Mexico Point of Care Diagnostics Market – Trends & Forecast 2025–2033

Buy NowMexico Point of Care Diagnostics Market Size and Forecast 2025-2033

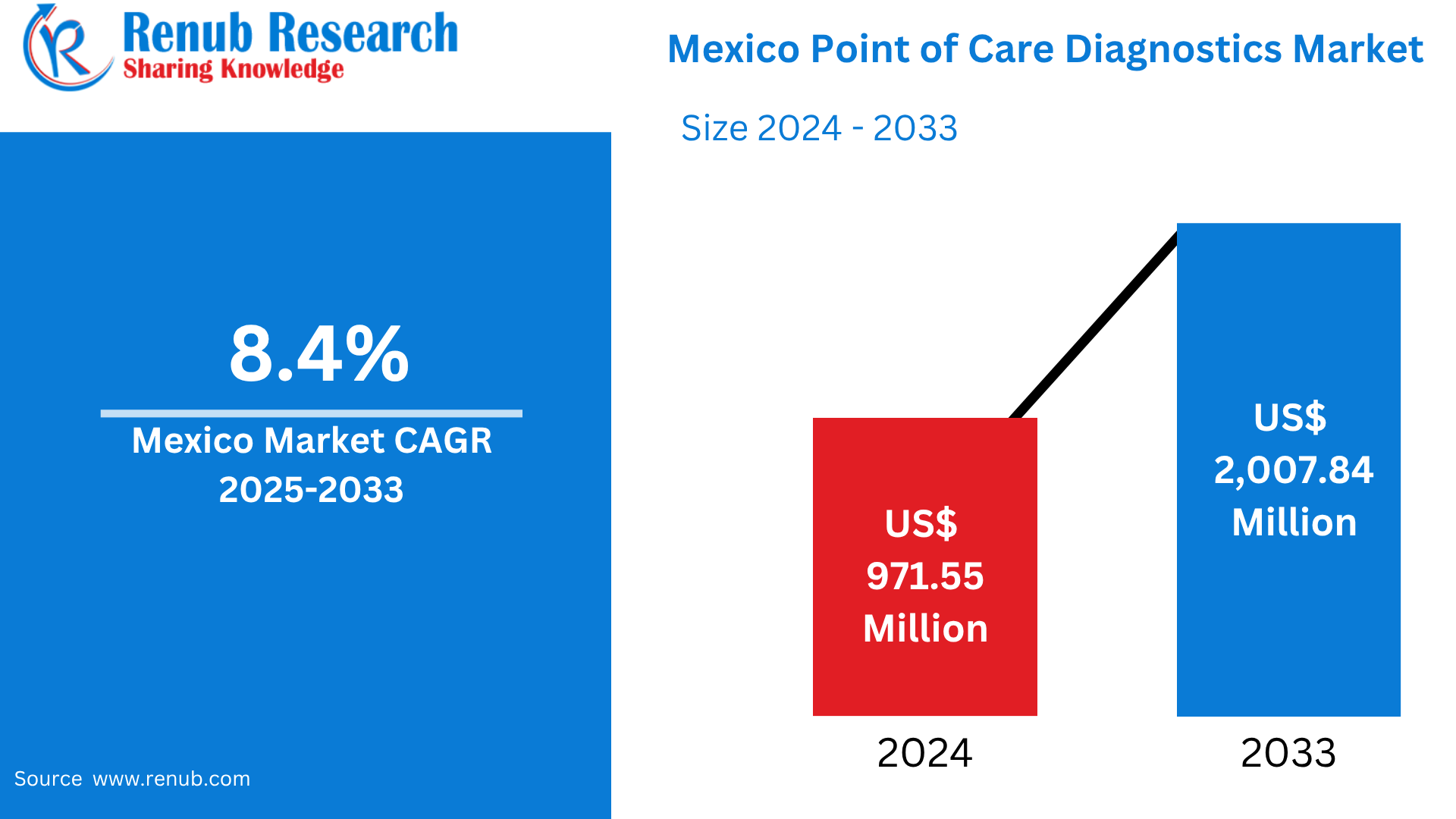

Mexico Point of Care Diagnostics Market is expected to reach US$ 2,007.84 million by 2033 from US$ 971.55 million in 2024, with a CAGR of 8.4% from 2025 to 2033. The growing frequency of infectious and chronic illnesses, the growing need for quick testing, and the expansion of healthcare access in rural regions are the main factors propelling the market. Government programs and technological developments to enhance early diagnosis and illness management also contribute to market expansion.

