Turkey Hotel Market & Volume, Budget & Star Rated Hotel ( 1st, 2nd, 3rd, 4th, 5th) Star, City, Province, Chain Hotel (International, Domestic), Company (Hilton, Marriott, Radisson, Accor) & Forecast

Buy NowGet Free Customization in This Report

In recent years, Turkey has been considered as one of the most attractive destinations for travel across the world as a variety of options is available at affordable prices. Besides, the country classic sun & sea vacation, apart from that it is also known for its historical, heritage as well as cultural attractions among tourists. In the year 2019, Turkey was named the 6th most visited country across the globe hosted a large number of tourists. According to Renub Research report, it is anticipated that Turkey Hotel Market will be US$ 11.6 Billion by the end of the year 2026.

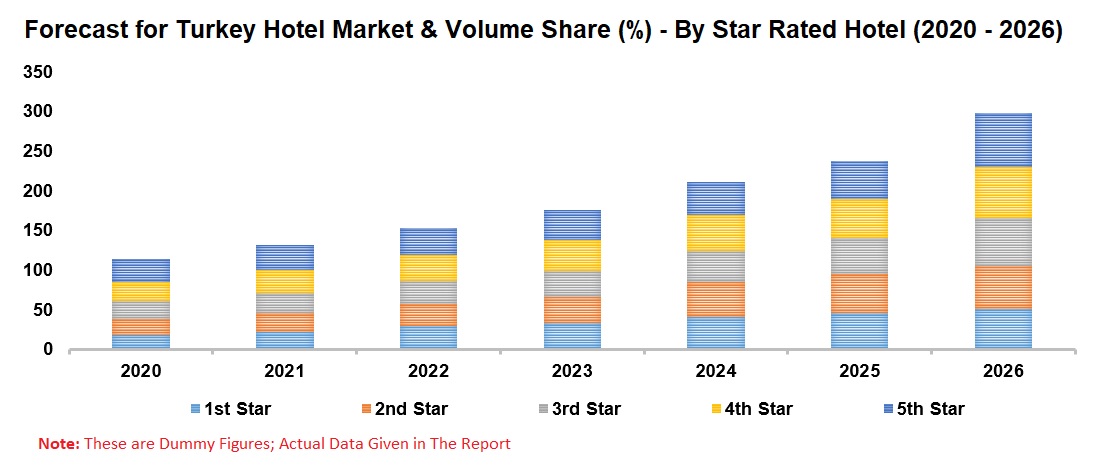

Foreign visitors have risen dramatically in the last few years in Turkey. Countries like Germany, Bulgaria, United Kingdom, Iran, and Russia are the country from where many tourists arrive in Turkey. Star rated hotel has the most significant market share in Turkey due to numbers of the facility given by star rated hotel. Besides, visitors also prefer star rated over a budget hotel.

Antalya is one of the most preferred cities in Turkey and has 4-star and 5-star hotels in its center and surrounding towns such as Kemer, Belek, and KaÅŸ. Star rated hotel occupancy is increasing year on year. Turkey's lucrative tourism industry souring and its top destination for Halal Tourism tend to drive Turkey hotel market in the future.

COVID–19 Impacts on Turkey Hotel Industry

Around the world, COVID-19 has impacted almost every economy, mostly tourism, hotel, and the airlines' industry. Turkey is a part of an interconnected globally, and this new crisis hits at the center of globalization. So, we expect the coronavirus will affect the Turkey hotel market severely in the year 2020. The year 2021 will see some growth on the back of domestic tourists. Read the complete analysis of Cornonavirus's impact on the hotel industry of Turkey in the report.

Renub Research report titled "Turkey Hotel Market & Volume, Star Rated Hotel & Budget Hotel, Hotel by Star Rated ( 1st Star ,2nd Star, 3rd Star, 4th Star, 5th Star), City (Antalya, Istanbul, Mugla, Izmir, Aydin, Ankara, Mersin, Busra, Afyonkarahisar, Balikesir), Province (Istanbul, Marmara (East & West), Aegean (Aegean & Mediterranean), Black Sea (West & East), Anatolia (Central Anatolia, Northeast Anatolia, Central-East Anatolia, Southeast Anatolia), Chain Hotel (Top 10 International Chain Groups, Top 10 Domestic Chain Groups, Top 9 Domestic Brand, Chain Hotel by Category), Company (Hilton, Marriott, Radisson, Accor) & Forecast” provides an all-encompassing analysis on the Turkey Hotel Market.

