United States Surgical Dressings Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States Surgical Dressings Market Trends & Summary

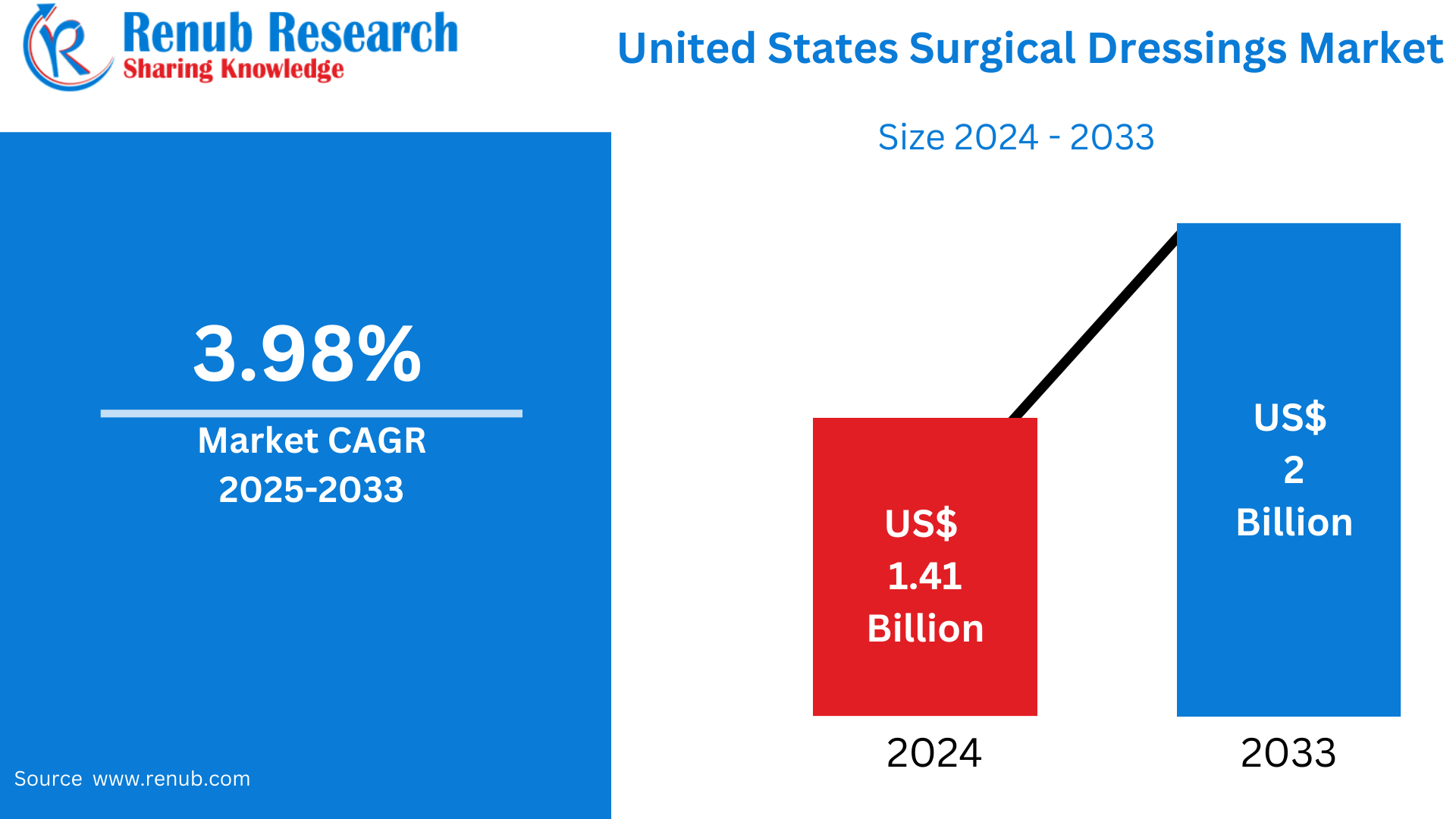

United States surgical dressings market is expected to grow substantially, from USD 1.41 billion in 2024 to USD 2 billion by 2033. The growth is expected to take place at a CAGR of 3.98% between 2025 and 2033. Drivers like the rising number of surgeries, improving wound care technology, and heightened awareness of infection control help drive the market.

