Israel Diabetes Market, Size, Forecast 2023-2028, By Insulin Pump, CGM, Self-Monitoring Blood Device and Company Analysis

Buy NowGet Free Customization in this Report

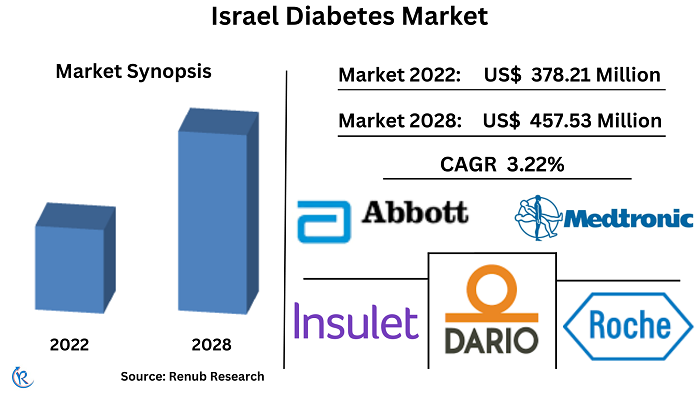

Israel Diabetes market will reach US$ 457.5 Million by 2028, according to Renub Research. Diabetes affects an estimated 15-20% of the adult population of Israel, making it one of the highest rates in the world. Diabetes is a chronic disease marked by excessive amounts of glucose (sugar) in the blood, which can lead to long-term health concerns if not effectively controlled. Diabetes occurs when the pancreas fails to make or release the hormone insulin as it should, resulting in the body's inability to adequately digest glucose. With over a million Israelis predicted to be diagnosed with type 2 diabetes by 2040, health experts have noted a critical need for novel approaches to preventing, treating, and curing this chronic illness. In Addition, in Israel, as elsewhere, socioeconomically disadvantaged populations are at greater risk of developing and suffering from the most severe effects of the disease. It is one of the four leading non-communicable diseases contributing to premature death globally, as well as in Israel.

Type 2 Diabetes is a major Public Health Threat in Israel

Type 1 holds the minimum percentage in the Israel diabetes market. Type 2 diabetes is caused by the body's ineffective use of Insulin, often resulting from excess body weight and physical inactivity. Israel Type 2 diabetes is considered an epidemic and is continuing on the rise. In Israel, the percentage of diabetes in the Arab population is twice that found in the Jewish population. Also, Insulin dependent diabetics generally take Insulin by injection or using a pump. Diabetes can lead to cardiovascular disease, blindness, and kidney failure. Furthermore, Israel's diabetes pandemic is a huge public health concern, and ongoing efforts are required to enhance access to care and support for persons with diabetes, as well as to avoid the condition in the first place.

Israel's Diabetes Market is poised to grow at a CAGR of 3.22% by 2028

It is now treatable with insulin shots, but there is no cure. Diabetes Mellitus fatalities in Israel reached 1,913 in 2020, according to the World Health Organization. Despite the fact that Israel's diabetes incidence is growing year after year, the World Bank estimates that diabetes prevalence will be 8.5% in 2021. Scientists in Israel found a treatment for Type 2 Diabetes in 2021. For four months, the mice maintained normal insulin levels with only one injection.

The Rising Prevalence of Diabetes in Israel will Increase demand for the Insulin Pump Market

