Global Subscription Box Market – Consumer Trends & Forecast 2025–2033

Buy NowSubscription Box Market Size and Forecast 2025-2033

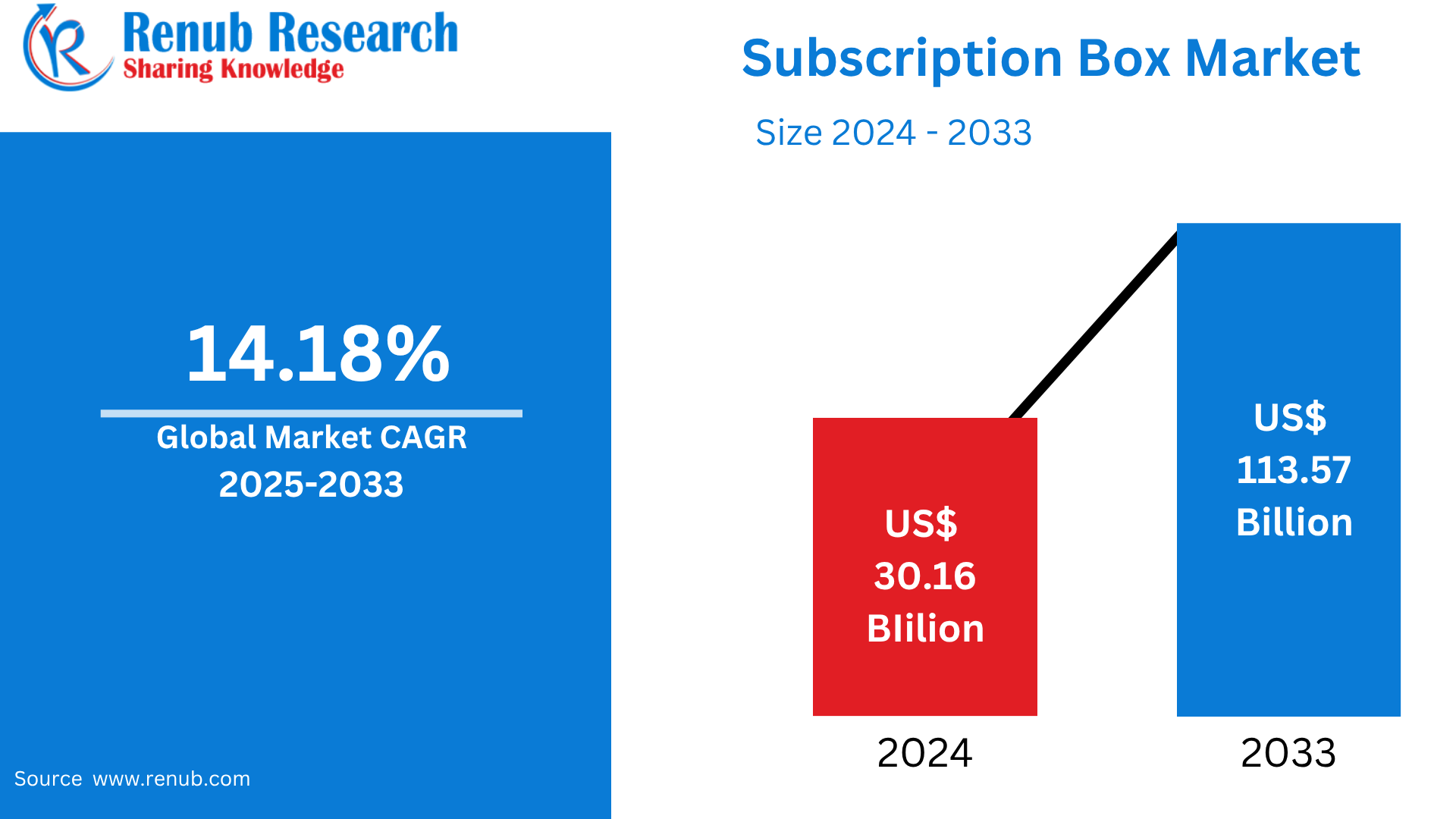

Global Subscription Box Market stood at US$ 30.16 billion in 2024 and is expected to be US$ 113.57 billion in 2033, growing at a CAGR of 14.18% during the forecast period 2025-2033. The growth is fuelled by growing consumer interest in customized products, convenience, and e-commerce growth. Beauty, food, fitness, and lifestyle categories continue to be popular among new subscribers across the world.

