United Arab Emirates Smart Home Market Share Analysis and Size, Key Player - Growth Trends and Forecast Report 2025-2033

Buy NowUnited Arab Emirates Smart Home Market Size and Forecast 2025-2033

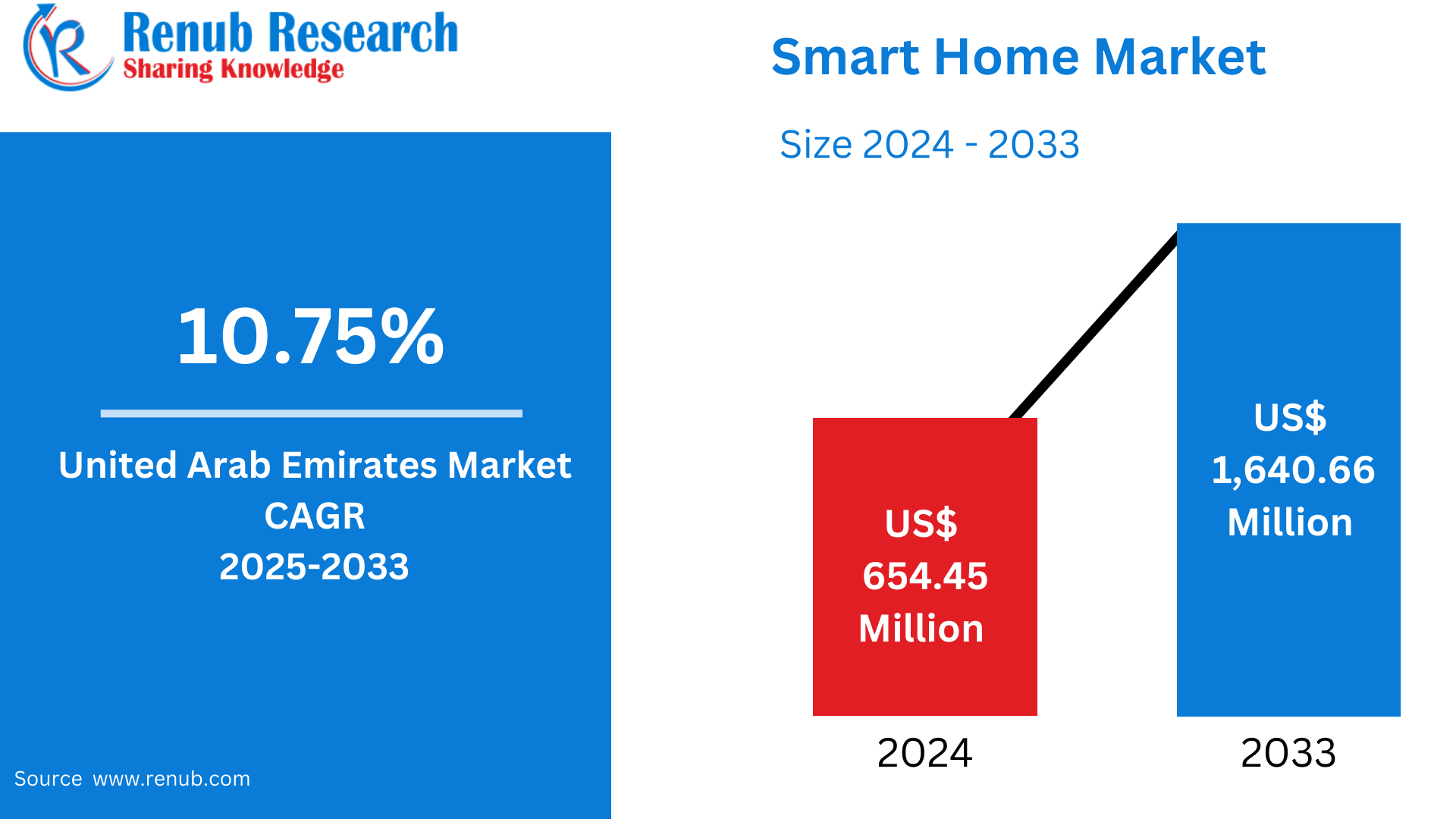

United Arab Emirates Smart Home Market is expected to reach US$ 1,640.66 million by 2033 from US$ 654.45 million in 2024, with a CAGR of 10.75% from 2025 to 2033. A tech-savvy populace and rising disposable incomes are fueling the market's notable development trajectory. Smart entertainment gadgets, energy management solutions, and improved security systems are becoming more and more popular in the area.

