Global Plug-in Hybrid Electric Vehicles Market Forecast 2025–2033

Buy NowPlug-in Hybrid Electric Vehicle Market Size and Forecast 2025-2033

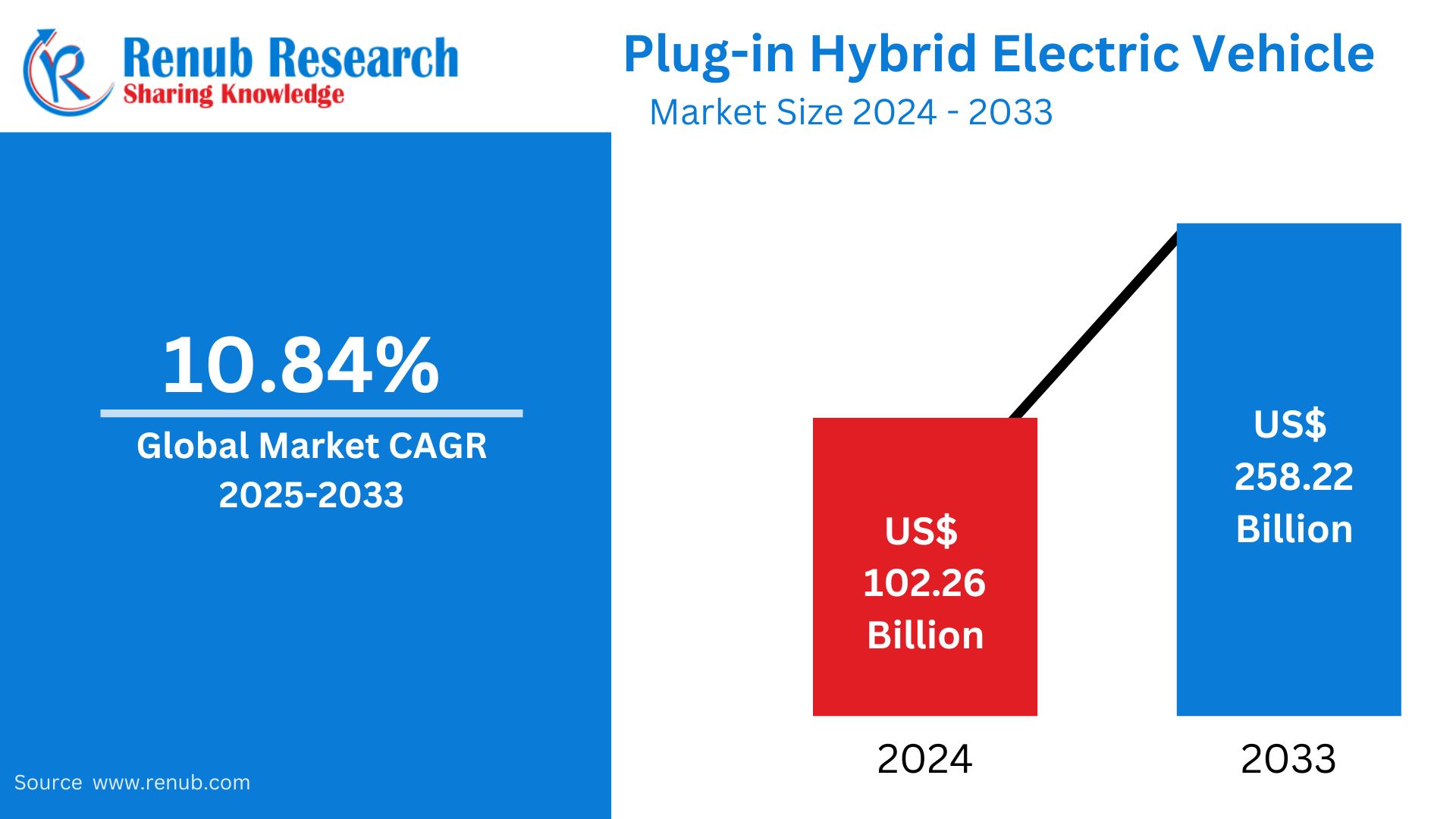

The global plug-in hybrid electric vehicle market is likely to expand further, and it is projected to be around US$ 258.22 billion in 2033 from the US$ 102.26 billion of 2024. The compound annual growth rate between 2025 and 203 will be 10.84%. Factors driving the PHEV market include the rising environmental consciousness of the people, government incentives on electric vehicles, and battery technology improvement. PHEVs, with electric and combustion engines, are gaining popularity as consumers are seeking environmentally friendly yet flexible modes of transportation.

Plug-In Hybrid Electric Vehicle Market Overview

A plug-in hybrid electric vehicle is a hybrid that consists of an internal combustion engine and an electric motor. The electric motor has a battery that can be charged via a plug. Unlike other hybrids, which depend only on the engine and regenerative braking to charge the battery, PHEVs are able to be plugged into an electrical outlet to charge their battery. They will therefore be able to run short distances on electric power alone, thus cutting fuel consumption and emissions.

