Sweden Diabetes Market, Size, Forecast 2023-2028, Industry Trends, Growth, Impact of Inflation, Opportunity Company Analysis

Buy NowGet Free Customization in this Report

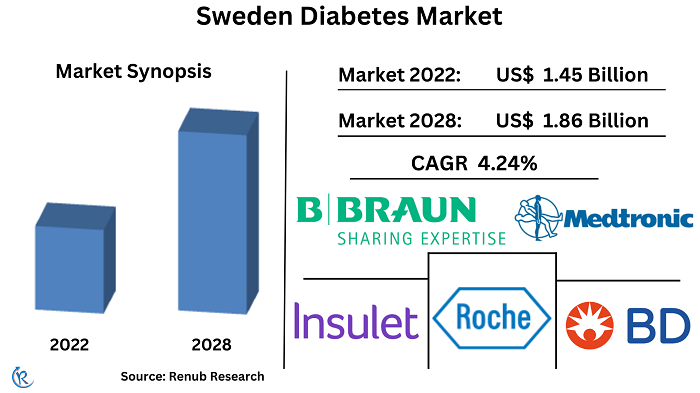

Sweden's Diabetes Market will reach US$ 1.86 Billion in 2028 and expand at a CAGR of 4.24% from 2023 to 2028, according to Renub Research. Diabetes is obtaining epidemic proportions, and digital health companies are fighting back with innovative solutions. According to World Diabetes Organization, diabetes presently affects 59.8 million individuals in Europe, which will rise to 73.8 million by 2040. Diabetes is currently one of the most critical emergencies in global health and shows an increasing prevalence in Sweden. The healthcare system of Sweden has taken a heavy toll due to diabetes, which could be due to the associated direct costs required for medical management. Nowadays, caring for people with Type 2 diabetes has expanded from including only GPs to involving RNs in the main workforce. In Sweden, PHCCs have diabetes-responsible GPs and RNs available in-house who have the overall responsibility for the care and treatment of people with T2DM. According to Renub Research, the Sweden Market was US$ 1.45 Billion in 2022.

Type 2 diabetes is a heterogeneous disease in Sweden

Diabetes mellitus is recognized as an epidemic. The prevalence of type 2 diabetes is increasing dramatically in Sweden, with projections of even higher growth over the coming decades. The rapidly increasing incidence and prevalence of diabetic patients and healthcare expenditure are indications of the increasing usage of diabetic drugs. At any age, increasing weight raises the risk of type 2 diabetes. In people who are obese, type 2 diabetes is three to ten times more common than it is in people of average weight. Moreover, over the past decades, childhood-onset type 1 diabetes has been reported to be increasing in Sweden.

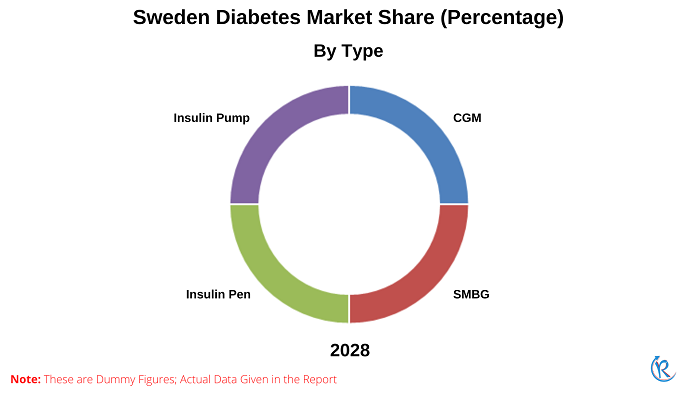

Insulin Pen will grow at a High Rate and Capturing the Highest Market Share in the Coming Years

The Sweden Diabetes Market by the device is segmented into; SMBG, CGM, Insulin Pumps, and Insulin Pens. Insulin cartridges in reusable pens are an upgraded version of insulin vials. Significant types of insulin are manufactured in the form of cartridges, which makes them easily attainable. These devices have all the functional advantages of reusable pens and are economical, as these cartridges are less costly than disposable insulin pens in the long run. Due to the rising demand for insulin cartridges, most insulin device manufacturers have produced reusable insulin pens compatible with various manufacturers' cartridges. These insulin cartridges are more consumer-friendly, as they are smaller and less observable than the classic vial-and-syringe. These devices are also more portable for consumers on the go.

