United States Hardware Stores Market Analysis 2025–2033

Buy NowUnited States Hardware Stores Market Size and Forecast

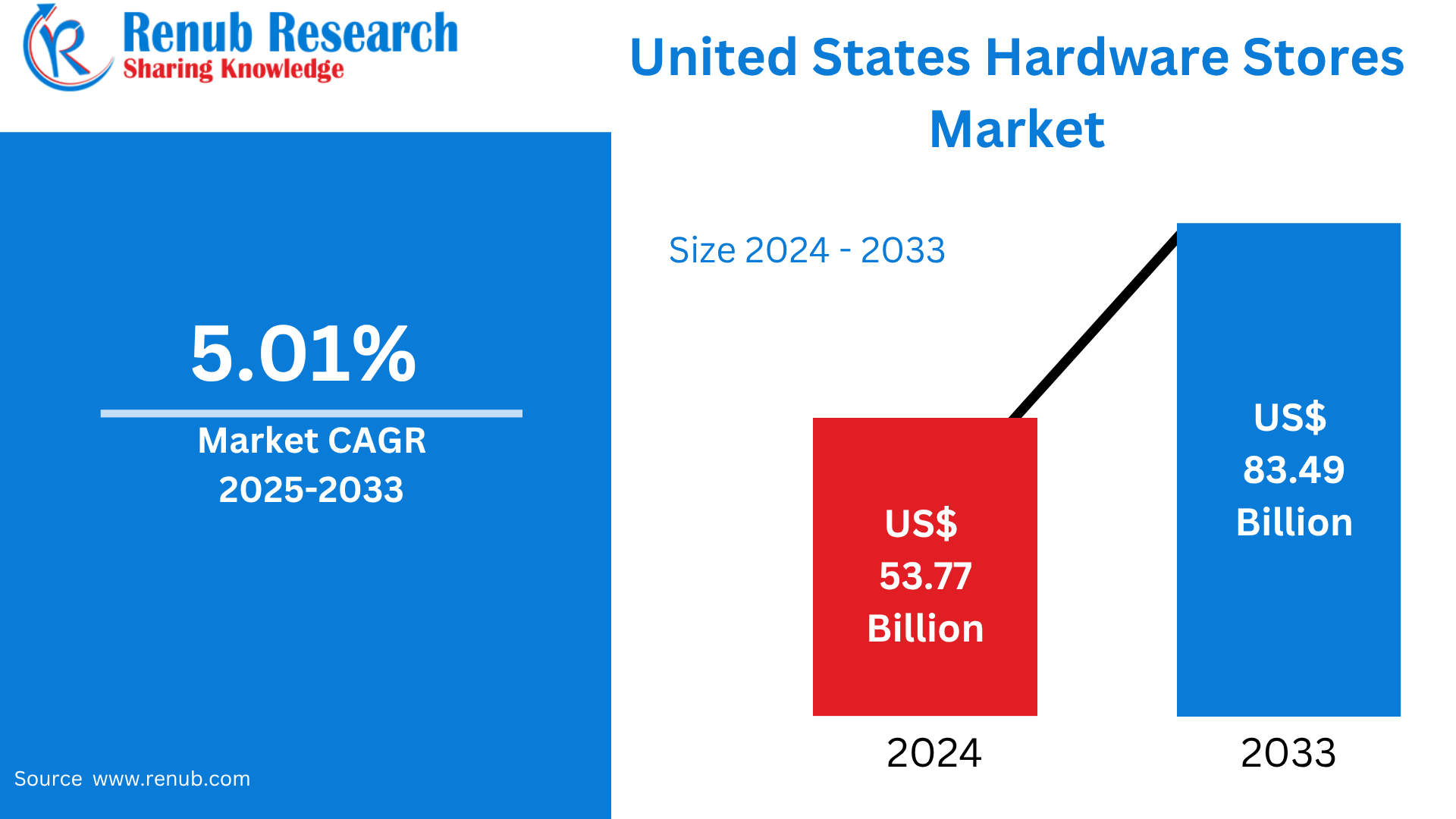

United States Hardware Stores Market is expected to reach US$ 83.49 billion by 2033 from US$ 53.77 billion in 2024, with a CAGR of 5.01% from 2025 to 2033. The increasing use of home appliances in remodeling projects is the main cause of the spike in demand for hardware merchants. This is fueled by a growing demand for efficient storage cabinets, changing appliance tastes, backsplash and hardwood flooring trends, and a desire for more effective outdoor area connections.

