Asia Pacific Yeast Market Size and Growth Trends - Forecast 2025-2033

Buy NowAsia-Pacific Yeast Market Trends & Summary

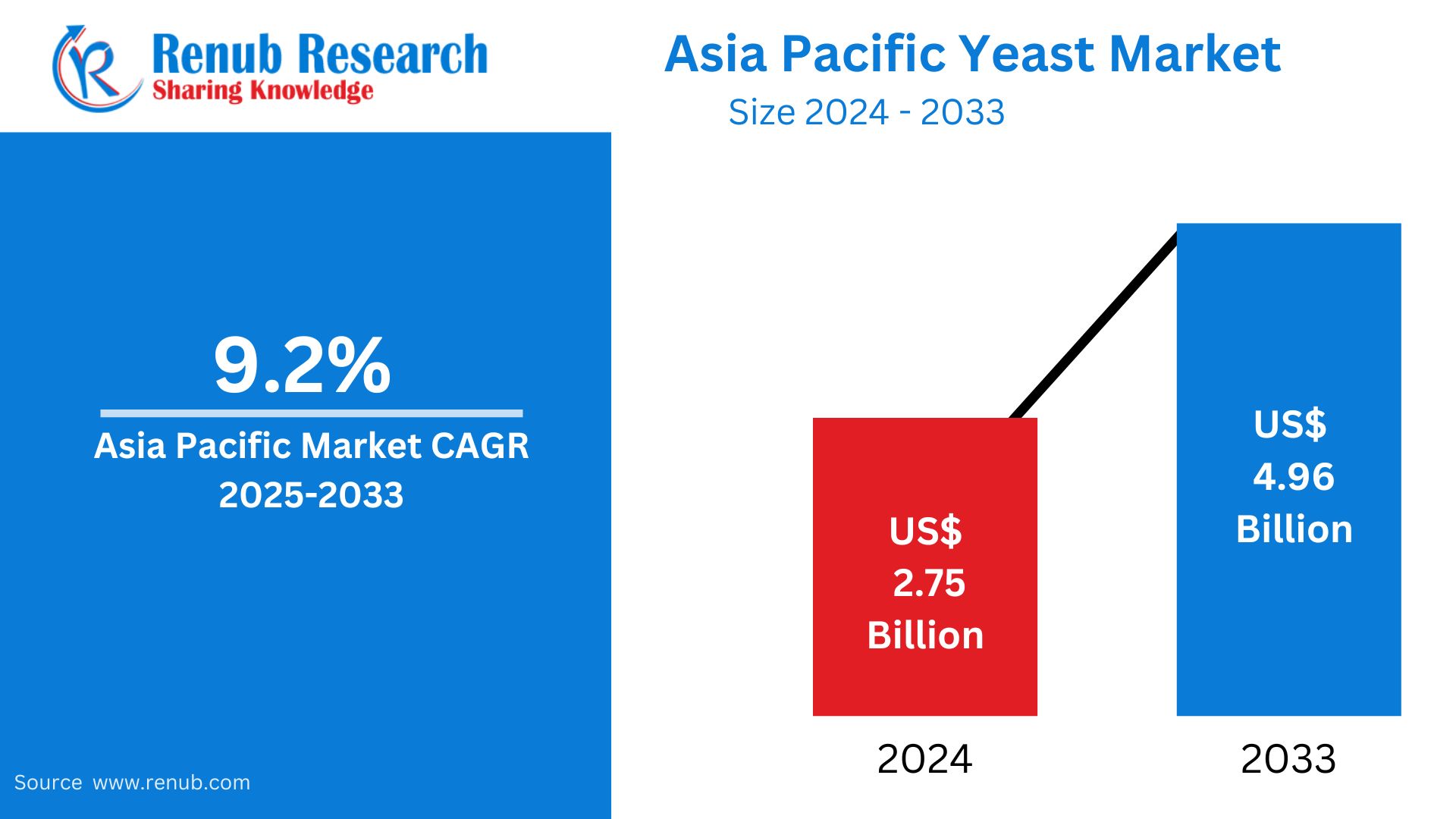

Asia-Pacific Yeast Market is expected to reach US$ 4.96 billion by 2033 from US$ 2.25 billion in 2024, with a CAGR of 9.2% from 2025 to 2033. Some of the drivers driving the market's growth include the increasing demand for bioethanol as a greener energy source, the rise in baked goods and convenience food consumption, and developments in plant-based food solutions.

Asia-Pacific Yeast Market Report by Form (Dry Yeast, Instant Yeast, Fresh Yeast, Others), Application (Food, Beverages, Bioethanol, Pharmaceuticals, Feed), Countries (China, Japan, India, South Korea, Thailand, Malaysia, Indonesia, Australia, New Zealand, Rest of Asia Pacific) and Company Analysis, 2025-2033.

Asia-Pacific Yeast Market Overview

The Asia-Pacific yeast market is expanding rapidly due to rising demand from a number of industries, such as pharmaceuticals, food and beverage, animal feed, and bioethanol. Particularly in the baking, brewing, and alcoholic beverage production industries—all of which are growing quickly in nations like China, India, Japan, and South Korea—yeast is essential to fermentation processes. The market is expanding due in large part to the region's expanding population, increasing disposable incomes, and changing customer tastes for alcoholic beverages and convenience meals.