Moreover, the SMBG segment also holds a significant market share. Driving factors that help to reach this market are the increasing diabetic population in Sweden, Governments, and NGOs' efforts to increase awareness, increasing per capita healthcare expenditure, and availability of reimbursements.

Key Players:

The major players competing in the Sweden Diabetes Market are B. Braun Melsungen AG, Eli Lilly and Company, Terumo Corporation, Becton, Dickenson (BD), Novo Nordisk A/S, Ypsomed AG, Medtronic, Insulet Corporation, Abbott Laboratories, DarioHealth Corp., Dexcom Inc., Roche Diagnostic, and Tandem Diabetes Care.

- In May 2021, Medtronic announced the CE Mark for expanded functionality of the company's In Pen smart insulin pen for multiple daily injections (MDI).

- In May 2021, Medtronic secured European approvals for its Guardian 4 sensor. The Guardian 4 sensor can be either utilized as a standalone continuous glucose monitor or combined into Medtronic's insulin pumps and pens to add real-time glucose monitoring alongside insulin tracking.

Renub Research report titled “Sweden Diabetes Market & Forecast, By Continuous Glucose Monitoring (CGM Market by Components, Glucose Sensor, Transmitter, CGM User, Reimbursement), Self-Monitoring Blood Glucose (SMBG Market by, Test Strips, Lancet, Meter, Blood Glucose Device Users & Reimbursement), Insulin Pen (User, Types – Disposable, Reusable and Smart Insulin Pen, Insulin Pen Needle Market, Reimbursement Policies), Insulin Pump (Users, Market & Differentiation Points of Insulin Pump Products, Training Model for Patients & HCP, Reimbursement Policies), Company (B. Braun Melsungen AG, Eli Lilly and Company, Terumo Corporation, Becton, Dickinson (BD), Novo Nardisk, Ypsomed AG, Medtronic, InsuletCorporation, Abbott Laboratories, DarioHealth Crop, Dexcom, Inc, Roche Diagnostic, Tandem Diabetes Care)” provides a complete analysis of Sweden Diabetes Industry.

Segments Market based on Devices

1. Continuous Glucose Monitoring (CGM)

2. Self-Monitoring Blood Glucose (SMBG)

3. Insulin Pen

4. Insulin Pump

Sweden Diabetes Sub-Segment Analysis

1. Continuous Glucose Monitoring (CGM)

1. Glucose Sensor Market & Forecast

2. CGM Transmitter Market & Forecast

3. CGM User

4. CGM Reimbursement

2. SMBG

1. Test Strips Market and Forecast

2. Lancet Market and Forecast

3. Meter Market and Forecast

4. Blood Glucose (SMBG) Users

5. Blood Glucose Devices Reimbursement

3. Insulin Pen Market

1. Disposable Insulin Pen

2. Reusable Insulin Pen

3. Smart Insulin Pen

4. Insulin Pen Needle Market

5. Insulin Pen Users

6. Reimbursement Policies

4. Insulin Pump Market

1. Insulin Pump Market

2. Insulin Pump Users

3. Insulin Pump Products

4. Reimbursement Policies

All the 13 Companies Studied in the Report have been Studied from 3 Points

• Company Overview

• Recent Developments

• Financial Insight

Company Analysis

1. B. Braun Melsungen AG

2. Eli Lilly and Company

3. Terumo Corporation

4. Becton, Dickinson (BD)

5. Novo Nardisk

6. Ypsomed AG

7. Medtronic

8. InsuletCororation

9. Abbott Laboratories

10. DarioHealth Crop

11. Dexcom, Inc

12. Roche Diagnostic

13. Tandem Diabetes Care

Report Details:

| Report Features | Details |

| Base Year | 2022 |

| Historical Period | 2017 - 2022 |

| Forecast Period | 2023 - 2028 |

| Market | US$ Billion |

| Segment Covered | CGM, SMBG, Insulin Pen, and Insulin Pump |

| Companies Covered | B. Braun Melsungen AG, Eli Lilly and Company, Terumo Corporation, Becton, Dickinson (BD), Novo Nardisk, Ypsomed AG, Medtronic, InsuletCorporation, Abbott Laboratories, DarioHealth Crop, Dexcom, Inc, Roche Diagnostic, Tandem Diabetes Care |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Frequently Asked Questions (FAQ):

- This report provides current market estimates and forecasts for Sweden Diabetic Market.

