Ophthalmic Devices Market Report by diagnostics & monitoring devices (Fundus Camera, Optical Coherence Tomography (OCT) Scanner, Tonometer and Others), surgical instruments devices (Refractive Error Surgery Devices, Glaucoma Surgery Devices, Cataract Surgery Devices, Retinal Surgery Devices), vision care products (Contact Lenses Market and Others), end-use (Hospitals, Specialty Clinics, Ambulatory Surgery Centers, Consumers and Others), Regions and Company Analysis 2024-2030

Ophthalmic Devices Market Outlook

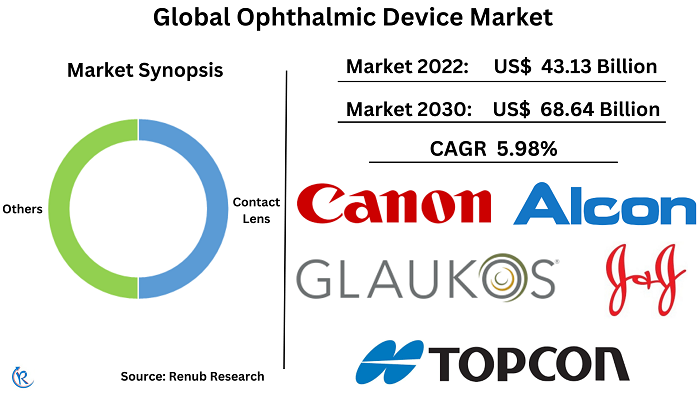

Global Ophthalmic Devices Market is expected to reach US$ 68.64 Billion in 2030, according to Renub Research. Ophthalmology, a branch of medical science specializing in the study and treatment of eye diseases, heavily relies on ophthalmic devices for various purposes such as diagnosis, surgical procedures, and vision correction. With the prevalence of conditions like glaucoma, cataracts, and other vision-related issues on the rise, the importance and adoption of these devices have grown significantly. The increasing global incidence of vision disorders have led to a surging demand for high-quality eye care services.

The field of ophthalmic devices is witnessing notable advancements, particularly in technologies like intraocular lenses, which enhance vision correction and contribute to improved outcomes in eye surgeries. This, coupled with the escalating number of eye surgeries performed worldwide, is expected to propel the market for ophthalmic devices in the years ahead.

Ophthalmic Device Companies News

Johnson & Johnson

In February 2024, Johnson & Johnson Medtech introduced a novel intraocular lens designed to correct presbyopia, named TecnisPuresee.

In September 2019, Johnson & Johnson Vision Care (US) introduced ACUVUE VITA, the astigmatism contact lens for the US market.

Topcon Corporation

In October 2023, Topcon Healthcare was pleased to announce the release of the NW500 in Europe.

In September 2023, Topcon Healthcare, a key player in eye care technology, introduced its Topcon RDx tele-refraction software to the EMEA market.

In July 2021, Topcon Corporation revealed its acquisition of VISIA Imaging S.r.l, a manufacturer specializing in ophthalmic devices.

Canon INC

In Nov 2023, Cleveland Clinic and Canon Inc. unveiled plans to establish a strategic research partnership focused on creating cutting-edge imaging and healthcare IT technologies to enhance patient diagnosis, care, and outcomes.

Alcon Inc

In Nov 2022, Alcon finalized its Aerie Pharmaceuticals, Inc. acquisition, enhancing its position in the ophthalmic pharmaceutical sector. This strategic move strengthens Alcon's portfolio of commercial products and development pipeline.

In March 2019, Alcon, a division of Novartis and a global leader in eye care, revealed its acquisition of PowerVision, Inc., a US-based medical device development company specializing in fluid-based intraocular lens implants. This strategic move underscores Alcon's dedication to introducing innovative lens options to cataract patients worldwide.

STAAR Surgical Co

In March 2022, Staar Surgical Co received FDA approval for the EVO/EVO+ Visian Implantable Collamer Lens to correct myopia and myopia with astigmatism. Myopia, or nearsightedness, is a prevalent vision disorder globally, with its prevalence rapidly increasing.