Furthermore, the usage of yeast as a functional and nutritional component is increasing due to the trend for natural ingredients and clean-label products. Growth is also being aided by advancements in yeast strains, better fermentation techniques, and growing uses in probiotics and health supplements. However, there may be difficulties due to varying raw material costs and uneven storage conditions in various areas. Notwithstanding these obstacles, the Asia Pacific yeast market is expected to rise further due to rising industrial demand, urbanization, and a broader understanding of the advantages of yeast in various industries.

India was the 44th greatest exporter of yeast (out of 162) in the world in 2023, with $8.97 million in exports. In that same year, yeast ranked 889th out of 1,212 products shipped from India. India's top export destinations for yeast in 2023 were South Korea ($541k), Nepal ($341k), Colombia ($1.77M), the Philippines ($734k), and the United Arab Emirates ($593k). India's top three export destinations for yeast between 2022 and 2023 were the United Arab Emirates ($245k), the Philippines ($271k), and Colombia ($800k).

India became the 25th highest importer of yeast (out of 219) in the world in 2023, bringing in $38 million. In that same year, yeast ranked 642nd out of 1,208 products imported into India. China ($23.2M), Mexico ($5.79M), Brazil ($2.05M), France ($1.28M), and South Africa ($1.15M) were the main suppliers of yeast to India in 2023. The top three countries from which India imported yeast between 2022 and 2023 were China ($3.12M), Brazil ($1.21M), and Mexico ($4.74M).

Growth Drivers for the Asia Pacific Yeast Market

Rising Demand in the Food & Beverage Industry

One of the main factors propelling the Asia Pacific yeast market's expansion is the growing demand in the food and beverage sector. The consumption of baked goods, ready-to-eat meals, and convenience foods—all of which mostly depend on yeast for fermentation, texture, and flavor—is rising as urbanization and hectic lives change consumer preferences. Additionally, the need for brewing yeast is increasing throughout the region due to the popularity of alcoholic beverages, especially wine and beer. Yeast use is being further stimulated by the rise in local and artisanal food and drink production in nations like China, India, and Japan. Because of its crucial function in food processing and the rising demands of consumers for flavor and quality, yeast is still a vital component of this industry.

Expansion of the Bakery Sector

One major factor propelling the Asia Pacific yeast market's growth is the expansion of the baking industry. Convenient, ready-to-eat food options, such as a wide range of baked products, are becoming more and more popular among consumers as urbanization and fast-paced lives increase. There is a strong demand for goods like bread, cakes, pastries, and cookies, especially in developing nations like the Philippines, Indonesia, and India. The steady need for baker's yeast, which is necessary for fermentation, leavening, and flavor development, is being driven by consumers' increasing hunger for baked goods. Yeast is an essential component of both commercial and domestic food production in the area, as evidenced by the growth of contemporary retail chains, quick-service eateries, and home baking practices.

Shift Toward Natural and Clean-Label Ingredients

The Asia Pacific yeast market is benefiting from the move toward natural and clean-label components. Manufacturers are using yeast as a natural substitute for artificial additives as health-conscious consumers look for meals with identifiable, transparent components. In addition to adding taste and texture, yeast also provides minerals, amino acids, and B vitamins, among other nutritional advantages. Its adaptability makes it perfect for plant-based, bakery, and snack goods with clean labels, where artificial enhancers are gradually being phased out. The demand for healthy, minimally processed meals is rising in metropolitan areas, where this tendency is especially pronounced. Yeast is becoming a popular component as regulatory agencies also work to improve food labeling, which is in line with industry reformulations and customer expectations.

Challenges in the Asia Pacific Yeast Market

Fluctuating Raw Material Prices

The Asia Pacific yeast market is severely hampered by fluctuating raw material prices. Molasses and sugar, by-products of the sugar industry, are essential feedstock for yeast fermentation. A number of variables, including seasonal production, weather patterns, and shifts in the dynamics of international trade, can affect the availability and price of these raw materials. For yeast manufacturers, this instability might result in erratic supplies and higher manufacturing costs, which will have an immediate impact on their pricing policies and profit margins. These difficulties are significantly more noticeable in nations with inadequate agricultural infrastructure. Manufacturers may need to invest in more effective production techniques or look into other sourcing strategies in order to preserve stability and lessen the impact of changes in the price of raw materials.

Competition from Chemical Additives

Chemical additive competition is still a significant obstacle for the Asia Pacific yeast market. Because of their affordability, simplicity of use, and longer shelf life, synthetic chemicals continue to rule many food processing applications despite the increased desire for natural and clean-label products. Cost-conscious businesses are drawn to these chemical substitutes because they frequently perform better than natural components like yeast in terms of flavor consistency, color retention, and preservation. Synthetic chemicals continue to be the go-to option in emerging nations where cost frequently trumps health concerns. This puts yeast-based substitutes, which would need more cautious handling and have shorter shelf life, at a competitive disadvantage. Stronger consumer education and business investment in the development of natural ingredients are necessary to overcome this obstacle.