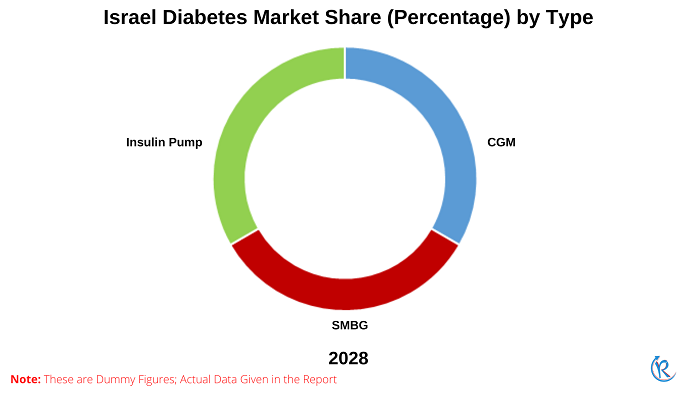

The Israel Diabetes Market is divided into three categories based on devices: Glucose Monitoring (CGM), Self-Monitoring Blood Glucose (SMBG), and Insulin Pumps. Insulin pumps will have the largest market share in the next years, owing to the rising prevalence of Type 1 diabetes and the development of high-quality pumps using clever technologies such as Artificial Intelligence and Machine Learning. The development of very precise glucose sensors and blood monitoring devices has also raised the demand for effective insulin pumps.

Insulin pump therapy was created to give a more physiologic form of insulin administration to patients who require Insulin. For starters, the insulin pump only utilizes conventional Insulin or rapid-acting insulin analogs, which produce more consistent results.

Furthermore, SMBG and CMG will dominate the Israeli market in the future year. Higher rates of self-monitored blood glucose (SMBG) measurement, especially eight times per day or more, are linked to better health. However, repeated daily SMBG fingerpick testing has a number of drawbacks, including low compliance owing to pain and discomfort and erroneous readings due to poor user technique.

CGM devices, which detect glucose in the interstitial fluid, have shown to be more successful than SMBG in monitoring glucose levels. As a result, CGM devices are becoming more widely accepted as a standard of treatment for diabetes. In 2022, Israel's Diabetes Market was estimated to be worth US$ 378.2 Million.

Diabetes Initiative in Israel

The Pesach Segal Israeli Center for Diabetes Research and Policy is a world-class research, policy, and teaching facility in Israel. The Israeli Center for Diabetes Research and Policy aims to be a resource for action, information, and understanding about diabetes, its origins, complications, effects, preventative measures, and treatment. Furthermore, the center is active in diabetes prevention and care activities and research in the following areas: therapeutic education, health promotion, behavioral modification, disease self-management, diabetes education, patient participation, and digital health.

Clinics treating diabetes in Israel have a completely different approach to treatment. An innovative method is the treatment of diabetes by stem cells in Israel. They are building materials for treating many diseases, including diabetes. The use of the newest therapy methods, the development and use of effective drugs, and the conduct of diabetic symposiums allow us to consider Israel one of the world centers for disease control. Also, doctors have made progress in the treatment of diabetic Israel. The causes of the disease are eliminated, and general restorative and substitution therapy is performed.

Diabetes clinics in Israel handle patients in a totally distinct way. Stem cell treatment for diabetes is a novel method in Israel. They are used to treat a variety of diseases, including diabetes. Because of the utilization of cutting-edge therapeutic techniques, the development and usage of beneficial drugs, and the organization of diabetes symposiums, Israel is considered one of the world's disease-control hotspots. Doctors have also made progress in treating diabetic Israelis. The sources of the disease are eliminated, and general restorative and replacement therapy are given.

Key Company

Medtronic, Insulet Corporation, Abbott Laboratories, DarioHealth Crop, Dexcom, Inc, Roche Diagnostic, and Tandem Diabetes Care are some of the major companies in the diabetes industry.

Kadimastem Ltd., a clinical-stage cell therapy company developing treatments for ALS and diabetes, received its third patent approval in September 2022 for its innovative cell selection and enrichment technology and its use in the production of IsletRx, the company's treatment and potential cure for diabetes.

- Aug 2022, Allevetix Company has invented a medical gadget that, without surgery, replicates the obesity and diabetes-fighting properties of a gastric bypass.