- Detailed analysis of the key market segments such as source, geography and applications; provides a comprehensive understanding of the market.

- Detailed analysis of Sweden SMBG Market.

- Detailed analysis of Sweden CGM Market.

- Detailed analysis of Sweden Insulin Pump Market.

- Detailed analysis of Sweden Insulin Pen Market.

- Australia Diabetic Market – Growth Drivers and Challenges.

- Key sustainability strategies adopted by market players.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Sweden Diabetes Market

6. Sweden Diabetes Population

6.1 Type 1 Diabetes

6.2 Type 2 Diabetes

7. Sweden Diabetes Market Share Analysis

7.1 By Types

8. Continuous Glucose Monitoring Market (CGM) – Market & Users

8.1 Sweden - CGM Market by Components

8.1.1 Glucose Sensor Market

8.1.2 CGM Transmitter Market

8.2 CGM User

8.3 Reimbursement Policies of CGM Devices in Sweden

9. Blood Glucose Device (SMBG) –Sweden Market & Users

9.1 Market

9.1.1 Type 1 Diabetes Market

9.1.2 Type 2 Diabetes Market

9.2 Test Strips Market

9.2.1 Type 1 Diabetes

9.2.2 Type 2 Diabetes

9.3 Lancet Market

9.3.1 Type 1 Diabetes

9.3.2 Type 2 Diabetes

9.4 Meter Market

9.4.1 Type 1 Diabetes

9.4.2 Type 2 Diabetes

9.5 Blood Glucose (SMBG) Users

9.5.1 Type 1 Diabetes

9.5.2 Type 2 Diabetes

9.6 Reimbursement Policies of Blood Glucose Devices in Sweden

10. Insulin Pen –Sweden Market & User Analysis

10.1 Insulin Pen Market

10.1.1 Disposable Insulin Pen Market

10.1.2 Reusable Insulin Pen Market

10.1.3 Smart Insulin Pen Market

10.2 Insulin Pen Needle Market

10.3 Insulin Pen User

10.3.1 Disposable Insulin Pen User

10.3.2 Reusable Insulin Pen User

10.3.3 Smart Insulin Pen User

10.4 Reimbursement Policies of Insulin Pen in Sweden

11. Insulin Pump – Sweden Market & Users

11.1 Insulin Pump Market

11.1.1 Type 1 Diabetes Market

11.1.2 Type 2 Diabetes Market

11.2 Insulin Pump User

11.2.1 Type 1 Insulin Pump User

11.2.2 Type 2 Insulin Pump User

11.3 Differentiation Points of Insulin Pump Products in Sweden

11.3.1 Animas Vibe

11.3.2 Medtronic 530G with Enlite

11.3.3 Insulet OmniPod

11.3.4 Tandem t: slim

11.3.5 Roche Accu-Chek Combo

11.4 Training Model for Patients & HCP – of Medtronic, Animas, Insulet Corp & Tandem Diabetes Care

11.4.1 Medtronic

11.4.1.1 Training Guidelines for Insulin Pump Therapy to New Patients

11.4.1.2 Training Model for HCP (HealthCare Professional)

11.5 Insulet Corporation

11.5.1 Training Structure for New Patients - Insulet Corporation

11.6 Animas Corporation

11.6.1 Training Modules for New Patients

11.6.2 Training Modules for HCP (Health Care Professional)

11.7 Tandem Diabetes Care

11.8 Reimbursement Policies Insulin Pump

12. Insulin Pen – Company Analysis

12.1 B. Braun Melsungen AG

12.1.1 Overview

12.1.2 Recent Developments

12.1.3 Revenue

12.2 Eli Lilly

12.2.1 Overview

12.2.2 Recent Developments

12.2.3 Revenue

12.3 Terumo Corporation

12.3.1 Overview

12.3.2 Recent Developments

12.3.3 Revenue

12.4 BD

12.4.1 Overview

12.4.2 Recent Developments

12.4.3 Revenue

12.5 Novo Nordisk A/S

12.5.1 Overview

12.5.2 Recent Developments

12.5.3 Revenue

12.6 Ypsomed AG

12.6.1 Overview

12.6.2 Recent Developments

12.6.3 Revenue

13. Insulin Pump – Company Analysis