PHEVs, first and foremost, have the primary benefit of being environmentally friendly transportation modes. A PHEV can, at times, be flexible, mainly due to the capacity to travel far. A PHEV runs solely on an electric motor in low speeds or short distances, while running on gasoline when traveling further or with a depleted battery. With this dual mode of operation, fuel costs go down and carbon emissions decline, so PHEVs are more popular among environment-conscious customers. PHEVs are becoming increasingly used for daily commutes, which is helping reduce reliance on fossil fuels and the overall environmental impact of transportation. It also serves as a bridge between traditional and fully electric vehicles, offering consumers the best of both worlds.

Growth Driver in the Plug-in Hybrid Electric Vehicle Market

Government Incentives and Regulations

Government incentives, which include tax credits, rebates, and grants, are major drivers in the PHEV market growth. Countries in Europe, North America, and Asia give a lot of incentives on EVs, which are known to include PHEVs. Further, rigid emission regulations force auto makers to look for alternatives, leading to an increased demand for PHEVs. As governments continue implementing policies aimed at reducing carbon emissions, PHEVs become attractive both to consumers and business concerns.

Growing Environmental Awareness

The growing concern among the consumers for a better and cleaner environment has become an impetus toward making eco-friendly transportation. Consumers choose more environmentally friendly and environmentally responsible vehicles like PHEVs, as well, because they do not have as much negative environmental impact as traditional gasoline engines do. PHEVs are an ideal solution that provides reduced emissions, fuel efficiency, and electricity usage for short trips, hence reducing dependence on fossil fuels. With increasing environmental consciousness among consumers, the demand for PHEVs will continue to increase.

Technological Advancements in Battery Technology

Improvements in battery technology have greatly enhanced the appeal of plug-in hybrid electric vehicles (PHEVs). Improvements in battery capacity, charging speed, and overall efficiency allow for a longer electric-only driving range, making PHEVs more practical and convenient for consumers. Lowering the costs of the battery, spurred by innovations and economies of scale, has made PHEVs more affordable and accessible to a wider market. Improving battery technology will continue to make PHEVs more efficient and attractive, further fueling market growth.

Challenge in the Plug-in Hybrid Electric Vehicle Market

High Initial Purchase Cost

One of the significant challenges in the plug-in hybrid electric vehicle (PHEV) market is the higher initial purchase cost compared to traditional vehicles. PHEVs usually possess advanced technology, such as an electric motor, a gasoline engine, and a large battery pack. Therefore, they are more expensive to manufacture and purchase. While incentives offered by the government can somewhat help reduce the cost, high front-end cost remains a major inhibitor to many consumers, especially those in price-sensitive markets. The high cost will further delay the widespread adoption in regions with less government incentives.

Limited Charging Infrastructure

Even though PHEVs can be run on both electricity and gasoline, more improvement is needed on charging infrastructure. Consumers may be reluctant to switch to PHEVs if they are concerned about the availability of charging stations, especially for full electric driving. Although PHEVs provide flexibility with their gasoline backup, widespread adoption will depend on the expansion of convenient and fast charging networks. In regions where charging stations are sparse or not easily accessible, this limitation can impact the adoption rate and growth of the PHEV market.

Mid-Priced Vehicle Market

The global market for mid-priced plug-in hybrid electric vehicles caters to a large consumer base searching for a balance between affordability and superior electrified technology. Positioned between cost-friendly options and luxury counterparts, mid-priced PHEVs charm cost-conscious customers looking for efficient capabilities without sacrificing performance. This class is on the rise in terms of acceptance as car makers such as Honda, Ford, and Hyundai launch competitive trends that bring an attractive combination of electrical performance and traditional driving range. The mid-priced PHEV class exemplifies a vital market niche contributing significantly to the substantial adoption of electrified transportation worldwide.

SUVs PHEV market

The SUV car type addresses many client choices, which offer the practicality of an SUV along with the efficiency benefits of PHEV technology. Notable companies like Tesla, Volvo, and Mitsubishi have launched PHEV SUV models offering robust electric-powered capabilities along with spacious interiors. SUVs in the PHEV market are gaining impressive growth due to increasing demands for efficient options without trading off the commanding presence, application, and driving experience that SUV lovers look for.

United States plug-in hybrid electric vehicles market

America plays an important role in the ongoing landscape of the global Plug-in Hybrid Electric Vehicle (PHEV) market that is witnessing a slow upward trend compared to other nations. Climate change concerns and environmental awareness push American customers towards green options, and PHEVs have emerged as a practical solution lying between conventional fuel-powered automobiles and fully electric-powered automobiles. Federal tax credits provide a boost for the adoption of PHEVs in the US. There are further incentives offered by the state level. On the other hand, American automobile makers are moving on to create more PHEVs while performance and competition levels are going up. Despite being less mature as in Europe, the growing number of charging infrastructure step by step has reduced range anxiety and triggered multiple adoption of PHEVs in the US.