China Yeast Market

China's market for yeast is growing quickly due to the country's booming food and beverage sector, rising urbanization, and rising demand for packaged and easy foods. Baking, brewing, and food fermentation are three common uses for yeast that are seeing strong demand as a result of changing dietary preferences and growing disposable incomes. Strong domestic yeast consumption is also a result of traditional Chinese meals like fermented sauces and steamed buns. Additionally, the trend toward natural ingredients and simpler labels is promoting the use of yeast rather than artificial additives. Nonetheless, issues including shifting prices for raw materials and environmental restrictions on industrial waste continue to exist. Nevertheless, continuous innovation and robust demand from export and domestic markets support consistent growth.

Japan Yeast Market

Strong demand in the food and beverage sector as well as a long-standing cultural preference for fermented foods are driving Japan's yeast market's steady expansion. Because it is a common ingredient in goods like sake, miso, and soy sauce, yeast is essential to traditional Japanese cooking. Additionally, customers are using both fresh and dry yeast more frequently as a result of the growing interest in artisanal foods and the popularity of baking at home.

Growing health consciousness and a move toward natural and functional ingredients are also helping the market. Supplements and nutritious goods made from yeast are becoming more popular, which is in line with general wellness trends. However, quick expansion may be hampered by Japan's elderly population and developed food market, necessitating innovation and diversification.

India Yeast Market

The market for yeast in India is expanding steadily due to rising demand from a number of industries, such as biofuels, pharmaceuticals, and food & beverage. This upward tendency is a result of the nation's growing population, increasing disposable incomes, and changing consumer tastes. With its extensive use in fermented breads, idli, dosa, and alcoholic beverages like wine and beer, yeast is essential to traditional Indian cuisine.

Growing health consciousness and a move toward natural and functional ingredients are also helping the market. Supplements and nutritious goods made from yeast are becoming more popular, which is in line with general wellness trends. Additionally, customers are using both fresh and dry yeast more frequently as a result of the growing interest in artisanal foods and the popularity of baking at home.

Nonetheless, issues including shifting raw material costs and environmental restrictions on industrial waste continue to exist. Nevertheless, continuous innovation and robust demand from export and domestic markets support consistent growth.

South Korea Yeast Market

The market for yeast in South Korea is expanding significantly due to rising demand in a number of industries, such as biofuels, pharmaceuticals, and food & beverage. This upward tendency is a result of the nation's growing population, increasing disposable incomes, and changing consumer tastes.

Traditional Korean cuisine relies heavily on yeast, which is utilized in fermented breads, idli, dosa, and alcoholic drinks like wine and beer. Growing health consciousness and a move toward natural and functional ingredients are also helping the market. Supplements and nutritious goods made from yeast are becoming more popular, which is in line with general wellness trends.

Additionally, customers are using both fresh and dry yeast more frequently as a result of the growing interest in artisanal foods and the popularity of baking at home. Nonetheless, issues including shifting raw material costs and environmental restrictions on industrial waste continue to exist. Nevertheless, continuous innovation and robust demand from export and domestic markets support consistent growth.

.

Asia-Pacific Yeast Market Segmentation

Form –Market breakup in 4 viewpoints:

- Dry Yeast

- Instant Yeast

- Fresh Yeast

- Others

Application –Market breakup in 5 viewpoints:

- Food

- Beverages

- Bioethanol

- Pharmaceuticals

- Feed

Country –Market breakup in 10 viewpoints:

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

- Rest of Asia Pacific

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Developments

- Revenue

Company Analysis:

- General Mills Inc.

- Dun & Bradstreet Holdings

- Danone SA

- Sensient Technologies Corporation

- Associated British Foods PLC

- Koninklijke DSM N.V

- Kerry Group Plc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Form, Application and Country |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Asia Pacific Yeast Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Form

6.2 By Application

6.3 By Country

7. Form

7.1 Dry Yeast

7.2 Instant Yeast

7.3 Fresh Yeast

7.4 Others

8. Application

8.1 Food

8.2 Beverages

8.3 Bioethanol

8.4 Pharmaceuticals

8.5 Feed

9. Countries

9.1 China

9.2 Japan

9.3 India

9.4 South Korea

9.5 Thailand

9.6 Malaysia

9.7 Indonesia

9.8 Australia

9.9 New Zealand

9.10 Rest of Asia Pacific

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 General Mills Inc.

12.1.1 Overviews

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 Dun & Bradstreet Holdings

12.2.1 Overviews

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 Danone SA

12.3.1 Overviews

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 Sensient Technologies Corporation

12.4.1 Overviews

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 Associated British Foods PLC

12.5.1 Overviews

12.5.2 Key Person

12.5.3 Recent Developments

12.5.4 Revenue

12.6 Koninklijke DSM N.V

12.6.1 Overviews

12.6.2 Key Person

12.6.3 Recent Developments

12.6.4 Revenue

12.7 Kerry Group Plc

12.7.1 Overviews

12.7.2 Key Person

12.7.3 Recent Developments

12.7.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com