North America Web Application Firewall Market Report 2025-2033

Buy NowNorth America Web Application Firewall Market Size and Forecast 2025-2033

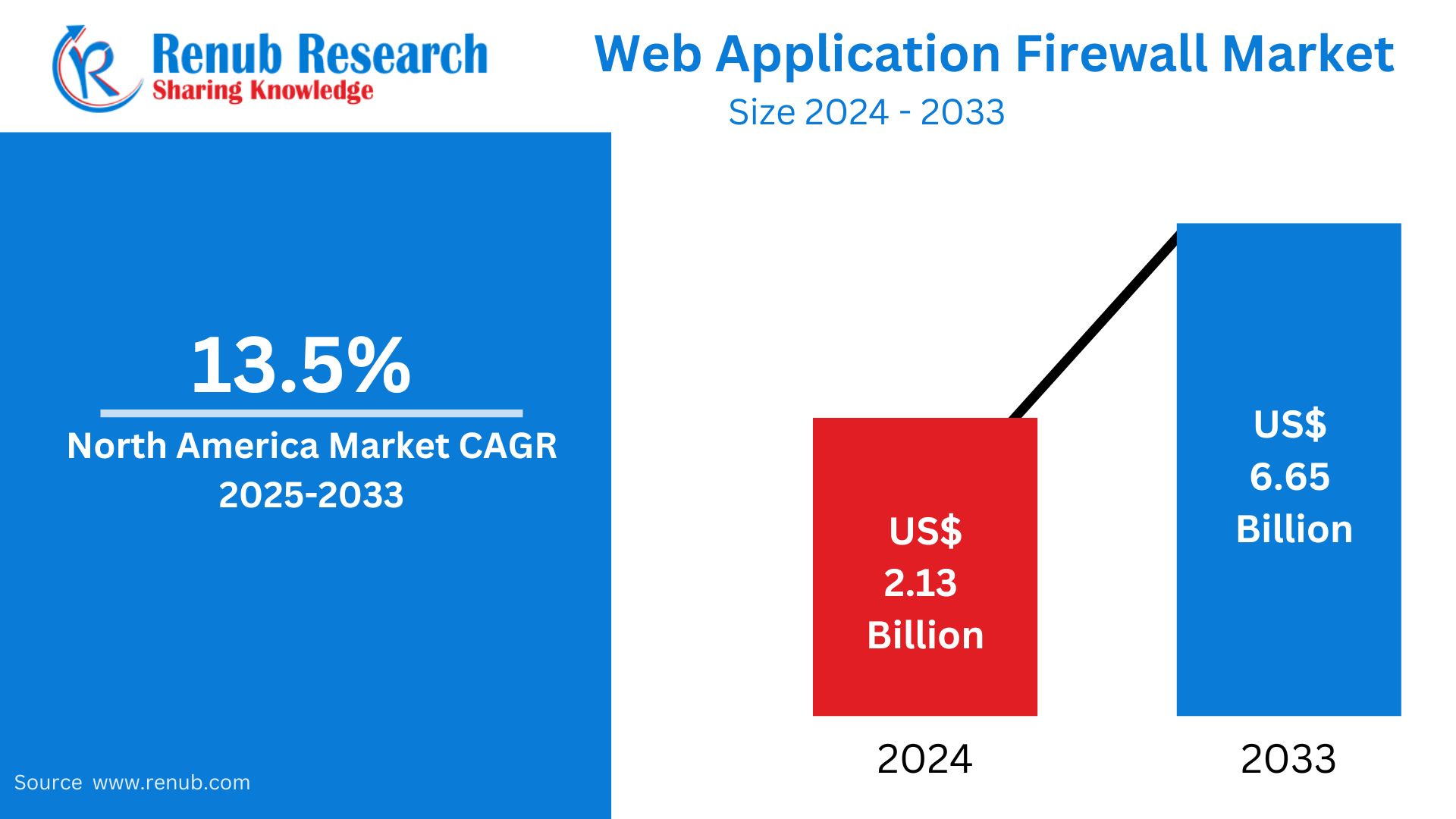

North America Web Application Firewall (WAF) Market is expected to expand strongly, increasing from USD 2.13 billion in 2024 to USD 6.65 billion by 2033. It is expected to grow with a CAGR of 13.5% from 2025 to 2033. The growth is driven by growing cybersecurity threats, an upsurge in web-based applications, and strict data protection laws. Companies across industries are spending big on WAF solutions to protect digital assets, provide regulatory compliance, and preserve customer trust.

