United States Meal Kit Market, by Food Type (Fresh & Processed Food), States (California, New York, Texas, Florida, Pennsylvania, Illinois), Ordering Methods, Food Category, Company Analysis

Buy NowGet Free Customization in this Report

In the United States Meal kit industry has emerged as one of the fastest-growing segment in the food and beverages sector. A meal kit is a subscription-based food service business model, where a customer gets a pre-cooked meal or half-cooked food products regularly to their home or desired place. This service is promoted as personalization of the food and beverage industry that is becoming a popular trend for the metropolitan population. According to Renub Research analysis, United States Meal Kit Market is anticipated to be US$ 6.39 Billion by 2026.

As of now, more than 150 meal kit companies are operating in the United States. Companies like Blue Apron, Home Chef, Kroger, Marley Spoon Inc, and Goodfood are investing heavily in United States Meal Kit Market. As the disposable income among millennial is increasing and time-crunch to prepare complete food are helping to grow the meal kits market in the United States. Meal Kits also have other benefits as it supports the consumer in cooking exotic dishes with proper ingredients and recipes.

The Impact of COVID-19 on Meal Kit Industry

Coronavirus has disrupted most of the industry negatively, but it has raised the demand for Meal Kits in the United States. This growth is due to the demand of customer for safe food during the lockdown. Since most food outlets and restaurants were closed during this period. In this report, we have covered all the insight for United States Meal Kit Market affected by COVID-19.

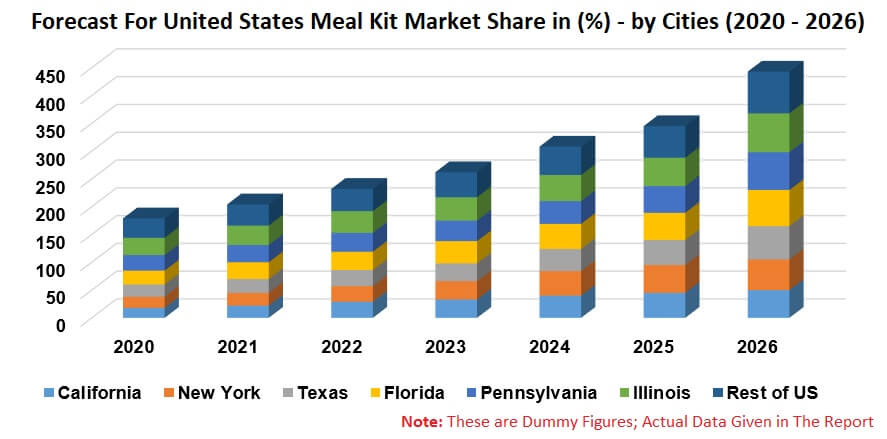

Renub Research report titled “United States Meal Kit Market by Food Type (Fresh & Processed Food), Ordering Methods (Online, Exclusive In-Store and Online & In-store), Category (Vegetarian, Non-Vegetarian), States (California, New York, Texas, Florida, Pennsylvania, Illinois and Others), Company Analysis (Blue Apron Holdings, Goodfood, HelloFresh, Marley Spoon Inc, and Kroger Co.)” provides complete analysis of the Meal Kit Market in the United States.

States – Top Six States Meal Kit Market is Covered in the Report

1. California

2. New York

3. Texas

4. Florida

5. Pennsylvania

6. Illinois

7. Rest of United States

Food Type – Both the Types of Food Market Covered in the Report

• Fresh Food

• Process Food

Ordering Methods – All three Types of Ordering Methods Market Covered in the Report

• Exclusive Online

• Exclusive In-Store

• Online & In-store

Food Category – Both Food Categories Market is Covered in the Report

• Vegetarian

• Non-Vegetarian

All the 5 Companies have been studied from Three Points

• Overview

• Recent Developments & Strategy

• Sales Analysis

Company Analysis

1. Blue Apron Holdings

2. Goodfood

3. HelloFresh

4. Marley Spoon Inc

5. Kroger Co.

If the information you seek is not included in the current scope of the study kindly share your specific requirements with our custom research team at info@renub.com

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Meal Kits Market

6. Share Analysis

6.1 By Product Type

6.2 By Ordering Methods

6.3 By Product Category

6.4 By Cities

7. Market by Product Type

7.1 Fresh Food

7.2 Process Food

8. Market by Ordering Methods

8.1 Exclusive Online

8.2 Exclusive In-Store

8.3 Online & In-store

9. Market by Product Category

9.1 Vegetarian

9.2 Non-Vegetarian

10. Market by Cities

10.1 California

10.2 New York

10.3 Texas

10.4 Florida

10.5 Pennsylvania

10.6 Illinois

10.7 Others

11. Company Analysis

11.1 Blue Apron Holdings, Inc

11.1.1 Overview

11.1.2 Recent Development

11.1.3 Sales Analysis

11.2 Goodfood

11.2.1 Overview

11.2.2 Recent Development

11.2.3 Sales Analysis

11.3 HelloFresh

11.3.1 Overview

11.3.2 Recent Development

11.3.3 Sales Analysis

11.4 Marley Spoon Inc

11.4.1 Overview

11.4.2 Recent Development

11.4.3 Sales Analysis

11.5 Home Chef (Acquired by Kroger Co.)

11.5.1 Overview

11.5.2 Recent Development

11.5.3 Sales Analysis

List of Figures:

