Key Persons

12.8.3 Product Portfolio

12.8.4 Recent Development & Strategies

12.8.5 Revenue Analysis

12.9 Ribble Cycles

12.9.1 Overview

12.9.2 Key Persons

12.9.3 Product Portfolio

12.9.4 Recent Development & Strategies

12.9.5 Revenue Analysis

12.10 Riese Und Muller Gmbh

12.10.1 Overview

12.10.2 Key Persons

12.10.3 Product Portfolio

12.10.4 Recent Development & Strategies

12.10.5 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com