France Plug-in Hybrid Electric Vehicle Market

The plug-in hybrid electric vehicle market in France is growing, primarily due to government incentives and a high focus on reducing carbon emissions. Consumers are being incentivized toward more eco-friendly transportation alternatives by policies like tax credits, rebates, and friendly regulations in France. Top automakers like Renault, Peugeot, and Citroën have been expanding their PHEV portfolio in response to the high demand. Increased environmental consciousness and the increased availability of charging infrastructure boost the market further. PHEVs have been found to provide the French consumers with the electric driving advantages along with the freedom of the traditional gasoline engine, and hence are considered an ideal choice for sustainable mobility.

China Plug-in Hybrid Electric Vehicle Market

The market for PHEVs in China is growing at a rapid pace because of incentives from the government, raising environmental consciousness, and an increasing shift towards electric mobility. China is the world's largest automotive market, and its government has provided many policies, subsidies, and tax incentives for promoting electric vehicles, such as PHEVs. Chinese home-grown brands such as BYD, Geely, and NIO lead the pack in PHEV market with models from a highly affordable price point to state-of-the-art offerings. With the growing infrastructure of charging stations and an increased interest in curbing pollution, the Chinese PHEV market is poised to surge in the future years.

Saudi Arabia Plug-in Hybrid Electric Vehicle Market

The Saudi Arabian market for PHEVs is slowly rising due to governmental initiatives in terms of eco-friendly transport options and people's growing awareness about pollution. Saudi Arabia, under its Vision 2030 initiative, is looking to reduce carbon emissions and diversify energy sources, which will promote electric and hybrid vehicles. Demand for PHEVs is in the early stages, but rising availability of charging infrastructure and government incentives are likely to boost demand. Major global automakers, such as Toyota, BMW, and Audi, are launching PHEV models in Saudi Arabia, with the aim of providing the Saudi consumer with a product that balances fuel efficiency with the flexibility of a traditional gasoline engine. The growth in interest in green technologies and the country's move to modernize its transportation sector are positive indicators for the Saudi PHEV market.

Global Plug-in Hybrid Electric Vehicle Market Key Players

- The leading businesses in the Global Plug-in Hybrid Electric Vehicle Market are Tesla, BMW Group, BYD Company Ltd., Mercedes-Benz Group AG, Ford Motor Company, General Motor Company, Nissan Motor Co. Ltd., and Toyota Motor Corporation.

- In 2022, Toyota announced it would invest an extra $35 billion in growing plug-in hybrid electric cars (PHEVs). Last year, the business enterprise sold over 500,000 hybrids and PHEVs.

Market Segmentation

Vehicle Class

- 1. Low Priced

- 2. Mid-Priced

- 3. Luxury

Car Type

- SUV

- MPV & Vans

- Midsize & Large Cars

- Small & Compact Cars

Regional Market Analysis

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherland

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Rest of the World

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Competitive Landscape

- Tesla

- BMW Group

- BYD Company Ltd.

- Mercedes-Benz Group AG

- Ford Motor Company

- General Motor Company

- Nissan Motor Co. Ltd.

- Toyota Motor Corporation

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product Type, Lead Type, End User and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Plug In Hybrid Electric Vehicle Market

6. Market Share

6.1 By Vehicle Class

6.2 By Car Type

6.3 By Countries

7. Vehicle Class

7.1 Low Priced

7.2 Mid Priced

7.3 Luxury

8. Car Type

8.1 SUV

8.2 MPV & Vans

8.3 Midsize & Large Cars

8.4 Small & Compact Cars

9. Countries

9.1 North America

9.1.1 United States

9.1.2 Canada

9.2 Europe

9.2.1 France

9.2.2 Germany

9.2.3 Italy

9.2.4 Spain

9.2.5 United Kingdom

9.2.6 Belgium

9.2.7 Netherland

9.2.8 Turkey

9.3 Asia Pacific

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 South Korea

9.3.5 Thailand

9.3.6 Malaysia

9.3.7 Indonesia

9.3.8 Australia

9.3.9 New Zealand

9.4 Latin America

9.4.1 Brazil

9.4.2 Mexico

9.4.3 Argentina

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.2 UAE

9.5.3 South Africa

9.6 Rest of the World

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 Tesla

12.1.1 Overview

12.1.2 Recent Development

12.1.3 Revenue Analysis

12.2 BMW Group

12.2.1 Overview

12.2.2 Recent Development

12.2.3 Revenue Analysis

12.3 BYD Company Ltd.

12.3.1 Overview

12.3.2 Recent Development

12.3.3 Revenue Analysis

12.4 Mercedes-Benz Group AG

12.4.1 Overview

12.4.2 Recent Development

12.4.3 Revenue Analysis

12.5 Ford Motor Company

12.5.1 Overview

12.5.2 Recent Development

12.5.3 Revenue Analysis

12.6 General Motor Company

12.6.1 Overview

12.6.2 Recent Development

12.6.3 Revenue Analysis

12.7 Nissan Motor Co. Ltd

12.7.1 Overview

12.7.2 Recent Development

12.7.3 Revenue Analysis

12.8 Toyota Motor Corporation

12.8.1 Overview

12.8.2 Recent Development

12.8.3 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com