Australia Fertilizer Market Size, Trends, Share & Forecast 2025-2033

Buy NowAustralia Fertilizer Market Size and Forecast 2025-2033

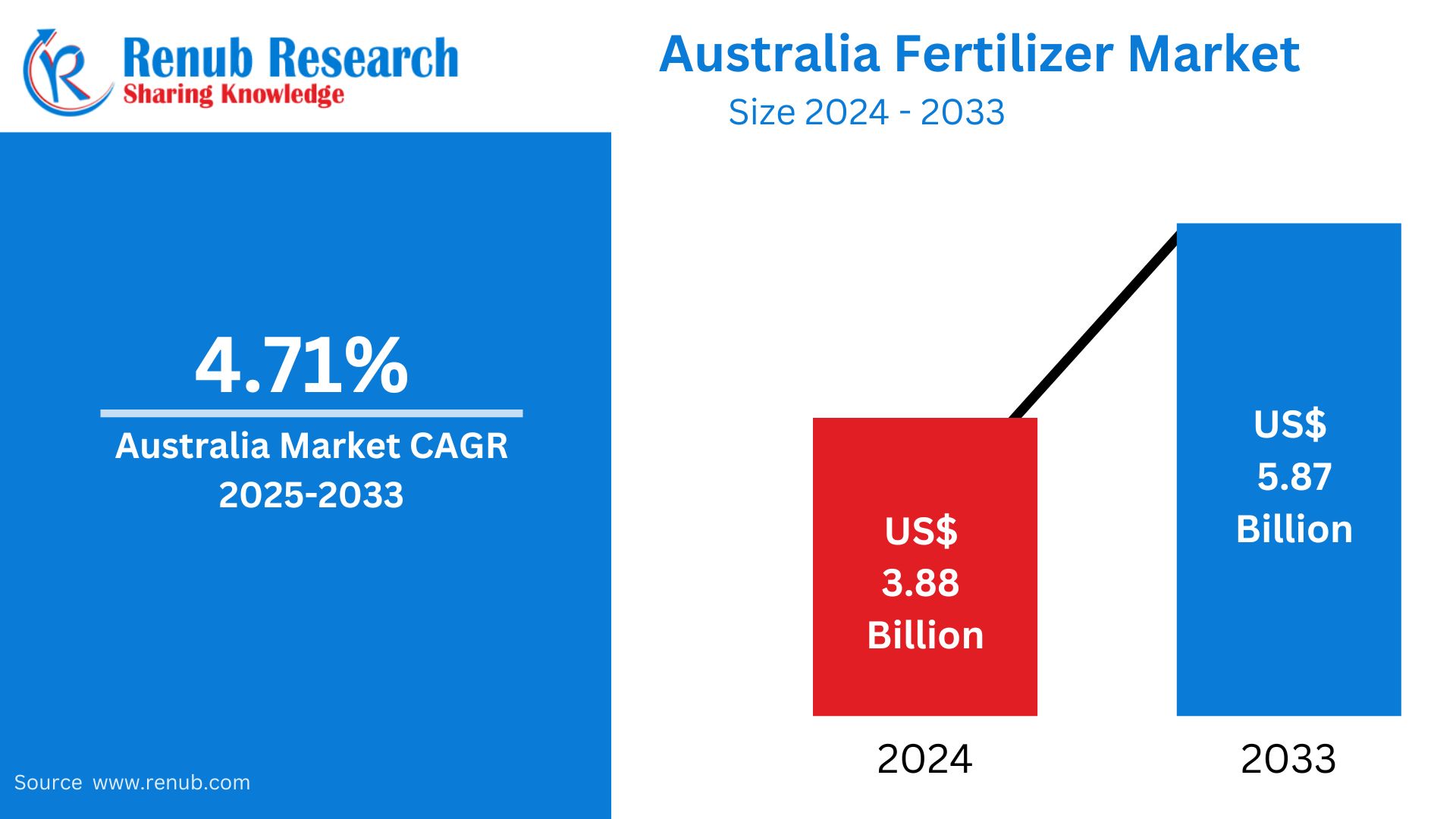

Australia Fertilizer Market is expected to reach US$ 5.87 billion by 2033 from US$ 3.88 billion in 2024, with a CAGR of 4.71% from 2025 to 2033. The main factor propelling the market expansion is the growing inclination of farmers nationwide towards organic product varieties that enhance soil health and reduce environmental impact.