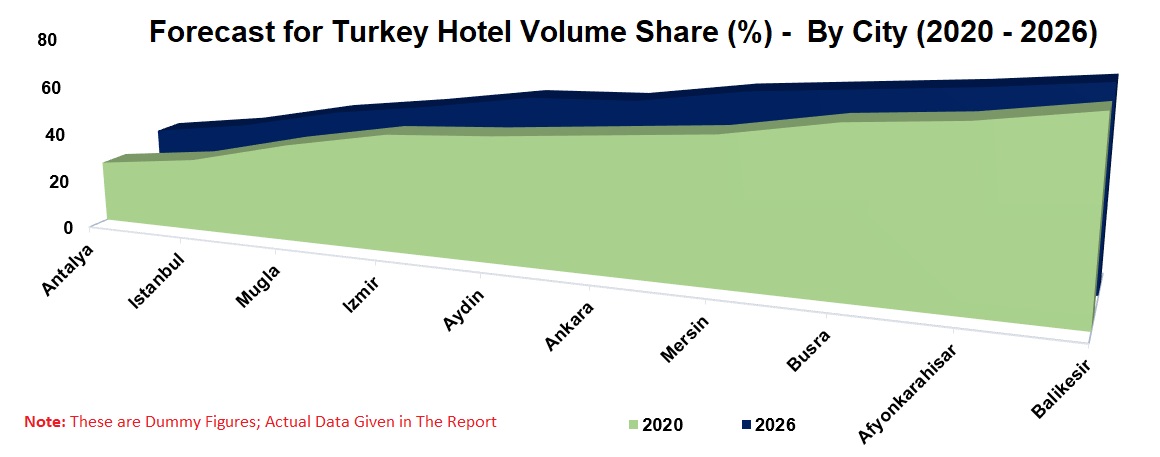

Antalya is the most preferred city in Turkey Star Rated Hotel

In this report, we have covered Star rated hotel Volume by City: we have studied complete insights of Star Rated Hotel Volume (Hotel rooms) by in these ten cities (Antalya, Istanbul, Mugla, Izmir, Aydin, Ankara, Mersin, Busra, Afyonkarahisar, Balikesir).

1 to 5 Star Turkey Hotels Market and Volume covered in the report

In this report, we have shown complete insight into Turkey Hotel by Star category. The covered market & Volume by Star Rated (By Number of Hotel and Number of rooms) are; 1st Star, 2nd Star, 3rd Star, 4th Star, 5th Star.

5 Province Budget Hotel Analysis

5 Province has been studied thoroughly in this report, namely Istanbul, Marmara (East & West), Aegean (Aegean & Mediterranean), Black Sea (West & East), Anatolia (Central Anatolia, Northeast Anatolia, Central-East Anatolia, Southeast Anatolia).

All the hotels have been studied from two points

• Recent Developments

• Sales Analysis

Company Insights - Turkey Hotel Market

• Radisson

• Hilton

• Accor

• Marriott

Hotel Category - Turkey Hotel Market

• Star Rated

• Budget

Star Rated Hotel Volume by City – Turkey Hotel Market

• Antalya

• Istanbul

• Mugla

• Izmir

• Aydin

• Ankara

• Mersin

• Busra

• Afyonkarahisar

• Balikesir

Market & Volume of Budget Hotel by Province - Turkey Hotel Market

• Istanbul

• Marmara (East & West)

• Aegean (Aegean & Mediterranean)

• Black Sea (West & East)

• Anatolia (Central Anatolia, Northeast Anatolia, Central-East Anatolia, Southeast Anatolia)

Chain Hotel - Turkey Hotel Market

• Top 10 International Chain Groups

• Top 10 Domestic Chain Groups

• Top 9 Domestic Brand

• Chain Hotel by Category

Top Five Countries People Visited in Turkey

• Distribution of Arriving Foreign Visitors - Top 5 Countries (2017-2019) November

• Distribution of Arriving Foreign Visitors - Top 5 Countries (2017-2019) January-November

If the information you seek is not included in the current scope of the study kindly share your specific requirements with our custom research team at info@renub.com