Renub Research report titled “Israel Diabetes Market & Volume Forecast by SMBG(Test Strips Market , Lancet Market, Meter Market and Forecast, Blood Glucose (SMBG) Users and Blood Glucose Devices Reimbursement), CGM(Glucose Sensor Market, CGM Transmitter Market, CGM User, and Reimbursement Policies of CGM devices in Israel) Insulin Pump(Insulin Pump Market ,Insulin Pump User, and Reimbursement Policies Insulin Pump), Company Analysis(Medtronic, Insulet Corporation, Abbott Laboratories, DarioHealth Crop, Dexcom, Inc, Roche Diagnostic, Tandem Diabetes Care)’’ provides a detailed analysis of Diabetes Industry in the Israel.

Israel Segments Market based on Devices

1. Continuous Glucose Monitoring (CGM)

2. Self-Monitoring Blood Glucose (SMBG)

3. Insulin Pump

Israel Diabetes Sub-Segment Analysis

Segments Market based on Devices: Breakup into 3 parts

1. Continuous Glucose Monitoring (CGM)

2. Self-Monitoring Blood Glucose (SMBG)

3. Insulin Pump

Israel Diabetes Sub-Segment Analysis

1. Self-Monitoring Blood Glucose (SMBG) Device:Breakup into 5 parts

1. Test Strips Market

2. Lancet Market

3. Meter Market

4. Blood Glucose (SMBG) Users

5. Blood Glucose Devices Reimbursement

2. Continuous Glucose Monitoring (CGM): Breakup into 4 parts

1. Glucose Sensor Market

2. CGM Transmitter Market

3. CGM User

4. CGM Reimbursement

3. Insulin Pump Market: Breakup into 3 parts

1. Insulin Pump Market

2. Insulin Pump Users

3. Reimbursement Policies

All the 7 Companies Studied in the Report have been Studied from 3 Points

• Company Overview

• Recent Developments

• Financial Insight

Company Analysis

1. Medtronic

2. Insulet Corporation

3. Abbott Laboratories

4. DarioHealth Crop

5. Dexcom, Inc

6. Roche Diagnostic

7. Tandem Diabetes Care

Report Details:

| Report Features | Details |

| Base Year | 2022 |

| Historical Period | 2017 - 2022 |

| Forecast Period | 2023 - 2028 |

| Market | US$ Billion |

| Segment Covered | SMBG, CGM, and Insulin Pump |

| Companies Covered | Medtronic, Insulet Corporation, Abbott Laboratories, DarioHealth Crop, Dexcom, Inc, Roche Diagnostic, and Tandem Diabetes Care |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

How big is the Israel Diabetes Market?

- This report provides current market estimates and forecasts for Israel Diabetic Market.

- Detailed analysis of the key market segments such as source, geography and applications; provides a comprehensive understanding of the market.

- Detailed analysis of the Insulin Pump.

- Detailed analysis of the SMBG.

- Detailed analysis of the CGM.

- Detailed analysis of the Insulin Pen.

- Israel Diabetic Market – Growth Drivers and Challenges.

- Key sustainability strategies adopted by market players.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Israel Diabetes Market