In December 2022, STAAR Surgical Co. launched the first company-operated EVO Experience Center to offer an immersive EVO lens-based experience for ophthalmologists and their staff.

Glaukos Corporation

In April 2023, Celanese partnered with Glaukos to supply its VitalDose drug delivery platform. Glaukos will incorporate VitalDose into its iDose TR micro-invasive intraocular implant to reduce intraocular pressure in patients. The integration is expected to provide continuous dosing and address patient non-adherence concerns.

In December 2023, Glaukos Corporation obtained approval from the Food and Drug Administration for a drug-releasing implant intended to lower intraocular pressure in individuals with ocular hypertension or open-angle glaucoma. The implant received approval for a single administration per eye.

IRIDEX Corporation

In February 2024, Iridex Corp received a European Patent EP 3009093 for their technology. The patent strengthens Iridex's intellectual property in the laser system domain, particularly for ophthalmology-related fields. The patented technology will enhance the safety and effectiveness of laser treatments, and Iridex has exclusive rights to offer the MicroPulse® devices based on this patented technology.

In Feb 2024, Iridex Corp, a global leader in laser-based medical systems for glaucoma and retinal diseases, announced the grant of European Patent EP 3009093, titled "Laser System with Short Pulse Characteristics and its Methods of Use." This patent safeguards Iridex's laser technology for safe and effective treatments, which are exclusively available in MicroPulse® devices.

In March 2021, Iridex Corporation, a leader in ophthalmic laser-based medical products for glaucoma and retinal diseases, partnered with Topcon Corporation, a Japanese manufacturer and distributor generating approximately US$ 1.3 Billion in annual revenues, with US$ 430 Million from its eye care segment.

Renub Research report forecasts a 5.98% CAGR for the global ophthalmic devices industry from 2022 to 2030

The prevalence of eye diseases is further amplified by lifestyle changes, reinforcing the need for surgical and vision care devices. Factors like higher per capita income, disposable income, favourable reimbursement policies, and the availability of easily accessible ophthalmic procedures have all contributed to an increase in surgical interventions and subsequently fuelled the demand for ophthalmic devices in the market. As the global population continues to face the challenges posed by eye disorders, the ophthalmic devices industry strives to meet the growing demand for innovative solutions in surgical and vision care, thereby playing a crucial role in ensuring improved eye health and enhanced quality of life for individuals worldwide. Global Ophthalmic Devices Market was Valued at US$ 43.13 Billion in 2022.

Continuous advancements in OCT technology, the market share of OCT scanners is expected to remain dominant in the global ophthalmic devices market

By Diagnostic & Monitoring, Global Ophthalmic Devices Market is segmented into Fundus Camera, Optical Coherence Tomography Scanner, Tonometer and Others. The Optical Coherence Tomography (OCT) scanner has emerged as a frontrunner in the global ophthalmic devices industry, commanding the highest market share. This advanced imaging technology enables detailed cross-sectional visualization of the eye, facilitating accurate diagnosis and monitoring of various eye conditions. Its non-invasive nature, high resolution, and ability to capture real-time images have made it a preferred choice among ophthalmologists worldwide. The OCT scanner's versatility and applications across multiple ophthalmic subspecialties, including glaucoma, macular degeneration, and diabetic retinopathy, have contributed to its dominant market position. With ongoing advancements and continuous improvements, the OCT scanner is poised to maintain its leadership in the global ophthalmic devices market.