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Turkey Hotel Market

6. Market Share - Turkey Hotel

6.1 Budget Hotel vs. Star Rated Hotel

6.2 Star rated Hotel

7. Market & Volume - Star Rated Hotel

7.1 1 Star

7.1.1 Market

7.1.2 Volume

7.2 2 Star

7.2.1 Market

7.2.2 Volume

7.3 3 Star

7.3.1 Market

7.3.2 Volume

7.4 4 Star

7.4.1 Market

7.4.2 Volume

7.5 5 Star

7.5.1 Market

7.5.2 Volume

8. City Volume - Star Rated Hotel

8.1 Antalya

8.2 Istanbul

8.3 Mugla

8.4 Izmir

8.5 Aydin

8.6 Ankara

8.7 Mersin

8.8 Busra

8.9 Afyonkarahisar

8.10 Balikesir

9. Market & Volume - by Province Budget Hotel

9.1 Istanbul

9.1.1 Market

9.1.2 Volume (No of Hotel, No of Rooms & No of Beds)

9.2 Marmara

9.2.1 East & West Market

9.2.2 East & West Volume (No of Hotel, No of Rooms & No of Beds)

9.3 Aegean

9.3.1 Aegean & Mediterranean Market

9.3.2 Aegean & Mediterranean Volume (No of Hotel, No of Rooms & No of Beds)

9.4 Black Sea

9.4.1 West & East Market

9.4.2 West & East Volume (No of Hotel, No of Rooms & No of Beds)

9.5 West Anatolia

9.5.1 Market

9.5.2 Volume (No of Hotel, No of Rooms & No of Beds)

9.6 Central Anatolia

9.6.1 Market

9.6.2 Volume (No of Hotel, No of Rooms & No of Beds)

9.7 Northeast Anatolia

9.7.1 Market

9.7.2 Volume (No of Hotel, No of Rooms & No of Beds)

9.8 Central-East Anatolia

9.8.1 Market

9.8.2 Volume (No of Hotel, No of Rooms & No of Beds)

9.9 Southeast Anatolia

9.9.1 Market

9.9.2 Volume (No of Hotel, No of Rooms & No of Beds)

10. Chain Hotel in Turkey

10.1 Top 10 International Chain Groups

10.2 Top 10 Domestic Chain Groups

10.3 Top 10 International Brand

10.4 Top 9 Domestic Brand

10.5 Chain Hotel by Category

11. Turkey Hospitality Sector: Merger & Acquisition Deals

12. Top Five Countries People Visited in Turkey

12.1 Distribution of Arriving Foreign Visitors

12.2 Distribution of Arriving Foreign Visitors

13. Company Analysis

13.1 Radisson Hotels

13.1.1 Overview

13.1.2 Recent Development

13.1.3 Revenue

13.2 Hilton

13.2.1 Overview

13.2.2 Recent Development

13.2.3 Revenue

13.3 Accor

13.3.1 Overview

13.3.2 Recent Development

13.3.3 Revenue

13.4 Marriott

13.4.1 Overview

13.4.2 Recent Development

13.4.3 Revenue

List of Figures:

Figure-01: Turkey Hotel Market by Category (US$ Million), 2019 – 2026

Figure-02: Turkey- Hotel Rooms by Category (Number), 2019 – 2026

Figure-03: Turkey Hotel Market (US$ Million), 2016 – 2019

Figure-04: Forecast for Turkey Hotel Market (US$ Million), 2020 – 2026

Figure-05: Turkey Hotel Market Share by Category (Percent), 2016 – 2019

Figure-06: Turkey - Forecast For Market Share by Category (Percent), 2020 – 2026

Figure-07: Turkey - 1 Star Hotel Market (USD Million), 2016 – 2019

Figure-08: Turkey- Forecast for 1 Star Hotel Market (USD Million), 2020 – 2026

Figure-09: Turkey - 1 Star Hotel & Hotel Room Volume (In Number), 2016 – 2019

Figure-10: Turkey - Forecast for 1 Star Hotel & Hotel Room Volume (In Number), 2020 – 2026

Figure-11: Turkey - 2 Star Hotel Market (USD Million), 2016 – 2019

Figure-12: Turkey - Forecast for 2 Star Hotel Market (USD Million), 2020 – 2026

Figure-13: Turkey - 2 Star Hotel & Hotel Room Volume (In Number), 2016 – 2019

Figure-14: Turkey – Forecast for 2 Star Hotel & Hotel Room Volume (In Number), 2020 – 2026

Figure-15: Turkey - 3 Star Hotel Market (USD Million), 2016– 2019

Figure-16: Turkey - Forecast for 3 Star Hotel Market (USD Million), 2020 – 2026

Figure-17: Turkey - 3Star Hotel & Hotel Room Volume (In Number), 2016 – 2019

Figure-18: Turkey - Forecast for 3 Star Hotel & Hotel Room Volume (In Number), 2020 – 2026

