Mexico Foodservice Market Analysis 2025–2033: Trends & Opportunities

Buy NowMexico Foodservice Market Trends & Opportunities

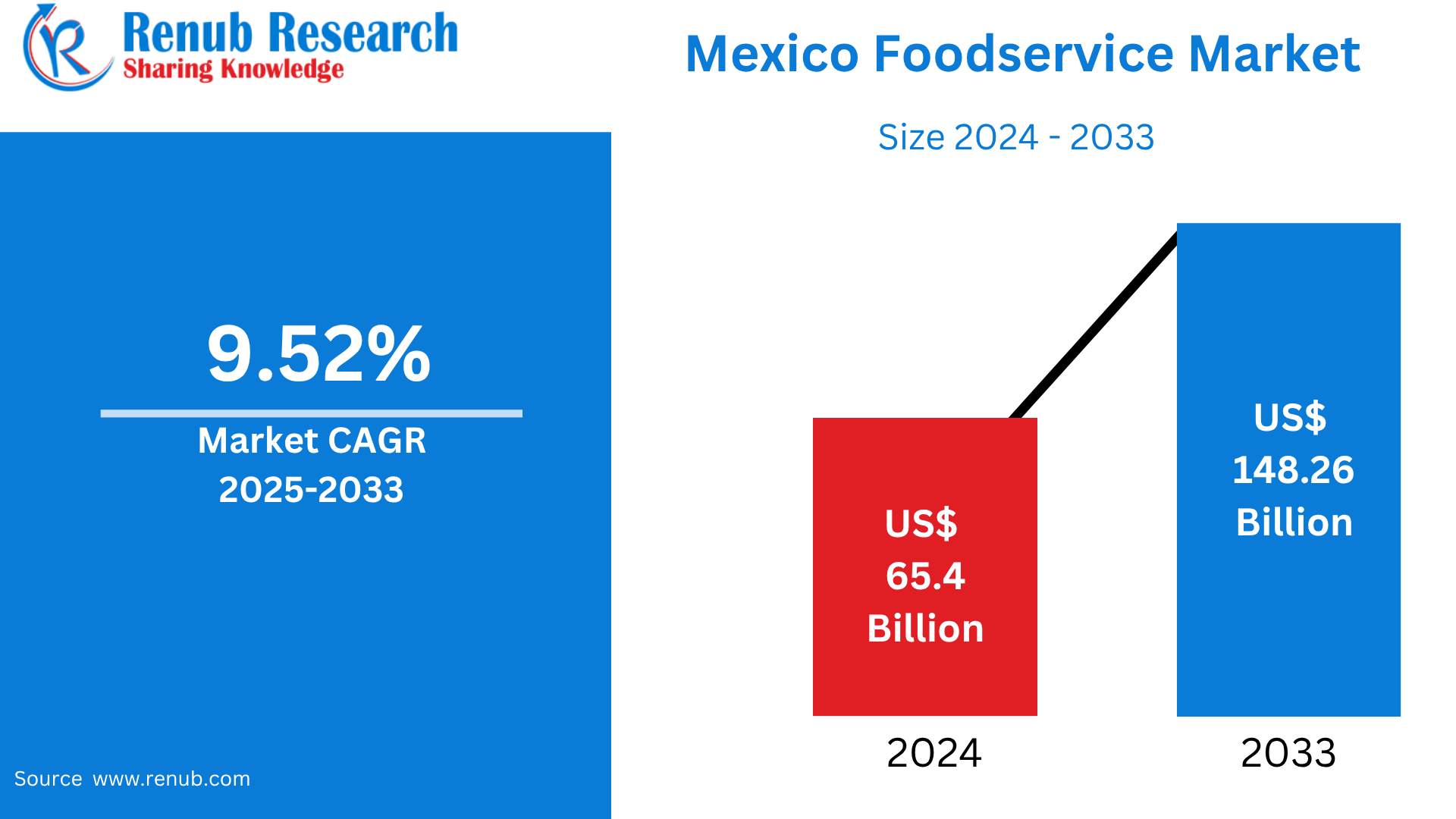

The Mexico foodservice market size was estimated to be USD 65.4 billion in 2024 and is expected to grow to USD 148.26 billion by 2033, recording a CAGR of 9.52% over the forecast period. The growth is fueled by urbanization, growing disposable incomes, rising tourism, and changing consumer lifestyles to favor convenience, variety, and online food delivery platforms in the quick-service, casual dining, and full-service restaurant segments.