Subscription Box Market Report by Subscription Type (Replenishment Subscription, Ciration Subscription, Access Subscription), Gender (Male, Female), Application (Beauty & Personal Care, Food & Beverages, Fashion & Apparel, Fitness & Wellness, Pet Products, Kids & Baby Products, Others), and Company Analysis 2025-2033.

Subscription Box Market Outlooks

A subscription box is a monthly delivery service wherein customers get a specially curated package of products based on certain requirements or interests, normally delivered on a monthly basis. Such boxes come in a variety of categories like beauty, fashion, food, fitness, books, pet food, and many others. People subscribe to these services to find new products, indulge in tailor-made selection, or get necessities with no hassle of frequent shopping.

Across the globe, subscription boxes have become extremely popular because of their convenience and surprise aspect. They service niche markets and tend to support small or craft brands. E-commerce expansion, social media power, and shifting consumer attitudes have spurred international growth. Subscription services are mainstream in developed markets such as the U.S., U.K., and Australia, while developing markets like India and Brazil are quickly embracing. Businesses use them for customer retention, brand awareness, and data collection. As customization technology improves, subscription boxes enhance user experiences, fueling global appeal and market growth.

Growth Drivers in the Subscription Box Market

Rising Demand for Personalization and Convenience

Consumers increasingly seek personalized experiences tailored to their lifestyles, preferences, and needs. Subscription boxes fulfill this demand by offering curated selections across beauty, fashion, food, and wellness categories. The factor of convenience, where the goods are supplied at regular intervals without extra efforts, is also attractive to time-starved consumers. Together, this aspect of customization and convenience increases the satisfaction and loyalty of the customers, fueling market growth. March 2023, Ipsy and BoxyCharm came together to form a combined beauty membership company. The combination brought together BoxyCharm's brand curation with Ipsy's AI-driven personalization, to drive customer experience for more than 20 million members.

E-Commerce and Digital Marketing Growth

The swift growth of e-commerce platforms and niche digital marketing initiatives complement the subscription box business model. Businesses utilize social media, influencer collaborations, and analytics to drive customer acquisition and retention. This online outreach simplifies access to niche customers, fueling subscriptions and global operations expansion. Increased logistics and mobile app integration have further optimized consumer experience and retention. For example, in August 2022, as per a report released by the U.S. Census Bureau, which is a government agency in the US, the aggregate retail sales value of goods through online platforms in 2021 was $240.9 billion, which went up to $257.3 billion in 2022 the US.

Growth into Diversified Product Categories

Subscription boxes have been able to move into non-traditional areas such as fitness equipment, books, technology gadgets, pet products, and children's products with success. Diversification takes advantage of new customer bases and expands the total addressable size of the market. With continued innovation and diversified consumer interests, brands can develop new types of boxes to satisfy changing needs and maximize customer involvement. For example, in July 2023, as per reports shared by Search Engine Journal, an American news publication firm, 4.8 billion social media users existed globally. In between 2022 and 2023, there was a 3.2% year-over-year growth, which led to 150 million new social media users. Hence, expanding social media is fueling the growth of the subscription box industry.

Challenges in the Subscription Box Market

High Customer Churn and Subscription Fatigue

Although sign-up rates may be high at first, holding onto subscribers in the long term proves to be a tough challenge. Subscribers often cancel after a few boxes of repetitiveness, no perceived value, or changed interests. Churn management needs ongoing innovation, high-quality products, and flexible pricing models. Subscription fatigue, when users feel overwhelmed by too many subscriptions, also forces companies to maintain strong differentiation.

Logistics, Supply Chain, and Cost Management

Effective logistics and inventory management are essential to ensuring deliveries on time and at a cost. Small brands might lack scale, particularly when there is a disruption in the supply chain, shipping volatility, or supply issues. Moreover, returns management, quality product management, and packaging cost can constrict profit margins and impact customer satisfaction if not managed well.