Figure-19: Turkey - 4 Star Hotel Market (USD Million), 2016 – 2019

Figure-20: Turkey - Forecast for 4 Star Hotel Market (USD Million), 2020 – 2026

Figure-21: Turkey - 4 Star Hotel & Hotel Room Volume (In Number), 2016 – 2019

Figure-22: Turkey – Forecast for 4 Star Hotel & Hotel Room Volume (In Number), 2020 – 2026

Figure-23: Turkey - 5 Star Hotel Market (USD Million), 2016 – 2019

Figure-24: Turkey - Forecast for 5 Star Hotel Market (USD Million), 2020 – 2026

Figure-25: Turkey - Star Hotel & Hotel Room Volume (In Number), 2016 – 2019

Figure-26: Turkey - Forecast for 5 Star Hotel & Hotel Room Volume (In Number), 2020 – 2026

Figure-27: Antalya - Star Rated Hotel Rooms Volume (Number), 2018 - 2019

Figure-28: Antalya - Forecast for Star Rated Hotel Rooms Volume (Number), 2020 - 2026

Figure-29: Istanbul - Star Rated Hotel Rooms Volume (Number), 2018 – 2019

Figure-30: Istanbul - Forecast for Star Rated Hotel Rooms Volume (Number), 2020 – 2026

Figure-31: Mugla - Star Rated Hotel Room Volume (Number), 2018 – 2019

Figure-32: Mugla - Forecast for Star Rated Hotel Room Volume (Number), 2020 – 2026

Figure-33: Izmir – Star Rated Hotel Rooms Volume (Number), 2018 – 2019

Figure-34: Forecast for - Izmir Star Rated Hotel Rooms Volume (Number), 2020 – 2026

Figure-35: Aydin – Star Rated Hotel Rooms Volume (Number), 2018 – 2019

Figure-36: Aydin- Forecast for Star Rated Hotel Rooms Volume (Number), 2020 – 2026

Figure-37: Ankara – Star Rated Hotel Rooms Volume (Number), 2018 – 2019

Figure-38: Ankara - Forecast for Star Rated Hotel Rooms Volume (Number), 2020 – 2026

Figure-39: Mersin –Star Rated Hotel Rooms Volume (Number), 2018 – 2019

Figure-40: Mersin - Forecast for Star Rated Hotel Rooms Volume (Number), 2020 – 2026

Figure-41: Busra – Star Rated Hotel Rooms Volume (Number), 2018 – 2019

Figure-42: Busra - Forecast for Star Rated Hotel Rooms Volume (Number), 2020 – 2026

Figure-43: Afyonkarahisar – Star Rated Hotel Rooms Volume (Number), 2018 – 2019

Figure-44: Afyonkarahisar- Forecast for Star Rated Hotel Rooms Volume (Number), 2020 – 2026

Figure-45: Balikesir – Star Rated Hotel Rooms Volume (Number), 2018 – 2019

Figure-46: Balikesir - Forecast for Star Rated Hotel Rooms Volume (Number), 2020 – 2026

Figure-47: Istanbul - Budget Hotel Market (US$ Million), 2017 - 2019

Figure-48: Istanbul – Forecast for Budget Hotel Market (US$ Million), 2020 – 2026

Figure-49: Istanbul - Budget Hotel, Hotel Room & Beds Volume (In Number), 2017- 2019

Figure-50: Istanbul – Forecast for Budget Hotel, Hotel Room & Beds Volume (In Number), 2020 – 2026

Figure-51: East & West Marmara- Budget Hotel Market (US$ Million), 2017 - 2019

Figure-52: East & West Marmara – Forecast for Budget Hotel Market (US$ Million), 2020 – 2026

Figure-53: Aegean & Mediterranean Aegean Budget Hotel Market (US$ Million), 2020 – 2026

Figure-54: Aegean & Mediterranean Aegean – Forecast for Budget Hotel Market (US$ Million), 2020 – 2026

Figure-55: East & West Black Sea - Budget Hotel Market (US$ Million), 2017- 2019

Figure-56: East & West Black Sea – Forecast for Budget Hotel Market (US$ Million), 2020 – 2026

Figure-57: West Anatolia - Budget Hotel Market (US$ Million), 2017-2019

Figure-58: West Anatolia – Forecast for Budget Hotel Market (US$ Million), 2020 – 2026