As the global population continues to age, the demand for these devices is expected to remain high in the global ophthalmic devices market

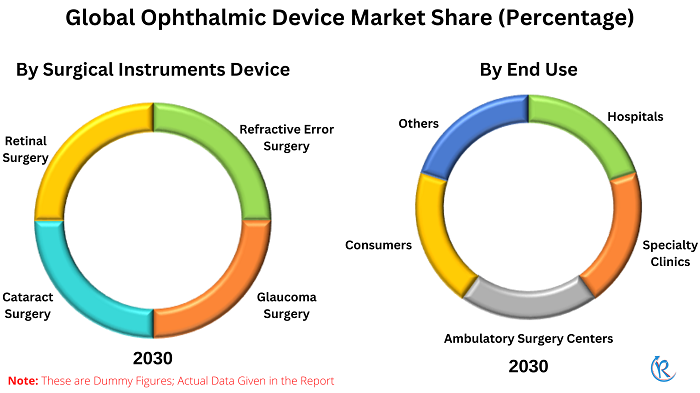

By Surgical, Global Ophthalmic Devices Market is divided into Refractive Error Surgery Devices, Glaucoma Surgery Devices, Cataract Surgery Devices and Retinal Surgery Devices. Cataract surgery devices hold the highest market share in the global ophthalmic devices market. Cataracts, a common age-related condition, affect the lens of the eye, leading to impaired vision. The demand for cataract surgery devices is fuelled by the increasing number of cataract cases worldwide. These devices, including phacoemulsification systems, intraocular lenses, and viscoelastic substances, are essential for safe and effective cataract removal and lens replacement. Technological advancements have resulted in improved surgical techniques and enhanced outcomes, driving the market for cataract surgery devices. As the aging population continues to grow and the need for vision restoration persists, the market for cataract surgery devices is expected to maintain its prominence in the global ophthalmic devices market.

Contact lenses are experiencing rapid growth and are considered the fastest-growing segment in the global ophthalmic devices market

By Vision Care, the Global Ophthalmic Devices Market is sub-segmented Contact Lenses and Others. Contact lenses are experiencing rapid growth and emerge as the fastest-growing segment in the global ophthalmic devices industry. With their convenience, comfort, and ability to correct various vision impairments, contact lenses have gained immense popularity among individuals seeking an alternative to traditional eyeglasses. Advancements in lens materials, such as silicone hydrogel, have improved breathability and prolonged wearing comfort, driving the increased adoption of contact lenses. The growing prevalence of myopia and astigmatism, particularly among younger populations, has fuelled the demand for contact lenses as a vision correction option. As the industry continues to innovate with features like multimodality and colour enhancement, contact lenses are expected to maintain their rapid growth trajectory in the global ophthalmic devices market.

As consumers continue to prioritize their visual health, they will continue to shape the global ophthalmic devices market through their preferences and demands

By End Use, global ophthalmic devices market is divided into Hospitals, Specialty Clinics, Ambulatory Surgery Centers, Consumers and Others. Consumers hold the highest market share in the global ophthalmic devices industry. As the end-users and beneficiaries of these devices, consumers play a crucial role in driving the market. The demand for ophthalmic devices is directly influenced by consumer needs, preferences, and the prevalence of eye conditions. Factors such as an aging population, lifestyle changes, and increasing awareness about eye health contribute to the growing market share of consumers. Advancements in technology, such as more comfortable and aesthetically appealing devices, have further fuelled consumer adoption.

United States is projected to have the highest market share in the global ophthalmic devices market in the upcoming years.

By Country, global ophthalmic devices market is breakup into United States, Canada, Mexico, Germany, France, United Kingdom, Italy, Spain, Denmark, Sweden, Norway, Japan, China, Australia, Thailand, India, Brazil, Saudi Arabia, South Africa, UAE and Rest of the World. The United States is expected to hold the highest market share in the global ophthalmic devices market in the upcoming years. The country's robust healthcare infrastructure, technological advancements, and high healthcare expenditure contributed to its dominant position in the market.

A large population suffering from eye disorders, along with a growing aging population, drives the demand for ophthalmic devices in the United States. The presence of leading ophthalmic device manufacturers, research institutions, and strong regulatory frameworks further solidify the country's market share. As the United States continues to focus on advanced eye care solutions and invest in innovative technologies, it is poised to maintain its prominent position in the global ophthalmic devices industry.

