United States Endoscopy Devices Market is expected to grow at a CAGR of 7.19% from 2021 to 2027, Bolstered by favourable reimbursement policies and Rising Cases of Cancer

14 Feb, 2022

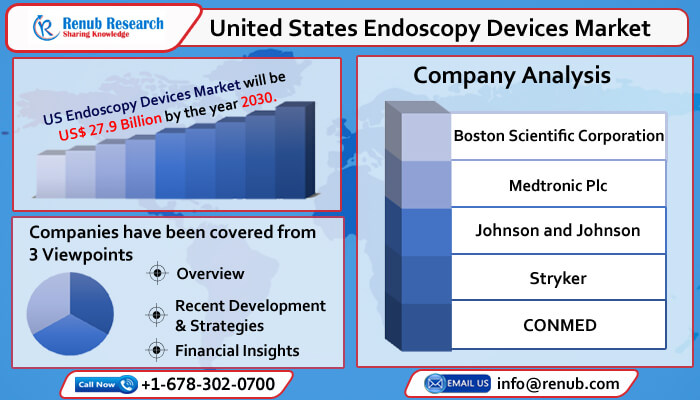

According to the latest report by Renub Research, “United States Endoscopy Devices Market, Size, Forecast 2022-2027, Industry Trends, Impact of COVID-19, Opportunity Company Analysis” the United States Endoscopy Devices Market Size is projected to reach US$ 27.9 Billion by 2027. Endoscopy devices are thin and long tubes inserted inside the body via mouth or incision to examine the interior of the bladder, stomach, ears, nose, esophagus, colon, throat, heart, joints, urinary tract, and abdomen. These tubes have a light source attached and a camera, which help healthcare professionals to perform laparoscopic and biopsies and arthroscopy surgeries. They are available in various lengths and flexibilities depending on diagnostic organs.

United States Endoscopy Devices Market Size was US$ 18.8 Billion in 2021

The change in the trend of adoption from traditional open surgeries to minimally invasive techniques by healthcare professionals and patients is one of the primary factors growing the endoscopy devices market in the United States. Other factors promoting growth include the rising prevalence of chronic conditions, the increasing geriatric population, and technological advancements in endoscopy devices.

Moreover, the increasing number of neurological disorders and the rising adoption of minimally invasive surgeries attributed to the United States endoscopic devices market growth. As per ONP hospitals statistics, the United States contributes to 32% of the number, i.e., around 4,800,000 laparoscopic procedures are performed every year. This implies that endoscopic procedures are performed widely in the country.

Endoscopy Visualization Components product dominates the United States Endoscopy Devices Market

Depending on the product, the global endoscopy devices market is divided into Operative Devices, Endoscopy Visualization Components, Endoscopy Visualization Systems, and Endoscopes. The endoscopy visualization components register a significant dominance in the United States endoscopy devices industry. This is attributable to benefits provided by high-definition visualization systems for treating and diagnosing complex health conditions such as cancer, urinary disorders, GI disorders, and lung disorders and increasing preference of healthcare professionals towards utilizing endoscopy visualization systems for better diagnosis and treatment.

In United States G.I. Tumors accounts for the Second Highest Cause of cancer-related Deaths

In the United States, endoscopy sub-products like robot-assisted endoscopes, capsule endoscopes, and rigid endoscopes are widely used in various medical specialties applications, such as gastroenterology, urology, gynecology, pulmonology ENT, and others. The increasing burden of G.I. disorders, coupled with the growing geriatric population, is propelling the demand for Gastroenterology Endoscopy. G.I. tumors are the second most extensive cause of cancer-related deaths in the United States. Thus, an upsurge in endoscopic procedures for the early diagnosis of G.I. cancers offers considerable revenue opportunities.

Bariatric Surgery Drives the Capsule Endoscopy Market Growth

Although, sub-product Capsule endoscopy is widely used to detect minor bowel damage, Crohn’s disease, obscure intestinal bleeding, etc., in the United States. Capsule endoscopy has significant benefits for patients with small bowel disease for whom the proper diagnosis is not available. In addition, the capsule endoscope is on-demand due to its cost-effectiveness. Moreover, many surgical procedures using endoscopic procedures such as bariatric surgery boost the Capsule endoscopy market growth in the United States.

Besides, the market comprises both hospitals and ambulatory surgery centers/clinics by end-users. Nevertheless, in the United States, hospitals have emerged as the most primary health system. Thus, the number of endoscopic surgeries done at hospitals is relatively more than the other health systems, such as specialty clinics or Ambulatory Surgical Centers (ASCs).

COVID- 19 Impact on the United States Endoscopy Devices Industry:

COVID-19 is an incomparable global public health emergency that has affected the United States in almost every industry, including the endoscopy device industry. The primary cause for the decline in endoscopy procedures during the COVID-19 pandemic was decreased patient volume in hospitals due to delaying guidelines for safety reasons and rescheduling. Moreover, these delays happened after careful review of patient history, and healthcare providers rescheduled endoscopic procedures to minimize the chance of exposure to COVID-19 during hospital visits.

Competitive Landscape:

The United States endoscopy devices industry is highly competitive, and prominent players have adopted various strategies to increase their endoscopy devices market share. These include product launch, product development, product approval, and acquisition. Major US endoscopy devices market players include Boston Scientific Corporation, Medtronic Plc, Johnson and Johnson, Stryker, and Conmed.

Market Summary:

- Product – We have covered United States Endoscopy Device Market breakup by 4 viewpoints by-product (Operative Devices, Endoscopy Visualization Components, Endoscopy Visualization Systems and Endoscopes)

- Sub-Product – Renub Research Report covers by Sub-Product in the 5 viewpoints (Rigid Endoscopes, Robot Assisted Endoscopes, Disposable Endoscopes, Capsule Endoscopes and Flexible Endoscopes)

- Application – Our Report has covered United States Endoscopy Device Market breakup by 6 Application (Gastroenterology, ENT Surgery, Gynecology, Neurology, Urology and Other Applications)

- End Users – This Report covers by End Users in the 3 viewpoints (Hospitals, Ambulatory Surgery Centers/Clinics and Other End Uses)

- All the major players have been covered from 3 Viewpoints (Overview, Recent Development, and Revenue Analysis) Boston Scientific Corporation, Medtronic Plc, Johnson and Johnson, Stryker and Conmed.

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com