Figure-59: West Anatolia - Budget Hotel, Hotel Room & Beds Volume (In Number), 2017 - 2019

Figure-60: West Anatolia – Forecast for Budget Hotel, Hotel Room & Beds Volume (In Number), 2020 – 2026

Figure-61: Central Anatolia – Budget Hotel Market (US$ Million), 2017-2019

Figure-62: Central Anatolia - Forecast for Budget Hotel Market (US$ Million), 2020-2026

Figure-63: Central Anatolia - Budget Hotel, Hotel Room & Beds Volume (In Number), 2017-2019

Figure-64: Central Anatolia – Forecast for Budget Hotel, Hotel Room & Beds Volume (In Number), 2020 – 2026

Figure-65: Northeast Anatolia Budget Hotel Market (US$ Million), 2017-2019

Figure-66: Northeast Anatolia – Forecast for Budget Hotel Market (US$ Million), 2020 – 2026

Figure-67: Northeast Anatolia - Hotel, Hotel Room & Beds Volume (In Number), 2017-2019

Figure-68: Northeast Anatolia – Forecast for Hotel, Hotel Room & Beds Volume (In Number), 2020 – 2026

Figure-69: Central East Anatolia - Budget Hotel Market (US$ Million), 2017-2019

Figure-70: Central East Anatolia – Forecast Budget for Hotel Market (US$ Million), 2020 – 2026

Figure-71: Central East Anatolia- Budget Hotel, Hotel Room & Beds Volume (In Number), 2017-2019

Figure-72: Central East Anatolia– Forecast Budget for Hotel, Hotel Room & Beds Volume (In Number), 2020 – 2026

Figure-73: Southeast Anatolia - Budget Hotel Market (US$ Million), 2017- 2019

Figure-74: Southeast Anatolia – Forecast for Budget Hotel Market (US$ Million), 2020 – 2026

Figure-75: Southeast Anatolia - Budget Hotel, Hotel Room & Beds Volume (In Number), 2017-2019

Figure-76: Southeast Anatolia – Forecast for Budget Hotel, Hotel Room & Beds Volume (In Number), 2020 – 2026

Figure-77: Global - Radisson Hotel Revenue (USD Million), 2017 – 2019

Figure-78: Global - Forecast for Radisson Hotel Revenue (USD Million), 2019 – 2026

Figure-79: Global - Hilton Hotel Revenue (USD Million), 2017 – 2019

Figure-80: Global - Forecast for Hilton Hotel Revenue (USD Million ), 2020 – 2026

Figure-81: Global – Accor Hotel Revenue (USD Million), 2017 – 2019

Figure-82: Global - Forecast for Accor Hotel Revenue (USD Million), 2020 – 2026

Figure-83: Global - Marriott Hotels Revenue (US$ Million), 2017 – 2019

Figure-84: Global - Forecast for Marriott Hotel Revenue (US$ Million), 2020 – 2026

List of Tables:

Table-1: Turkey – Star Rated Hotel Market Share Analysis (Percent), 2016 - 2019

Table-2: Turkey – Forecast For Star Rated hotel Market Share Analysis (Percent), 2019 - 2026

Table-3: East & West Marmara - Budget Hotel, Hotel Room & Beds Volume (In Number), 2017-2019

Table-4: West & East Marmara – Forecast for Budget Hotel, Hotel Room & Beds Volume (In Number), 2020 – 2026

Table-5: Aegean & Mediterranean Aegean - Budget Hotel, Hotel Room & Beds Volume (In Number), 2017-2019

Table-6: Aegean & Mediterranean Aegean – Forecast for Budget Hotel, Hotel Room & Beds Volume (In Number), 2020 – 2026

Table-7: East & West Black Sea –Budget Hotel, Hotel Room & Beds Volume (In Number), 2017 – 2019

Table-8: East & West Black Sea – Forecast for Budget Hotel, Hotel Room & Beds Volume (In Number), 2020 – 2026

Table-9: Turkey - Top Ten International Hotel Chain Groups, 2018

Table-10: Turkey - Top Ten Domestic Hotel Chain Groups 2018

Table-11: Turkey – Top Ten International Brand 2018

Table-12: Turkey – Top Nine Domestic Brand 2018

Table-13: Turkey – Chain Hotel by Category 2018

Table-14: Turkey – TOP 5 Countries By Distribution of Arriving Foreign Visitors (2017-2019), November

Table-15: Turkey – Top 5 Countries By Distribution of Arriving Foreign Visitors (2017-2019), January - November

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com