Australia Dump Trucks & Mining Trucks Market – Industry Outlook & Forecast 2025–2033

Buy NowAustralia Dump Trucks & Mining Trucks Market Size and Forecast 2025-2033

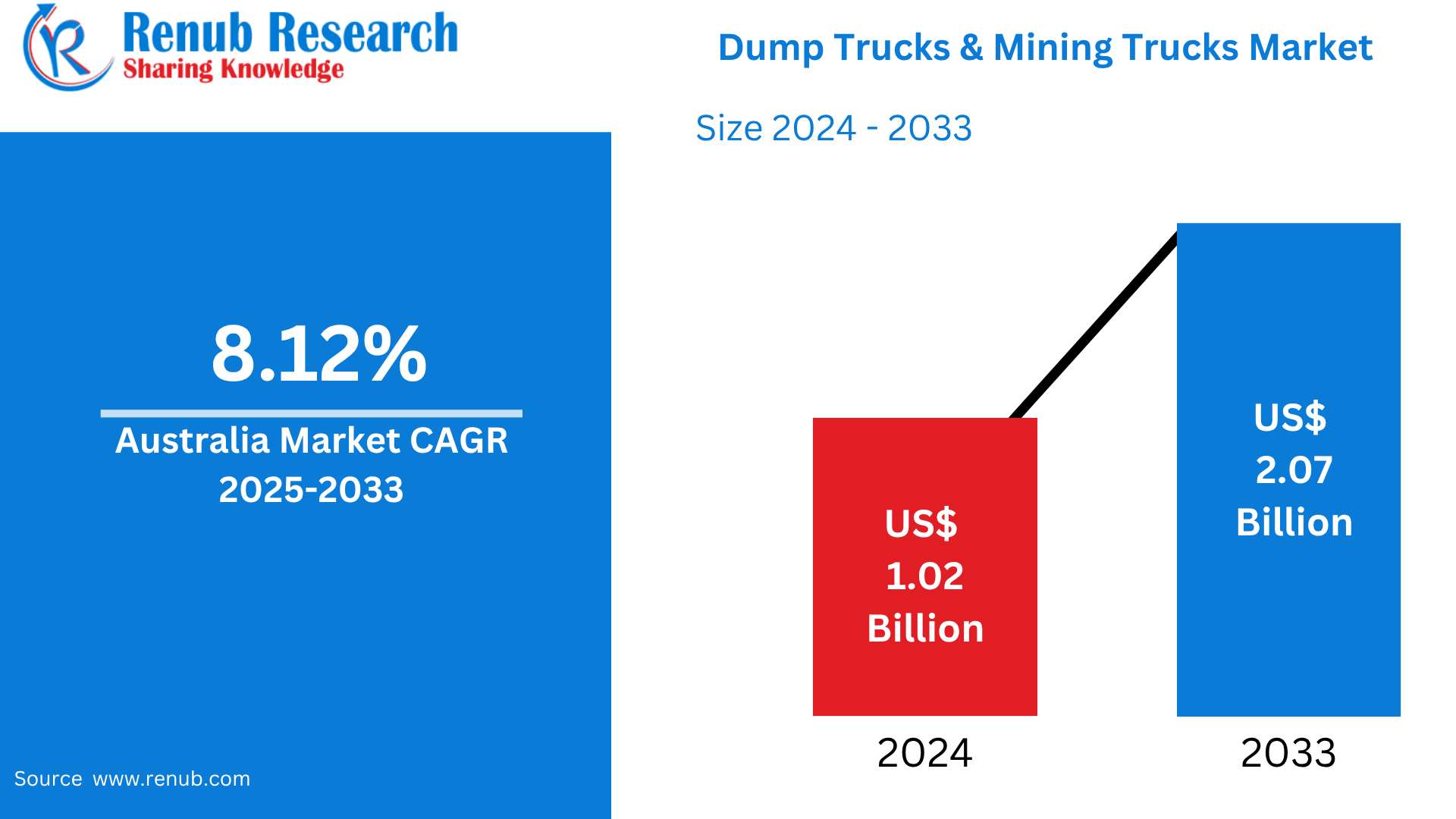

Australia Dump Trucks & Mining Trucks Market is expected to reach US$ 2.07 billion by 2033 from US$ 1.02 billion in 2024, with a CAGR of 8.12% from 2025 to 2033. Expanding mining operations, infrastructure development, technical developments, fleet modernization, and rising need for effective, high-capacity hauling solutions in both surface and underground mining operations are the main factors propelling the growth of the Australian dump truck and mining truck market.