United States Hardware Stores Market Report by Product Type (Tools and Hardware, Building Materials, Plumbing and Electrical Supplies, Paint and Home Improvement, Outdoor and Garden Supplies), Application (Professional Contractors, DIY Consumers, Institutional Buyers, Industrial Customers), States and Company Analysis, 2025-2033.

United States Hardware Stores Industry Overview

The hardware store sector in the US is essential to the construction, home renovation, and upkeep of both residential and commercial buildings. From little individual stores to major national chains like Ace Hardware, Lowe's, and The Home Depot, this industry includes a diverse spectrum of businesses. Tools, construction materials, paint, electrical and plumbing supplies, lawn and garden products, and other home improvement items are all supplied by the industry. Due to rising property ownership and home remodeling trends, consumer demand for do-it-yourself solutions has generated consistent development over the last ten years. The marketing and delivery of hardware items has also changed as a result of the growth of e-commerce and omnichannel shopping, with major retailers now making significant investments in digital infrastructure and logistics.

Notwithstanding its advantages, the hardware store sector confronts a number of difficulties, such as labor shortages, increased material costs, and supply chain interruptions. Traditional hardware merchants have also been forced to improve their in-store experience and customer service due to competition from internet behemoths like Amazon. Personalized service, knowledgeable guidance, and community involvement, however, are still advantages of local establishments that are hard to duplicate online. Eco-friendly and sustainable items are becoming popular consumer choices that affect supplier relationships and inventory management plans. With the help of an older housing stock, more renovation projects, and infrastructure improvements, the sector is predicted to develop moderately in the future. All things considered, the hardware store business in the United States continues to be a robust and flexible sector with chances for local market distinctiveness and innovation.

Lowe announced in September 2023 that its multi-year contract with the NFL will be extended for the current season. A national television ad, a new roster of Lowe's Home Team players, and the release of a limited-edition DIY Wrist Coach accessory are all part of the extensive marketing push that will launch the partnership.

Key Factors Driving the United States Hardware Stores Market Growth

Growing Do-It-Yourself Culture

The market expansion for hardware stores is being greatly aided by the expanding do-it-yourself (DIY) culture in the US. Thanks to easy access to educational materials, cost savings, and a sense of success, consumers are increasingly doing their own home repair tasks. With its step-by-step instructions for repairs, restorations, and inventive home improvements, platforms like YouTube, Instagram, and TikTok have grown in popularity as inspiration and advice sources. Among younger homeowners and renters who value customization and experiential learning, this tendency is especially prevalent. Consequently, there is a greater need for basic tools, paints, hardware, and supplies. In response, retailers are offering courses, information, and product packages that are easy for do-it-yourselfers to assist this expanding customer base and improve customer engagement.

Trends in Home Renovation

The U.S. hardware shop business is steadily expanding due to a significant emphasis on comfort, functionality, and home aesthetics. In order to improve living areas, boost energy efficiency, and raise the value of their homes, homeowners are spending more money on remodeling and renovation projects. Improvements to outdoor living spaces, flooring replacements, and kitchen and bathroom renovations are major areas of concentration. As more individuals spent more time at home and tried to modify their homes for remote work, exercise, and pleasure, the COVID-19 epidemic accelerated this tendency. The need for paint, lighting, fixtures, tools, and building supplies is still being driven by this change. By providing a wide range of products, project planning services, and financing alternatives for more extensive renovations, hardware stores are taking advantage of these developments.

Integration of Smart Homes

In the US, hardware businesses are seeing significant growth due to the use of smart home technologies. Smart thermostats, doorbells, security systems, and lighting controls are among the gadgets that consumers are increasingly looking for because they improve convenience, safety, and energy economy. Both new and existing homes are incorporating technology as it becomes more accessible and user-friendly. Hardware retailers are extending their product lines to include accessories and linked devices, frequently in partnership with well-known tech companies. For less tech-savvy consumers, in-store displays, professional guidance, and installation assistance are bridging the knowledge gap. Hardware merchants are positioned as key participants in the expanding smart home ecosystem as a result of this trend.

Challenges in the United States Hardware Stores Market

High Level of Competition in E-Commerce

Traditional hardware stores face a significant challenge from the explosive rise of e-commerce, particularly from behemoths like Amazon and Walmart. These online marketplaces appeal to customers who value convenience by providing a large selection of goods, affordable prices, and quick delivery. Smaller product inventories, lengthier shipping times, and limited digital capabilities make it difficult for many physical hardware merchants to compete. Smaller, independent businesses that lack the infrastructure for internet sales or logistics are most affected by this. Hardware businesses need to make investments in omnichannel strategies, strong websites, and effective delivery or pickup options in order to stay competitive as customer behavior continues to trend toward digital buying. Traditional businesses run the danger of losing a sizable portion of their clientele to online rivals if they don't adapt.