The report United States Surgical Dressings Market & Forecast covers by Product (Primary, Secondary, Others), Application (Diabetes Based Surgeries, Cardiovascular Diseases, Ulcers Burns, Transplant Sites, Others), End Use (Hospitals, Ambulatory Surgery Centers, Specialty Centers, Home Healthcare, Others), Company Analysis 2025-2033.

United States Surgical Dressings Market Outlooks

Surgical dressings are also known as sterile medical products and are applied on wounds to protect and cover wounds, especially after surgery. Surgical dressings are essential to carry out various critical functions such as exudate absorption, infection prevention, moist environment for the wound, and providing optimal healing. Surgical dressings can be in the form of gauze pads, adhesive bandages, hydrocolloids, alginates, foam, and transparent films based on the severity and type of the wound.

In the United States, surgical dressings are commonly used in hospitals, ambulatory surgery centers, and home healthcare. They are a vital component in post-operative treatment, trauma management, chronic wound care (diabetic foot ulcers and pressure sores), and minor wounds. With more surgical procedures being done every year, particularly in the aging population, demand for advanced wound care and surgical dressings has grown. Further, a rising trend of infection control prevention and improved recovery times continue to propel the growth of novel dressing materials. Initiatives in the government towards health care, including enhanced health services access, further fuel the development of the market.

Market Drivers in United States Surgical Dressings Market

Surge in Surgical Procedures and Diseases

Increasing surgery procedures such as orthopedic, cardiovascular, and obesity operations are strong market drivers of surgical dressings within the United States. The American College of Surgeons reports that more than 15 million surgery procedures are conducted in the U.S. every year. In addition, the number of chronic conditions like obesity and diabetes increases the incidence of chronic wounds, which require effective wound care solutions. Demand for surgical dressings is therefore driven by the necessity to effectively treat post-operative wounds and chronic ulcers.

Technological Advances in Wound Care

Technological advances in wound care have resulted in the creation of sophisticated surgical dressings that improve healing and minimize infection risk. Some of these are antimicrobial dressings, moisture-retentive dressings, and smart dressings that track wound conditions. These innovations enhance patient outcomes and are used more and more in clinical environments, fueling market expansion. In January 2024, the US Army Medical Research Acquisition Activity contracted the Medical Solutions Division of 3M Health Care $34.2 million to improve the treatment procedures of critical wounds from the point-of-injury locations to hospitals. The money will help 3M design treatment protocols for demanding environments, specifically delayed emergencies and mass casualty settings. The program will emphasize infection prevention, wound care, and healing.

Aging Population and Rising Healthcare Spending

The aging American population is more prone to chronic wounds and needs more surgical procedures, thus raising the demand for surgical dressings. In addition, increased healthcare spending allows access to sophisticated wound care products. The combination of an aging population and rising healthcare spending sustains the growth of the surgical dressings market. The U.S. population aged 65 and above is expected to grow from 58 million in 2022 to 82 million in 2050 (an increase of 47%), and the 65-and-older age group as a percentage of the total population is expected to grow from 17% to 23%.

Challenges in the United States Surgical Dressings Market

Excessive Cost of Sophisticated Wound Care Products

Advanced surgical dressings, while very effective in healing wounds and lowering infection rates, tend to have significant financial drawbacks that limit their use on a large scale. Their price, which can involve the use of proprietary substances and advanced technology, can be a major deterrent, especially for budget-conscious healthcare systems like community hospitals or clinics with limited budgets. This budget limitation may limit the availability of these superior dressings for use with special patient populations or better-funded hospitals that have sufficient financial capabilities. Thus, these patients in financially underprivileged units may miss receiving the potential benefit these advanced dressings have to offer, promoting inequality in treatment quality and outcome.

Stringent Regulatory Requirements

The surgical dressings market is regulated by strict regulatory guidelines intended to ensure product safety and efficacy. Manufacturers frequently experience walking through a maze of complicated approval procedures, which can be both time-consuming and expensive. This complicated regulatory environment can mean that it takes a long time to get new products to market, hindering the potential for new developments to improve patient care and outcomes.

United States Primary Surgical Dressings Market

Primary surgical dressings that directly contact the wound are vital in order to cover the wound bed and initiate healing. The segment commands a high market share in the U.S. market because of the large number of surgical procedures that take place in the country along with the importance of effective management of the wound. The demand for primary dressings will continue to rise, boosted by improvements in dressing technology and heightened awareness of best practice in wound care. Jan 2023, Convatec is thrilled to introduce the US release of ConvaFoam™, a line of sophisticated foam dressings intended to meet the requirements of healthcare professionals and patients.

