Saudi Arabia Data Center Market Overview 2025–2033

Buy NowSaudi Arabia Data Center Market Size and Forecast

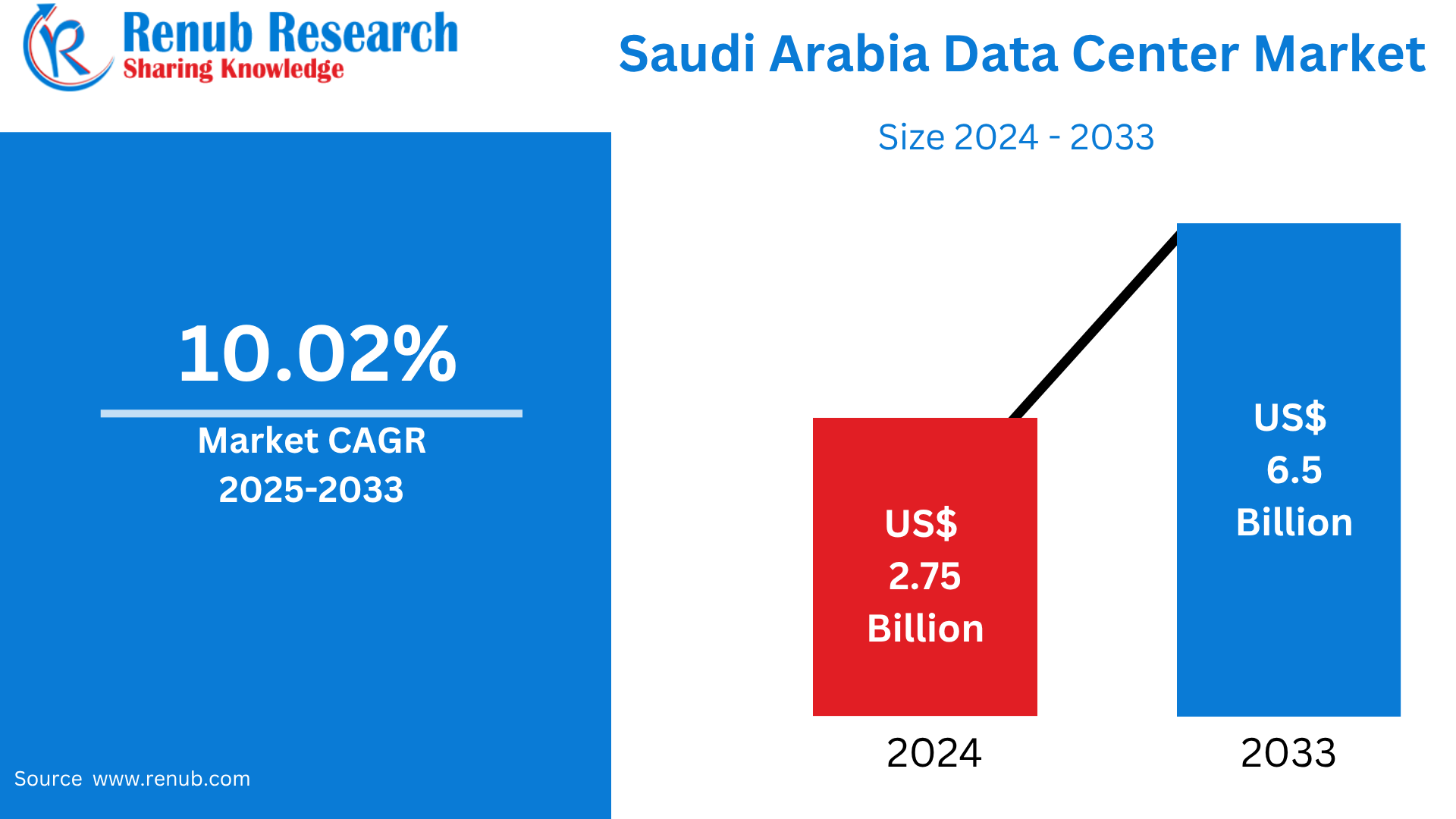

Saudi Arabia Data Center Market is expected to reach US$ 6.5 Billion by 2033 from US$ 2.75 Billion in 2024, with a CAGR of 10.02% from 2025 to 2033. The market is expanding mainly due to the growing volume of digital information and the growing demand for cloud computing network services.