Replenishment Subscription Box Market

Replenishment boxes are designed for customers who require periodic delivery of must-haves like grooming products, home supplies, or dietary supplements. They thrive on necessity and predictability, ensuring stable demand and low customer churn. Brands here enjoy stable revenue streams and long-term relationships with customers. The model also ensures cost-effectiveness through bulk purchasing and subscription-based pricing benefits.

Curation Subscription Box Market

Subscription boxes with curated products of a specific theme or personal preference are usually found in beauty, fashion, book, or lifestyle categories. They sell on the basis of discovery and surprise, enabling customers to try new items that may not be chosen otherwise. The market relies heavily on aesthetics, customization, and value-added experience. Customer pleasure is generally tied to presentation and diversity in products.

Male Subscription Box Market

Men's subscription boxes have become popular, providing exclusive grooming products, fashion accessories, snacks, and fitness equipment. These boxes appeal to men wanting convenience and access to high-quality, niche products with no shopping ordeal. Increased male-targeted marketing, heightened self-care consciousness, and higher disposable income among younger males are driving the growth of this segment, especially in urban regions.

Food & Beverages Subscription Box Market

Food and drink boxes consist of meal kits, snacks, gourmet foods, and drinks such as coffee, wine, or tea. They bring convenience, variety, and the possibility to try new cuisines or dietary options. Consumers love health-aware options, dietary flexibility, and eco-friendliness. The segment has evolved quickly, particularly post-pandemic, as people have cooked more at home and sought experiential food options delivered right to their doorstep.

Pet Products Subscription Box Market

Pet subscription boxes provide treats, toys, grooming products, and accessories to individual pet types and sizes. Pet owners are more than happy to pay for the quality and convenience of their pets. These boxes tend to concentrate on fun and wellness, with customized pet elements. The sentiment between owners and pets underpins repeat purchase demand, which is a strong and expanding niche.

Fashion & Apparel Subscription Box Market

Fashion and apparel boxes offer personalized clothing and accessories according to size, fashion tastes, and season. Some plans include "try-before-you-buy" programs. This service attracts consumers who appreciate styling guidance and ease of use. AI-driven styling and access to personal stylists drive improved customer experiences. Sustainability-conscious fashion boxes are also emerging as popular options among environmentally aware customers looking for ethical and fashionable alternatives. For example, in February 2022, Kidpik, a US subscription-based e-commerce firm, launched a clothes subscription box service that sends custom outfits to the doorsteps of kids every month. It is the perfect choice for parents looking for a personalized, convenient, and fashion-forward means of shopping for their children's clothing, providing endless styles, high-quality fabrics, and a no-risk guarantee.

Kids & Baby Products Subscription Box Market

These boxes send toys, books, learning materials, apparel, or necessities for children and babies. Parents like suitable age customization, learning benefits, and ease. The market derives strength from deep emotional drivers and regular stages of growth in the life of kids, which encourages ongoing demand for fresh products. Safety, quality control, and developmental advantages play a key role in establishing trust and loyalty for this delicate segment.

United States Subscription Box Market

The U.S. has the largest and most developed subscription box market. Customers are extremely accepting of digital commerce and personalization and have top categories in fashion, food, and beauty. Well-developed and extensive fulfillment infrastructure, robust e-commerce ecosystem, and creative marketing approach account for continued market expansion. Growing competition and competition intensity compel businesses to enhance curation, customer experience, and value propositions and decrease prices. October 2024: VW Group of America has introduced VW Flex, a month-to-month Volkswagen vehicle subscription service in the Atlanta market beginning October 2024. The service integrates maintenance, roadside service, and insurance into one monthly fee. As of October 30, subscribers are able to enroll in best-selling models such as the Atlas, Atlas Cross Sport, Tiguan, Golf GTI, and Jetta, offering a convenient mobility solution for those looking to try out the Volkswagen brand.

France Subscription Box Market

In France, subscription boxes are mainstream in lifestyle, wine, beauty, and gourmet food. Luxury, sustainability, and artisanal motivations drive the market. French people value beauty and cultural significance in curation. Development is underpinned by increasing e-commerce penetration and a preference for high-quality, bespoke experiences. Localization and strong branding are essential for long-term success in this market.