United States Diabetes-Based Surgical Dressings Market

The incidence of diabetes in the United States has also resulted in an increase in complications relating to diabetes, including diabetic foot ulcers, that need specialized wound management. Diabetic wound dressings for surgical use are highly sought after to avoid infection and enhance wound healing. The demand for such specialized dressings is growing as healthcare professionals target minimizing diabetes-related morbidity and healthcare expenses.

United States Cardiovascular Diseases Surgical Dressings Market

Cardiovascular diseases in most cases require surgical procedures, causing the demand for successful post-surgery wound care. Surgical dressings are essential in keeping patients safe from infections and aiding healing for those undergoing surgeries like bypass surgeries and angioplasties. The rise in the occurrence of cardiovascular conditions in America partly explains the demand for surgical dressings in this market. Sept 2024 -- Solventum has announced the release of the V.A.C.® Peel and Place Dressing, an all-in-one dressing and drape that can be applied within less than two minutesi and be worn by patients up to seven daysii.

United States Surgical Dressings Hospitals Market

Hospitals are the major end-users of surgical dressings due to the large number of surgical procedures and wound care services offered. Hospital demand for surgical dressings is influenced by the necessity for effective infection control, adherence to healthcare standards, and management of acute and chronic wounds. Hospitals' emphasis on patient outcomes and cost-effective care drives the long-term growth of this market segment.

United States Surgical Dressings Home Healthcare Market

The trend towards home-based healthcare services has raised the demand for surgical dressings that can be used outside of conventional clinical environments. Patients undergoing surgery or suffering from chronic wounds at home need simple-to-use and effective dressings. The home healthcare market for surgical dressings is growing due to patient preference for home care, cost-effectiveness, and developments in dressing technologies that enable self-care. April 19, 2024, Remedium Healthcare Products issued a press release announcing the introduction of NuVeria Labs' groundbreaking Sacral Silicone Dressing, now up for sale on Amazon, and bringing sophisticated wound care solutions directly to consumers' doorsteps.

United States Surgical Dressings Market Segmentation

Product

- Primary

- Secondary

- Others

Application

- Diabetes Based Surgeries

- Cardiovascular Diseases

- Ulcers

- Burns

- Transplant Sites

- Others

End Use

- Hospitals

- Ambulatory Surgery Centers

- Specialty Centers

- Home Healthcare

- Others

All companies have been covered

- Overview

- Key Persons

- Recent Development & Strategies

- Revenue Analysis

Key Players Analysis

- Smith & Nephew plc

- Essity AB

- DeRoyal Industries, Inc.

- 3M

- Integra LifeSciences Holdings Corporation

- Cardinal Health Inc

- MiMedx Group Inc

- Medtronic plc

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product, Application and End User |

| Application Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Surgical Dressings Market

5.1 Historical Market Trends

5.2 Market Forecast

6. United States Surgical Dressings Market Share Analysis

6.1 By Product

6.2 By Application

6.3 By End Use

7. Product

7.1 Primary

7.2 Secondary

7.3 Others

8. Application

8.1 Diabetes Based Surgeries

8.2 Cardiovascular Diseases

8.3 Ulcers

8.4 Burns

8.5 Transplant Sites

8.6 Others

9. End Use

9.1 Hospitals

9.2 Ambulatory Surgery Centers

9.3 Specialty Centers

9.4 Home Healthcare

9.5 Others

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 Smith & Nephew plc

12.1.1 Overview

12.1.2 Key Persons

12.1.3 Recent Development & Strategies

12.1.4 Revenue Analysis

12.2 Essity AB

12.2.1 Overview

12.2.2 Key Persons

12.2.3 Recent Development & Strategies

12.2.4 Revenue Analysis

12.3 DeRoyal Industries, Inc.

12.3.1 Overview

12.3.2 Key Persons

12.3.3 Recent Development & Strategies

12.3.4 Revenue Analysis

12.4 3M

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Recent Development & Strategies

12.4.4 Revenue Analysis

12.5 Integra LifeSciences Holdings Corporation

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Recent Development & Strategies

12.5.4 Revenue Analysis

12.6 Cardinal Health Inc

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Recent Development & Strategies

12.6.4 Revenue Analysis

12.7 MiMedx Group Inc

12.7.1 Overview

12.7.2 Key Persons

12.7.3 Recent Development & Strategies

12.7.4 Revenue Analysis

12.8 Medtronic plc

12.8.1 Overview

12.8.2 Key Persons

12.8.3 Recent Development & Strategies

12.8.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com