North America Sports Medicine Market – Industry Trends, Forecast & Growth Outlook 2025-2033

Buy NowNorth America Sports Medicine Market Size and Forecast 2025-2033

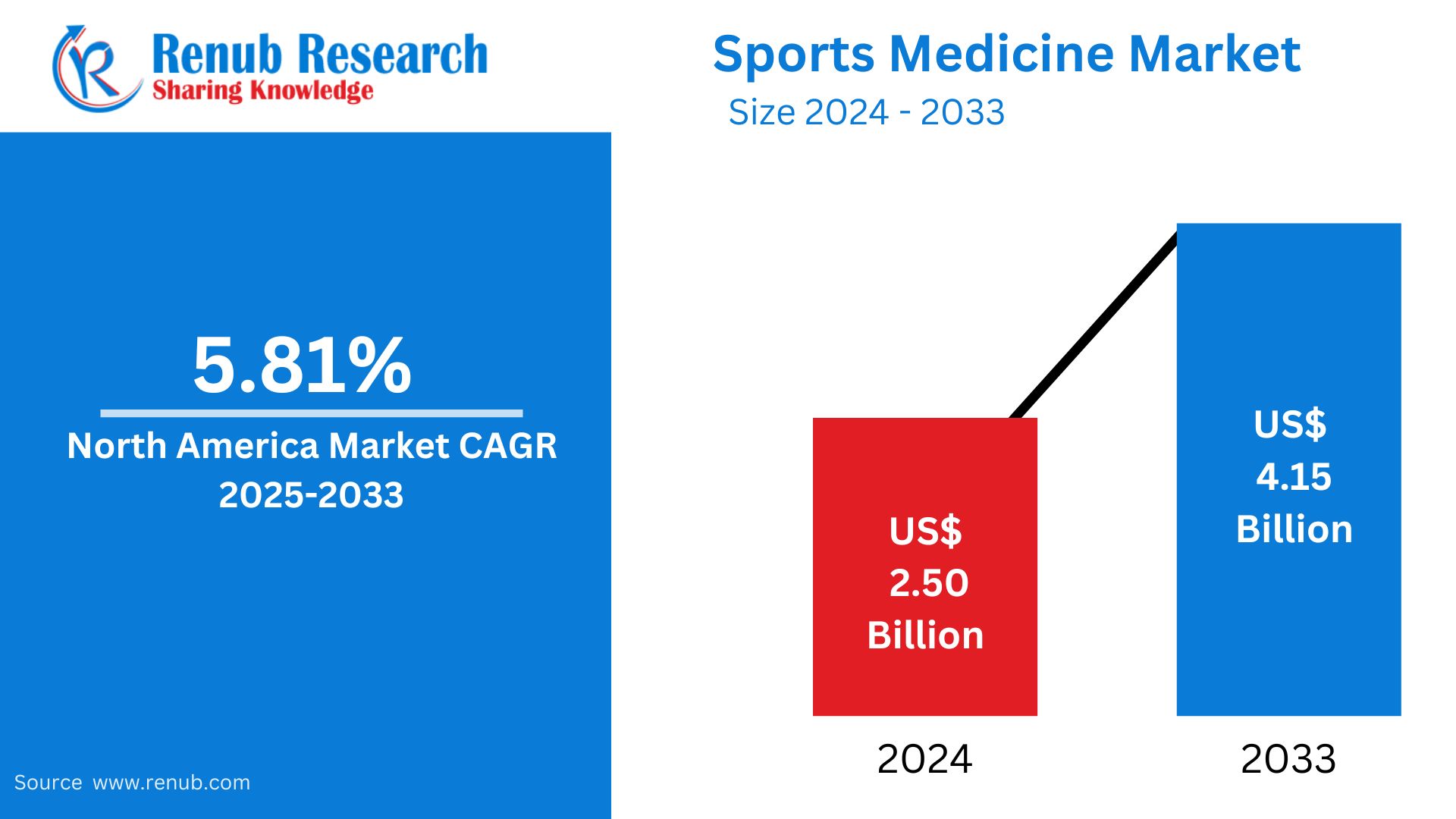

North America Sports Medicine Market is expected to reach US$ 4.15 billion by 2033 from US$ 2.50 billion in 2024, with a CAGR of 5.81% from 2025 to 2033. The market is expanding steadily due to factors like the growing emphasis on wellness and fitness, the aging population's desire to lead active lives, and ongoing improvements in medical procedures like less invasive surgery and better rehabilitation techniques.

