Mexico Carmine Market – Natural Colorant Trends & Forecast 2025–2033

Buy NowMexico Carmine Market Size and Forecast 2025-2033

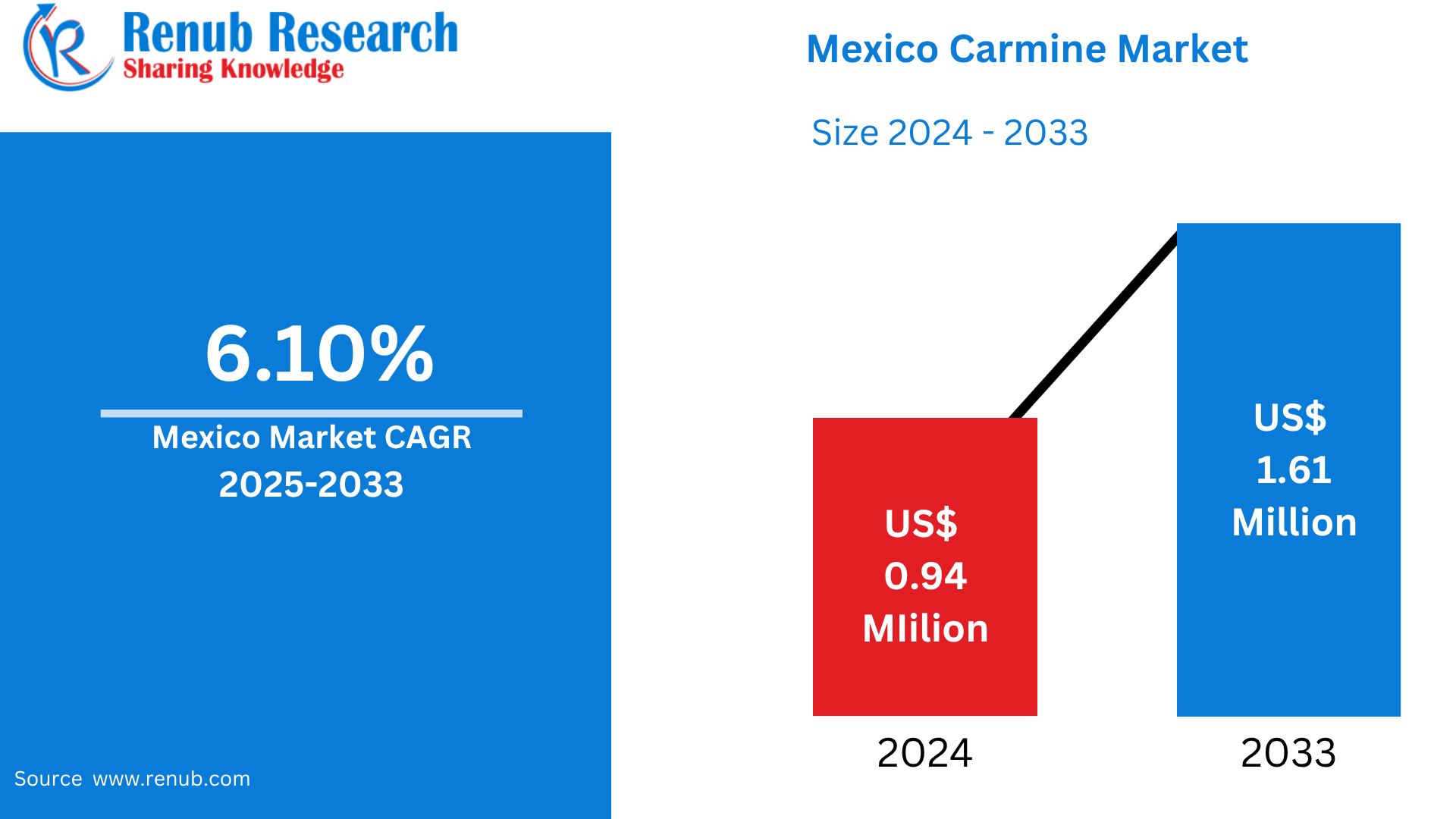

Mexico Carmine Market is expected to reach US$ 1.61 million by 2033 from US$ 0.94 million in 2024, with a CAGR of 6.10% from 2025 to 2033. The increased need for natural dyes in foods, cosmetics, and pharmaceuticals, consumer trend toward clean-label products, increased export opportunities, and favorable government initiatives favoring industries of natural ingredients and sustainable cochineal insect rearing are the primary drivers of the Mexican carmine market growth.

