United States Mobile Virtual Network Operator Market Overview 2025–2033

Buy NowUnited States Mobile Virtual Network Operator (MVNO) Market Size and Forecast

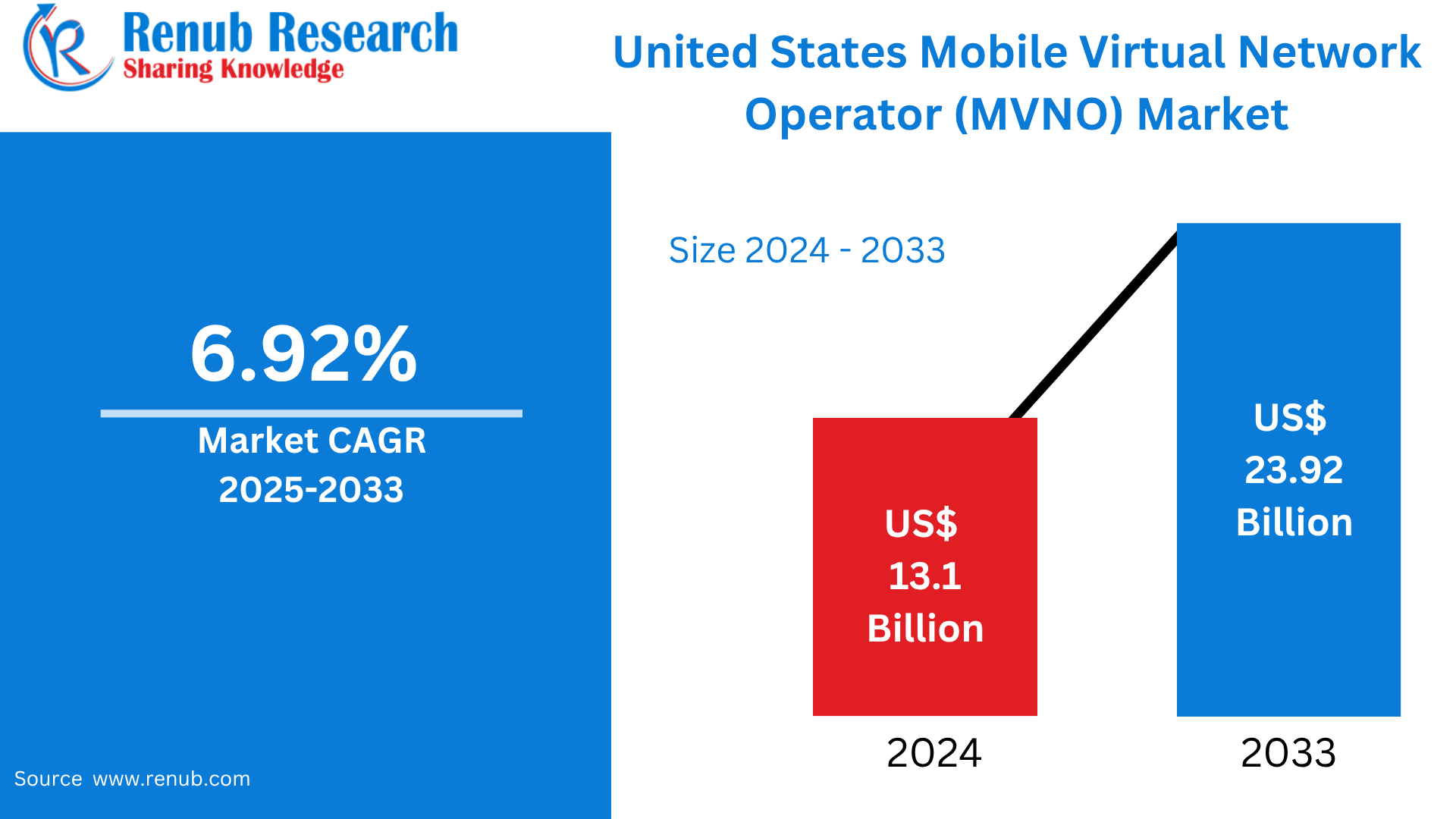

United States Mobile Virtual Network Operator (MVNO) Market is expected to reach US$ 23.92 billion by 2033 from US$ 13.1 billion in 2024, with a CAGR of 6.92% from 2025 to 2033. The increased use of mobile devices, the growing demand for reasonably priced mobile services, the major MNOs' accelerated rollout of 5G, the growing collaborations between MNOs and MVNOs, and the growing demand from consumers and businesses for affordable, high-speed internet access are all factors that are expected to propel the US MVNO market's rapid growth over the forecast period.

United States Mobile Virtual Network Operator (MVNO) Market Report by Type (Discount, Telecom, Retail, Migrant, Business, Roaming, M2M), Operational Model (Reseller, service Provider, Full MNVO), End Use (Consumer, Enterprise), States and Company Analysis, 2025-2033.