High Reliance on Trends in the Housing Market

The state of the housing market has a direct impact on hardware shop performance. Hardware supply demand usually decreases when house sales, new building, or remodeling activity slows. Retail sales in this industry may be directly impacted by economic conditions that discourage home activity, such as tightened loan criteria, inflation, and rising interest rates. In times of financial uncertainty, homeowners may also put off major remodeling projects, which would lower foot traffic and sales for hardware stores. Long-term planning is made more difficult by regional housing trends and seasonal variations. Hardware merchants must broaden their product lines, focus on do-it-yourself and small-scale project customers, and increase their attractiveness to both professionals and households in a variety of economic cycles in order to lessen this risk.

United States Hardware Stores Market Overview by States

Due to factors including population size, housing activity, and demand for new construction, the hardware store market in the United States differs by state, with Florida, Texas, and California dominating in both store count and sales. The following provides a market overview by States:

California Hardware Stores Market

The market for hardware shops in California is vibrant and varied, fueled by the state's sizable population, diverse environment, and thriving building and remodeling industries. Hardware stores provide to a variety of consumer demands, such as gardening, house renovation, and earthquake-resistant building materials, in both urban and rural areas. The demand for sustainable and energy-efficient products is further boosted by the state's green construction laws and environmental restrictions. There is a significant DIY culture, particularly in suburban regions where homeowners often work on maintenance and restoration projects. Californian retailers have to adjust to regional variations in seasonal patterns, inventory requirements, and consumer preferences. Traditional hardware stores are also under pressure to stand out from the competition by providing individualized service, knowledgeable guidance, and community-based involvement in response to competition from big-box retailers and online marketplaces.

Texas Hardware Stores Market

Due to its large geographic area, fast urbanization, and thriving construction industry, Texas has a strong and varied hardware store market. Serving both urban and rural populations, the state is home to a variety of individual merchants, regional firms, and big national brands. With a booming population and a robust do-it-yourself culture, cities like Houston, Dallas, and Austin are important centers for hardware retail. Furthermore, Texas's ranching and farming industries generate a need for specific tools and equipment. To improve client involvement and expedite operations, retailers in the state are progressively implementing digital platforms and e-commerce tactics. Texas continues to be a major participant in the hardware store sector in the United States because to its broad customer base and welcoming business climate.

New York Hardware Stores Market

The market for hardware stores in New York is distinguished by a mix of big national chains and conventional, family-run companies, which reflects the state's varied urban and rural environments. Hardware stores frequently provide specific goods and services suited to smaller living spaces and outdated infrastructure in metropolitan places like New York City, meeting the particular demands of city people. Through workshops and individualized services, these retailers regularly interact with the community, cultivating a devoted client base. On the other hand, big-box stores, which provide a large selection of goods at affordable prices, could be more prevalent in suburban and rural areas. By embracing e-commerce platforms, which enable customers to purchase online and pick up in-store, the market is also adjusting to contemporary issues by combining convenience with individualized service.

Market Segmentations

Product Type

- Tools and Hardware

- Building Materials

- Plumbing and Electrical Supplies

- Paint and Home Improvement

- Outdoor and Garden Supplies

Application

- Professional Contractors

- DIY Consumers

- Institutional Buyers

- Industrial Customers

States

- California

- Texas

- New York

- Florida

- Illinois

- Pennsylvania

- Ohio

- Georgia

- Washington

- New Jersey

- Rest of United States

All the Key players have been covered

- Overviews

- Key Person

- Recent Developments

- SWOT Analysis

- Revenue Analysis

Company Analysis:

- Home Depot Inc.

- Lowe's Companies Inc.

- Menard Inc.

- Ace Hardware

- True Value Hardware

- 84 Lumber

- Handy Andy Home Improvement Centers Inc.

