Saudi Arabia IVF Market Outlook 2025–2033

Buy NowSaudi Arabia IVF Market Size

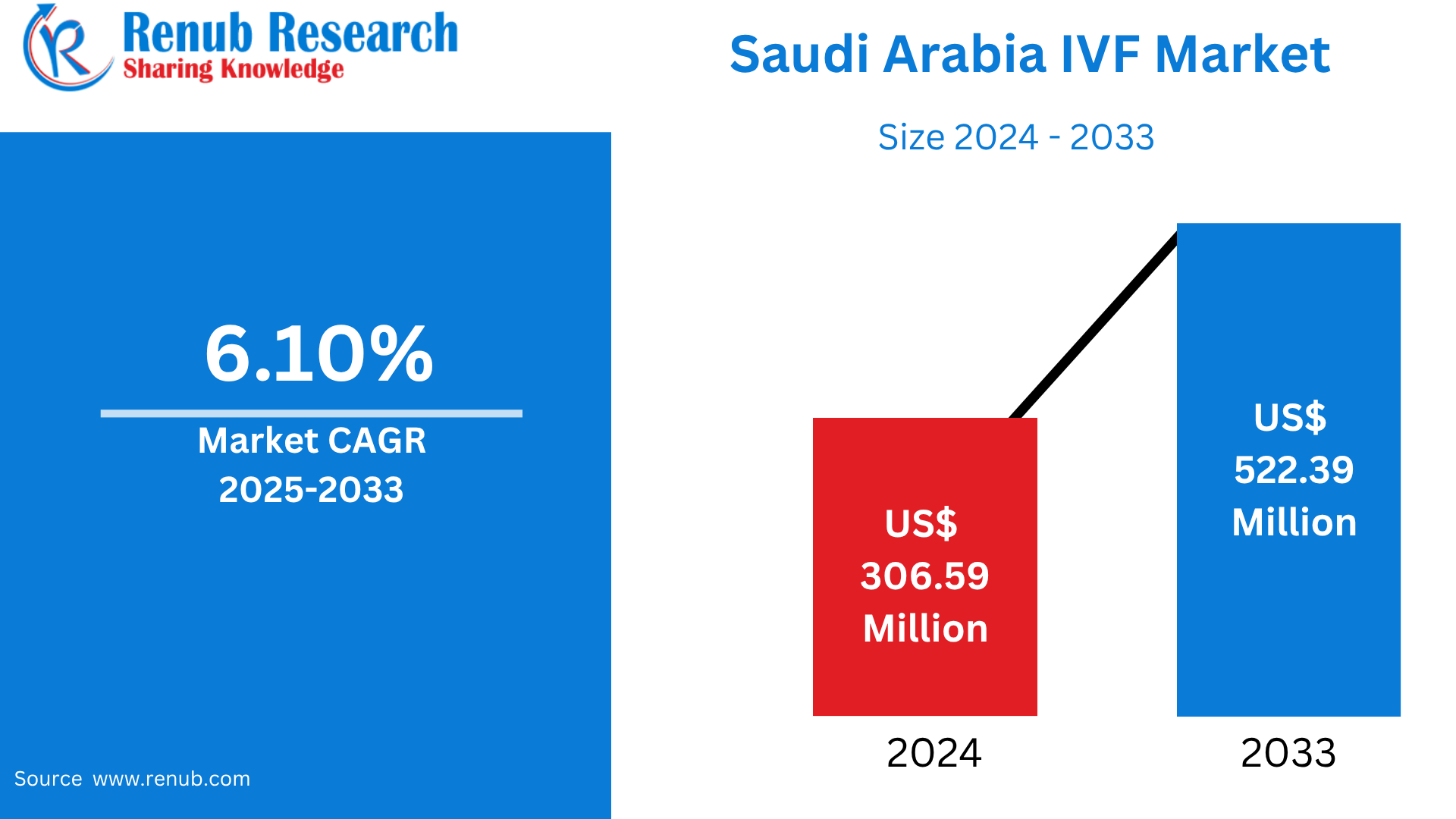

Saudi Arabia IVF Market is expected to reach US$ 522.39 million by 2033 from US$ 306.59 million in 2024, with a CAGR of 6.10% from 2025 to 2033. Increasing infertility rates, increased awareness, delayed parenthood, reproductive technology improvements, supportive government policies, increased medical tourism, higher disposable incomes, higher healthcare investments, improved healthcare infrastructure, and shifting cultural perceptions towards fertility treatments are some of the drivers of the Saudi Arabian IVF market.