Figure 1: United States – Meal Kit Market (Billion US$), 2019 – 2026

Figure 2: United States – Urban population (% of total population) 2010 - 2019

Figure 3: United States – Gross National Income (GNI) in Purchasing Power Parity (PPP) per capita 2010 - 2018

Figure 4: United States – Meal Kit Market (Billion US$), 2015 – 2019

Figure 5: United States – Forecast for Meal Kits Market (Billion US$), 2020 – 2026

Figure 6: United States – Meal Kits Market Share Analysis by Product Type (Percent), 2016 – 2019

Figure 7: United States – Forecast for Meal Kits Market Share Analysis by Product Type (Percent), 2020 – 2026

Figure 8: United States – Meal Kits Market Share Analysis by Ordering Methods (Percent), 2016 – 2019

Figure 9: United States – Forecast for Meal Kits Market Share Analysis by Ordering Methods (Percent), 2020 – 2026

Figure 10: United States – Meal Kits Market Share Analysis by Product Category (Percent), 2016 – 2019

Figure 11: United States – Forecast for Meal Kits Market Share Analysis by Product Category (Percent), 2020 – 2026

Figure 12: By Product – Fresh Food Market (Million US$), 2016 – 2019

Figure 13: By Product – Forecast for Fresh Food Market (Million US$), 2020 – 2026

Figure 14: By Product – Process Food Market (Million US$), 2016 – 2019

Figure 15: By Product – Forecast for Process Food Market (Million US$), 2020 – 2026

Figure 16: By Ordering Methods – Exclusive Online Market (Million US$), 2016 – 2019

Figure 17: By Ordering Methods – Forecast for Exclusive Online Market (Million US$), 2020 – 2026

Figure 18: By Ordering Methods – Exclusive In-Store Market (Million US$), 2016 – 2019

Figure 19: By Ordering Methods – Forecast for Exclusive In-Store Market (Million US$), 2020 – 2026

Figure 20: By Ordering Methods – Online & In-store Market (Million US$), 2016 – 2019

Figure 21: By Ordering Methods – Forecast for Online & In-store Market (Million US$), 2020 – 2026

Figure 22: By Product Category – Vegetarian Market (Million US$), 2016 – 2019

Figure 23: By Product Category – Forecast for Vegetarian Market (Million US$), 2020 – 2026

Figure 24: By Product Category – Non-Vegetarian Market (Million US$), 2016 – 2019

Figure 25: By Product Category – Forecast for Non-Vegetarian Market (Million US$), 2020 – 2026

Figure 26: By Cities – California Meal Kit Market (Million US$), 2016 – 2019

Figure 27: By Cities – Forecast for California Meal Kit Market (Million US$), 2020 – 2026

Figure 28: By Cities – New York Meal Kit Market (Million US$), 2016 – 2019

Figure 29: By Cities – Forecast for New York Meal Kit Market (Million US$), 2020 – 2026

Figure 30: By Cities – Texas Meal Kit Market (Million US$), 2016 – 2019

Figure 31: By Cities – Forecast for Texas Meal Kit Market (Million US$), 2020 – 2026

Figure 32: By Cities – Florida Meal Kit Market (Million US$), 2016 – 2019

Figure 33: By Cities – Forecast for Florida Meal Kit Market (Million US$), 2020 – 2026

Figure 34: By Cities – Pennsylvania Meal Kit Market (Million US$), 2016 – 2019

Figure 35: By Cities – Forecast for Pennsylvania Meal Kit Market (Million US$), 2020 – 2026

Figure 36: By Cities – Illinois Meal Kit Market (Million US$), 2016 – 2019

Figure 37: By Cities – Forecast for Illinois Meal Kit Market (Million US$), 2020 – 2026

Figure 38: By Cities – Others Meal Kit Market (Million US$), 2016 – 2019

Figure 39: By Cities – Forecast for Others Meal Kit Market (Million US$), 2020 – 2026

Figure 40: Blue Apron Holdings, Inc – Meal Kits Sales Analysis (Million USD), 2015 – 2019

Figure 41: Blue Apron Holdings, Inc.– Forecast for Meal Kits Sales Analysis (Million USD), 2020 – 2026

Figure 42: Goodfood – Meal Kits Sales Analysis (Million USD), 2016 – 2019

Figure 43: Goodfood – Forecast for Meal Kits Sales Analysis (Million USD), 2020 – 2026

Figure 44: HelloFresh – Meal Kits Sales Analysis (Million USD), 2017 – 2019

Figure 45: HelloFresh – Forecast for Meal Kits Sales Analysis (Million USD), 2020 – 2026

Figure 46: Marley Spoon Inc. – Meal Kits Sales Analysis (Million USD), 2017 – 2019

Figure 47: Marley Spoon Inc. – Forecast for Meal Kits Sales Analysis (Million USD), 2020 – 2026

Figure 48: Kroger – Global Sales Analysis (Billion USD), 2015 – 2019

Figure 49: Kroger – Forecast for Global Sales Analysis (Billion USD), 2020 – 2026

List of Tables:

Table 1: United States – Meal Kits Market Share Analysis by Cities (Percent), 2016 – 2019

Table 2: United States – Forecast for Meal Kits Market Share Analysis by Cities (Percent), 2020 – 2026

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com