Business Process Outsourcing Market – Forecast & Growth Trends 2025–2033

Buy NowBusiness Process Outsourcing Market Forecast 2025–2033 | Renub Research

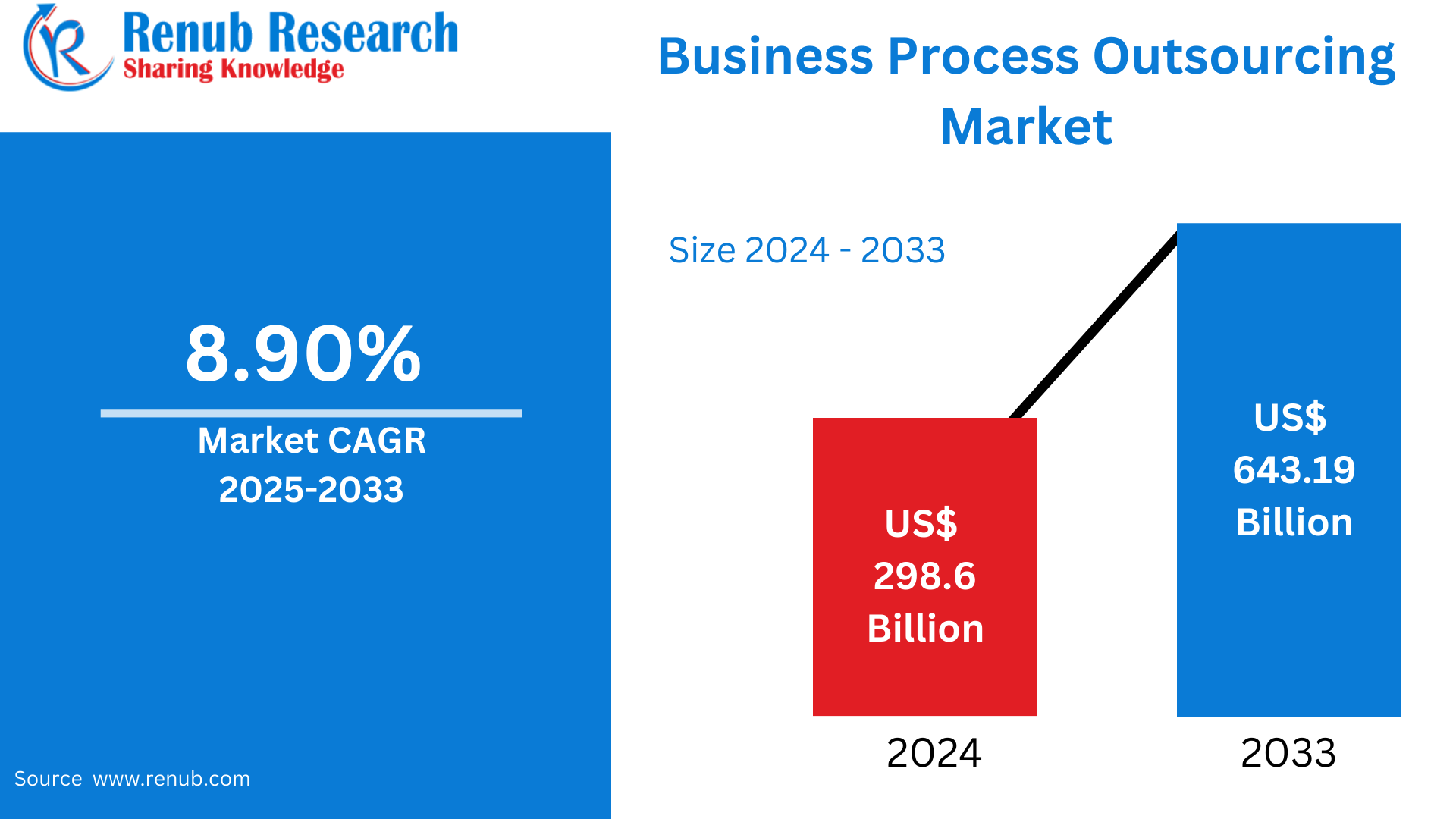

The Business Process Outsourcing (BPO) market size was US$ 298.6 billion in 2024 and is anticipated to grow to US$ 643.19 billion by 2033 at a CAGR of 8.90% during the period 2025-2033. The growth is fueled by increasing demand for cost-effectiveness, digitalization, and business firms concentrating on core competency by outsourcing non-core activities in IT, customer support, and financial areas.

