Saudi Arabia Vision Care Market – Services & Forecast 2025–2033

Buy NowSaudi Arabia Vision Care Market Size and Forecast 2025-2033

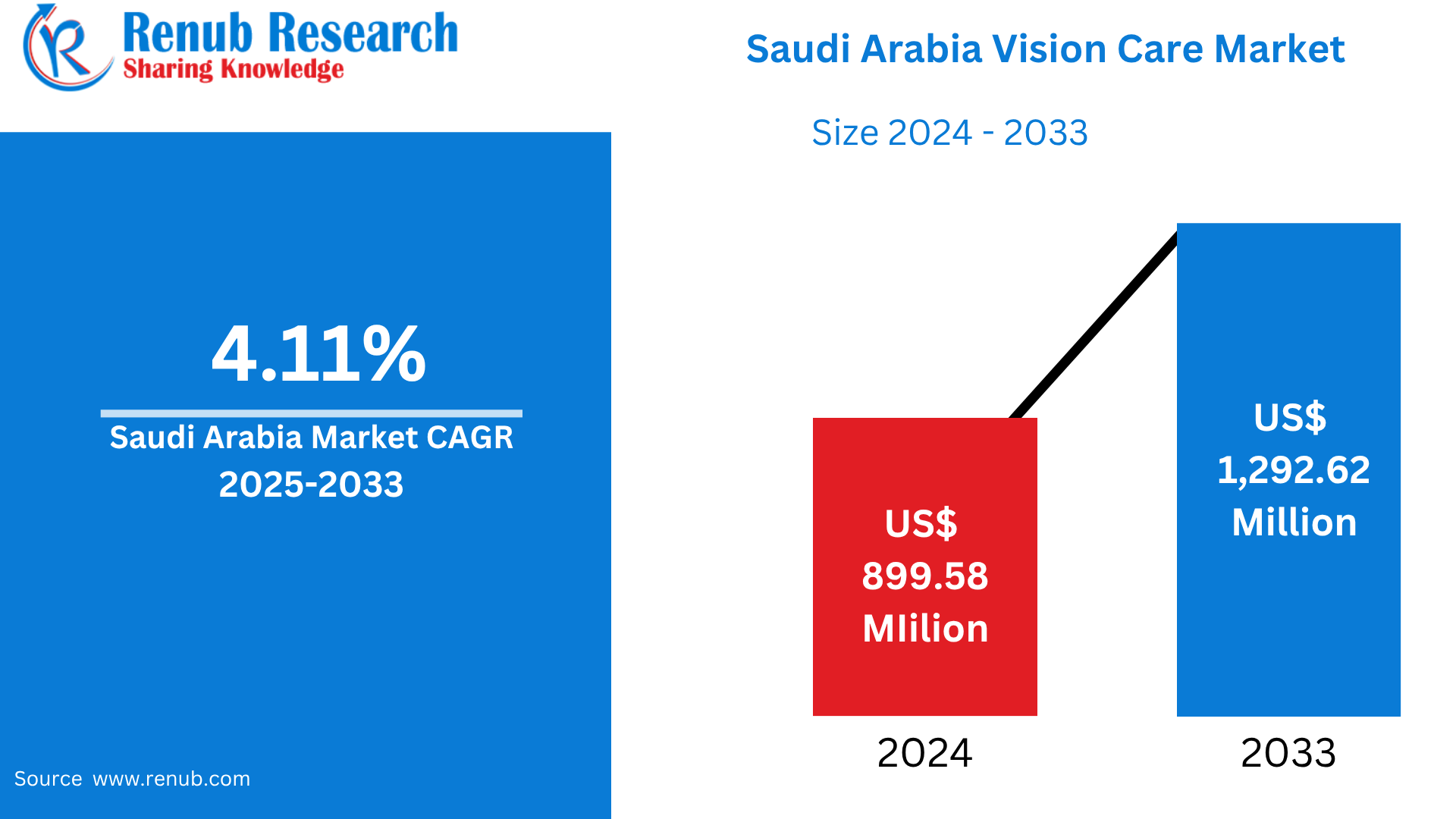

Saudi Arabia Vision Care Market is expected to reach US$ 1,292.62 million by 2033 from US$ 899.58 million in 2024, with a CAGR of 4.11% from 2025 to 2033. The aging population, rising eye disorders, increased screen time, technological advancements, growing awareness of eye health, expanding healthcare infrastructure, higher disposable incomes, and supportive government initiatives that promote access to high-quality eye care services are the main factors driving the Saudi Arabian vision care market.