North America Sports Medicine Market Report by Product (Body Reconstruction & Repair, Accessories, Body Monitoring & Evaluation, Body Support & Recovery), Application (Knee Injuries, Shoulder Injuries, Foot and Ankle Injuries, Hip and Groin Injuries, Elbow and Wrist Injuries, Back and Spine Injuries, Others), End User (Hospitals, Ambulatory Surgery Centers, Physiotherapy Centers and Clinics), Countries (United States, Canada, Mexico, Rest of North America) and Company Analysis, 2025-2033

North America Sports Medicine Market Overview

A growing number of sports-related injuries, expanding awareness of physical fitness, and increased sports participation have all contributed to the well-established and quickly changing sports medicine market in North America. The area benefits from a sophisticated healthcare system, significant R&D investment, and a large number of specialized sports medicine specialists and facilities. Orthopedic implants, rehabilitation supplies, minimally invasive techniques, and performance-monitoring equipment are in great demand. Joint and soft tissue therapies are also becoming more and more necessary as a result of the aging population and active lifestyle trends. The market is also being shaped by technological developments like wearable technology and regenerative medicines. Because of its strong sports culture, healthcare system, and innovation pipeline, the United States leads the region.

For example, according to the Sports Accident Statistics report that LegalMatch updated in August 2022, approximately 150,000 anterior cruciate ligament (ACL) injuries occur annually in the United States. Furthermore, compared to other athletes, female basketball and soccer players experienced ACL injuries 2–8 times more frequently. The high frequency of sports-related injuries in the area is anticipated to raise demand for sports medicine and accelerate market expansion.

Innovative sports medical techniques, such as joint repair and arthroscopic technology, are being developed by companies. Surgeons can now receive seamless, integrated procedural solutions thanks to new technologies, which enables them to treat patients effectively. For example, at the American Academy of Orthopedic Surgeons 2023 Annual Meeting in March 2023, Smith+Nephew presented the UltraTRAC Quad ACL Reconstruction Technique, which includes the QUADTRAC Quadriceps Tendon Harvest Guide System, X-WING Graft Preparation System, and ULTRABUTTON family of adjustable fixation devices. Surgeons can increase graft visualization and preparation efficiency thanks to sophisticated, regulated, and repeatable technology that harvests the desired quadriceps tendon tissue and lessens knee pain. Therefore, it is anticipated that such advancements in sports medicine will raise demand for it, thereby driving market expansion.

Growth Drivers for the North America Sports Medicine Market

Rising Sports Participation

One of the main factors propelling the sports medicine market's expansion is the rise in sports participation in North America. The frequency of sports-related injuries is continuously rising as more people participate in organized sports, fitness programs, and leisure activities, spanning from school-age athletes to adults and seniors. This covers typical ailments that call for both non-surgical and surgical treatments, such as sprains, strains, fractures, and overuse injuries. The rising need for specialized sports medicine treatments has been largely attributed to the growth of high-impact activities including football, basketball, soccer, and running. Sports medicine is becoming a crucial part of contemporary athletic participation and care as a result of increased investments made by healthcare providers and athletic organizations in injury prevention, diagnosis, rehabilitation, and performance optimization services.

Aging Yet Active Population

The market for sports medicine is expanding in large part due to North America's aging but active population. Walking, swimming, cycling, and recreational sports are among the many active lifestyles that older persons are embracing in order to preserve their health and mobility. Despite its advantages, the increase in physical activity has also increased the prevalence of age-related musculoskeletal issues, such as arthritis, tendon injuries, and joint degeneration. As a result, the necessity for physical therapy, orthopedic interventions, and rehabilitation services catered to the requirements of senior citizens is increasing. These days, sports medicine is essential in helping this population stay mobile, heal from injuries, and carry on with the physical activities that promote their general health.