Key Player

Johnson & Johnson, Topcon Corporation, Canon INC, Alcon Inc, STAAR Surgical Co, Glaukos Corporation and IRIDEX Corporation are the key company in the global ophthalmic devices market.

Diagnostics & Monitoring Devices – Market has been covered from 4viewpoints:

1. Fundus Camera

2. Optical Coherence Tomography Scanner

3. Tonometer

4. Others

Surgical Instruments Devices – Market has been covered from 4 viewpoints:

1. Refractive Error Surgery Devices

2. Glaucoma Surgery Devices

3. Cataract Surgery Devices

4. Retinal Surgery Devices

Vision Care Products – Market has been covered from 2 viewpoints:

1. Contact Lenses Market

2. Others

End Use – Market has been covered from 5 viewpoints:

1. Hospitals

2. Specialty Clinics

3. Ambulatory Surgery Centers

4. Consumers

5. Others

Country – Market has been covered from 21 viewpoints:

1. United States

2. Canada

3. Mexico

4. Germany

5. France

6. United Kingdom

7. Italy

8. Spain

9. Denmark

10. Sweden

11. Norway

12. Japan

13. China

14. Australia

15. Thailand

16. India

17. Brazil

18. Saudi Arabia

19. South Africa

20. UAE

21. Rest of the World

Company Insights:

• Overview

• Recent Development & Strategies

• Financial Insights

Company Analysis:

1. Johnson & Johnson

2. Topcon Corporation

3. Canon INC

4. Alcon Inc

5. STAAR Surgical Co

6. Glaukos Corporation

7. IRIDEX Corporation

Report Details:

| Report Features | Details |

| Base Year | 2022 |

| Historical Period | 2018 - 2022 |

| Forecast Period | 2023 - 2030 |

| Market | US$ Billion |

| Segment Covered | Diagnostics & Monitoring Devices, Surgical Instruments Devices, Vision Care Products, End Use, and Country |

| Country Covered | United States, Canada, Mexico, Germany, France, United Kingdom, Italy, Spain, Denmark, Sweden, Norway, Japan, China, Australia, Thailand, India, Brazil, Saudi Arabia, South Africa, UAE, and Rest of the World |

| Companies Covered | Johnson & Johnson, Topcon Corporation, Canon Inc, Alcon, Inc, STAAR Surgical Co., Glaukos Corporation, and IRIDEX Corporation |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamic

4.1 Growth Drivers

4.2 Challenges

5. Global Ophthalmic Device Market

6. Market Share – Global Ophthalmic Device Market

6.1 Diagnostic & Monitoring

6.2 Surgical

6.3 Vision Care

6.4 End Use

6.5 Country

7. Market Analysis – By Diagnostics & Monitoring Devices

7.1 Fundus Camera

7.2 Optical Coherence Tomography Scanner

7.3 Tonometer Market

7.4 Others

8. Market Analysis – Surgical Instruments Devices

8.1 Refractive Error Surgery Devices

8.2 Glaucoma Surgery Devices

8.3 Cataract Surgery Devices

8.4 Retinal Surgery Devices

9. Market Analysis – Vision Care Products

9.1 Contact Lenses Market

9.2 Others

10. By End Use – Global Ophthalmic Device Market

10.1 Hospitals

10.2 Specialty Clinics

10.3 Ambulatory Surgery Centers

10.4 Consumers

10.5 Others

11. By Country – Global Ophthalmic Device Market

11.1 Americas

11.1.1 United States

11.1.2 Canada

11.1.3 Mexico

11.1.4 Brazil

11.2 Europe

11.2.1 Germany

11.2.2 France

11.2.3 United Kingdom

11.2.4 Italy

11.2.5 Spain

11.2.6 Denmark

11.2.7 Sweden

11.2.8 Norway

11.3 Asia Pacific

11.3.1 Japan

11.3.2 China

11.3.3 Australia

11.3.4 Thailand

11.3.5 India

11.4 Middle East and Africa

11.4.1 Saudi Arabia

11.4.2 South Africa

11.4.3 UAE

11.5 Rest of the World

12. Porter’s Five Forces Analysis - Global Ophthalmic Device Market

12.1 Bargaining Power of Buyer

12.2 Bargaining Power of Supplier

12.3 Threat of New Entrants

12.4 Rivalry among Existing Competitors

12.5 Threat of Substitute Products

13. SWOT Analysis - Global Ophthalmic Device Market

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threat

14. Company Analysis

14.1 Johnson & Johnson

14.1.1 Overview

14.1.2 Recent Development & Strategies

14.1.3 Financial Insights

14.2 Topcon Corporation

14.2.1 Overview

14.2.2 Recent Development & Strategies

14.2.3 Financial Insights

14.3 Canon Inc

14.3.1 Overview

14.3.2 Recent Development & Strategies

14.3.3 Financial Insights

14.4 Alcon ,Inc

14.4.1 Overview

14.4.2 Recent Development & Strategies

14.4.3 Financial Insights

14.5 STAAR Surgical Co.

14.5.1 Overview

14.5.2 Recent Development & Strategies

14.5.3 Financial Insights

14.6 GlaukosCorporation

14.6.1 Overview

14.6.2 Recent Development & Strategies

14.6.3 Financial Insights

14.7 IRIDEX Corporation

14.7.1 Overview

14.7.2 Recent Development & Strategies

14.7.3 Financial Insights

List of Figures:

Figure-01: Global – Ophthalmic Device Market (Billion US$), 2018 – 2022

Figure-02: Global – Forecast for Ophthalmic Device Market (Billion US$), 2023 – 2030

Figure-03: Diagnostics & Monitoring – Fundus Camera Market (Billion US$), 2018 – 2022

Figure-04: Diagnostics & Monitoring – Forecast for Fundus Camera Market (Billion US$), 2023 – 2030

Figure-05: Diagnostics & Monitoring – Optical Coherence Tomography Scanner Market (Billion US$), 2018 – 2022

Figure-06: Diagnostics & Monitoring – Forecast for Optical Coherence Tomography Scanner Market (Billion US$), 2023 – 2030

Figure-07: Diagnostics & Monitoring – Tonometer Market (Billion US$), 2018 – 2022

Figure-08: Diagnostics & Monitoring – Forecast for Tonometer Market (Billion US$), 2023 – 2030

Figure-09: Diagnostics & Monitoring – Others Market (Billion US$), 2018 – 2022

Figure-10: Diagnostics & Monitoring – Forecast for Others Market (Billion US$), 2023 – 2030

Figure-11: Surgical Instruments – Refractive Error Surgery Devices Market (Billion US$), 2018 – 2022

Figure-12: Surgical Instruments – Forecast for Refractive Error Surgery Devices Market (Billion US$), 2023 – 2030

Figure-13: Surgical Instruments – Glaucoma Surgery Devices Market (Billion US$), 2018 – 2022

Figure-14: Surgical Instruments – Forecast for Glaucoma Surgery Devices Market (Billion US$), 2023 – 2030

Figure-15: Surgical Instruments – Cataract Surgery Devices Market (Billion US$), 2018 – 2022

Figure-16: Surgical Instruments – Forecast for Cataract Surgery Devices Market (Billion US$), 2023 – 2030

Figure-17: Surgical Instruments – Retinal Surgery Devices Market (Billion US$), 2018 – 2022

Figure-18: Surgical Instruments – Forecast for Retinal Surgery Devices Market (Billion US$), 2023 – 2030

Figure-19: Surgical Instruments – Contact Lenses Market (Billion US$), 2018 – 2022

Figure-20: Surgical Instruments – Forecast for Contact Lenses Market (Billion US$), 2023 – 2030

Figure-21: Surgical Instruments – Others Market (Billion US$), 2018 – 2022

Figure-22: Surgical Instruments – Forecast for Others Market (Billion US$), 2023 – 2030