13.1 Medtronic

13.1.1 Overview

13.1.2 Recent Developments

13.1.3 Revenue

13.2 Insulet Corporation

13.2.1 Overview

13.2.2 Recent Developments

13.2.3 Revenue

14. SMBG – Company Analysis

14.1 DarioHealth Corp

14.1.1 Overview

14.1.2 Recent Developments

14.1.3 Revenue

14.2 Abbott Laboratories

14.2.1 Overview

14.2.2 Recent Developments

14.2.3 Revenue

15. CGM – Company Analysis

15.1 Dexcom Inc

15.1.1 Overview

15.1.2 Recent Developments

15.1.3 Revenue

15.2 Roche

15.2.1 Overview

15.2.2 Recent Developments

15.2.3 Revenue

15.3 Tandem Diabetes Care

15.3.1 Overview

15.3.2 Recent Developments

15.3.3 Revenue

List of Figures:

Figure-01: Sweden – Diabetes Market (Billion US$), 2017 – 2022

Figure-02: Sweden – Forecast for Diabetes Market (Billion US$), 2023 – 2028

Figure-03: Sweden – Type 1 Diabetes Population (Thousand), 2017 – 2022

Figure-04: Sweden – Forecast for Type 1 Diabetes Population (Thousand), 2023 – 2028

Figure-05: Sweden – Type 2 Diabetes Population (Thousand), 2017 – 2022

Figure-06: Sweden – Forecast for Type 2 Diabetes Population (Thousand), 2023 – 2028

Figure-07: Sweden – Glucose Sensor Market (Million US$), 2017 – 2023

Figure-08: Sweden – Forecast for Glucose Sensor Market (Million US$), 2023 – 2028

Figure-09: Sweden – CGM Transmitter Market (Million US$), 2017 – 2023

Figure-10: Sweden – Forecast for CGM Transmitter Market (Million US$), 2023 – 2028

Figure-11: Sweden – CGM User (Thousand), 2017 – 2023

Figure-12: Sweden – Forecast for CGM User (Thousand),2023 – 2028

Figure-13: Sweden – Self-Monitoring of Blood Glucose (SMBG) Type 1 Diabetes Market (Million US$), 2023 – 2028

Figure-14: Sweden – Forecast for Self-Monitoring of Blood Glucose (SMBG) Type 1 Diabetes Market (Million US$), 2017 – 2023

Figure-15: Sweden – Self-Monitoring of Blood Glucose (SMBG) Type 2 Diabetes Market (Million US$), 2023 – 2028

Figure-16: Sweden – Forecast for Self-Monitoring of Blood Glucose (SMBG) Type 2 Diabetes Market (Million US$), 2017 – 2023

Figure-17: Sweden – Test Strips Type 1 Diabetes Market (Million US$), 2023 – 2028

Figure-18: Sweden – Forecast for Test Strips Type 1 Diabetes Market (Million US$), 2017 – 2023

Figure-19: Sweden – Test Strips Type 2 Diabetes Market (Million US$), 2023 – 2028

Figure-20: Sweden – Forecast for Test Strips Type 2 Diabetes Market (Million US$), 2017 – 2023

Figure-21: Sweden – Lancet Type 1 Diabetes Market (Million US$), 2023 – 2028

Figure-22: Sweden – Forecast for Lancet Type 1 Diabetes Market (Million US$), 2017 – 2023

Figure-23: Sweden – Lancet Type 2 Diabetes Market (Million US$), 2023 – 2028

Figure-24: Sweden – Forecast for Lancet Type 2 Diabetes Market (Million US$), 2017 – 2023

Figure-25: Sweden – Meter Type 1 Diabetes Market (Million US$), 2023 – 2028

Figure-26: Sweden – Forecast for Meter Type 1 Diabetes Market (Million US$), 2017 – 2023

Figure-27: Sweden – Meter Type 2 Diabetes Market (Million US$), 2023 – 2028

Figure-28: Sweden – Forecast for Meter Type 2 Diabetes Market (Million US$), 2017 – 2023

Figure-29: Sweden – Self-Monitoring of Blood Glucose (SMBG) Type 1 Users (Thousand), 2017 – 2022

Figure-30: Sweden – Forecast for Self-Monitoring of Blood Glucose (SMBG) Type 1 Users (Thousand), 2023 – 2028

