Mexico System Integration Market Outlook 2025–2033

Buy NowMexico System Integration Market Size

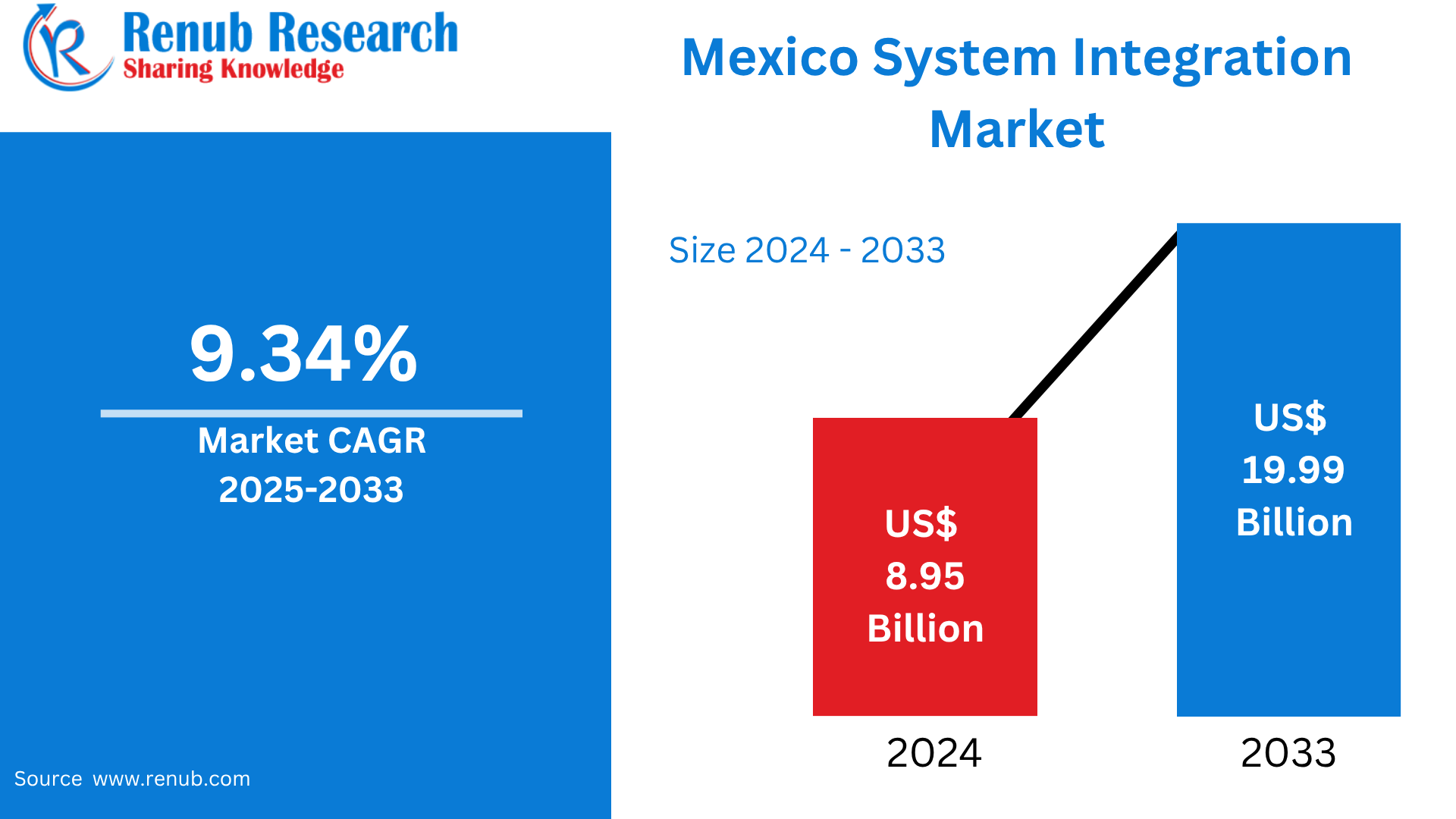

Mexico System Integration Market is expected to reach US$ 19.99 billion by 2033 from US$ 8.95 billion in 2024, with a CAGR of 9.34% from 2025 to 2033. More digital transformation, smart city programs by the government, increasing spending on IT infrastructure, increasing demand for cloud and cybersecurity services, and the increasing industry adoption of IoT and AI technologies are the key drivers for the Mexico System Integration Market.