Saudi Arabia Vision Care Market Report by Product Type (Glass Lenses, Contact Lenses, Intraocular Lenses, Contact Solutions, Lasik Equipment, Artificial Tears), Treatment (Laser Therapy, Surgery, Medication), Distribution Channel (Retail Stores, E-Commerce, Clinics, Hospitals, Others) and Company Analysis 2025-2033.

Saudi Arabia Vision Care Market Overview

In order to preserve ideal vision and general eye health, vision care includes the prevention, diagnosis, and treatment of eye disorders. It covers routine eye exams, the prescription of glasses or contact lenses, and the treatment of eye conditions such macular degeneration, cataracts, and glaucoma. In addition to lifestyle modifications to lessen eye strain, vision care also includes surgical procedures such as LASIK and cataract removal. The need for vision care services is growing as a result of aging populations and rising screen usage. With the help of improvements in diagnostic tools and available treatments, professionals like optometrists and ophthalmologists are essential in providing these services.

A number of important variables are driving the Saudi Arabian vision care market's rapid growth. A major contributing factor is the increasing incidence of eye conditions such myopia, hyperopia, and astigmatism, especially in young people, as a result of extended screen time and usage of digital devices. Treatments for age-related eye disorders including cataracts and macular degeneration are also becoming more and more necessary as the population ages. The quality of care is also being improved by technological developments in diagnoses and therapies, such as optical coherence tomography (OCT) and laser-assisted surgery. Access to ophthalmology treatments is being promoted and healthcare infrastructure is being improved through government initiatives under Vision 2030. Further driving market expansion is the shift in consumer behavior toward proactive health management brought about by growing awareness of the importance of routine checkups and preventive eye care.

Growth Drivers for the Saudi Arabia Vision Care Market

Government Initiatives and Healthcare Infrastructure Expansion

In order to diversify the economy and raise the standard of public health services, the Saudi Arabian government is implementing a number of healthcare initiatives within its Vision 2030 objectives. This is leading to significant investment in modernizing medical facilities, especially those in the field of ophthalmology. To improve access to specialized vision care services, particularly in rural areas, public-private partnerships are being encouraged. Government-sponsored programs immediately affect the vision care market by improving early diagnosis and preventive care. Innovation in optometry technology and the diagnosis of eye diseases is being further supported by new regulations and funding for medical businesses. According to a 2024 article by the U.S. Chamber of Commerce, the Saudi government plans to increase the private sector's participation from 40% to 65% and spend over $65 billion on healthcare under Vision 2030. Furthermore, the Ministry of Health expects the private sector to contribute $12.8 billion over the next five years (2022–2027), resulting in more than 100 new public-private partnerships in the healthcare industry.

The prevalence of vision disorders is rising

The need for efficient vision care services is being driven by the rising incidence of vision-related conditions such as myopia, hyperopia, astigmatism, and presbyopia. The prevalence of visual impairments has significantly increased as a result of changes in lifestyle, especially among young people. Early-onset myopia is being exacerbated, particularly in metropolitan areas, by increased screen time from digital gadget use and a dearth of outside activities. Furthermore, an epidemic of age-related eye conditions like cataracts and macular degeneration is being exacerbated by Saudi Arabia's aging population. Saudi Arabia is going through a demographic change, according to UNFPA, as the country's population of people over 60 is expected to increase fivefold between 2020 and 2050, from 2 million (5.9% of the total) to 10.5 million (23.7%). This will further increase the public's need for appropriate vision care services.

Growing Knowledge and Use of Preventive Eye Care

In Saudi Arabia, health education efforts and increased access to vision care services are raising awareness of the importance of routine eye exams and preventive treatment. As more consumers take care of their eye correction and maintenance needs before problems arise, the industry is shifting from reactive to proactive care. While retail chains and internet platforms offer simple access to vision tests and prescription services, optometrists and ophthalmologists are playing a critical role in teaching people about eye health. Because of their reliance on digital gadgets, young people—more especially, students and young professionals—are become more conscious of eye strain and long-term visual health issues. The need for blue light-blocking spectacles, anti-fatigue lenses, and personalized prescription eyewear is being driven by this. Additionally, this is motivating businesses to spend money on eye care services. Alcon, a global leader in eye care dedicated to helping people see brilliantly, is happy to announce the opening of the Alcon Experience Center (AEC) in Jeddah in 2025. This marks a significant milestone in the company's efforts to promote surgical innovation and ophthalmic education in the area. In keeping with Saudi Vision 2030, this inauguration of the first AEC in the Middle East and Africa reinforces Alcon's dedication to advancing eye care, upskilling local practitioners, and integrating cutting-edge surgical technologies.