United Arab Emirates Smart Home Market Report by Component Components (Hardware, Smart Appliances, AI Speaker, Services), Application (Comfort and Lighting, Control and Connectivity, Energy Management, Home Entertainment, Security, Smart Appliance), Region (East, West, North, South) and Company Analysis, 2025-2033.

United Arab Emirates Smart Home Industry Overview

Due to the high demand for automation, convenience, and energy efficiency, the smart home market in the United Arab Emirates (UAE) is expanding quickly. The UAE is adopting smart home solutions in the commercial, residential, and hospitality sectors due to its high rate of technology adoption and government backing for innovation. The desire for improved security and comfort, the rising popularity of energy-saving solutions, and developments in Internet of Things (IoT) technology are some of the main factors. Homes are rapidly incorporating smart gadgets like voice assistants, security cameras, lighting controls, and thermostats. The industry is further boosted by the UAE's ambition for sustainable urban development, which includes eco-friendly projects like Masdar City. The industry's growth is also aided by increased disposable incomes and consumer awareness.

100% of UAE citizens have access to the internet, and the Telecommunications Regulatory Authority (UAE) said that there are over 18 million active mobile subscriptions, according to figures released by the World Bank. This connectivity improves convenience and security by enabling users to remotely manage and monitor their home appliances using smartphones and other devices.

This tendency is further amplified by the growing use of 5G, which offers quicker and more dependable connections. The UAE has one of the highest percentages of consumers worldwide—57 percent—who are extremely satisfied with the performance of their 5G network, according to an Ericsson poll. In the third quarter of 2023, 96.3% of internet users in the United Arab Emirates had a smartphone, 37.4% owned a tablet, and 12.5% owned a smart home device, according to statistics released by DataReportal.

Growth Drivers for the United Arab Emirates Smart Home Market

Government Initiatives and Smart City Projects

Through a number of programs and projects aimed at revolutionizing urban life, the UAE government significantly contributes to the expansion of the smart home sector. The Dubai Smart City project is one of the main forces behind the adoption of smart home solutions as it incorporates state-of-the-art technologies into the city's infrastructure. The creation of sustainable urban zones, like Masdar City, where smart technology are integrated into the design, is also being led by the government. Furthermore, government-sponsored contests and awareness-raising initiatives, such as Dubai's "Best Connected Home" competition, encourage creativity and advance smart living. The UAE is now a worldwide leader in the smart home revolution thanks to these initiatives, which also improve quality of life and increase demand for cutting-edge smart home devices.

Technological Advancements and 5G Infrastructure

One of the main factors driving the growth of the smart home industry in the United Arab Emirates is the fast rollout of 5G networks. 5G facilitates smooth communication between systems and smart devices with its lightning-fast internet speeds, minimal latency, and enhanced connection. The ease of remotely controlling household appliances is increased by the widespread usage of smartphones and the availability of high-speed internet. Smart houses are becoming more and more popular as a result of residents' ability to manage appliances, lighting, security, and temperature from their mobile devices. Additionally, the development of cloud-based and IoT (Internet of Things) technology opens the door to more creative and comprehensive smart home solutions. The UAE is maintaining its lead in the worldwide transition to smart living because to this increase in connectivity.

Consumer Demand for Convenience and Energy Efficiency

The need for smart home solutions has increased as UAE citizens place a higher priority on convenience, energy efficiency, and increased security. Because they may increase comfort while consuming less energy, smart technologies like climate control systems, automatic security features, and energy-efficient lighting are very alluring. Energy-efficient appliances enable households to lower power bills and lessen their carbon impact in the UAE, which places a strong emphasis on sustainability. Additionally, by automating routine chores like remotely regulating lights or temperature, smart home devices increase convenience. The UAE's smart home industry is expanding due to rising consumer demand for these solutions, which is being driven by the desire for contemporary living with less of an impact on the environment.