Mexico Carmine Market Report by Application (Bakery & Confectionery, Beverages, Dairy & Frozen Products, Meat Products, Fruits & Vegetables, Oil & Fat, Cosmetics, Other Food Products), Form (Liquid, Powder, Crystal), End Users (Food Processing Companies,, Beverage Industry, Catering Industry, Cosmetics and Pharmaceutical Industry)and Company Analysis 2025-2033.

Mexico Carmine Market Overview

Carminic acid, which is extracted from cochineal insects (Dactylopius coccus), is the origin of carmine, a red pigment that occurs naturally. In countries such as Mexico and Peru, these insects are mostly grown on prickly pear cacti. Insects are gathered, dried, and processed to form the dye. Due to its vibrant red color and chemical stability, carmine has been utilized for centuries in food, cosmetics, textiles, and drugs. It is commonly used in medications, yogurts, candies, and lipsticks. Carmine usage has grown as individuals prefer natural products over artificial ones. Nonetheless, vegans and people with allergies may worry about its insect source.

Increasing demand for natural and sustainable pigments globally, especially across the food, cosmetics, and pharmaceutical industries, is driving growth for Mexico's carmine industry. Carmine is gaining increasing popularity as a natural alternative for synthetic colorants as consumers shift toward clean-label and plant-based products. Secure production is assured by the perfect climate and traditional cochineal cultivation of Mexico, and government initiatives supporting natural ingredients also encourage business expansion. Increasing exports to Europe, Asia, and North America also increase market potential. Demand for Mexican carmine continues to be fueled by improved processing and uses and heightened awareness of its beneficial impacts on the environment and human health.

Growth Drivers for the Mexico Carmine Market

Rising Demand for Natural Products

The Mexico carmine market is growing immensely on account of the increasing demand for natural products. There has been a discernible trend toward naturally sourced and clean-label ingredients in food, cosmetics, and pharmaceuticals as consumers across the globe become increasingly ecologically aware and health driven. Carmine derived from the cochineal insect has been considered a healthier and greener alternative to man-made dyes, which are under scrutiny for potential health risks. Natural colorants such as carmine have gained popularity as consumers prefer fewer artificial additives in a range of products, including beverages, confections, dairy products, and personal care products. Mexico is well placed to provide this demand with its well-established methods of cochineal farming and favorable conditions for production, which will ensure local consumption as well as export opportunities.

Expanding Applications

Escalating applications in numerous industries are one of the key drivers propelling the market for carmine in Mexico. Due to its intense red hue, great stability, and natural origin, carmine that has long been used as a food and beverage additive is increasingly applied in cosmetics, medicines, textiles, and personal care products. It is a favorite ingredient of eyeshadows, blushes, and lipsticks in cosmetics to meet consumer interest in green and sustainable cosmetic products. Carmine is also utilized to tint syrups and tablets in the pharmaceutical world. Carmine's versatility also inspires its application in gourmet and artisanal food products, enhancing aesthetic value. This expansion of applications, coupled with natural products' trends, accelerates demand and inspires Mexico to continue increasing its carmine production and export opportunities.