Mexico Foodservice Market Outlooks

Foodservice is the industry segment that prepares, serves, and retails food and beverages away from home. This involves restaurants, cafes, food trucks, catering establishments, hotels, institutional cafeterias, and online food ordering sites. It encompasses a broad range of operations, ranging from fast food to high-end dining and corporate or school meal services.

Foodservice is an important industry in Mexico, both to the economy and to everyday life. Affluent gastronomic heritage, a booming tourism industry, and a growing urban population propel strong demand for varied eating occasions. Ranging from street-level tacos and informal restaurants to upscale restaurants and international brands, foodservice captures the nation's cultural diversity and changing consumption patterns. Digitalization has further increased its popularity, with apps and platforms facilitating convenient ordering, delivery, and table bookings. Increased disposable income, lifestyle shifts, and an expanding middle class have driven the popularity of eating out. Convenience, flavor, and social experience continue to fuel Mexican foodservice growth as consumers make their purchasing decisions.

Growth Drivers in the Mexico Foodservice Market

Urbanization and Lifestyle Shifts

Mexico's fast urbanization is bringing with it busy life and increased demand for quick food. With more individuals moving to cities, the demand for eating out or ordering meals over the internet is on the rise. This trend fuels the growth of foodservice units, particularly fast food, casual dining, and delivery units. People are looking for time-saving food options instead of cooking at home, making foodservice an integral element of city living.

Increasing Disposable Income and Middle-Class Growth

A growing middle class and increasing incomes are driving consumer spending on food and beverages away from home. This economic expansion has resulted in more frequent restaurant visits and increased experimentation with international and gourmet foods. Customers are willing to pay for quality, atmosphere, and convenience, stimulating investment in full-service restaurants, food courts, and quick-service chains. This trend fuels steady growth in both local and international foodservice brands.

Emergence of Online Food Delivery Platforms

The expansion of digital food platforms such as Uber Eats, Rappi, and Didi Food has reshaped the Mexican foodservice market. Customers have more convenience, choice, and accessibility, leading to increased demand from formerly underserved markets. Restaurants gain broader reach and data insights. The pandemic hastened this movement, and the trend maintains pace with robust mobile penetration, smartphone usage, and contactless payments. This digital expansion creates new revenue streams for foodservice providers.

Obstacles in the Mexico Foodservice Market

High Informal Sector and Fragmentation

A massive unlicensed food vendor market in Mexico is problematic for formal foodservice businesses. Street vendors and small restaurants dominate, many unlicensed and unregulated, with lower prices that undercut larger operators. The fragmentation results in decreased consistency in food quality and safety while increasing difficulty for formal companies to capture market share. Regulatory programs are in place, but enforcement is mixed across geographies.

Economic Instability and Inflation

Vicissitudes in the Mexican economy, such as increasing inflation and currency fluctuations, affect foodservice operations. Increased input costs for ingredients, labor, and utilities can compress profit margins. Customers can reduce discretionary spending during economic slumps, thereby reducing restaurant traffic and sales. These demands stretch small and medium-sized foodservice operators, especially those without price power or scale economies to buffer cost escalation.

Mexico Commercial Foodservice Market

Full-service restaurants, cafes, bars, fast food chains, and food trucks make up the commercial foodservice market in Mexico. Consumer expenditure, tourist activity, and urbanization drive this segment. Commercial establishments are better able to cope with shifting trends, including plant-based menus, fusion dishes, and sustainability measures. As interest in social eating and culinary experiences increases, the commercial market draws investment from both local entrepreneurs as well as international chains. Its development is also led by robust demand for digital ordering and delivery integration, and thus it is a dynamic and rapidly changing segment of the foodservice industry.