North America Web Application Firewall (WAF) Market Forecast Report by Component (Solution, Services), Organization Type (Large Enterprises, Small and Medium Enterprises), Deployment Mode (On-Premise, Cloud), Industry Vertical (Retail, BFSI, Manufacturing, Government, IT & Telecommunication, Healthcare, Energy & Utilities and Others), Countries and Company Analysis 2025-2033.

North America Web Application Firewall Market Outlooks

A Web Application Firewall, or WAF, is a type of advanced cybersecurity technology used to safeguard web applications through filtering, monitoring, and blocking malicious traffic. In contrast to other firewalls that defend a network's perimeter, a WAF attacks from the application level since most cyberattacks are launched from there. It protects against threats such as SQL injection, cross-site scripting (XSS), and cookie poisoning by scanning and managing HTTP and HTTPS traffic between an internet and a web application.

WAFs are crucial for companies that deal with sensitive customer information, such as e-commerce websites, banks, and medical care providers. They assist organizations in ensuring the integrity, availability, and confidentiality of their web applications, protecting customer trust and compliance with regulations. WAF popularity has increased tremendously because of the rise in cyber attacks and the high demand for digital services.

Cloud-hosted WAF products have further stimulated uptake, with the advantage of scalability, economic benefits, and simple deployment. As cyberattacks develop and evolve, WAFs are fast becoming an indispensable element in enterprise cybersecurity planning.

Growth Drivers in the Web Application Firewall Market in North America

Increased Cybersecurity Threats

Increased levels and frequency of cyberattacks have hugely driven up the uptake of Web Application Firewalls (WAFs) in North America. Organizations are constantly threatened by ransomware, phishing, and DDoS attacks on their web applications. WAFs offer essential protection by blocking malicious traffic and guarding against data breaches. With an increasing number of businesses migrating more services online, protecting customer data and business data has become more pressing, and WAF adoption across industries has been growing widespread. May 2023, Global cybersecurity software and services company Fortra unveiled an upgraded Managed Web Application Firewall (WAF) service. Offered by Fortra's Alert Logic business, the solution integrates the sophisticated tools and security know-how organizations require to safeguard key web applications and APIs from attack.

E-commerce and Digital Services Growth

The proliferation of online retailing, digital banking, and telemedicine services has driven the demand for solid web application security. As companies expand their online platforms, so too does the attack surface, leaving them increasingly exposed. WAFs secure customer transactions and sensitive data, maintain business continuity and compliance, and support regulatory mandates. The growing need for safe and seamless online experiences is forcing North American businesses to spend generously on sophisticated WAF solutions. Feb 2025, Yottaa, a pioneer in eCommerce website performance optimization, introduced Yottaa Web Performance Services. This managed solution accelerates website performance, increases security, and reduces operational complexity for online retailers and brands. Leverage best-in-class technologies from Fastly, HUMAN Security, and Yottaa, it delivers a high-performance platform optimized for eCommerce.

Strict Data Protection Regulations

Regulations such as the California Consumer Privacy Act (CCPA) and vertical regulations such as HIPAA have imposed strict data protection requirements. Firms must protect personal and financial data or incur massive fines. WAFs are important components in compliance initiatives by protecting web applications from unauthorized access and security breaches. The regulatory landscape in North America is driving organizations in various industries—particularly healthcare, finance, and retail—to invest in WAF as a means of evading legal consequences. The California Privacy Rights Act (CPRA), enacted through ballot initiative in November 2020, is the most far-reaching state data privacy law to date. It modifies the California Consumer Privacy Act (CCPA) and became effective in January 2023.