6. Israel Diabetes Population

6.1 Type 1 Diabetes

6.2 Type 2 Diabetes

7. Share Analysis - Israel Diabetes Market

7.1 By Types

8. Continuous Glucose Monitoring Market (CGM) – Israel Market & Users

8.1 Israel - CGM Market by Components

8.1.1 Glucose Sensor Market

8.1.2 CGM Transmitter Market

8.2 Israel CGM User

8.3 Reimbursement Policies of CGM Devices in Israel

9. Blood Glucose Device (SMBG) – Israel Market & Users

9.1 Market

9.1.1 Type 1 Diabetes Market

9.1.2 Type 2 Diabetes Market

9.2 Test Strips Market

9.2.1 Type 1 Diabetes

9.2.2 Type 2 Diabetes

9.3 Lancet Market

9.3.1 Type 1 Diabetes

9.3.2 Type 2 Diabetes

9.4 Meter Market and Forecast

9.4.1 Type 1 Diabetes

9.4.2 Type 2 Diabetes

9.5 Blood Glucose (SMBG) Users

9.5.1 Type 1 Diabetes

9.5.2 Type 2 Diabetes

9.6 Reimbursement Policies of Blood Glucose Devices in Israel

10. Insulin Pump – Israel Market & Users

10.1 Insulin Pump Market

10.1.1 Type 1 Diabetes Market

10.1.2 Type 2 Diabetes Market

10.2 Insulin Pump User

10.2.1 Type 1 Insulin Pump User

10.2.2 Type 2 Insulin Pump User

10.3 Differentiation Points of Insulin Pump Products in Israel

10.3.1 Animas Vibe

10.3.2 Medtronic 530G with Enlite

10.3.3 InsuletOmniPod

10.3.4 Tandem t: slim

10.3.5 Roche Accu-Chek Combo

10.4 Training Model for Patients & HCP – of Medtronic, Animas, Insulet Corp & Tandem Diabetes Care

10.4.1 Medtronic

10.4.1.1 Training Guidelines for Insulin Pump Therapy to New Patients

10.4.1.2 Training Model for HCP (HealthCare Professional)

10.5 Insulet Corporation

10.5.1 Training Structure for New Patients - Insulet Corporation

10.6 Animas Corporation

10.6.1 Training Modules for New Patients

10.6.2 Training Modules for HCP (Health Care Professional)

10.7 Tandem Diabetes Care

10.8 Reimbursement Policies Insulin Pump

11. Insulin Pump – Company Analysis

11.1 Medtronic

11.1.1 Overview

11.1.2 Recent Development

11.1.3 Revenue

11.2 Insulet Corporation

11.2.1 Overview

11.2.2 Recent Development

11.2.3 Revenue

12. SMBG – Company Analysis

12.1 Abbott Laboratories

12.1.1 Business Overview

12.1.2 Recent Development

12.1.3 Revenue

12.2 DarioHealth Corp

12.2.1 Business Overview

12.2.2 Recent Development

12.2.3 Revenue

13. CGM – Company Analysis

13.1 DexcomInc

13.1.1 Overview

13.1.2 Recent Development

13.1.3 Revenue

13.2 Roche

13.2.1 Overview

13.2.2 Recent Development

13.2.3 Revenue

13.3 Tandem Diabetes Care

13.3.1 Overview

13.3.2 Recent Development

13.3.3 Revenue

List of Figures:

Figure-01: Israel – Diabetes Market (Billion US$), 2017 – 2022

Figure-02: Israel – Forecast for Diabetes Market (Billion US$), 2023 – 2028

Figure-03: Israel – Type 1 Diabetes Population (Thousand), 2017 – 2022

Figure-04: Israel – Forecast for Type 1 Diabetes Population (Thousand), 2023 – 2028

Figure-05: Israel – Type 2 Diabetes Population (Thousand), 2017 – 2022

Figure-06: Israel – Forecast for Type 2 Diabetes Population (Thousand), 2023 – 2028

Figure-07: Israel – Glucose Sensor Market (Million US$), 2017 – 2023

Figure-08: Israel – Forecast for Glucose Sensor Market (Million US$), 2023 – 2028

Figure-09: Israel – CGM Transmitter Market (Million US$), 2017 – 2023

Figure-10: Israel – Forecast for CGM Transmitter Market (Million US$), 2023 – 2028

Figure-11: Israel – CGM User (Thousand), 2017 – 2023

Figure-12: Israel – Forecast for CGM User (Thousand),2023 – 2028

Figure-13: Israel – Self-Monitoring of Blood Glucose (SMBG) Type 1 Diabetes Market (Million US$), 2023 – 2028

Figure-14: Israel – Forecast for Self-Monitoring of Blood Glucose (SMBG) Type 1 Diabetes Market (Million US$), 2017 – 2023

Figure-15: Israel – Self-Monitoring of Blood Glucose (SMBG) Type 2 Diabetes Market (Million US$), 2023 – 2028

Figure-16: Israel – Forecast for Self-Monitoring of Blood Glucose (SMBG) Type 2 Diabetes Market (Million US$), 2017 – 2023