Mexico Traditional Foodservice Market

The traditional foodservice industry consists of institutions such as hospitals, schools, corporate cafeteria facilities, prisons, and government buildings. These establishments prepare meals and serve them on the premises, usually from in-house kitchens or outsourced suppliers. Public investment in education and healthcare drives demand. Although less adaptable than commercial dining, this market enjoys stable contracts and bulk meal preparation. Food safety and nutritional standards are of primary importance. As the Mexican government and private institutions continue to extend their services, the traditional segment offers consistent, long-term growth prospects, especially for institutional foodservice providers and contract caterers.

Mexico Fast Food Foodservice Market

Fast food is among the most widely consumed and fast-growing categories in Mexico's foodservice sector. Motivated by affordability, speed, and convenience, it is very appealing to the urban youth and working-class consumers. International chains such as McDonald's, Burger King, and KFC compete with local chains and taco stands. The segment has also adopted digital delivery platforms, making it more accessible. Localization of the menu and healthier alternatives are the new trends with changing consumer preferences. Fast food's wider popularity, reduced prices, and effective business models guarantee its ongoing growth, particularly in urban areas and highway corridors.

Mexico Full-Service Foodservice Market

Sit-down eating with table service is provided by full-service restaurants in Mexico, such as casual dining, family restaurants, and fine dining. They provide solutions to special occasions, business dining, and recreational dining. Growth is driven by increased consumer expenditures and a need for varied dining experiences. International and regional cuisines are increasing in popularity, as is chef-led concept. The segment has more to contend with in terms of operational expenses and susceptibility to recession, but full-service restaurants enjoy solid brand equity and experiential value. The growth of casual dining and themed restaurants shows the segment's high-end positioning within the market.

North Mexico Foodservice Market

Northern Mexico along the U.S. border enjoys a vibrant foodservice sector driven by cross-border trade, tourism, and consumer patterns from the U.S. Fast casual and international cuisine are in strong demand in cities such as Monterrey, Tijuana, and Ciudad Juárez. The north enjoys favorable logistics networks and incomes on the higher side. Most American foodservice chains pilot Mexican operations in the north because of cultural and economic affinities. Proximity to the U.S. also fosters cross-border food trends and imports, giving rise to a hybrid food culture. This is a strategic entry point for new foodservice concepts.

South Mexico Foodservice Market

Southern Mexico, comprising states of Oaxaca, Chiapas, and Yucatán, is entrenched in traditional and indigenous foods. The foodservice market here is more fragmented with a combination of local restaurants, markets, and street vendors. Tourism is a dominant sector, particularly in resort cities such as Cancún and Mérida, where hotel restaurants and seashore dining are prevalent. Although infrastructure might be less advanced in the south than in the north, cultural depth and biodiversity provide a basis for farm-to-table ideas, culinary tourism, and eco-dining. Opportunities for growth include formalizing informal vendors, enhancing supply chains, and increasing access to digital technology in rural areas.

Market Segmentation

Sector

- Commercial

- Non-commercial

System

- Conventional Foodservice System

- Centralized Foodservice System

- Ready Prepared Foodservice System

- Assembly-Serve Foodservice System

Type of Restaurant

- Fast Food Restaurants

- Full-Service Restaurants

- Limited Service Restaurants

- Special Food Services Restaurants

Region

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

All companies have been covered from 5 viewpoints:

- Overviews

- Key Person

- Recent Developments

- SWOT Analysis

- Revenue Analysis

Key Players Analysis

- Papa John's International Inc.

- Alsea SAB de CV

- Yum! Brands Inc.

- Arcos Dorados Holdings Inc.

- CMR SAB de CV

- Seven & I Holdings Co. Ltd

- Jack In The Box Inc.