The report Australia Fertilizer Market & Forecast covers by Type {Nitrogen Fertilizers (Urea, Ammonium nitrate, Ammonium sulfate, Others), Phosphorus Fertilizers (Superphosphates, MAP, DAP), Potassium Fertilizers (Potash, SOP), Bio-Fertilizers (Microbial, Organic variants)}, Category (Organic, Inorganic), Form (Dry, Liquid), Application (Agriculture, Horticulture, Gardening, Others), Crop (Grassland, Vegetables, Fruits/Treenuts, Roots/Tubers, Sugar Crops, Fibre Crops, Other Oil Crops, Oil Palm, Soybeans, Other Cereals, Maize, Rice, Wheat, Others), Region (Northeast, Midwest, South, West) and Company Analysis, 2025-2033.

Australia Fertilizer Market Overview

Australia's fertilizer sector is essential to sustaining the nation's agricultural output. The sector plays a crucial role in preserving the sustainability of farming methods in a variety of agricultural zones, with a particular emphasis on improving crop output and soil health. Fertilizers are used extensively to address the nutritional needs of different crops, especially in areas with nutrient-deficient soils. They can be nitrogen-based or organic blends. Strict safety and environmental laws govern the industry's operations, guaranteeing that goods fulfill quality requirements while having the least possible negative environmental impact. Imports supplement domestic production, resulting in a competitive and well-supplied market environment.

Innovation and sustainability have been more prominent in the Australian fertilizer sector in recent years. Precision farming techniques and contemporary technologies are being embraced by farmers more and more in an effort to maximize fertilizer use, cut waste, and improve crop production. As part of larger environmental and financial objectives, there is an increasing need for effective and environmentally friendly solutions, such as liquid and water-soluble fertilizers. Government programs encouraging sustainable agriculture, along with expenditures on irrigation and infrastructure, could also help the industry's expansion. The emphasis is still on creating solutions that satisfy the changing demands of contemporary farming while still being environmentally conscious.

Growing agricultural methods and government assistance programs are driving major change in Australia's fertilizer sector. The Australian government's USD 30 million investment in 2023, which is expressly intended to assist grain growers in managing risks like drought and market volatility, demonstrates its dedication to agricultural sustainability. Modern irrigation systems and precision farming methods have been widely adopted nationwide as a result of this investment. Water resource management has advanced significantly in the agricultural sector; Australian farms use over 8.1 million megaliters of water annually through a variety of advanced irrigation systems and channels.

The nation's leading field crop industry, especially wheat production, which occupies 50.2% of all field cropland, has a significant impact on market dynamics. Farmers are rapidly implementing advanced fertilizer management systems and soil monitoring technologies, indicating a noticeable shift in the sector toward precision agriculture practices. Though there is a lot of room for technological improvement in the industry, the adoption of modern irrigation techniques is still quite low, with only 9% of farmers using surface drip irrigation and 2% using sub-surface drip systems.

Growth Drivers for the Australia Fertilizer Market

Rising Agricultural Demand

The Australian fertilizer market is expanding due in large part to rising agricultural demand. The agriculture sector is under growing pressure to increase crop yields more effectively as the nation's population and export markets grow. Cereals, fruits, vegetables, and pulses are just a few of the crops that must have their nutrient needs consistently and effectively met. Fertilizers are essential to modern farming because they improve soil fertility and increase productivity. Furthermore, the demand for fertilizers to maintain high-quality outputs is further fueled by Australia's dominant position in the world's agricultural exports, particularly in wheat, barley, and horticulture. Increased fertilizer consumption nationwide is a direct result of this ongoing agricultural expansion.