Challenges in the United Arab Emirates Smart Home Market

Lack of Standardization and Compatibility

The lack of interoperability and standardization across different smart devices and platforms is another major issue facing the UAE's smart home sector. It might be challenging to ensure smooth integration between devices from various brands when there are several manufacturers offering a large range of goods. It might be difficult for customers to design a completely integrated smart home system in which every gadget can successfully connect with every other device. Customers may become frustrated, have longer setup times, and incur higher expenses as a result of this incompatibility. A more uniform industry standard would facilitate the integration process for customers and hasten the adoption of smart home technology.

Privacy and Security Concerns

Data security and privacy issues have become major obstacles in the UAE market as the use of smart home appliances grows. Numerous smart gadgets, like voice assistants, webcams, and smart thermostats, gather private information that may be subject to illegal access or hacks. Customers are reluctant to use technologies that might put them at danger and are growing increasingly concerned about the security of their personal data. Better encryption and secure data methods are being used by manufacturers to solve these problems, but until customers have greater confidence in the security of their data, the market's development may be slowed by persistent worries about connected devices' safety.

East United Arab Emirates Smart Home

As people of the Eastern United Arab Emirates (UAE) want for more convenience, energy efficiency, and security in their homes, the smart home market there is growing. The need for smart home appliances like climate control systems, security cameras, and controlled lighting is growing as a result of government programs like smart city projects and the expanding use of cutting-edge technologies. Better device integration is made possible by the advent of 5G infrastructure, which further facilitates seamless communication. Widespread adoption is nevertheless hampered by issues including expensive upfront costs, a lack of standards, and worries about data protection. Despite these challenges, it is anticipated that as consumer awareness and technology improvements increase, the Eastern United Arab Emirates will continue to embrace smart home solutions, helping to drive the region's digital transformation.

West United Arab Emirates Smart Home

Modern technology is seamlessly integrated into a smart house in the western United Arab Emirates (UAE) to improve comfort, security, and convenience. These residences include sophisticated automation systems that use voice commands or smartphone applications to regulate the lighting, climate, and entertainment. Safety is ensured by real-time monitoring provided by smart security systems with cameras, motion sensors, and doorbell cameras. Smart thermostats, controlled irrigation systems, and solar panels are examples of energy-efficient innovations that save utility bills while promoting sustainability. Appliances with AI capabilities, such air purifiers, washing machines, and refrigerators, streamline daily chores. Sleek designs and premium materials are also used in the design of residences, which emphasize luxury and contemporary aesthetics. These smart houses are a representation of contemporary life in the United Arab Emirates due to their unique blend of style and innovation.

United Arab Emirates Smart Home Market Segments

Component

- Hardware

- Smart Appliances

- AI Speaker

- Services

Application

- Comfort and Lighting

- Control and Connectivity

- Energy Management

- Home Entertainment

- Security

- Smart Appliance

Region

- East

- West

- North

- South

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Development

- Financial Insights

Company Analysis:

- Johnson Controls

- Schneider Electric

- Emerson Electric Revenue

- LG

- Legrand SA

- Siemens AG

- Honeywell

- Apple

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

By Components, By Application and By Region |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Source

2.1.2 Secondary Source

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United Arab Emirates Smart Home Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Components

6.2 By Application

6.3 By Region

7. Components

7.1 Hardware

7.2 Smart Appliances

7.3 AI Speaker

7.4 Services

8. Application

8.1 Comfort and Lighting

8.2 Control and Connectivity

8.3 Energy Management

8.4 Home Entertainment

8.5 Security

8.6 Smart Appliance

9. Region

9.1 East

9.2 West

9.3 North

9.4 South

10. Porter’s Five Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players

12.1 Johnson Controls

12.1.1 Overview

12.1.2 Key Persons

12.1.3 Recent Development

12.1.4 Revenue

12.2 Schneider Electric

12.2.1 Overview

12.2.2 Key Persons

12.2.3 Recent Development

12.2.4 Revenue

12.3 Emerson Electric Revenue

12.3.1 Overview

12.3.2 Key Persons

12.3.3 Recent Development

12.3.4 Revenue

12.4 LG

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Recent Development

12.4.4 Revenue

12.5 Legrand SA

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Recent Development

12.5.4 Revenue

12.6 Siemens AG

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Recent Development

12.6.4 Revenue

12.7 Honeywell

12.7.1 Overview

12.7.2 Key Persons

12.7.3 Recent Development

12.7.4 Revenue

12.8 Apple

12.8.1 Overview

12.8.2 Key Persons

12.8.3 Recent Development

12.8.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com