Business Process Outsourcing Market Outlooks

Business Process Outsourcing (BPO) is the hiring out of typical business operations or processes to an external third-party service provider. Many firms use it to cut costs, increase efficiency, and maximize core business functions. BPO services normally fall within back-office (like accounting, data entry, and human resources) or front-office (like customer service, technical support, and marketing) functions.

BPO can be delivered through offshore (overseas providers), nearshore (neighboring countries), or onshore (within the same country) models, depending on cost, time zone, and language considerations. Common industries utilizing BPO include banking, insurance, telecom, healthcare, and e-commerce. The key advantages of BPO include access to global talent, scalability, 24/7 operations, and enhanced service quality. By outsourcing non-core activities, firms can drive productivity and more effectively dedicate internal assets to innovation and strategic planning. BPO is an essential business tool for operation flexibility in the competitive economy of today.

Growth Drivers in the Business Process Outsourcing Market

Demand for Cost Efficiency and Operational Flexibility

Firms are increasingly outsourcing non-core business processes to lower the cost of operations while ensuring effectiveness. By outsourcing services such as customer support, payroll, or data entry to BPO vendors—particularly in lower-cost locations—firms conserve on labor, infrastructure, and technology. Furthermore, BPO vendors provide scalability, enabling organizations to vary staffing levels and services as needed without long-term overhead. This agile model enables business resilience and accelerates digital transformation. With intensifying global competition, cost-effectiveness remains the leading motive driving BPO growth.

Emphasis on Core Business Functions

With growing pressure on companies to innovate and remain competitive, companies are giving importance to core functions like product development, customer interaction, and strategic planning. BPO facilitates this by taking care of routine or specialized tasks outside. This outsourcing strategy not only releases internal resources but also enhances the quality of services by tapping into specialized knowledge of third-party vendors. Especially in IT, HR, and finance, outsourcing allows for quicker response times, exposure to new technologies, and improved compliance, leading to overall increased productivity. March 2024, AnyMind Group launched BPaaS for Cross-Border Commerce solutions. It takes advantage of the company's own proprietary technology and operations services that have been built up in the Asia Pacific and Middle East regions while leveraging on the company's local networks of publishers and creators.

Technological Innovations and Automation Incorporation

The BPO industry has grown with the incorporation of technologies such as robotic process automation (RPA), artificial intelligence (AI), and cloud computing. These technologies boost precision, velocity, and scalability of outsourced services and minimize dependency on manual effort. Providers nowadays deliver value-added offerings such as intelligent customer service robots, predictive analytics, and automated back-office operations. This technology-driven transformation invites organizations looking to digitize operations without exorbitant capital investment. With the maturing of automation, BPO companies providing hybrid human-tech services are going to witness greater demand. February 2024, Acquire BPO has launched its new business division, Acquire.AI. Acquire.AI is well positioned to revolutionize industries by helping businesses identify, prioritize, and implement customized solutions for enhanced business efficiency, strong growth, and better customer experiences.

Challenges in the Business Process Outsourcing Market

Data Security and Compliance Issues

Processing of business functions usually entails the handling of sensitive customer or financial data, which creates issues of data security and compliance. Data breaches, unauthorized access, or non-compliance with standards such as GDPR and HIPAA can lead to financial and reputational loss. Organizations must ensure BPO vendors adopt robust cybersecurity practices, employee training, and compliance audit. The dilemma is more severe within sectors such as finance and healthcare. Trust establishment while ensuring control of data privacy continues to be the biggest obstacle for worldwide BPO adoption.