Growing Awareness of Fitness and Preventive Care

In North America, interest in sports medicine is rising as people become more conscious of fitness and preventive care. Physical exercise, appropriate training methods, and injury prevention strategies are becoming more and more important as more people place a higher priority on leading healthy lives. Professional athletes, fitness fanatics, and regular customers are all being encouraged by this change to seek professional advice from sports medicine specialists. Physical therapy, fitness regimens, and dietary counseling are examples of preventive treatment that is growing increasingly popular since it keeps people active and lowers their chance of injury. Sports medicine's involvement in proactive health management is also growing as a result of public health initiatives and media coverage regarding wellness and performance optimization, which are increasing awareness of the advantages of early intervention and continuing care.

Challenges in the North America Sports Medicine Market

Injury Prevention and Education Gaps

There is still a large knowledge gap in injury prevention, especially at the amateur and grassroots levels, despite growing awareness of the issue. Safe training methods, warm-up exercises, and injury prevention approaches are not well understood by many athletes, coaches, and leisure participants. Particularly in youth sports, this lack of knowledge frequently results in avoidable injuries like sprains, strains, and stress fractures. People are more vulnerable to overuse injuries and inadequate rehabilitation if they don't receive the right advice on biomechanics, equipment, and conditioning. Sports medicine services, such as treatments and rehabilitation, are therefore in greater demand. Reducing injury rates, lowering treatment costs, and enhancing overall athlete safety may all be achieved by filling this knowledge gap through focused community-based programs and services.

Shortage of Specialized Practitioners

One major issue facing the sports medicine industry in North America is the lack of qualified professionals. The need for specialists like orthopedic surgeons, physical therapists, and athletic trainers to manage and treat sports-related injuries is growing as more people participate in sports and physical activities. Longer wait times for individuals seeking care are the result of the supply of skilled practitioners frequently not keeping up with this rising demand. Delays in diagnosis, treatment, and rehabilitation may result from this scarcity, which could have an impact on patient outcomes and general satisfaction. Increased funding for education and training initiatives is required to meet this problem, as is the growth of telemedicine and support personnel to lessen the workload for specialists.

United States Sports Medicine Market

The market for sports medicine in the US is expanding quickly due to factors like growing awareness of fitness, aging populations leading active lifestyles, and more sports participation. The market is driven by the need for sports injury, rehabilitation, and injury prevention treatments. Strong R&D capabilities, a sophisticated healthcare system, and easy access to specialized personnel and facilities are all advantages for the nation. The market's expansion is being shaped by the application of minimally invasive procedures, cutting-edge treatments including regenerative medicine, and sophisticated diagnostic instruments. Sports medicine services are also becoming more and more necessary as fitness trends, sports leagues, and performance optimization among professional athletes and the general public grow. But issues like expensive medical care and insurance coverage still exist.

The primary driver of the demand for different sports medications, which is anticipated to fuel the segment's growth during the forecast period, is the rising prevalence of shoulder injuries among the general public, particularly among athletes. For example, there were almost 9,000 cases of shoulder dislocation reported in the United States, with an incidence of 23.9 per 100,000 person-years, according to a May 2022 MDPI article. Males account for about 72% of shoulder injuries, with patients aged 15 to 29 accounting for nearly half of these cases. A fall was the most common cause of dislocation, occurring in almost 60% of cases. As a result, the high frequency of shoulder injuries increases the need for pain-relieving shoulder braces, bandages, and tapes; hence, this is anticipated to support the segment's growth over the forecast period.

Canada Sports Medicine Market

The market for sports medicine in Canada is expanding steadily due to rising sports participation, an active yet aging population, and improvements in medical technology. Serving both professional athletes and the general public, the market offers a variety of services such as injury prevention, rehabilitation, and surgical procedures. Body support and rehabilitation, body reconstruction and repair, and accessories are important sections. Government programs encouraging physical exercise and sports participation also contribute to the need for sports medicine services. A competent workforce in the sector is a result of accredited sports therapy programs offered by educational institutions such as Sheridan College and Acadia University. Setting standards and developing the field of sports medicine in Canada are important tasks for professional associations like the Canadian Academy of Sport and Exercise Medicine (CASEM) and the Canadian Athletic Therapists Association (CATA).