Figure-17: Israel – Test Strips Type 1 Diabetes Market (Million US$), 2023 – 2028

Figure-18: Israel – Forecast for Test Strips Type 1 Diabetes Market (Million US$), 2017 – 2023

Figure-19: Israel – Test Strips Type 2 Diabetes Market (Million US$), 2023 – 2028

Figure-20: Israel – Forecast for Test Strips Type 2 Diabetes Market (Million US$), 2017 – 2023

Figure-21: Israel – Lancet Type 1 Diabetes Market (Million US$), 2023 – 2028

Figure-22: Israel – Forecast for Lancet Type 1 Diabetes Market (Million US$), 2017 – 2023

Figure-23: Israel – Lancet Type 2 Diabetes Market (Million US$), 2023 – 2028

Figure-24: Israel – Forecast for Lancet Type 2 Diabetes Market (Million US$), 2017 – 2023

Figure-25: Israel – Meter Type 1 Diabetes Market (Million US$), 2023 – 2028

Figure-26: Israel – Forecast for Meter Type 1 Diabetes Market (Million US$), 2017 – 2023

Figure-27: Israel – Meter Type 2 Diabetes Market (Million US$), 2023 – 2028

Figure-28: Israel – Forecast for Meter Type 2 Diabetes Market (Million US$), 2017 – 2023

Figure-29: Israel – Self-Monitoring of Blood Glucose (SMBG) Type 1 Users (Thousand), 2017 – 2022

Figure-30: Israel – Forecast for Self-Monitoring of Blood Glucose (SMBG) Type 1 Users (Thousand), 2023 – 2028

Figure-31: Israel – Self-Monitoring of Blood Glucose (SMBG) Type 2 Users (Thousand), 2017 – 2022

Figure-32: Israel – Forecast for Self-Monitoring of Blood Glucose (SMBG) Type 2 Users (Thousand), 2023 – 2028

Figure-33: Israel – Insulin Pump Market for Type 1 Diabetes Market (Million US$), 2017 – 2023

Figure-34: Israel – Forecast for Insulin Pump Market for Type 1 Diabetes Market (Million US$), 2023 – 2028

Figure-35: Israel – Insulin Pump Market for Type 2 Diabetes Market (Million US$), 2017 – 2023

Figure-36: Israel – Forecast for Insulin Pump Market for Type 2 Diabetes Market (Million US$), 2023 – 2028

Figure-37: Israel – Insulin Pump Type 1 Users (Thousand), 2017 – 2022

Figure-38: Israel – Forecast for Insulin Pump Type 1 Users (Thousand), 2023 – 2028

Figure-39: Israel – Insulin Pump Type 2 Users (Thousand), 2017 – 2022

Figure-40: Israel – Forecast for Insulin Pump Type 2 Users (Thousand), 2023 – 2028

Figure-41: Medtronic – Global Revenue (Billion US$), 2017 – 2022

Figure-42: Medtronic – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-43: Insulet Corporation – Global Revenue (Billion US$), 2017 – 2022

Figure-44: Insulet Corporation – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-45: Abbott Laboratories – Global Revenue (Billion US$), 2017 – 2022

Figure-46: Abbott Laboratories – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-47: DarioHealth Corp – Global Revenue (Billion US$), 2017 – 2022

Figure-48: DarioHealth Corp – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-49: Dexcom Inc – Global Revenue (Billion US$), 2017 – 2022

Figure-50: Dexcom Inc – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-51: Roche – Global Revenue (Billion US$), 2017 – 2022

Figure-52: Roche – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-53: Tandem Diabetes Care – Global Revenue (Billion US$), 2017 – 2022

Figure-54: Tandem Diabetes Care – Forecast for Global Revenue (Billion US$), 2023 – 2028

List of Tables:

Table-01: Israel – Diabetes Market Share by Type (Percent), 2017 – 2022

Table-02: Israel – Forecast for Diabetes Market Share by Type (Percent), 2023 – 2028

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com