Mexico System Integration Market Report by Services (Infrastructure Integration, Application Integration, Consulting), Application (IT & Telecom, Defense & Security, BFSI, Oil and Gas, Healthcare, Transportation, Retail, Others) and Company Analysis 2025-2033.

Mexico System Integration Industry Overview

Physically or functionally integrating different computer systems and software programs to operate as one, unified body is called system integration. It allows different systems, such as databases, networks, hardware, and software, to communicate and work as a unified one. Through the provision of an integrated platform for information exchange, this integration enables improved decision-making, enhances efficiency, and enhances data flow. For organizations to reduce costs, streamline operations, and adapt rapidly to technology developments, system integration is essential. It often involves custom programming, middleware, APIs, and protocols in order to ensure compatibility and unfettered communication between various components of an organization's IT ecosystem.

Accelerated digitalization across various sectors such as manufacturing, healthcare, and financial services is propelling the Mexico System Integration Market. Government initiatives for developing smart cities and digital infrastructure significantly boost demand. The market is expanding due to increasing investments in IT infrastructure, cloud computing, and cybersecurity. The demand for combined systems to enhance data handling and operational effectiveness is driven by the increased use of advanced technologies such as big data analytics, AI, and IoT. Enterprises are also focusing on increasing customer satisfaction and streamlining procedures, which enhances the adoption of customized system integration services and expands the market.

Growth Drivers for the Mexico System Integration Market

Digital Transformation Initiatives

Digital transformation projects, fueled by both government and private sector initiatives to modernize infrastructure and services, are one of the major growth drivers of Mexico's system integration market. Development of digital infrastructure, expansion of e-government services, and increased ICT penetration throughout the country are the primary targets of the Mexican government's National Digital Strategy (2021–2024). Technology integration is being speeded up by gigantic investments by global tech giants, like Microsoft's $1.3 billion commitment towards expanding cloud and AI adoption for small and medium enterprises. Moreover, to manage complex digital transactions and optimize consumer experiences, rapid growth of sectors like e-commerce requires advanced system integration. When considered collectively, these activities increase the call for seamless technological integration, which drives robust industry growth.

Artificial Intelligence Adoption

Artificial intelligence (AI) adoption is a major driver driving the system integration market in Mexico. There is a huge requirement for integrated systems with the capacity to handle complicated AI workloads because of the rapid surge in AI deployments in sectors such as financial, manufacturing, healthcare, and logistics. Firms apply AI to automate business processes, enhance fraud detection, streamline supply chains, and enhance customer experiences. Firms must have the ability to integrate AI platforms with their existing IT systems for the full potential of AI to drive business value, which calls for the deployment of sophisticated system integration services. The adoption is also spurred by increasing investments in AI solutions, as well as supportive government initiatives. Mexican system integration companies are critical in enabling successful, scalable, and secure AI implementations since AI moves to the forefront of digital transformation projects.

E-commerce and Digital Payments Growth

Digital payments and e-commerce are among the key drivers of the system integration market in Mexico. The sophistication of managing multiple sales channels and payment means increases as increasing numbers of customers and businesses shift to the online environment, creating the demand for integrated systems that ensure seamless transaction processing and a good customer experience. The demand for robust, secure, and scalable integration solutions is also underscored by the acceleration of mobile commerce. The Mexican digital payments environment is also evolving with the collaboration of banks, fintech companies, and payment processors; complex integration is required in this case to offer rapid, reliable, and secure financial services. To efficiently run operations, promote innovation, and remain competitive within the rapidly evolving market, companies are pushed by this emerging digital environment to adopt advanced system integration solutions.

Challenges in the Mexico System Integration Market

Data Security Concerns

One of the biggest obstacles in Mexico's system integration market is data security. Protecting sensitive data gets more difficult as businesses connect more platforms and technologies. Interconnected networks increase the danger of illegal access, cyberattacks, and data breaches. Strong security measures are necessary to comply with strict laws like Mexico's Federal Law on Protection of Personal Data. Many businesses find it difficult to apply uniform authentication, encryption, and monitoring procedures across several systems. Effective protection is further hampered by a lack of cybersecurity knowledge and financial limitations. Data security is a major obstacle to smooth system integration in Mexico because of these reasons, which might jeopardize customer trust and business operations.