Growth in Horticulture and Field Crops

In Australia, the need for fertilizer is largely driven by the expansion of field crops and horticulture. The requirement for effective and balanced nutrition management increases as farmers increase their production of high-value commodities including fruits, vegetables, and grains. To attain the best yield and quality, these crops frequently need particular nutrient profiles, which leads to a rise in the use of customized fertilizer solutions. Fertilizer use is further increased by the move toward intensive farming methods and year-round production, particularly in horticulture focused on exports. Additionally, farmers are being encouraged to invest in soil fertility and plant health due to the domestic and international consumer demand for fresh produce and premium-quality grains. Fertilizers are a key input in the expansion of these agricultural sectors, and this trend is predicted to continue.

Innovation in Fertilizer Products

The future of the fertilizer market in Australia is being significantly shaped by innovations in fertilizer products. As farmers and politicians prioritize sustainable agriculture, the development of slow-release, water-soluble, and environmentally friendly fertilizers is accelerating. These cutting-edge products are made to limit their negative effects on the environment, decrease leaching, and increase the efficiency of nutrient uptake. For example, slow-release fertilizers give a consistent supply of nutrients over time, lowering the need for regular application, while water-soluble fertilizers offer precise nutrient delivery and are perfect for contemporary irrigation systems. These developments promote ethical agricultural methods in addition to increasing crop yields. In the agricultural industry, there is a growing need for more intelligent and sustainable fertilizer solutions as environmental concerns and laws become more stringent.

Challenges in the Australia Fertilizer Market

High Cost of Specialty Fertilizers

One major obstacle to the widespread use of specialty fertilizers in Australia is their expensive cost, particularly for slow-release and water-soluble formulations. Despite the fact that these products have higher nutrient absorption, increased efficiency, and a lower environmental impact, small and medium-sized farmers frequently cannot afford them due to their high cost. The cost element is particularly difficult when profit margins are narrow or the economy is unpredictable. Because of this, despite the long-term advantages of more recent options, many farmers still use conventional fertilizers. In order to encourage the adoption of modern fertilizers across larger agricultural segments, it may be essential to close this affordability gap through government subsidies, cost-cutting measures supported by research, or cooperative purchasing arrangements.

Stringent Environmental Regulations

Strict environmental laws that aim to lessen the detrimental effects of chemical use, including nutrient runoff, soil deterioration, and greenhouse gas emissions, govern the fertilizer sector in Australia. These rules raise the price of compliance for businesses even though they are crucial for preserving ecosystems and encouraging sustainable farming methods. To comply with legal requirements, businesses must make investments in cleaner manufacturing technology, monitoring systems, and reporting procedures. These extra costs have the potential to limit innovation investment and lower profitability. Furthermore, navigating intricate regulatory frameworks may cause new methods or items to be introduced later than planned. Notwithstanding these obstacles, conforming to environmental norms is becoming more and more recognized as a critical step in preserving public and regulatory confidence and ensuring the long-term profitability of the sector.

Northeast Australia Fertilizer Market

In Northeast Australia, especially in areas like North Queensland, the fertilizer market plays a crucial role in the country's agricultural environment. Important fertilizer manufacturing facilities, such Incitec Pivot's ammonium phosphate facility in Phosphate Hill, are located in North Queensland and provide both domestic and export supply. The need for fertilizers to preserve soil fertility and maximize crop yields is driven by the region's agricultural pursuits, which include horticulture, cotton, and sugarcane. Furthermore, because of the region's closeness to the Great Barrier Reef, fertilizer application must be carefully managed to avoid nutrient runoff and save marine habitats. In order to combine ecological preservation and agricultural productivity in this area, sustainable farming methods and compliance with environmental rules are crucial.