- Hippo Hardware and Trading Company

- Orchard Supply Hardware

- Harbor Freight Tools

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product Type, Customer Type and States |

| States Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Hardware Stores Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Product Type

6.2 By Customer Type

6.3 By States

7. Product Type

7.1 Tools and Hardware

7.1.1 Market Analysis

7.1.2 Market Size & Forecast

7.2 Building Materials

7.2.1 Market Analysis

7.2.2 Market Size & Forecast

7.3 Plumbing and Electrical Supplies

7.3.1 Market Analysis

7.3.2 Market Size & Forecast

7.4 Paint and Home Improvement

7.4.1 Market Analysis

7.4.2 Market Size & Forecast

7.5 Outdoor and Garden Supplies

7.5.1 Market Analysis

7.5.2 Market Size & Forecast

8. Customer Types

8.1 Professional Contractors

8.1.1 Market Analysis

8.1.2 Market Size & Forecast

8.2 DIY Consumers

8.2.1 Market Analysis

8.2.2 Market Size & Forecast

8.3 Institutional Buyers

8.3.1 Market Analysis

8.3.2 Market Size & Forecast

8.4 Industrial Customers

8.4.1 Market Analysis

8.4.2 Market Size & Forecast

9. States

9.1 California

9.1.1 Market Analysis

9.1.2 Market Size & Forecast

9.2 Texas

9.2.1 Market Analysis

9.2.2 Market Size & Forecast

9.3 New York

9.3.1 Market Analysis

9.3.2 Market Size & Forecast

9.4 Florida

9.4.1 Market Analysis

9.4.2 Market Size & Forecast

9.5 Illinois

9.5.1 Market Analysis

9.5.2 Market Size & Forecast

9.6 Pennsylvania

9.6.1 Market Analysis

9.6.2 Market Size & Forecast

9.7 Ohio

9.7.1 Market Analysis

9.7.2 Market Size & Forecast

9.8 Georgia

9.8.1 Market Analysis

9.8.2 Market Size & Forecast

9.9 Washington

9.9.1 Market Analysis

9.9.2 Market Size & Forecast

9.10 New Jersey

9.10.1 Market Analysis

9.10.2 Market Size & Forecast

9.11 Rest of United States

9.11.1 Market Analysis

9.11.2 Market Size & Forecast

10. Value Chain Analysis

11. Regulatory Framework

11.1 Health and Safety Regulations

11.2 Environmental Protection Compliance

11.3 Trade and Tariff Regulations

11.4 Certification Requirements

12. Porter's Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Competition

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threats

14. Pricing Benchmark Analysis

14.1 Home Depot Inc.

14.2 Lowe's Companies Inc.

14.3 Menard Inc.

14.4 Ace Hardware

14.5 True Value Hardware

14.6 84 Lumber

14.7 Handy Andy Home Improvement Centers Inc.

14.8 Hippo Hardware and Trading Company

14.9 Orchard Supply Hardware

14.10 Harbor Freight Tools

15. Key Players Analysis

15.1 Home Depot Inc.

15.1.1 Overviews

15.1.2 Key Person

15.1.3 Recent Developments

15.1.4 SWOT Analysis

15.1.5 Revenue Analysis

15.2 Lowe's Companies Inc.

15.2.1 Overviews

15.2.2 Key Person

15.2.3 Recent Developments

15.2.4 SWOT Analysis

15.2.5 Revenue Analysis

15.3 Menard Inc.

15.3.1 Overviews

15.3.2 Key Person

15.3.3 Recent Developments

15.3.4 SWOT Analysis

15.3.5 Revenue Analysis

15.4 Ace Hardware

15.4.1 Overviews

15.4.2 Key Person

15.4.3 Recent Developments

15.4.4 SWOT Analysis

15.4.5 Revenue Analysis

15.5 True Value Hardware

15.5.1 Overviews

15.5.2 Key Person

15.5.3 Recent Developments

15.5.4 SWOT Analysis

15.5.5 Revenue Analysis

15.6 84 Lumber

15.6.1 Overviews

15.6.2 Key Person

15.6.3 Recent Developments

15.6.4 SWOT Analysis

15.6.5 Revenue Analysis

15.7 Handy Andy Home Improvement Centers Inc.

15.7.1 Overviews

15.7.2 Key Person

15.7.3 Recent Developments

15.7.4 SWOT Analysis

15.7.5 Revenue Analysis

15.8 Hippo Hardware and Trading Company

15.8.1 Overviews

15.8.2 Key Person

15.8.3 Recent Developments

15.8.4 SWOT Analysis

15.8.5 Revenue Analysis

15.9 Orchard Supply Hardware

15.9.1 Overviews

15.9.2 Key Person

15.9.3 Recent Developments

15.9.4 SWOT Analysis

15.9.5 Revenue Analysis

15.10 Harbor Freight Tools

15.10.1 Overviews

15.10.2 Key Person

15.10.3 Recent Developments

15.10.4 SWOT Analysis

15.10.5 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com