Mexico Point of Care Diagnostics Market Report by Product (Glucose Monitoring Kits, Infectious Diseases Kits, Pregnancy & Fertility Testing Kits, Hematology Testing Kits, Cardiometabolic Monitoring Kits, Urinalysis Testing Kits, Cholesterol Test Strips, Drugs Abuses Testing Kits, Others), Technology (Lateral Flow, Agglutination, Flow Through, Solid phase, Biosensor, Others), Mode of Prescription (Prescription-Based Devices, Over-the-counter (OTC)-Based Devices), End Users (Professional Diagnostic Centers, Research Laboratories, Home Care, Others) and Company Analysis, 2025-2033.

Mexico Point of Care Diagnostics Market Overview

The increasing need for effective, affordable, and easily accessible healthcare solutions is propelling the Point of Care Diagnostics (POC) market in Mexico to significant growth. By providing quicker answers, point-of-care testing enhances patient outcomes by enabling prompt diagnosis and decision-making outside of conventional laboratory settings. The aging population, infectious diseases, and the rising incidence of chronic illnesses are the main drivers of market expansion. POC devices have also become more widely used as a result of the COVID-19 epidemic, underscoring their value in handling public health emergencies by enabling quick testing and monitoring. The growth of POC diagnostics is further aided by the development of telemedicine and mobile health apps, which provide access to healthcare in Mexico's rural and metropolitan areas.

Government programs in Mexico that aim to improve healthcare accessible, especially in underprivileged areas, also help the market. The need of minimizing diagnostic delays and facilitating prompt actions is growing as healthcare infrastructure advances. Innovative POC solutions that are suited to the unique requirements of the Mexican populace are being developed by both domestic and foreign firms. These options include sophisticated molecular diagnostic tools, pregnancy tests, and glucose meters. The market for POC diagnostics in Mexico is anticipated to rise further as patients and healthcare professionals want to improve diagnostic precision and expedite healthcare delivery throughout the nation, notwithstanding obstacles including regulatory barriers and price sensitivity in the healthcare system.

Key Factors Driving the Mexico Point of Care Diagnostics Market Growth

An increase of chronic illnesses

In Mexico, the prevalence of chronic illnesses such as diabetes, high blood pressure, and heart disease is increasing, which has a substantial impact on the country's healthcare costs and system load. In 2024, cardiovascular illnesses accounted for almost 100,000 fatalities in the first half of the year, making them the top cause of mortality, according to Mexico's National Institute of Statistics and Geography (INEGI). This is more than deaths from cancer, COVID-19, and diabetes combined. In order to guarantee prompt clinical intervention and efficient disease treatment, the rising incidence of various chronic illnesses has increased the demand for ongoing, real-time diagnostic monitoring, which is further contributing to the favorable prognosis for the Mexico point-of-care market.

In this sense, point-of-care diagnostics are essential because they give patients and medical staff instant results that might affect treatment decisions at the moment. Accordingly, coagulation diagnostic equipment, lipid profile analyzers, and blood glucose monitors are becoming more popular for everyday usage in clinical and home-based care settings, which is driving market expansion. Point-of-care technology are becoming crucial tools to track patient compliance and lower hospital readmissions as the healthcare system places an emphasis on self-monitoring and preventative treatment.

Measures Taken by the Government to Improve Disease Surveillance

In light of the lessons learnt during the COVID-19 pandemic, the Mexican government has been aggressively boosting public health readiness through enhanced disease surveillance and diagnostic facilities. Point-of-care diagnostic instruments are being purchased and used in primary and secondary care institutions as a result of federal initiatives to increase access to healthcare and early illness identification. For example, the Instituto Mexicano del Seguro Social (IMSS) Bienestar program is being extended in 2024 to offer more than 53 million uninsured people free medical treatment. In order to provide ongoing treatment in isolated locations, this involves finishing hospitals that were previously incomplete and establishing surgical teams that are available around-the-clock in 282 rural hospitals. In order to control endemic conditions, monitor infectious disease outbreaks, and enhance maternal and child health outcomes, health authorities are giving priority on scalable and fast-testing solutions.

Increasing Requirement for Quick, Remote Testing

One of the main reasons driving the Mexico point-of-care market share is the growing need for quick and decentralized testing, especially in underserved and isolated areas. Disparities in healthcare access between urban and rural areas have led to a move toward on-site and mobile testing options that may provide findings right away without the need for centralized laboratory assistance. These issues are resolved by point-of-care (POC) diagnostics, which allow medical professionals to identify and track illnesses at the patient's location while cutting down on sample transportation and turnaround times at the lab. This is especially important during public health crises or infectious disease epidemics, when prompt detection is essential to control measures. Rapid testing, which increases patient throughput and lessens the operational burden on centralized facilities, is becoming more and more popular in metropolitan areas for usage in emergency rooms, outpatient departments, and private clinics. Additionally, it is anticipated that the drive for localized care delivery models would strengthen the need for these diagnostic instruments nationwide, further driving market expansion.