India Subscription Box Market

India's subscription box industry is growing fast, particularly among millennial, Gen Z, and urban consumers. Segments such as beauty, snacks, health supplements, and baby care have high traction. Demand is driven by the growing middle class, rising digital connectivity, and convenience-led consumption patterns. Yet, logistics and affordability issues remain. Tier-2 and Tier-3 towns hold tremendous untapped potential to drive growth in the future. May 2025, Zepto has made public the launch of "Zepto Atom", a sophisticated data insights subscription for Indian Consumer Brands. Zepto Atom will leverage an in-house technology-driven analytics tool to shake up India's 1,000+ Crore Consumer Analytics market, which is presently owned by incumbent multi-national players.

Saudi Arabia Subscription Box Market

Saudi Arabia's subscription box industry is picking up speed, fueled by a youth demographic, increasing internet penetration, and shifting consumer tendencies. There is high demand for beauty, grooming, fashion, and health boxes. Subscription business models fit in well with the nation's increasing e-commerce and direct-to-consumer trends. Cultural adaptability, quality control, and high-end positioning are critical to earn customer confidence and grow in the market.

Market Segments

Subscription Type

- Replenishment Subscription

- Ciration Subscription

- Access Subscription

Gender

- Male

- Female

Application

- Beauty & Personal Care

- Food & Beverages

- Fashion & Apparel

- Fitness & Wellness

- Pet Products

- Kids & Baby Products

- Others

Countries

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

All companies have been covered with 4 Viewpoints

- Overview

- Key Persons

- Recent Development & Strategies

- Revenue Analysis

Key Players Analysis

- Deutsche Post AG

- United Parcel Service of America, Inc.

- FedEx

- Maersk

- CEVA Logistics (The CMA CGM Group)

- DB Schenker

- Kuehne + Nagel

- Nippon Express

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Subscription Type, By Gender, By Application and By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Subscription Box Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Subscription Box Market Share Analysis

6.1 By Subscription Type

6.2 By Gender

6.3 By Application

6.4 By Countries

7. Subscription Type

7.1 Replenishment Subscription

7.2 Ciration Subscription

7.3 Access Subscription

8. Gender

8.1 Male

8.2 Female

9. Application

9.1 Beauty & Personal Care

9.2 Food & Beverages

9.3 Fashion & Apparel

9.4 Fitness & Wellness

9.5 Pet Products

9.6 Kids & Baby Products

9.7 Others

10. Countries

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 South Korea

10.3.5 Thailand

10.3.6 Malaysia

10.3.7 Indonesia

10.3.8 Australia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 UAE

10.5.3 South Africa

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 Blue Apron Holdings Inc.

13.1.1 Overview

13.1.2 Key Persons

13.1.3 Recent Development & Strategies

13.1.4 Revenue Analysis

13.2 FabFitFun

13.2.1 Overview

13.2.2 Key Persons

13.2.3 Recent Development & Strategies

13.2.4 Revenue Analysis

13.3 Glossybox (The Hut.com Ltd.)

13.3.1 Overview

13.3.2 Key Persons

13.3.3 Recent Development & Strategies

13.3.4 Revenue Analysis

13.4 Grove Collaborative Inc.

13.4.1 Overview

13.4.2 Key Persons

13.4.3 Recent Development & Strategies

13.4.4 Revenue Analysis

13.5 Harry's Inc

13.5.1 Overview

13.5.2 Key Persons

13.5.3 Recent Development & Strategies

13.5.4 Revenue Analysis

13.6 HelloFresh SE

13.6.1 Overview

13.6.2 Key Persons

13.6.3 Recent Development & Strategies

13.6.4 Revenue Analysis

13.7 Personalized Beauty Discovery Inc

13.7.1 Overview

13.7.2 Key Persons

13.7.3 Recent Development & Strategies

13.7.4 Revenue Analysis

13.8 TechStyle Fashion Group

13.8.1 Overview

13.8.2 Key Persons

13.8.3 Recent Development & Strategies

13.8.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com