Communication Barriers and Service Quality Issues

One of the chronic issues with global BPO operations is having effective communication between client organizations and service providers. Time zones, language mismatches, and cultural misalignments can influence customer satisfaction and efficiency in workflows. Poor interpretation of instructions, delayed turnaround, and variability in quality impact overall service. Technology can cover some of the distances, but having seamless communication, transparency, and performance levels across dispersed teams is fundamental to long-term success in BPO alliances.

BPO in Customer Service and Support

Customer service is a leading segment in the BPO sector. Companies outsource inbound and outbound call center services, technical support, and social media interactions to maximize customer experience while keeping costs in check. Providers leverage multilingual support, AI-driven chatbots, and CRM software to enhance efficiency. With consumers expecting 24/7 support and customized service, outsourcing enables companies to remain responsive and competitive. The transition to value-adding customer interaction measures from cost-saving measures is intensifying demand for quality BPO customer service offerings.

BPO in Human Resource and Payroll

Outsourcing human resources operations, such as payroll, recruitment, onboarding, and benefits administration, enables businesses to concentrate on employee growth and strategy instead of administrative tasks. HR BPO vendors provide compliance know-how, worldwide payroll platforms, and scalable recruitment tools. This is especially valuable for multinational companies that must contend with intricate labor regulations. With remote work increasingly becoming the norm, there is a growing need for flexible, technology-enabled HR services, which is making HR outsourcing one of the main pillars of contemporary workforce management strategies.

BPO in IT and Technical Support

The IT outsourcing business in BPO is experiencing robust growth due to growing demand for far-from-home infrastructure management, cybersecurity, and software support. Businesses outsource IT activities to gain access to skilled people, ensure uptime, and embrace emerging technologies with minimal capital investment. Activities include help desk services and application maintenance up to network surveillance and cloud migration. As businesses are transforming digitally, IT outsourcing keeps them secure, nimble, and technologically current.

United States Business Process Outsourcing Market

The U.S. BPO market continues to be a world leader because of the strong demand for specialized services in finance, IT, healthcare, and customer experience management. American companies outsource both onshore and offshore to save costs and tap skilled talent. With a emphasis on data-driven insights and cloud adoption, BPO providers in the U.S. deliver more advanced, tech-enabled services. Domestic nearshoring trends are also increasing as businesses focus on data security and aim to enhance communication and service quality. For example, Capgemini purchased Aodigy Asia Pacific Pte Limited in September 2022 to enhance its end-to-end digital transformation capabilities. The business was anticipating using the acquisition to offer sustainable business solutions to regional customers.

France Business Process Outsourcing Market

France's BPO market is developing as organizations seek to rationalize non-core operations in the face of increasing operating expenses. French firms are embracing outsourcing for HR, customer service, and IT support, with growing emphasis on cloud and AI-based solutions. Data privacy under GDPR continues to be a prime consideration, with incentives to form alliances with European or nearshore vendors. Government incentives towards digital revolution and innovation are driving BPO uptake, especially by public sector organizations and mid-market companies in France. Teleperformance made a September 2023 investment to enhance its business in France through the improvement of their employee base and capabilities for service delivery. Wipro and Accenture are also traversing the expansion of the market by concentrating on automation and innovative technology solutions for boosting client activities.

India Business Process Outsourcing Market

India remains a world leader in the BPO sector, with a huge pool of English-speaking, skilled talent and affordable services. India's strength in IT, customer service, and finance processes positions it as a destination of choice for international companies. Indian BPOs are adopting automation, AI, and analytics to provide high-value, transformational services. The government's emphasis on digital infrastructure and skill development also helps fuel industry growth. While demand for outsourcing with technology increases, India continues to be at the heart of the international BPO market. July 2023 – NTT DATA, a global leader in digital business and IT services, announces the launch of an outsourcing service for security management (MDR service1) aimed at averting incidents and reducing damage when they happen. The service will initially be offered in Japan in July 2023, and rolled out globally within the financial year (March 2024).

Saudi Arabia Business Process Outsourcing Market

Saudi Arabia's BPO market is progressing steadily with Vision 2030 programs on economic diversification and digital transformation. Government and private sectors are outsourcing customer service, IT support, and HR activities to become more efficient and save costs. Increased use of cloud computing and intelligent technologies underlines BPO market growth. Moreover, domestic demand for Arabic-language support is also driving regional outsourcing relationships. Regulatory reforms and investment in digital infrastructure are making Saudi Arabia an up-and-coming BPO hub in the Middle East.