Challenges in the Mexico Point of Care Diagnostics Market

Lack of Awareness and Education

Point of Care (POC) diagnostics adoption in Mexico is hampered by a severe lack of knowledge and instruction among patients and healthcare professionals. Many medical practitioners might not be completely aware of the newest POC technologies or how they might increase the speed and accuracy of diagnosis, especially in rural locations. Adoption of these devices in clinical settings is therefore hesitant. Patients may not seek out or request these services if they are unaware of the benefits and availability of POC testing. In order to overcome this obstacle, focused educational programs are necessary to educate the public and medical professionals, promoting increased acceptance and incorporation of POC diagnostics into standard medical procedures.

Limited Training for Healthcare Providers

Another barrier to the extensive adoption of Point of Care (POC) diagnostics in Mexico is the lack of proper training for medical personnel on how to use and interpret these instruments. To obtain correct findings, POC tests frequently need for specialized technical abilities, but many healthcare professionals—particularly those in poor areas—may not have received the training they need to reliably utilize these technologies. The advantages of POC testing might be undermined by inaccurate diagnoses or postponed treatments if operating methods and result interpretation are not properly taught. In order to solve this, thorough training courses and workshops must be put in place to provide medical professionals the know-how to optimize the use of POC diagnostics in providing precise, prompt care.

Recent Developments in Mexico Point of Care Diagnostics Industry

- The Mexican government began its "door-to-door" senior healthcare initiative in 2024, sending medical teams to visit senior citizens in their homes. The program's main goals are to improve vulnerable, frequently immobile people' access to point-of-care services in rural and underserved regions by offering health exams, early illness diagnosis, and basic medical treatment.

Market Segmentations

Product

- Glucose Monitoring Kits

- Infectious Diseases Kits

- Pregnancy & Fertility Testing Kits

- Hematology Testing Kits

- Cardiometabolic Monitoring Kits

- Urinalysis Testing Kits

- Cholesterol Test Strips

- Drugs Abuses Testing Kits

- Others

Technology

- Lateral Flow

- Agglutination

- Flow Through

- Solid phase

- Biosensor

- Others

Mode of Prescription

- Prescription-Based Devices

- Over-the-counter (OTC)-Based Devices

End Users

- Professional Diagnostic Centers

- Research Laboratories

- Home Care

- Others

All the Key players have been covered

- Overview

- Key Persons

- Recent Developments

- Revenue Analysis

Company Analysis:

- Sysmex

- Abbott Laboratories

- Becton Dickinson and Company

- Danaher Corporation

- Quidel Diagnostics

- F. Hoffmann-La Roche Ltd

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

By Product, By Technology, By Mode of Prescription and By End Users |

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Mexico Point of Care Diagnostics Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Product

6.2 By Technology

6.3 By Mode of Prescription

6.4 By End Users

7. Product

7.1 Glucose Monitoring Kits

7.2 Infectious Diseases Kits

7.3 Pregnancy & Fertility Testing Kits

7.4 Haematology Testing Kits

7.5 Cardiometabolic Monitoring Kits

7.6 Urinalysis Testing Kits

7.7 Cholesterol Test Strips

7.8 Drugs Abuses Testing Kits

7.9 Others

8. Technology

8.1 Lateral Flow

8.2 Agglutination

8.3 Flow Through

8.4 Solid phase

8.5 Biosensor

8.6 Others

9. Mode of Prescription

9.1 Prescription-Based Devices

9.2 Over-the-counter (OTC)-Based Devices

10. End Users

10.1 Professional Diagnostic Centers

10.2 Research Laboratories

10.3 Home Care

10.4 Others

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1.1 Strength

12.1.2 Weakness

12.1.3 Opportunity

12.1.4 Threat

13. Key Players Analysis

13.1 Sysmex

13.1.1 Overviews

13.1.2 Key Person

13.1.3 Recent Developments

13.1.4 Revenue

13.2 Abbott Laboratories (US)

13.2.1 Overviews

13.2.2 Key Person

13.2.3 Recent Developments

13.2.4 Revenue

13.3 Becton Dickinson and Company (US)

13.3.1 Overviews

13.3.2 Key Person

13.3.3 Recent Developments

13.3.4 Revenue

13.4 Danaher Corporation (US)

13.4.1 Overviews

13.4.2 Key Person

13.4.3 Recent Developments

13.4.4 Revenue

13.5 Quidel Diagnostics (US)

13.5.1 Overviews

13.5.2 Key Person

13.5.3 Recent Developments

13.5.4 Revenue

13.6 F. Hoffmann-La Roche Ltd

13.6.1 Overviews

13.6.2 Key Person

13.6.3 Recent Developments

13.6.4 Revenue

13.7 Thermo Fisher Scientific Inc.

13.7.1 Overviews

13.7.2 Key Person

13.7.3 Recent Developments

13.7.4 Revenue

13.8 Bio-Rad Laboratories Inc.

13.8.1 Overviews

13.8.2 Key Person

13.8.3 Recent Developments

13.8.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com