Figure-23: Vision Care Products – Hospitals Market (Billion US$), 2018 – 2022

Figure-24: Vision Care Products – Forecast for Hospitals Market (Billion US$), 2023 – 2030

Figure-25: Vision Care Products – Specialty Clinics Market (Billion US$), 2018 – 2022

Figure-26: Vision Care Products – Forecast for Specialty Clinics Market (Billion US$), 2023 – 2030

Figure-27: Vision Care Products – Ambulatory Surgery Centers Market (Billion US$), 2018 – 2022

Figure-28: Vision Care Products – Forecast for Ambulatory Surgery Centers Market (Billion US$), 2023 – 2030

Figure-29: Vision Care Products – Consumers Market (Billion US$), 2018 – 2022

Figure-30: Vision Care Products – Forecast for Consumers Market (Billion US$), 2023 – 2030

Figure-31: Vision Care Products – Others Market (Billion US$), 2018 – 2022

Figure-32: Vision Care Products – Forecast for Others Market (Billion US$), 2023 – 2030

Figure-33: United States – Ophthalmic Device Market (Billion US$), 2018 – 2022

Figure-34: United States – Forecast for Ophthalmic Device Market (Billion US$), 2023 – 2030

Figure-35: Canada – Ophthalmic Device Market (Million US$), 2018 – 2022

Figure-36: Canada – Forecast for Ophthalmic Device Market (Million US$), 2023 – 2030

Figure-37: Mexico – Ophthalmic Device Market (Million US$), 2018 – 2022

Figure-38: Mexico – Forecast for Ophthalmic Device Market (Million US$), 2023 – 2030

Figure-39: Brazil – Ophthalmic Device Market (Million US$), 2018 – 2022

Figure-40: Brazil – Forecast for Ophthalmic Device Market (Million US$), 2023 – 2030

Figure-41: Germany – Ophthalmic Device Market (Million US$), 2018 – 2022

Figure-42: Germany – Forecast for Ophthalmic Device Market (Million US$), 2023 – 2030

Figure-43: France – Ophthalmic Device Market (Million US$), 2018 – 2022

Figure-44: France – Forecast for Ophthalmic Device Market (Million US$), 2023 – 2030

Figure-45: United Kingdom – Ophthalmic Device Market (Million US$), 2018 – 2022

Figure-46: United Kingdom – Forecast for Ophthalmic Device Market (Million US$), 2023 – 2030

Figure-47: Italy – Ophthalmic Device Market (Million US$), 2018 – 2022

Figure-48: Italy – Forecast for Ophthalmic Device Market (Million US$), 2023 – 2030

Figure-49: Spain – Ophthalmic Device Market (Million US$), 2018 – 2022

Figure-50: Spain – Forecast for Ophthalmic Device Market (Million US$), 2023 – 2030

Figure-51: Denmark – Ophthalmic Device Market (Million US$), 2018 – 2022

Figure-52: Denmark – Forecast for Ophthalmic Device Market (Million US$), 2023 – 2030

Figure-53: Sweden – Ophthalmic Device Market (Million US$), 2018 – 2022

Figure-54: Sweden – Forecast for Ophthalmic Device Market (Million US$), 2023 – 2030

Figure-55: Norway – Ophthalmic Device Market (Million US$), 2018 – 2022

Figure-56: Norway – Forecast for Ophthalmic Device Market (Million US$), 2023 – 2030

Figure-57: Japan – Ophthalmic Device Market (Million US$), 2018 – 2022

Figure-58: Japan – Forecast for Ophthalmic Device Market (Million US$), 2023 – 2030

Figure-59: China – Ophthalmic Device Market (Billion US$), 2023 – 2030

Figure-60: China – Forecast for Ophthalmic Device Market (Billion US$), 2018 – 2022

Figure-61: Australia – Ophthalmic Device Market (Million US$), 2018 – 2022

Figure-62: Australia – Forecast for Ophthalmic Device Market (Million US$), 2023 – 2030