Stricter Regulations on Synthetic Dyes

The carmine industry in Mexico is expanding considerably due to tighter laws regulating synthetic dyes. Regulatory bodies around the globe are putting more controls on artificial coloring use in foodstuffs, cosmetics, and drugs because of health issues, such as links to child hyperactivity and potential carcinogenic effects. For instance, the U.S. is urging manufacturers to change over to natural colors. Food and Drug Administration (FDA), which is actively seeking to eliminate artificial colorants such as Red 3 and Yellow 5. Likewise, due to safety reasons, some synthetic pigments have been prohibited by the European Union. Due to such policy shifts, companies are searching for safer, natural pigments, and one such natural colorant is carmine, a cochineal insect-based colorant. Mexico is well-placed to meet this increasing demand domestically as well as through exports due to its long-standing cochineal agricultural industry.

Challenges in the Mexico Carmine Market

Labor-Intensive Production

One of the biggest problems facing the Mexican carmine market is labor-intensive manufacture. Cochineal insect cultivation, harvesting, and carminic acid extraction are labor-intensive and time-consuming processes. Mechanization and large-scale industrialization are limited since each stage, from rearing the insects on cactus plants to drying and processing them, requires careful handling and conventional methods. Compared to synthetic dyes or plant-based substitutes, this heavy reliance on manual labor raises production costs and limits scalability. The industry may find it difficult to effectively meet supply as demand rises globally, which might reduce its competitiveness and slow its rate of rapid expansion.

Price Volatility

For the Mexican carmine market, price volatility is a major obstacle. Weather, pest infestations, and changes in cochineal bug populations are some of the major elements that affect carmine prices. Because harvesting depends on seasonal cycles, any interruptions, such as sickness or drought, can lower supplies and raise prices. Furthermore, manufacturing costs may increase due to a lack of workers or growing wages in rural farming areas. These elements lead to price volatility, which makes it challenging for customers to properly budget and for producers to forecast expenses. Carmine's ability to compete with other natural colorants or synthetic dyes may also be impacted by this volatility.

Market Segmentation:

Application

- Bakery & Confectionery

- Beverages

- Dairy & Frozen Products

- Meat Products

- Fruits & Vegetables

- Oil & Fat

- Cosmetics

- Other Food Products

Form

- Liquid

- Powder

- Crystal

End Users

- Food Processing Companies

- Beverage Industry

- Catering Industry

- Cosmetics and Pharmaceutical Industry

All companies have been covered from 4 viewpoints:

- Company Overview

- Key Persons

- Recent Development & Strategies

- Sales Analysis

Key Players Analysis

- Clariant AG

- Naturex (Givaudan)

- NATUREX (GIVAUDAN)

- Sensient Technologies Corporation

- The Hershey Company

- Biocon

- Amerilure

- DDW Color House

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

By Application, By Form and By End Users |

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Mexico Carmine Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Application

6.2 By Form

6.3 By End Users

7. Application

7.1 Bakery & Confectionery

7.2 Beverages

7.3 Dairy & Frozen Products

7.4 Meat Products

7.5 Fruits & Vegetables

7.6 Oil & Fat

7.7 Cosmetics

7.8 Other Food Products

8. Form

8.1 Liquid

8.2 Powder

8.3 Crystal

9. End Users

9.1 Food Processing Companies

9.2 Beverage Industry

9.3 Catering Industry

9.4 Cosmetics and Pharmaceutical Industry

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 Clariant AG

12.1.1 Overviews

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 Naturex (Givaudan)

12.2.1 Overviews

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 NATUREX (GIVAUDAN)

12.3.1 Overviews

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 Sensient Technologies Corporation

12.4.1 Overviews

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 The Hershey Company

12.5.1 Overviews

12.5.2 Key Person

12.5.3 Recent Developments

12.5.4 Revenue

12.6 Biocon

12.6.1 Overviews

12.6.2 Key Person

12.6.3 Recent Developments

12.6.4 Revenue

12.7 Amerilure

12.7.1 Overviews

12.7.2 Key Person

12.7.3 Recent Developments

12.7.4 Revenue

12.8 DDW Color House

12.8.1 Overviews

12.8.2 Key Person

12.8.3 Recent Developments

12.8.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com