United States Mobile Virtual Network Operator (MVNO) Industry Overview

In order to provide services to their consumers, wireless service providers known as mobile virtual network operators (MVNOs) purchase network capacity from already-existing MNOs rather than owning the network infrastructure. They operate in a number of ways, including service operator, reseller, complete MVNO, etc. Operators of mobile virtual networks target particular market niches and provide tailored programs for them. Because they don't require a large staff or substantial investment to build and operate networks, they provide more benefits and lower rates than mobile network operators (MNOs).

The worldwide mobile virtual network operator (MVNO) industry is mostly driven by the growing demand for communication-based services with improved network infrastructure. Another important aspect driving development is the growing acceptance of digital services, such as cloud-based solutions, machine-to-machine (M2M) transactions, mobile money, etc. The need for MVNOs is also being fueled by the introduction of several creative government programs, such as the European Union's Digital Single Market (DSM) policy, which aims to improve network service access for customers and encourage digital services throughout Europe. Additionally, a number of legal frameworks that let MVNOs and MNOs to coexist are being put into place, which is improving the picture for the worldwide business.

In addition, the growing need for affordable cellular network services for daily needs like online gaming, video conferencing, and over-the-top streaming is driving the MVNO market's expansion. Furthermore, the worldwide industry is being positively impacted by the growing developments in LTE infrastructures, which provide services like VoLTE, ViLTE, and VoWiFi. Over the course of the projection period, a number of other reasons are anticipated to support the worldwide mobile virtual network operator (MVNO) market, such as the growing acceptance of embedded SIM cards and significant investments in 5G MVNO technology to provide effective communication services with low latency.

Key Factors Driving the United States Mobile Virtual Network Operator (MVNO) Market Growth

Economical Substitutes

Due to their capacity to provide incredibly low-cost mobile service plans, MVNOs are becoming more and more well-liked in the US. Budget-conscious customers who want basic mobile access without the hefty prices associated with established network operators, such as retirees, students, and low-income folks, may find these affordable solutions very appealing. MVNOs can lower administrative expenses and pass those savings on to customers by renting network infrastructure from established carriers instead of maintaining their own. Furthermore, consumers may avoid long-term commitments with variable price structures and no-contract choices, which increases the services' accessibility and popularity. These affordable options continue to encourage MVNO adoption among a wide range of consumers as price sensitivity and economic worries rise, particularly in the wake of the epidemic.

Customer Requests for Personalization

Services that meet their unique communication and data use requirements are becoming more and more in demand from today's mobile customers. By providing incredibly personalized mobile plans that surpass traditional carriers' one-size-fits-all approach, MVNOs have benefited from this trend. Pay-as-you-go, data-only, family, and specialty international calling choices are just a few of the versatile alternatives that MVNOs provide to accommodate a wide range of customer preferences. Increased consumer happiness, brand loyalty, and access to underdeveloped market groups are all benefits of this personalization. The option to customize plans helps MVNOs stand out in a crowded market and attract a loyal customer base, particularly from younger consumers and tech-savvy people seeking greater control over their mobile experience.

Developments in Technology

For MVNOs in the US, the introduction of 5G technology and the increasing integration of Internet of Things (IoT) technologies have created new growth prospects. Customers that want speed, dependability, and contemporary connectivity features are drawn to MVNOs because of these developments, which enable them to provide fast, high-quality data services that compete with those of incumbent carriers. MVNOs that enable the newest advancements in mobile technology are particularly appealing to tech-savvy users and corporate clients. MVNOs can also guarantee improved coverage and network performance thanks to their flexibility in partnering with numerous network providers. MVNOs with 5G and IoT capabilities are in a strong position to take advantage of emerging market niches and increase their presence as the demand for connected devices and smart services rises.

Challenges in the United States Mobile Virtual Network Operator (MVNO) Market

Reliance on the operators of the host network

In the US, major carriers including Verizon, AT&T, and T-Mobile lease network access to Mobile Virtual Network Operators (MVNOs). This paradigm establishes a crucial reliance even if it spares MVNOs the high expenses of developing and maintaining their own infrastructure. Because the host networks determine the quality of service, coverage regions, data speeds, and pricing structures, MVNOs have little influence over these aspects. Furthermore, MVNO operations and profitability may be directly impacted by modifications to wholesale agreements, such as higher lease fees or use limitations. Because of this dependence, MVNOs are in a precarious situation where it is challenging to provide service quality or uphold steady pricing in a market that is extremely competitive.