Saudi Arabia Data Center Market Report by Component (Hardware, Software), Type (Colocation, Hyperscale, Edge, Others), Enterprise (Large Enterprises, Small and Medium Enterprises), End User (Cloud Service Provider, Technology Provider, Telecom, Healthcare, BFSI, Retail & E-commerce, Entertainment & Media, Energy, Others) and Company Analysis, 2025-2033.

Saudi Arabia Data Center Industry Overview

The market for data centers in Saudi Arabia is expanding quickly, supported by both strategic state objectives and technology needs. The market is being shaped by a number of new trends. The high temperatures in the area make cooling a major operational expense for data centers. In addition, cutting-edge cooling techniques that lessen their impact on the environment and energy consumption are being embraced. Additionally, as cyber threats get more complex, data centers are placing a greater emphasis on cybersecurity, implementing cutting-edge security measures and solutions to safeguard data integrity.

The kingdom's ambitious digital transformation projects under Vision 2030 are propelling the data center sector in Saudi Arabia to revolutionary development. The recent announcement of a USD 18 billion investment plan for the development of hyperscale data centers nationwide demonstrates the government's dedication to building a strong data center infrastructure. This strategic project is to reach 1,300 MW data center capacity before 2030, positioning Saudi Arabia as a regional digital hub and computing powerhouse. In the healthcare industry, where telemedicine solutions have been used by almost 70% of services and 34% of young physicians are using artificial intelligence to improve diagnostic procedures, the integration of cutting-edge technology is especially noteworthy.

Data center services are in high demand due to the digital revolution of the industrial sector; by 2023, the industry is projected to be worth USD 850 billion. This wave of digitization is a component of the larger Industry 4.0 initiative, which seeks to use cutting-edge technology to improve industrial productivity and performance. The industry's noteworthy 13% GDP contribution highlights how crucial it is to the growth of digital infrastructure and the demand for data centers.

The population of Saudi Arabia is becoming more and more digitally savvy, which is driving up demand for data center services. The kingdom exhibits a high level of digital adoption, with 19 million social media users, or 59% of the total population. By making Saudi Arabia the first country in Europe, Africa, and the Middle East to allow WiFi use throughout the whole 6 GHz frequency band, the Communications and Information Technology Commission (CITC) has advanced the cause by granting next-generation WiFi networks 150% more airwaves. With 2,035 MHz of spectrum available for next-generation WiFi and license-exempt technologies, Saudi Arabia now leads the globe in this regard, outpacing all other countries.

Key Factors Driving the Saudi Arabia Data Center Market Growth

Digital Transformation and Cloud Adoption

Strategic government measures targeted at increasing cloud use and establishing the Kingdom as a regional technology leader are driving a considerable acceleration of Saudi Arabia's digital transformation. Introduced in 2019, the "Cloud First" policy encourages a move toward more flexible and effective digital infrastructures by requiring government organizations to give cloud solutions first priority for new IT initiatives. The creation of the Cloud Computing Special Economic Zone (CCSEZ) in April 2023 complements this objective by providing a flexible regulatory framework to draw in international cloud service providers and foster domestic innovation. By 2030, these initiatives should boost the Saudi economy by $109 billion and provide about 148,600 new employments.

Strategic Investments and Infrastructure Development

With large expenditures in data centers and artificial intelligence (AI) technology, Saudi Arabia is significantly improving its digital infrastructure. "Humain," a business committed to developing artificial intelligence, including the creation of next-generation data centers and AI infrastructure, was established by the Public Investment Fund (PIF). To create a net-zero AI data center campus in Oxagon, NEOM's industrial zone, DataVolt is investing $5 billion in partnership with NEOM. Utilizing cutting-edge cooling technology and renewable energy sources, this plant seeks to reach a 1.5-gigawatt capacity while reducing its environmental effect. Investments in fiber-optic cable and submarine networks supplement these advancements, improving connection and meeting the rising demand for digital services. Together, these initiatives are establishing Saudi Arabia as a preeminent AI and digital center in the Middle East, supporting the goals of the country's Vision 2030.