- Grupo Gigante SAB de CV

- Fomento Economico Mexicano SAB de CV

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Sector, System, Type of Restaurant and Region |

| Region Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Mexico Foodservice Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Sector

6.2 By System

6.3 By Type of Restaurant

6.4 By Region

7. Sector

7.1 Commercial

7.1.1 Market Analysis

7.1.2 Market Size & Forecast

7.2 Non-commercial

7.2.1 Market Analysis

7.2.2 Market Size & Forecast

8. System

8.1 Conventional Foodservice System

8.1.1 Market Analysis

8.1.2 Market Size & Forecast

8.2 Centralized Foodservice System

8.2.1 Market Analysis

8.2.2 Market Size & Forecast

8.3 Ready Prepared Foodservice System

8.3.1 Market Analysis

8.3.2 Market Size & Forecast

8.4 Assembly-Serve Foodservice System

8.4.1 Market Analysis

8.4.2 Market Size & Forecast

9. Type of Restaurant

9.1 Fast Food Restaurants

9.1.1 Market Analysis

9.1.2 Market Size & Forecast

9.2 Full-Service Restaurants

9.2.1 Market Analysis

9.2.2 Market Size & Forecast

9.3 Limited Service Restaurants

9.3.1 Market Analysis

9.3.2 Market Size & Forecast

9.4 Special Food Services Restaurants

9.4.1 Market Analysis

9.4.2 Market Size & Forecast

10. Region

10.1 Northern Mexico

10.1.1 Market Analysis

10.1.2 Market Size & Forecast

10.2 Central Mexico

10.2.1 Market Analysis

10.2.2 Market Size & Forecast

10.3 Southern Mexico

10.3.1 Market Analysis

10.3.2 Market Size & Forecast

10.4 Others

10.4.1 Market Analysis

10.4.2 Market Size & Forecast

11. Value Chain Analysis

12. Porter's Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Competition

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threats

14. Pricing Benchmark Analysis

14.1 Papa John's International Inc.

14.2 Alsea SAB de CV

14.3 Yum! Brands Inc.

14.4 Arcos Dorados Holdings Inc.

14.5 CMR SAB de CV

14.6 Seven & I Holdings Co. Ltd

14.7 Jack In The Box Inc.

14.8 Grupo Gigante SAB de CV

14.9 Fomento Economico Mexicano SAB de CV

15. Key Players Analysis

15.1 Papa John's International Inc.

15.1.1 Overviews

15.1.2 Key Person

15.1.3 Recent Developments

15.1.4 SWOT Analysis

15.1.5 Revenue Analysis

15.2 Alsea SAB de CV

15.2.1 Overviews

15.2.2 Key Person

15.2.3 Recent Developments

15.2.4 SWOT Analysis

15.2.5 Revenue Analysis

15.3 Yum! Brands Inc.

15.3.1 Overviews

15.3.2 Key Person

15.3.3 Recent Developments

15.3.4 SWOT Analysis

15.3.5 Revenue Analysis

15.4 Arcos Dorados Holdings Inc.

15.4.1 Overviews

15.4.2 Key Person

15.4.3 Recent Developments

15.4.4 SWOT Analysis

15.4.5 Revenue Analysis

15.5 CMR SAB de CV

15.5.1 Overviews

15.5.2 Key Person

15.5.3 Recent Developments

15.5.4 SWOT Analysis

15.5.5 Revenue Analysis

15.6 Seven & I Holdings Co. Ltd

15.6.1 Overviews

15.6.2 Key Person

15.6.3 Recent Developments

15.6.4 SWOT Analysis

15.6.5 Revenue Analysis

15.7 Jack In The Box Inc.

15.7.1 Overviews

15.7.2 Key Person

15.7.3 Recent Developments

15.7.4 SWOT Analysis

15.7.5 Revenue Analysis

15.8 Grupo Gigante SAB de CV

15.8.1 Overviews

15.8.2 Key Person

15.8.3 Recent Developments

15.8.4 SWOT Analysis

15.8.5 Revenue Analysis

15.9 Fomento Economico Mexicano SAB de CV

15.9.1 Overviews

15.9.2 Key Person

15.9.3 Recent Developments

15.9.4 SWOT Analysis

15.9.5 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com