Midwest Australia Fertilizer Market

The thriving agricultural industry in the Midwest of Australia, especially in Western Australia, is propelling the fertilizer market's notable expansion. The agriculture sector in the state includes a variety of farming pursuits, including horticulture, cattle, and grain production. Major fertilizer suppliers are investing in infrastructure improvements to service this vast agricultural base. A more dependable supply chain for nearby farmers will be ensured, for example, by Nutrien Ag Solutions' $70 million construction of a state-of-the-art fertilizer distribution center in Rockingham, which will expand its bulk granular fertilizer storage capacity by 20%. Similar to this, CBH Group is expanding its line of granular fertilizers and entering the liquid fertilizer business by building a Urea Ammonium Nitrate (UAN) storage facility next to its Kwinana grain port. These expenditures are intended to promote the long-term viability of Western Australia's agriculture sector, improve supply chain efficiency, and satisfy the rising demand for fertilizers.

South Australia Fertilizer Market

The varied farming practices and climate of South Australia have an impact on the fertilizer business. The state's agricultural methods range from horticulture in the Riverland to the production of grains and cereals in the Eyre Peninsula. A variety of fertilizer products suited to certain crop requirements and soil types are required due to these fluctuating agricultural demands. Furthermore, fertilizer application tactics are impacted by the region's environment, which is marked by arid conditions and sporadic droughts, underscoring the importance of effective nutrient management. For fertilizers to be delivered on time and available to satisfy South Australian farmers' needs, local distributors and suppliers are essential. Overall, the interaction of climatic conditions, agricultural diversification, and local stakeholders' initiatives to promote sustainable farming techniques shapes the South Australian fertilizer industry.

Australia Fertilizer Market Segmentation Analysis

Type – Market breakup in 4 viewpoints:

1. Nitrogen Fertilizers

- Urea

- Ammonium nitrate

- Ammonium sulfate

- Others

2. Phosphorus Fertilizers

- Superphosphates

- MAP

- DAP

3. Potassium Fertilizers

- Potash

- SOP

4. Bio-Fertilizers

- Microbial

- Organic variants

Category – Market breakup in 2 viewpoints:

- Organic

- Inorganic

Form – Market breakup in 2 viewpoints:

- Dry

- Liquid

Application – Market breakup in 4 viewpoints:

- Agriculture

- Horticulture

- Gardening

- Others

Crop – Market breakup in 14 viewpoints:

- Grassland

- Vegetables

- Fruits/Treenuts

- Roots/Tubers

- Sugar Crops

- Fibre Crops

- Other Oil Crops

- Oil Palm

- Soybeans

- Other Cereals

- Maize

- Rice

- Wheat

- Others

Region – Market breakup in 4 viewpoints:

- Northeast

- Midwest

- South

- West

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Development

- Revenue

Company Analysis:

- Yara International ASA

- K+S AG

- CF Industries Holdings

- GrupaAzoty S.A

- ICL Group

- OCI NV

- Sociedad Quimica y Minera de Chile SA

- BASF SA

- PhosAgro

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Type, Category, Foam, Application, Crop and Region |

| Region Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Australia Fertilizer Market