Competitive Energy Costs and Favorable Regulations

Saudi Arabia is a desirable location for data center investments due to its reasonable energy prices and strong regulatory frameworks. With rates as low as $0.05 per kWh for business customers, the country has some of the lowest energy prices in the area because to its plentiful fossil fuel supplies. Data centers and other energy-intensive enterprises find this cost benefit especially alluring. In addition, the National Cybersecurity Authority (NCA) of the Saudi government has created extensive cybersecurity legislation. Data center operators must adhere to the NCA's Essential Cybersecurity Controls (ECC-2) and Critical Systems Cybersecurity Controls (CSCC), which provide required criteria for both public and commercial organizations. The Kingdom's Vision 2030 goals are supported and investor trust is increased by these rules, which provide a safe and legal environment.

Challenges in the Saudi Arabia Data Center Market

Lack of Skilled Workers

The sector's expansion is hampered by a severe lack of qualified personnel in data center operations and cutting-edge technologies like artificial intelligence and cloud computing. The Saudi Technical and Vocational Training Corporation (TVTC) revealed a 25% shortage of skilled engineers and technicians in the beginning of 2024. This scarcity emphasizes the necessity of labor development to support market expansion by delaying project execution and raising operating expenses.

Maintaining the expansion and competitiveness of Saudi Arabia's data center sector will require addressing these issues through investments in cybersecurity infrastructure, workforce development, and renewable energy.

The Complexities of Regulation and Cybersecurity

Data center security faces major issues due to Saudi Arabia's changing threat landscape. Data center operators face a difficult environment due to the country's strict data protection laws, extensive anti-cybercrime policies, and the complicated and quickly evolving nature of cybersecurity threats. Concerns over privacy abuses and surveillance may arise from these legislation' ability to force tech companies to divulge data on people who are critical of the government. Another difficulty is negotiating Saudi Arabia's complicated regulatory environment, where strict data localization regulations and compliance standards raise operating costs and impede market growth.

Market Segmentations

Component

- Hardware

- Software

Type

- Colocation

- Hyperscale

- Edge

- Others

Enterprise

- Large Enterprises

- Small and Medium Enterprises

End User

- Cloud Service Provider

- Technology Provider

- Telecom

- Healthcare

- BFSI

- Retail & E-commerce

- Entertainment & Media

- Energy

- Others

All the Key players have been covered

- Overview

- Key Persons

- Recent Developments

- Revenue Analysis

Company Analysis:

- Delta Electronics, Inc.

- Cisco Systems, Inc.

- Equinix, Inc.

- Fujitsu Ltd.

- General Electric

- Hitachi, Ltd.

- Schneider Electric

- Siemens AG

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Component, Type, Enterprise and End User |

| End User Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Saudi Arabia Data Center Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Component

6.2 By Type

6.3 By Enterprise

6.4 By End User

7. Component

7.1 Hardware

7.2 Software

8. Type

8.1 Colocation

8.2 Hyperscale

8.3 Edge

8.4 Others

9. Enterprise

9.1 Large Enterprises

9.2 Small and Medium Enterprises

10. End User

10.1 Cloud Service Provider

10.2 Technology Provider

10.3 Telecom

10.4 Healthcare

10.5 BFSI

10.6 Retail & E-commerce

10.7 Entertainment & Media

10.8 Energy

10.9 Others

11. Porter's Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Competition

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threats

13. Key Players Analysis

13.1 Delta Electronics, Inc.

13.1.1 Overviews

13.1.2 Key Person

13.1.3 Recent Developments

13.1.4 Revenue

13.2 Cisco Systems, Inc.

13.2.1 Overviews

13.2.2 Key Person

13.2.3 Recent Developments

13.2.4 Revenue

13.3 Equinix, Inc.

13.3.1 Overviews

13.3.2 Key Person

13.3.3 Recent Developments

13.3.4 Revenue

13.4 Fujitsu Ltd.

13.4.1 Overviews

13.4.2 Key Person

13.4.3 Recent Developments

13.4.4 Revenue

13.5 General Electric

13.5.1 Overviews

13.5.2 Key Person

13.5.3 Recent Developments

13.5.4 Revenue

13.6 Hitachi, Ltd.

13.6.1 Overviews

13.6.2 Key Person

13.6.3 Recent Developments

13.6.4 Revenue

13.7 Schneider Electric.

13.7.1 Overviews

13.7.2 Key Person

13.7.3 Recent Developments

13.7.4 Revenue

13.8 Siemens AG

13.8.1 Overviews

13.8.2 Key Person

13.8.3 Recent Developments

13.8.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com