Saudi Arabia IVF Market Report by Procedure Type (Fresh non-donor, Frozen non-donor, Fresh Donor, Frozen Donor), Instrument (Disposable Devices, Culture Media, Equipment), Surgery (Embryo Culture Media, Cryopreservation Media, Sperm Processing Media, Ovum Processing Media), End Users (Fertility Clinics, Hospitals & Other Setting) and Company Analysis 2025-2033.

Saudi Arabia IVF Industry Overview

When it is difficult to conceive naturally, couples or individuals may have the medical procedure of in vitro fertilization (IVF) done to help conceive. To create an embryo, an egg and a sperm are joined outside the body in a laboratory. After fertilization, the resulting embryo is monitored before it is inserted into the woman's uterus in hopes of potential implantation and pregnancy. IVF is often employed to treat infertility caused by issues such as male infertility, blocked fallopian tubes, or unexplained infertility. To enhance the chances of a healthy pregnancy, the treatment may additionally include genetic testing, hormone therapy, egg harvesting, and freezing embryos.

The IVF market in Saudi Arabia is growing considerably owing to a variety of converging factors. Stress, lifestyle changes, and the rising age of first-time mothers are significant reasons for the high rates of infertility. Second, due to shifting social values and greater awareness of IVF options, there is greater societal acceptance of assisted reproduction. Treatment is becoming more appealing with greater success rates introduced by advances in technology such as genetic screening, freezing embryos, and intracytoplasmic sperm injection (ICSI). Market access is also supplemented by government initiatives, including subsidies and supportive healthcare legislation. In addition, Saudi Arabia's attempts to boost its medical tourism sector and enhance its health infrastructure cement its position as a regional hub for advanced reproductive treatment.

Growth Drivers for the Saudi Arabia IVF Market

Delayed Parenthood

Delayed parenthood is one of the key drivers fueling the Saudi Arabian IVF market's growth. The first-time parents' average age keeps rising because more individuals and couples tend to prioritize their education, careers, and financial stability before having children. Delaying childbearing naturally reduces fertility, rendering IVF and other reproductive technologies more essential. This trend is being driven by changing social norms and greater acceptance of working women in Saudi Arabia. Lower reproduction rates are further linked to lifestyle and delayed marriages. Infertility treatments are increasingly being sought after with delayed motherhood gaining pace. IVF offers an effective solution, driving market growth as more people seek effective, scientifically validated solutions to age-related infertility.

Technological Advancements

The Saudi Arabian IVF industry is growing largely because of technological advancements. Intracytoplasmic sperm injection (ICSI), preimplantation genetic testing (PGT), and embryo vitrification are some of the advanced reproductive technologies that have increased IVF success rates significantly and made them more reliable and accessible. Couples who are facing problems with infertility are increasingly interested in these advances. To further expand its presence in the region, Burjeel Holdings PLC, a leading provider of super-specialty healthcare services, made plans in September 2024 to introduce IVF services in Saudi Arabia. Their Trust Fertility Clinic at Burjeel Medical City (BMC) will integrate with gynecology, fetal medicine, and pediatric subspecialties and IVF. BMC provides women with a seamless, superior reproductive experience from conception through birth in one, cutting-edge facility by offering full mother and baby care through specialized NICU and PICU units.

Government Support

The growth of the IVF market in Saudi Arabia is largely attributed to government support, which aligns with the Saudi Vision 2030 objectives of enhancing the quality and availability of healthcare. The government has entrusted the licensing and regulation of fertility clinics to the Ministry of Health, ensuring that the requirements of safety and effectiveness are fulfilled. To reduce economic burdens and provide better access to care, the government also offers funded help for IVF procedures to qualified individuals. The IVF sector has been further encouraged through massive investments in health infrastructure, including the development of advanced fertility centers. These programs combined create a friendly environment for individuals in need of fertility treatments, which stimulates market growth and positions Saudi Arabia as a front runner in the field for reproductive health.

Challenges in the Saudi Arabia IVF Market

Cultural and Religious Sensitivities

The Saudi Arabian IVF market faces considerable obstacles due to cultural and religious sensitivity. In a culture steeped in Islamic customs, several forms of assisted reproduction, such surrogacy or third-party gamete donation, are typically forbidden by Islamic law. Compared to other nations, these limitations restrict the variety of IVF therapies that are available. Furthermore, frank conversations regarding infertility may be discouraged by conservative social norms, which could cause stigma and emotional hardship, particularly for women. Access to care is further diminished when people are reluctant to seek treatment out of fear of criticism or social pressure. Campaigns for culturally sensitive education and awareness are necessary to overcome these obstacles.