Limited Possibilities for Differentiation

The majority of operators in the very competitive U.S. MVNO industry provide equivalent basic services, including as voice, text, and data, frequently at comparable costs. MVNOs, find it challenging to differentiate themselves or develop a distinctive value offer because to this lack of product variety. Many MVNOs are forced to compete only on price, customer service, or by focusing on certain markets like elderly, students, or foreign tourists as they lack control of network infrastructure or access to proprietary technology. These tactics, however, are frequently insufficient to foster strong brand loyalty and are readily imitated by rivals. Lack of significant difference restricts long-term growth, client retention, and the capacity to enter larger or more profitable consumer groups in such a crowded industry.

United States Mobile Virtual Network Operator (MVNO) Market Overview by States

States in the US have different MVNO markets, but California, Texas, Florida, and New York have the highest adoption rates because of their dense populations, tech-savvy customers, and metropolitan infrastructure that makes competitive, adaptable, and reasonably priced mobile service alternatives possible. The following provides a market overview by States:

California Mobile Virtual Network Operator (MVNO) Market

A tech-savvy populace and a high desire for adaptable, reasonably priced mobile services have made California's MVNO industry one of the most vibrant in the US. The popularity of MVNOs that provide specialized plans like international calling or bilingual service is influenced by the state's diverse demographics and sizable immigrant groups. Cities like Los Angeles, San Francisco, and San Diego offer a competitive setting where customers look for digital convenience and personalized mobile solutions. Additionally, California's emphasis on sustainability and innovation pushes MVNOs to investigate eco-friendly projects and value-added services. Operational difficulties are also brought on by fierce rivalry and legal restrictions. All things considered, flexibility, affordability, and a solid fit with customer lifestyle preferences are what drive the industry.

Texas Mobile Virtual Network Operator (MVNO) Market

Due in significant part to the state's diversified population, the Texas Mobile Virtual Network Operator (MVNO) market is characterized by a competitive and dynamic environment. Texas MVNOs provides reasonably priced and adaptable mobile plans to meet a variety of customer demands. To provide services in both urban and rural locations, these operators take use of alliances with significant network providers. Regional preferences also have an impact on the market; several MVNOs target particular groups, such retirees, students, or foreign visitors. Additionally, MVNOs have the chance to improve their services due to the increased demand for data-centric services and the development of 5G networks. They must, however, contend with fierce competition, legal requirements, and sustaining profitability in a market that is price-sensitive.

New York Mobile Virtual Network Operator (MVNO) Market

With a wide variety of service providers meeting different customer demands, the New York Mobile Virtual Network Operator (MVNO) market is a vibrant sector of the telecom sector. In order to provide competitive pricing and flexible plans without having to make significant infrastructure investments, operators in this sector usually lease network infrastructure from large carriers. The competitive climate created by the state's dense population and high demand for mobile services encourages innovation and customer-focused products. Regulations that guarantee fair competition and consumer protection also have an impact on the market. In an effort to satisfy the wide range of demands of its clientele, MVNOs in New York are constantly adapting as consumer tastes shift toward data-centric and customized plans.

Market Segmentations

Type

- Discount

- Telecom

- Retail

- Migrant

- Business

- Roaming

- M2M

Operational Model

- Reseller

- service Provider

- Full MNVO

End Use

- Consumer

- Enterprise

States

- California

- Texas

- New York

- Florida

- Illinois

- Pennsylvania

- Ohio

- Georgia

- Washington

- New Jersey

- Rest of United States

All the Key players have been covered

- Overviews

- Key Person

- Recent Developments

- SWOT Analysis

- Revenue Analysis

Company Analysis:

- H2O Wireless (Locus Telecommunications, LLC)

- Mint Mobile, LLC. (T-Mobile US, Inc.)

- RedPocket Mobile

- TracFone Wireless, Inc. (Verizon Communications Inc.)

- Visible (Verizon Communications)

- Cricket Wireless LLC

- Google Fi Wireless (Google LLC, a subsidiary of Alphabet Inc.)

- Tello, LLC

- UVNV, LLC

- Xfinity Mobile (COMCAST CORPORATION)

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Type, Operational Model, End User and States |

| States Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Mobile Virtual Network Operator (MVNO) Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Type