Challenges in the Saudi Arabia Vision Care Market

Regulatory Challenges

Regulatory obstacles have a major effect on the Saudi Arabian vision care market's expansion. Innovative innovations may be delayed by drawn-out and difficult regulatory procedures for new eye care products, therapies, and drugs. For multinational suppliers of vision care, inconsistent regulatory frameworks and a lack of conformity with international standards impede foreign investment and delay market entry. Furthermore, regulatory obstacles to clinic and healthcare professional licensure further limit the expansion of services, particularly in impoverished areas. These legal barriers restrict access to cutting-edge eye care products and obstruct the industry's overall development, calling for changes to improve workflow and promote creativity.

High Cost of Advanced Eye Care Treatments

One of the biggest obstacles facing the Saudi Arabian vision care market is the high expense of sophisticated eye care procedures. Advanced diagnostics like Optical Coherence Tomography (OCT), cataract operations, and LASIK surgery are frequently costly procedures that insurance does not completely cover. This restricts middle- and low-income people's access, especially in disadvantaged and rural areas. The expense barrier may cause eye diseases to deteriorate by discouraging prompt diagnosis and treatment. Additionally, it is challenging for smaller clinics to provide full services due to the high expenses of technology and equipment. Expanding fair access to high-quality eye care requires addressing affordability.

Saudi Arabia Vision Care Market Segments:

Product Type

- Glass Lenses

- Contact Lenses

- Intraocular Lenses

- Contact Solutions

- Lasik Equipment

- Artificial Tears

Treatment

- Laser Therapy

- Surgery

- Medication

Distribution Channel

- Retail Stores

- E-Commerce

- Clinics

- Hospitals

- Others

All companies have been covered from 4 viewpoints:

- Company Overview

- Key Persons

- Recent Development & Strategies

- Sales Analysis

Key Players Analysis

- Essilor International

- Johnson & Johnson Services, Inc.

- Bausch Health Companies, Inc.

- Novartis International AG

- Grand Vision

- Carl Zeiss

- Valeant Pharmaceuticals

- Paragon Vision Science

- Menicon

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

By Product Type, By Treatment and By Distribution Channel |

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Saudi Arabia Vision Care Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Product Type

6.2 By Treatment

6.3 By Distribution Channel

7. Product Type

7.1 Glass Lenses

7.2 Contact Lenses

7.3 Intraocular Lenses

7.4 Contact Solutions

7.5 Lasik Equipment

7.6 Artificial Tears

8. Treatment

8.1 Laser Therapy

8.2 Surgery

8.3 Medication

9. Distribution Channel

9.1 Retail Stores

9.2 E-Commerce

9.3 Clinics

9.4 Hospitals

9.5 Others

10. Porter's Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Competition

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threats

12. Key Players Analysis

12.1 Essilor International

12.1.1 Overviews

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 Johnson & Johnson Services, Inc.

12.2.1 Overviews

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 Bausch Health Companies, Inc.

12.3.1 Overviews

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 Novartis International AG

12.4.1 Overviews

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 Grand Vision

12.5.1 Overviews

12.5.2 Key Person

12.5.3 Recent Developments

12.5.4 Revenue

12.6 Carl Zeiss

12.6.1 Overviews

12.6.2 Key Person

12.6.3 Recent Developments

12.6.4 Revenue

12.7 Valeant Pharmaceuticals

12.7.1 Overviews

12.7.2 Key Person

12.7.3 Recent Developments

12.7.4 Revenue

12.8 Paragon Vision Science

12.8.1 Overviews

12.8.2 Key Person

12.8.3 Recent Developments

12.8.4 Revenue

12.9 Menicon

12.9.1 Overviews

12.9.2 Key Person

12.9.3 Recent Developments

12.9.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com