Mexico Sports Medicine Market

The market for sports medicine in Mexico is expanding quickly due to factors like rising sports participation, an aging but active populace, and improvements in medical technology. Serving both professional athletes and the general public, the market offers a variety of services such as injury prevention, rehabilitation, and surgical procedures. Body support and rehabilitation, body reconstruction and repair, and accessories are important sections. Government programs encouraging physical exercise and sports participation also contribute to the need for sports medicine services. Accredited sports therapy programs are offered by educational institutions such as Universidad Autónoma de Nuevo León and Universidad Nacional Autónoma de México, which helps to create a workforce with the necessary skills. Setting standards and promoting the practice of sports medicine in Mexico are important tasks for professional associations like the Mexican Federation of Sports Medicine (FMMD) and the Mexican Society of Sports Medicine (SMME).

North America Sports Medicine Market Segments

Product–Market breakup in 4 viewpoints:

- Body Reconstruction & Repair

- Accessories

- Body Monitoring & Evaluation

- Body Support & Recovery

Application –Market breakup in 7 viewpoints:

- Knee Injuries

- Shoulder Injuries

- Foot and Ankle Injuries

- Hip and Groin Injuries

- Elbow and Wrist Injuries

- Back and Spine Injuries

- Others

End User –Market breakup in 3 viewpoints:

- Hospitals

- Ambulatory Surgery Centers

- Physiotherapy Centers and Clinics

Country –Market breakup in 4 viewpoints:

- United States

- Canada

- Mexico

- Rest of North America

All the Key players have been covered from 4 Viewpoints:

- Overviews

- Key Person

- Recent Developments

- Revenue

Company Analysis:

- Zimmer Biomet Holdings, Inc.

- Stryker

- Medtronic Plc.

- Novartis AG

- Smith & Nephew Plc.

- CONMED Corporation

- Johnson & Johnson Services, Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product, Application, End User and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. North America Sports Medicine Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share

6.1 By Product

6.2 By Application

6.3 By End User

6.4 By Countries

7. Product

7.1 Body Reconstruction & Repair

7.2 Accessories

7.3 Body Monitoring & Evaluation

7.4 Body Support & Recovery

8. Application

8.1 Knee Injuries

8.2 Shoulder Injuries

8.3 Foot and Ankle Injuries

8.4 Hip and Groin Injuries

8.5 Elbow and Wrist Injuries

8.6 Back and Spine Injuries

8.7 Others

9. End User

9.1 Hospitals

9.2 Ambulatory Surgery Centers

9.3 Physiotherapy Centers and Clinics

10. Countries

10.1 United States

10.2 Canada

10.3 Mexico

10.4 Rest of North America

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 Zimmer Biomet Holdings, Inc.

13.1.1 Overviews

13.1.2 Key Person

13.1.3 Recent Developments

13.1.4 Revenue

13.2 Stryker

13.2.1 Overviews

13.2.2 Key Person

13.2.3 Recent Developments

13.2.4 Revenue

13.3 Medtronic Plc.

13.3.1 Overviews

13.3.2 Key Person

13.3.3 Recent Developments

13.3.4 Revenue

13.4 Novartis AG

13.4.1 Overviews

13.4.2 Key Person

13.4.3 Recent Developments

13.4.4 Revenue

13.5 Smith & Nephew Plc.

13.5.1 Overviews

13.5.2 Key Person

13.5.3 Recent Developments

13.5.4 Revenue

13.6 CONMED Corporation

13.6.1 Overviews

13.6.2 Key Person

13.6.3 Recent Developments

13.6.4 Revenue

13.7 Johnson & Johnson Services, Inc.

13.7.1 Overviews

13.7.2 Key Person

13.7.3 Recent Developments

13.7.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com