6.2 By Operational Model

6.3 By End Use

6.4 By States

7. Type

7.1 Discount

7.1.1 Market Analysis

7.1.2 Market Size & Forecast

7.2 Telecom

7.2.1 Market Analysis

7.2.2 Market Size & Forecast

7.3 Retail

7.3.1 Market Analysis

7.3.2 Market Size & Forecast

7.4 Migrant

7.4.1 Market Analysis

7.4.2 Market Size & Forecast

7.5 Business

7.5.1 Market Analysis

7.5.2 Market Size & Forecast

7.6 Roaming

7.6.1 Market Analysis

7.6.2 Market Size & Forecast

7.7 Media

7.7.1 Market Analysis

7.7.2 Market Size & Forecast

7.8 M2M

7.8.1 Market Analysis

7.8.2 Market Size & Forecast

8. Operational Model

8.1 Reseller

8.1.1 Market Analysis

8.1.2 Market Size & Forecast

8.2 Service Provider

8.2.1 Market Analysis

8.2.2 Market Size & Forecast

8.3 Full MNVO

8.3.1 Market Analysis

8.3.2 Market Size & Forecast

9. End Use

9.1 Consumer

9.1.1 Market Analysis

9.1.2 Market Size & Forecast

9.2 Enterprise

9.2.1 Market Analysis

9.2.2 Market Size & Forecast

10. States

10.1 California

10.1.1 Market Analysis

10.1.2 Market Size & Forecast

10.2 Texas

10.2.1 Market Analysis

10.2.2 Market Size & Forecast

10.3 New York

10.3.1 Market Analysis

10.3.2 Market Size & Forecast

10.4 Florida

10.4.1 Market Analysis

10.4.2 Market Size & Forecast

10.5 Illinois

10.5.1 Market Analysis

10.5.2 Market Size & Forecast

10.6 Pennsylvania

10.6.1 Market Analysis

10.6.2 Market Size & Forecast

10.7 Ohio

10.7.1 Market Analysis

10.7.2 Market Size & Forecast

10.8 Georgia

10.8.1 Market Analysis

10.8.2 Market Size & Forecast

10.9 Washington

10.9.1 Market Analysis

10.9.2 Market Size & Forecast

10.10 New Jersey

10.10.1 Market Analysis

10.10.2 Market Size & Forecast

10.11 Rest of United States

10.11.1 Market Analysis

10.11.2 Market Size & Forecast

11. Value Chain Analysis for MVNOs

11.1 Role of MVNE in MVNO success

11.2 MVNOs and their Partnerships with MNOs

11.3 Analysis of 4G & 5G-based MVNO services in the US

12. Porter's Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Competition

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threats

14. Pricing Benchmark Analysis

14.1 H2O Wireless (Locus Telecommunications, LLC)

14.2 Mint Mobile, LLC. (T-Mobile US, Inc.)

14.3 RedPocket Mobile

14.4 TracFone Wireless, Inc.(Verizon Communications Inc.)

14.5 Visible (Verizon Communications)

14.6 Cricket Wireless LLC

14.7 Google Fi Wireless (Google LLC, a subsidiary of Alphabet Inc.)

14.8 Tello, LLC

14.9 UVNV, LLC

14.10 Xfinity Mobile (COMCAST CORPORATION)

15. Key Players Analysis

15.1 H2O Wireless (Locus Telecommunications, LLC)

15.1.1 Overviews

15.1.2 Key Person

15.1.3 Recent Developments

15.1.4 SWOT Analysis

15.1.5 Revenue Analysis

15.2 Mint Mobile, LLC. (T-Mobile US, Inc.)

15.2.1 Overviews

15.2.2 Key Person

15.2.3 Recent Developments

15.2.4 SWOT Analysis

15.2.5 Revenue Analysis

15.3 RedPocket Mobile

15.3.1 Overviews

15.3.2 Key Person

15.3.3 Recent Developments

15.3.4 SWOT Analysis

15.3.5 Revenue Analysis

15.4 TracFone Wireless, Inc.(Verizon Communications Inc.)

15.4.1 Overviews

15.4.2 Key Person

15.4.3 Recent Developments

15.4.4 SWOT Analysis

15.4.5 Revenue Analysis

15.5 Visible (Verizon Communications)

15.5.1 Overviews

15.5.2 Key Person

15.5.3 Recent Developments

15.5.4 SWOT Analysis

15.5.5 Revenue Analysis

15.6 Cricket Wireless LLC

15.6.1 Overviews

15.6.2 Key Person

15.6.3 Recent Developments

15.6.4 SWOT Analysis

15.6.5 Revenue Analysis

15.7 Google Fi Wireless (Google LLC, a subsidiary of Alphabet Inc.)

15.7.1 Overviews

15.7.2 Key Person

15.7.3 Recent Developments

15.7.4 SWOT Analysis

15.7.5 Revenue Analysis

15.8 Tello, LLC

15.8.1 Overviews

15.8.2 Key Person

15.8.3 Recent Developments

15.8.4 SWOT Analysis

15.8.5 Revenue Analysis

15.9 UVNV, LLC

15.9.1 Overviews

15.9.2 Key Person

15.9.3 Recent Developments

15.9.4 SWOT Analysis

15.9.5 Revenue Analysis

15.10 Xfinity Mobile (COMCAST CORPORATION)

15.10.1 Overviews

15.10.2 Key Person

15.10.3 Recent Developments

15.10.4 SWOT Analysis

15.10.5 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com