Figure-63: Thailand – Ophthalmic Device Market (Million US$), 2018 – 2022

Figure-64: Thailand – Forecast for Ophthalmic Device Market (Million US$), 2023 – 2030

Figure-65: India – Ophthalmic Device Market (Million US$), 2018 – 2022

Figure-66: India – Forecast for Ophthalmic Device Market (Million US$), 2023 – 2030

Figure-67: Saudi Arabia – Ophthalmic Device Market (Million US$), 2018 – 2022

Figure-68: Saudi Arabia – Forecast for Ophthalmic Device Market (Million US$), 2023 – 2030

Figure-69: South Africa – Ophthalmic Device Market (Million US$), 2018 – 2022

Figure-70: South Africa – Forecast for Ophthalmic Device Market (Million US$), 2023 – 2030

Figure-71: UAE – Ophthalmic Device Market (Million US$), 2018 – 2022

Figure-72: UAE – Forecast for Ophthalmic Device Market (Million US$), 2023 – 2030

Figure-73: Rest of the World – Ophthalmic Device Market (Million US$), 2018 – 2022

Figure-74: Rest of the World – Forecast for Ophthalmic Device Market (Million US$), 2023 – 2030

Figure-75: Johnson & Johnson – Global Revenue Market (Billion US$), 2023 – 2030

Figure-76: Johnson & Johnson – Forecast for Global Revenue Market (Billion US$), 2018 – 2022

Figure-77: Topcon Corporation – Global Revenue Market (Million US$), 2018 – 2022

Figure-78: Topcon Corporation – Forecast for Global Revenue Market (Million US$), 2023 – 2030

Figure-79: Canon Inc – Global Revenue Market (Billion US$), 2023 – 2030

Figure-80: Canon Inc – Forecast for Global Revenue Market (Billion US$), 2018 – 2022

Figure-81: Alcon ,Inc – Global Revenue Market (Billion US$), 2023 – 2030

Figure-82: Alcon ,Inc – Forecast for Global Revenue Market (Billion US$), 2018 – 2022

Figure-83: STAAR Surgical Co. – Global Revenue Market (Million US$), 2018 – 2022

Figure-84: STAAR Surgical Co. – Forecast for Global Revenue Market (Million US$), 2023 – 2030

Figure-85: GlaukosCorporation – Global Revenue Market (Million US$), 2018 – 2022

Figure-86: GlaukosCorporation – Forecast for Global Revenue Market (Million US$), 2023 – 2030

Figure-87: IRIDEX Corporation – Global Revenue Market (Million US$), 2018 – 2022

Figure-88: IRIDEX Corporation – Forecast for Global Revenue Market (Million US$), 2023 – 2030

List of Tables:

Table-01: Global – Ophthalmic Device Market Share by Diagnostics & Monitoring Devices (Percent), 2018 – 2022

Table-02: Global – Forecast for Ophthalmic Device Market Share by Diagnostics & Monitoring Devices (Percent), 2023 – 2030

Table-03: Global – Ophthalmic Device Market Share by Surgical Instruments Devices (Percent), 2018 – 2022

Table-04: Global – Forecast for Ophthalmic Device Market Share by Surgical Instruments Devices (Percent), 2023 – 2030

Table-05: Global – Ophthalmic Device Market Share by Vision Care Products (Percent), 2018 – 2022

Table-06: Global – Forecast for Ophthalmic Device Market Share by Vision Care Products (Percent), 2023 – 2030

Table-07: Global – Ophthalmic Device Market Share by End Use (Percent), 2018 – 2022

Table-08: Global – Forecast for Ophthalmic Device Market Share by End Use (Percent), 2023 – 2030

Table-09: Global – Ophthalmic Device Market Share by Country (Percent), 2018 – 2022

Table-10: Global – Forecast for Ophthalmic Device Market Share by Country (Percent), 2023 – 2030

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com