Figure-31: Sweden – Self-Monitoring of Blood Glucose (SMBG) Type 2 Users (Thousand), 2017 – 2022

Figure-32: Sweden – Forecast for Self-Monitoring of Blood Glucose (SMBG) Type 2 Users (Thousand), 2023 – 2028

Figure-33: Sweden – Disposable Insulin Pen Market (Million US$), 2017 – 2023

Figure-34: Sweden – Forecast for Disposable Insulin Pen Market (Million US$), 2023 – 2028

Figure-35: Sweden – Reusable Insulin Pen Market (Million US$), 2017 – 2023

Figure-36: Sweden – Forecast for Reusable Insulin Pen Market (Million US$), 2023 – 2028

Figure-37: Sweden – Smart Insulin Pen Market (Million US$), 2017 – 2023

Figure-38: Sweden – Forecast for Smart Insulin Pen Market (Million US$), 2023 – 2028

Figure-39: Sweden – Disposable Insulin Pen User (Thousand), 2017 – 2022

Figure-40: Sweden – Forecast for Disposable Insulin Pen User (Thousand), 2023 – 2028

Figure-41: Sweden – Reusable Insulin Pen User (Thousand), 2017 – 2022

Figure-42: Sweden – Forecast for Reusable Insulin Pen User (Thousand), 2023 – 2028

Figure-43: Sweden – Smart Insulin Pen User (Thousand), 2017 – 2022

Figure-44: Sweden – Forecast for Smart Insulin Pen User (Thousand), 2023 – 2028

Figure-45: Sweden – Insulin Pump Market for Type 1 Diabetes Market (Million US$), 2017 – 2023

Figure-46: Sweden – Forecast for Insulin Pump Market for Type 1 Diabetes Market (Million US$), 2023 – 2028

Figure-47: Sweden – Insulin Pump Market for Type 2 Diabetes Market (Million US$), 2017 – 2023

Figure-48: Sweden – Forecast for Insulin Pump Market for Type 2 Diabetes Market (Million US$), 2023 – 2028

Figure-49: Sweden – Insulin Pump Type 1 Users (Thousand), 2017 – 2022

Figure-50: Sweden – Forecast for Insulin Pump Type 1 Users (Thousand), 2023 – 2028

Figure-51: Sweden – Insulin Pump Type 2 Users (Thousand), 2017 – 2022

Figure-52: Sweden – Forecast for Insulin Pump Type 2 Users (Thousand), 2023 – 2028

Figure-53: B. Braun Melsungen AG – Global Revenue (Billion US$), 2017 – 2022

Figure-54: B. Braun Melsungen AG – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-55: Eli Lilly – Global Revenue (Billion US$), 2017 – 2022

Figure-56: Eli Lilly – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-57: Terumo Corporation – Global Revenue (Billion US$), 2017 – 2022

Figure-58: Terumo Corporation – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-59: BD – Global Revenue (Billion US$), 2017 – 2022

Figure-60: BD – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-61: Novo Nordisk A/S – Global Revenue (Billion US$), 2017 – 2022

Figure-62: Novo Nordisk A/S – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-63: Ypsomed AG – Global Revenue (Billion US$), 2017 – 2022

Figure-64: Ypsomed AG – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-65: Medtronic – Global Revenue (Billion US$), 2017 – 2022

Figure-66: Medtronic – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-67: Insulet Corporation – Global Revenue (Billion US$), 2017 – 2022

Figure-68: Insulet Corporation – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-69: DarioHealth Corp – Global Revenue (Billion US$), 2017 – 2022

Figure-70: DarioHealth Corp – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-71: Abbott Laboratories – Global Revenue (Billion US$), 2017 – 2022

Figure-72: Abbott Laboratories – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-73: Dexcom Inc – Global Revenue (Billion US$), 2017 – 2022

Figure-74: Dexcom Inc – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-75: Roche – Global Revenue (Billion US$), 2017 – 2022

Figure-76: Roche – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-77: Tandem Diabetes Care – Global Revenue (Billion US$), 2017 – 2022

Figure-78: Tandem Diabetes Care – Forecast for Global Revenue (Billion US$), 2023 – 2028

List of Tables:

Table-01: Sweden – Diabetes Market Share by Type (Percent), 2017 – 2022

Table-02: Sweden – Forecast for Diabetes Market Share by Type (Percent), 2023 – 2028

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com