Challenges in the North America Web Application Firewall Market

High Implementation and Maintenance Costs

It is costly to implement and manage WAF solutions, particularly in small and medium-sized enterprises (SMBs). The costs consist of software licenses, hardware appliances, professional IT personnel, and maintenance. Such costs might drive most organizations away from investing in high-quality WAF systems, especially when matching limited cybersecurity budgets. Moreover, regular updates and tuning must be done to ensure that WAFs remain effective, and this contributes to the overall cost of ownership and represents a serious market challenge.

Complex Integration with Legacy Systems

Most North American businesses have legacy IT infrastructure. It is complex and expensive to integrate newer WAF solutions with older systems. Integration can lead to compatibility problems, poor system performance, and rising operation risks. The complexity tends to hinder or slow down WAF deployment, particularly in traditional sectors such as manufacturing and government, and thus brakes the overall expansion of the WAF market across North America.

North America Web Application Firewall Solution Market

The market for North America WAF solutions is flourishing with the demand for sophisticated, scalable, and easy-to-implement security solutions. Vendors are providing cloud-based, on-premises, and hybrid WAF solutions to address the different requirements of companies. Important features such as AI-powered threat identification, automated patching, and centralized management are becoming the norm. Organizations prefer flexible and configurable WAF solutions that can adjust to new forms of attacks and integrate easily into complex IT systems.

North America Large Enterprises Web Application Firewall Market

Enterprise customers in North America are spearheading WAF adoption because of their sophisticated infrastructure and greater exposure to risk. They need highly scalable and hardened security solutions that can deliver significant traffic and advanced cyber threats. Financial, healthcare, and technology sector enterprises put WAF solutions at the top of their list to safeguard valuable customer information and intellectual property. They also look for WAFs with more analytics, reporting, and threat intelligence capabilities to enhance their cybersecurity platforms.

North America Cloud Web Application Firewall Market

The transition to cloud computing is driving the adoption of cloud-based WAF solutions in North America. Companies are increasingly turning to Software-as-a-Service (SaaS) models to secure applications running on public and hybrid cloud infrastructures. Cloud WAFs provide advantages such as scalability, cost savings, and simplicity of management. They also enable quick deployment without the requirement for extensive on-site infrastructure, which makes them particularly attractive to startups, SMBs, and digitally transforming companies.

North America Retail Web Application Firewall Market

The retail industry in North America is one of the largest consumers of WAF solutions due to the e-commerce and omnichannel shopping boom. Retailers need to shield such sensitive customer information as payment data and personal information from cyber attackers. WAFs prevent online platforms from attacks by SQL injections and bot traffic. Furthermore, with the rising number of web promotions and sale events, there is more investment in WAF technologies by retailers to maintain customer trust and compliance with regulations.

North America IT & Telecommunication Web Application Firewall Market

The telecommunications and IT industries in North America are significantly investing in WAF solutions to secure data and critical infrastructure. With these industries transitioning to 5G and edge computing, the security of communication channels and APIs is more important than ever. WAFs assist in reducing threats to customer portals, enterprise applications, and cloud services. In an interconnected world, these industries need sophisticated, real-time protection to ensure service continuity and user privacy.

North America Healthcare Web Application Firewall Market

The North American healthcare industry is subject to stringent regulatory requirements and increased cyber threats, and WAFs are a key component of their cybersecurity defenses. Hospitals, clinics, and insurers employ WAFs to safeguard electronic health records (EHRs), patient portals, and telemedicine software. HIPAA compliance also requires robust data protection. With healthcare going increasingly online, WAFs enable providers to ensure confidentiality, integrity, and availability of sensitive medical information.

United States Web Application Firewall Market

The United States leads the North America WAF market due to a widespread presence of healthcare organizations, financial institutions, and tech giants. High WAF adoption rates are being driven by stringent regulatory standards, increasing cybersecurity threats, and operational resilience demands. U.S. firms are making investments in both cloud and on-premises WAF products to protect their assets from sophisticated threats and also remain compliant with federal and state data protection legislation. March 2025, Akamai Technologies, Inc. has been identified as a Leader in The Forrester Wave: Web Application Firewall Solutions, Q1 2025 report.