High Treatment Costs

In the Saudi Arabian IVF industry, high treatment costs are a significant obstacle that prevents many couples from accessing fertility services. Because of the sophisticated equipment, skilled personnel, and numerous treatment cycles that are frequently necessary for success, IVF procedures can be costly. Although there is some government assistance, it is not very extensive, and many private insurance policies do not cover infertility treatments. Consequently, families with lower and intermediate incomes might find it difficult to pay for care, which could cause treatment to be postponed or stopped. These financial constraints highlight the need for more comprehensive insurance coverage and reasonably priced treatment options because they not only limit access but also heighten emotional stress.

Recent Developments in Saudi Arabia IVF Industry:

- July 2024: The protein Phospholipase C Zeta (PLCζ) plays a critical role in the early development of the embryo during pregnancy, according to a ground-breaking study released by experts at King Faisal Specialist Hospital & Research Centre (KFSHRC). According to the study, PLCζ gene expression is essential for a successful embryo's implantation in the uterus; defects in the protein may result in infertility and implantation failure. The importance of PLCζ in the creation and improvement of upcoming reproductive treatments is highlighted by this important discovery.

- April 2024: Al Hokail Hospital's outstanding staff of top specialists earned it a ranking as Saudi Arabia's top IVF facility. The facility is well known for using state-of-the-art tools and cutting-edge methods for fertilization, egg retrieval, and embryo preservation. Modern incubators are used to guarantee embryo viability and ideal circumstances for division, which improves the effectiveness of its fertility treatment even more.

Saudi Arabia IVF Market Segmentation:

Procedure Type

- Fresh non-donor

- Frozen non-donor

- Fresh Donor

- Frozen Donor

Instrument

- Disposable Devices

- Culture Media

- Equipment

Surgery

- Embryo Culture Media

- Cryopreservation Media

- Sperm Processing Media

- Ovum Processing Media

End Users

- Fertility Clinics

- Hospitals & Other Setting

All companies have been covered from 4 viewpoints:

- Company Overview

- Key Persons

- Recent Development & Strategies

- Sales Analysis

Key Players Analysis

- FUJIFILM Holdings Corporation

- Hamilton Thorne Ltd.

- Vitrolife AB

- Thermo Fisher Scientific, Inc.

- Bayer AG

- Merck & Co., Inc.

- Boston IVF

- Fortis Healthcare

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

Procedure Type, Instrument, Surgery, and End Users |

| Procedure Type Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Saudi Arabia IVF Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Procedure Type

6.2 By Instrument

6.3 By Surgery

6.4 By End Users

7. Procedure Type

7.1 Fresh non-donor

7.2 Frozen non-donor

7.3 Fresh Donor

7.4 Frozen Donor

8. Instrument

8.1 Disposable Devices

8.2 Culture Media

8.3 Equipment

9. Surgery

9.1 Embryo Culture Media

9.2 Cryopreservation Media

9.3 Sperm Processing Media

9.4 Ovum Processing Media

10. End Users

10.1 Fertility Clinics

10.2 Hospitals & Other Setting

11. Porter's Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Competition

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threats

13. Key Players Analysis

13.1 FUJIFILM Holdings Corporation

13.1.1 Overviews

13.1.2 Key Person

13.1.3 Recent Developments

13.1.4 Revenue

13.2 Hamilton Thorne Ltd.

13.2.1 Overviews

13.2.2 Key Person

13.2.3 Recent Developments

13.2.4 Revenue

13.3 Vitrolife AB

13.3.1 Overviews

13.3.2 Key Person

13.3.3 Recent Developments

13.3.4 Revenue

13.4 Thermo Fisher Scientific, Inc.

13.4.1 Overviews

13.4.2 Key Person

13.4.3 Recent Developments

13.4.4 Revenue

13.5 Bayer AG

13.5.1 Overviews

13.5.2 Key Person

13.5.3 Recent Developments

13.5.4 Revenue

13.6 Merck & Co., Inc.

13.6.1 Overviews

13.6.2 Key Person

13.6.3 Recent Developments

13.6.4 Revenue

13.7 Boston IVF

13.7.1 Overviews

13.7.2 Key Person

13.7.3 Recent Developments

13.7.4 Revenue

13.8 Fortis Healthcare

13.8.1 Overviews

13.8.2 Key Person

13.8.3 Recent Developments

13.8.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com