Australia Dump Trucks & Mining Trucks Market Report by Type (Rear Dump Trucks, Side Dump Trucks, Roll-off Dump Trucks), Payload Class (Less than 100 tonnes, more than 100 tonnes), Engine Type (Internal Combustion, Electric), End Use (Mining, Construction, Waste Management, Others) and Company Analysis, 2025-2033.

Australia Dump Trucks & Mining Trucks Industry Overview

Australia's vast mining activities, especially those that extract coal, iron ore, and other precious minerals, are greatly aided by the dump trucks and mining trucks sector. There are many different types of heavy-duty trucks available on the market, including articulated trucks, rigid dump trucks, and increasingly autonomous vehicles designed for use in both open-pit and underground mining settings. Prominent mining firms are spending money on cutting-edge truck fleets to increase output, security, and overall operational effectiveness. The management of mining fleets is changing as a result of the integration of technology like improved telematics, electrification, and autonomous haulage systems (AHS), which help businesses plan maintenance better and minimize operational downtime.

The rising demand for raw materials, a strong emphasis on mining automation, and an increased focus on environmental sustainability are some of the major drivers propelling market expansion. In an effort to meet carbon reduction targets, businesses are actively investigating electric and low-emission trucks. Additionally, fleet modernization plans and the adoption of digital technology are growing, improving efficiency and lowering fuel usage. Notwithstanding these encouraging developments, the sector still confronts obstacles including exorbitant equipment costs, inadequate infrastructure in isolated mining areas, and a continuous demand for qualified operators and specialists. Nonetheless, it is anticipated that Australia's mining and dump truck markets would continue to be robust and flexible with sustained innovation and investment, meeting the changing needs of the mining industry.

Key Factors Driving the Australia Dump Trucks & Mining Trucks Market Growth

Rising Demand for Minerals

The rise of mining activities, notably in Australia, one of the world's top exporters of minerals, is mostly driven by the rising demand for minerals worldwide, particularly coal, iron ore, and lithium. Mining firms are boosting output to satisfy the demands of international markets as sectors like energy, technology, and construction depend more and more on these basic resources. More durable and effective mining equipment is needed to meet this rising demand, particularly dump and mining trucks that can withstand heavy loads and function in challenging environments. Mining businesses are investing in cutting-edge vehicles that provide improved capacity, durability, and performance in order to support this development, which will ultimately lead to market growth in the mining and dump truck industries.

Technological Advancements

The market for mining and dump trucks in Australia is undergoing a change thanks to technological advancements like telematics, electric vehicles, and autonomous haulage systems (AHS). By guaranteeing round-the-clock operation and cutting labor expenses, AHS, which enables vehicles to function without human intervention, increases production. With their lower emissions, fuel consumption, and smaller environmental impact, electric trucks are becoming more and more popular as a sustainable alternative. Furthermore, real-time truck performance data from telematics systems facilitates improved fleet management, predictive maintenance, and enhanced operational effectiveness. These developments are increasing the cost-effectiveness, safety, and efficiency of mining operations, which makes them very appealing to businesses trying to boost output while lowering expenses and their negative effects on the environment.

Sustainability Initiatives

The mining industry is adopting sustainability efforts, including the use of electric and hybrid vehicles, as a result of mounting pressure on businesses to lessen their environmental effect. When compared to conventional diesel-powered vehicles, these trucks drastically lower air pollution, fuel consumption, and carbon emissions. Mining businesses may comply with more stringent environmental standards and satisfy the rising demand from investors and consumers for sustainable operations by incorporating these greener options into their fleets. Additionally, by decreasing reliance on fossil fuels, cutting total operating costs, and improving the industry's overall environmental imprint, these eco-friendly vehicles help ensure the long-term viability of mining operations. The industry is expanding as a result of this move toward more environmentally friendly mining methods.