Business Process Outsourcing Market Segmentation

Service Type

- Finance & Accounting

- Customer Services

- Sales & Marketing

- KPO

- Human Resource

- Procurement & Supply Chain

- Logistics

- Training and Development Outsourcing

- Others

Outsourcing Type

- Offshore

- Nearshore

- Onshore

Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

End Use

- IT & Telecommunications

- BFSI

- Manufacturing

- Healthcare

- Retail

- Government & Defense

- Others

Countries

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

All companies have been covered with 4 Viewpoints

- Overview

- Key Persons

- Recent Development & Strategies

- Revenue Analysis

Key Players Analysis

- Accenture

- Triniter

- IBM

- Cognizant

- Concentrix

- Wipro

- Genpact

- Amdocs

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Service Type, Outsourcing Type, Enterprise Size, End User and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Business Process Outsourcing Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Business Process Outsourcing Market Share Analysis

6.1 By Service Type

6.2 By Outsourcing Type

6.3 By Enterprise Size

6.4 By End Use

6.5 By Countries

7. Service Type

7.1 Finance & Accounting

7.2 Customer Services

7.3 Sales & Marketing

7.4 KPO

7.5 Human Resource

7.6 Procurement & Supply Chain

7.7 Logistics

7.8 Training and Development Outsourcing

7.9 Others

8. Outsourcing Type

8.1 Offshore

8.2 Nearshore

8.3 Onshore

9. Enterprise Size

9.1 Large Enterprises

9.2 Small & Medium Enterprises

10. End Use

10.1 IT & Telecommunications

10.2 BFSI

10.3 Manufacturing

10.4 Healthcare

10.5 Retail

10.6 Government & Defense

10.7 Others

11. Countries

11.1 North America

11.1.1 United States

11.1.2 Canada

11.2 Europe

11.2.1 France

11.2.2 Germany

11.2.3 Italy

11.2.4 Spain

11.2.5 United Kingdom

11.2.6 Belgium

11.2.7 Netherlands

11.2.8 Turkey

11.3 Asia Pacific

11.3.1 China

11.3.2 Japan

11.3.3 India

11.3.4 South Korea

11.3.5 Thailand

11.3.6 Malaysia

11.3.7 Indonesia

11.3.8 Australia

11.3.9 New Zealand

11.4 Latin America

11.4.1 Brazil

11.4.2 Mexico

11.4.3 Argentina

11.5 Middle East & Africa

11.5.1 Saudi Arabia

11.5.2 UAE

11.5.3 South Africa

12. Porter’s Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Rivalry

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threat

14. Key Players Analysis

14.1 Accenture

14.1.1 Overview

14.1.2 Key Persons

14.1.3 Recent Development & Strategies

14.1.4 Revenue Analysis

14.2 Triniter

14.2.1 Overview

14.2.2 Key Persons

14.2.3 Recent Development & Strategies

14.2.4 Revenue Analysis

14.3 IBM

14.3.1 Overview

14.3.2 Key Persons

14.3.3 Recent Development & Strategies

14.3.4 Revenue Analysis

14.4 Cognizant

14.4.1 Overview

14.4.2 Key Persons

14.4.3 Recent Development & Strategies

14.4.4 Revenue Analysis

14.5 Concentrix

14.5.1 Overview

14.5.2 Key Persons

14.5.3 Recent Development & Strategies

14.5.4 Revenue Analysis

14.6 Wipro

14.6.1 Overview

14.6.2 Key Persons

14.6.3 Recent Development & Strategies

14.6.4 Revenue Analysis

14.7 Genpact

14.7.1 Overview

14.7.2 Key Persons

14.7.3 Recent Development & Strategies

14.7.4 Revenue Analysis

14.8 Amdocs

14.8.1 Overview

14.8.2 Key Persons

14.8.3 Recent Development & Strategies

14.8.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com