Fragmented Market

There are many difficulties because of Mexico's system integration market's fragmented structure. There are many small and mid-sized vendors in the market, each with a different level of experience, which leads to variable standards for integration and service quality. Businesses find it more difficult to choose vendors as a result of this fragmentation, which raises project risks and delays. Furthermore, the supply of smooth, end-to-end integration solutions may be hampered by providers' lack of cooperation and standard operating procedures. Innovation may be slowed by smaller vendors' inability to extend their operations or adopt cutting-edge technologies due to a lack of funding. In general, market fragmentation affects the development and maturity of system integration services in Mexico by causing inefficiencies and unpredictability.

Recent Developments in Mexico System Integration Industry

- Cisco introduced a new Security Service Edge (SSE) solution in June 2023 that allows for safe and easy access from any device, application, or location. By intelligently directing traffic to both private and public destinations, removing the need for end-user intervention, and simplifying access management for increased efficiency, the service solves issues like inconsistent access experiences and boosts productivity.

- The digital communications behemoth Cisco Systems, Inc. and the information technology company NEC Corporation announced their alliance in February 2023. This collaboration entails system integration and the investigation of possible prospects in the fields of private 5G and 5G xHaul. The goal of this partnership is to help clients change their architecture so they can connect to a wider range of objects and people.

Mexico System Integration Market Segmentation:

Services

- Infrastructure Integration

- Application Integration

- Consulting

End Use

- IT & Telecom

- Defense & Security

- BFSI

- Oil and Gas

- Healthcare

- Transportation

- Retail

- Others

All companies have been covered from 4 viewpoints:

- Company Overview

- Key Persons

- Recent Development & Strategies

- Sales Analysis

Key Players Analysis

- Accenture Plc.

- BAE Systems Plc.

- Capgemini SA.

- Cisco Systems Inc.

- Dell Inc.

- Fujitsu Limited (Furukawa Group)

- HCL Technologies Limited

- Hewlett Packard Enterprise Company

- IBM Corporation

- Infosys Limited

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Services and End User |

| End Use Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Mexico System Integration Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Services

6.2 By End Use

7. Services

7.1 Infrastructure Integration

7.2 Application Integration

7.3 Consulting

8. End Use

8.1 IT & Telecom

8.2 Defense & Security

8.3 BFSI

8.4 Oil and Gas

8.5 Healthcare

8.6 Transportation

8.7 Retail

8.8 Others

9. Porter’s Five Forces Analysis

9.1 Bargaining Power of Buyers

9.2 Bargaining Power of Suppliers

9.3 Degree of Rivalry

9.4 Threat of New Entrants

9.5 Threat of Substitutes

10. SWOT Analysis

10.1 Strength

10.2 Weakness

10.3 Opportunity

10.4 Threat

11. Key Players Analysis

11.1 Accenture Plc.

11.1.1 Overviews

11.1.2 Key Person

11.1.3 Recent Developments

11.1.4 Revenue

11.2 BAE Systems Plc.

11.2.1 Overviews

11.2.2 Key Person

11.2.3 Recent Developments

11.2.4 Revenue

11.3 Capgemini SA.

11.3.1 Overviews

11.3.2 Key Person

11.3.3 Recent Developments

11.3.4 Revenue

11.4 Cisco Systems Inc.

11.4.1 Overviews

11.4.2 Key Person

11.4.3 Recent Developments

11.4.4 Revenue

11.5 Dell Inc.

11.5.1 Overviews

11.5.2 Key Person

11.5.3 Recent Developments

11.5.4 Revenue

11.6 Fujitsu Limited (Furukawa Group)

11.6.1 Overviews

11.6.2 Key Person

11.6.3 Recent Developments

11.6.4 Revenue

11.7 HCL Technologies Limited

11.7.1 Overviews

11.7.2 Key Person

11.7.3 Recent Developments

11.7.4 Revenue

11.8 Hewlett Packard Enterprise Company

11.8.1 Overviews

11.8.2 Key Person

11.8.3 Recent Developments

11.8.4 Revenue

11.9 IBM Corporation

11.9.1 Overviews

11.9.2 Key Person

11.9.3 Recent Developments

11.9.4 Revenue

11.10 Infosys Limited

11.10.1 Overviews

11.10.2 Key Person

11.10.3 Recent Developments

11.10.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com