6. Market Share Analysis

6.1 By Type

6.2 By Category

6.3 By Foam

6.4 By Application

6.5 By Crop

6.6 By Region

7. Type

7.1 Nitrogen Fertilizers

7.1.1 Urea

7.1.1.1 Market Trends

7.1.1.2 Market Forecast

7.1.2 Ammonium nitrate

7.1.2.1 Market Trends

7.1.2.2 Market Forecast

7.1.3 Ammonium sulfate

7.1.3.1 Market Trends

7.1.3.2 Market Forecast

7.1.4 Others

7.1.4.1 Market Trends

7.1.4.2 Market Forecast

7.2 Phosphorus Fertilizers

7.2.1 Superphosphates

7.2.1.1 Market Trends

7.2.1.2 Market Forecast

7.2.2 MAP

7.2.2.1 Market Trends

7.2.2.2 Market Forecast

7.2.3 DAP

7.2.3.1 Market Trends

7.2.3.2 Market Forecast

7.3 Potassium Fertilizers

7.3.1 Potash

7.3.1.1 Market Trends

7.3.1.2 Market Forecast

7.3.2 SOP

7.3.2.1 Market Trends

7.3.2.2 Market Forecast

7.4 Bio-Fertilizers

7.4.1 Microbial

7.4.1.1 Market Trends

7.4.1.2 Market Forecast

7.4.2 Organic variants

7.4.2.1 Market Trends

7.4.2.2 Market Forecast

8. Category

8.1 Organic

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Inorganic

8.2.1 Market Trends

8.2.2 Market Forecast

9. Form

9.1 Dry

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 Liquid

9.2.1 Market Trends

9.2.2 Market Forecast

10. Application

10.1 Agriculture

10.1.1 Market Trends

10.1.2 Market Forecast

10.2 Horticulture

10.2.1 Market Trends

10.2.2 Market Forecast

10.3 Gardening

10.3.1 Market Trends

10.3.2 Market Forecast

10.4 Others

10.4.1 Market Trends

10.4.2 Market Forecast

11. Crop

11.1 Grassland

11.1.1 Market Trends

11.1.2 Market Forecast

11.2 Vegetables

11.2.1 Market Trends

11.2.2 Market Forecast

11.3 Fruits/Treenuts

11.3.1 Market Trends

11.3.2 Market Forecast

11.4 Roots/Tubers

11.4.1 Market Trends

11.4.2 Market Forecast

11.5 Sugar Crops

11.5.1 Market Trends

11.5.2 Market Forecast

11.6 Fibre Crops

11.6.1 Market Trends

11.6.2 Market Forecast

11.7 Other Oil Crops

11.7.1 Market Trends

11.7.2 Market Forecast

11.8 Oil Palm

11.8.1 Market Trends

11.8.2 Market Forecast

11.9 Soybeans

11.9.1 Market Trends

11.9.2 Market Forecast

11.10 Other Cereals

11.10.1 Market Trends

11.10.2 Market Forecast

11.11 Maize

11.11.1 Market Trends

11.11.2 Market Forecast

11.12 Rice

11.12.1 Market Trends

11.12.2 Market Forecast

11.13 Wheat

11.13.1 Market Trends

11.13.2 Market Forecast

11.14 Others

11.14.1 Market Trends

11.14.2 Market Forecast

12. Region

12.1 Northeast

12.1.1 Market Trends

12.1.2 Market Forecast

12.2 Midwest

12.2.1 Market Trends

12.2.2 Market Forecast

12.3 South

12.3.1 Market Trends

12.3.2 Market Forecast

12.4 West

12.4.1 Market Trends

12.4.2 Market Forecast

13. Company Analysis

13.1 Yara International ASA

13.1.1 Overview

13.1.2 Key Person

13.1.3 Recent Development

13.1.4 Revenue

13.2 K+S AG

13.2.1 Overview

13.2.2 Key Person

13.2.3 Recent Development

13.2.4 Revenue

13.3 CF Industries Holdings

13.3.1 Overview

13.3.2 Key Person

13.3.3 Recent Development

13.3.4 Revenue

13.4 GrupaAzoty S.A

13.4.1 Overview

13.4.2 Key Person

13.4.3 Recent Development

13.4.4 Revenue

13.5 ICL Group

13.5.1 Overview

13.5.2 Key Person

13.5.3 Recent Development

13.5.4 Revenue

13.6 OCI NV

13.6.1 Overview

13.6.2 Key Person

13.6.3 Recent Development

13.6.4 Revenue

13.7 Sociedad Quimica y Minera de Chile SA

13.7.1 Overview

13.7.2 Key Person

13.7.3 Recent Development

13.7.4 Revenue

13.8 BASF SA

13.8.1 Overview

13.8.2 Key Person

13.8.3 Recent Development

13.8.4 Revenue

13.9 PhosAgro

13.9.1 Overview

13.9.2 Key Person

13.9.3 Recent Development

13.9.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com