Challenges in the Australia Dump Trucks & Mining Trucks Market

Skilled Labor Shortage

The need for highly qualified operators and technicians has increased as mining trucks develop with cutting-edge technology like electric drivetrains and autonomous haulage systems (AHS). However, there is a lack of personnel in the mining sector who can run and maintain these complex systems. Electric trucks require understanding of new powertrains and battery technology, whereas autonomous vehicles, in particular, require specific knowledge for both operation and troubleshooting. Because businesses find it difficult to locate trained workers to operate and maintain sophisticated equipment, this skilled labor shortage hinders the adoption and optimization of new technology. In addition to driving up labor costs, the shortfall presents a problem for mining companies looking to update their fleets.

Environmental and Regulatory Compliance

In an effort to improve sustainability and lower their carbon footprints, mining corporations are coming under more and more pressure to adhere to strict environmental rules. Mining enterprises must adjust to regulations mandating fewer emissions, less fuel usage, and the adoption of greener technology as worries about climate change grow on a worldwide scale. Meeting these requirements by switching to electric or hybrid mining vehicles can be expensive, both in terms of initial outlays and adjustments to operations. A company's market position may be impacted by severe penalties, operating limitations, and reputational harm resulting from noncompliance with environmental legislation. Therefore, mining operators have to strike a compromise between the long-term objective of sustainable, environmentally friendly mining methods and the financial cost of compliance.

Market Segmentations

Type

- Rear Dump Trucks

- Side Dump Trucks

- Roll-off Dump Trucks

Payload Class

- Less than 100 tonnes

- More than 100 tonnes

Engine Type

- Internal Combustion

- Electric

End Use

- Mining

- Construction

- Waste Management

- Others

All the Key players have been covered

- Overview

- Key Persons

- Recent Developments

- Revenue Analysis

Company Analysis:

- Caterpillar Inc.

- CNH Industrial N.V.

- Deere & Company

- Doosan Corporation

- Hitachi Construction Machinery Co., Ltd.

- Komatsu Ltd.

- Volvo Group

- XCMG Group

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Type, By Payload Class, By Engine Type and By End Use |

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Australia Dump Trucks & Mining Trucks Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Type

6.2 By Payload Class

6.3 By Engine Type

6.4 By End Use

7. Type

7.1 Rear Dump Trucks

7.2 Side Dump Trucks

7.3 Roll-off Dump Trucks

8. Payload Class

8.1 Less than 100 tonnes

8.2 More than 100 tonnes

9. Engine Type

9.1 Internal Combustion

9.2 Electric

10. End Use

10.1 Mining

10.2 Construction

10.3 Waste Management

10.4 Others

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 Caterpillar Inc.

13.1.1 Overviews

13.1.2 Key Person

13.1.3 Recent Developments

13.1.4 Revenue

13.2 CNH Industrial N.V.

13.2.1 Overviews

13.2.2 Key Person

13.2.3 Recent Developments

13.2.4 Revenue

13.3 Deere & Company

13.3.1 Overviews

13.3.2 Key Person

13.3.3 Recent Developments

13.3.4 Revenue

13.4 Doosan Corporation

13.4.1 Overviews

13.4.2 Key Person

13.4.3 Recent Developments

13.4.4 Revenue

13.5 Hitachi Construction Machinery Co., Ltd.

13.5.1 Overviews

13.5.2 Key Person

13.5.3 Recent Developments

13.5.4 Revenue

13.6 Komatsu Ltd.

13.6.1 Overviews

13.6.2 Key Person

13.6.3 Recent Developments

13.6.4 Revenue

13.7 Volvo Group

13.7.1 Overviews

13.7.2 Key Person

13.7.3 Recent Developments

13.7.4 Revenue

13.8 XCMG Group

13.8.1 Overviews

13.8.2 Key Person

13.8.3 Recent Developments

13.8.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com