Canada Web Application Firewall Market

Canada's WAF market is steadily developing, with momentum provided by measures to strengthen country-level cybersecurity capabilities and defend sensitive infrastructure. Enterprise adoption of digital services in Canada is growing fast, which ranks cybersecurity high as a concern. Banking, health, and the government are industries that lead in WAF consumption. Beyond defenses against data intrusions, Canada's WAFs enable entities to comply with privacy regulations such as PIPEDA. June 2024: Vercara is opening its first distributed denial-of-service (DDoS) and application security (AppSec) point of presence (PoP) in Toronto, Canada. The new PoP expands Vercara's international presence for its UltraDDoS Protect and UltraWAF solutions, providing Canadian customers with an in-country data processing and mitigation solution.

Mexico Web Application Firewall Market

Mexico's WAF market is growing as companies go digital and face an increasing number of cyber attacks. Sectors like finance, retail, and manufacturing are prioritizing web application security to safeguard consumer information and business processes. While awareness of cybersecurity has increased, market issues persist in terms of cost and technical skills. Nevertheless, growing investments in IT security and government initiatives are driving WAF adoption in the country.

North America Web Application Firewall Market Types

Component

- Solution

- Services

Organization Type

- Large Enterprises

- Small and Medium Enterprises

Deployment Mode

- On-Premise

- Cloud

Industry Vertical

- Retail

- BFSI

- Manufacturing

- Government

- IT & Telecommunication

- Healthcare

- Energy & Utilities

- Others

Countries

- United States

- Canada

- Mexico

- Rest of North America

Companies have been covered from 4 viewpoints

- Overviews

- Key Person

- Recent Developments

- Revenue

Key Players Analysis

- Akamai Technologies, Inc.

- Cloudflare Inc.

- Qualys Inc.

- F5 Inc.

- Fortinet Inc.

- Radware Ltd.

- Microsoft Corporation

- Barracuda Networks, Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Product, By Packaging Type, By Distribution Channel and By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. North America Web Application Firewall Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Component

6.2 By Organization Type

6.3 By Deployment Mode

6.4 By Industry Vertical

6.5 By Countries

7. Component

7.1 Solution

7.2 Services

8. Organization Type

8.1 Large Enterprises

8.2 Small and Medium Enterprises

9. Deployment Mode

9.1 On-Premise

9.2 Cloud

10. Industry Vertical

10.1 Retail

10.2 BFSI

10.3 Manufacturing

10.4 Government

10.5 IT & Telecommunication

10.6 Healthcare

10.7 Energy & Utilities

10.8 Others

11. Countries

11.1 United States

11.2 Canada

11.3 Mexico

11.4 Rest of North America

12. Porter’s Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Rivalry

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threat

14. Key Players Analysis

14.1 Akamai Technologies, Inc.

14.1.1 Overviews

14.1.2 Key Person

14.1.3 Recent Developments

14.1.4 Revenue

14.2 Cloudflare Inc.

14.2.1 Overviews

14.2.2 Key Person

14.2.3 Recent Developments

14.2.4 Revenue

14.3 Qualys Inc.

14.3.1 Overviews

14.3.2 Key Person

14.3.3 Recent Developments

14.3.4 Revenue

14.4 F5 Inc.

14.4.1 Overviews

14.4.2 Key Person

14.4.3 Recent Developments

14.4.4 Revenue

14.5 Fortinet Inc.

14.5.1 Overviews

14.5.2 Key Person

14.5.3 Recent Developments

14.5.4 Revenue

14.6 Radware Ltd.

14.6.1 Overviews

14.6.2 Key Person

14.6.3 Recent Developments

14.6.4 Revenue

14.7 Microsoft Corporation

14.7.1 Overviews

14.7.2 Key Person

14.7.3 Recent Developments

14.7.4 Revenue

14.8 Barracuda Networks, Inc.

14.8.1 Overviews

14.8.2 Key Person

14.8.3 Recent Developments

14.8.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com