Global Meat Snacks Market Size, Share & Forecast 2025–2033

Buy NowMeat Snacks Market Size and Forecast 2025-2033

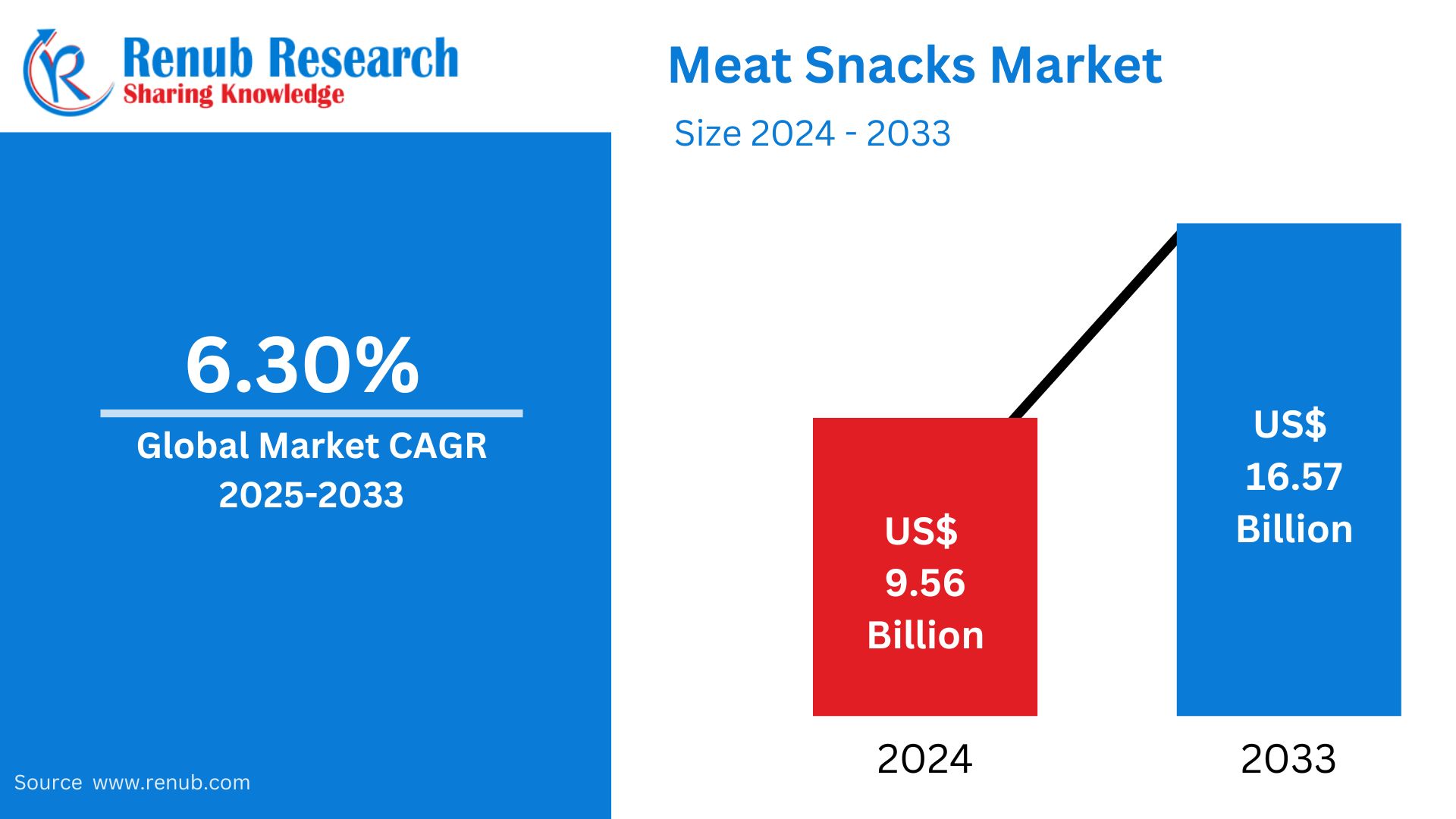

The global meat snacks market is estimated to witness strong growth and will reach US$ 16.57 billion by 2033, from US$ 9.56 billion in 2024, with a compound annual growth rate of 6.30% between 2025 and 2033. Market growth is being supported by rising demand among consumers for convenient, high-protein snack options. Flavour innovations, clean-label products, and an increasingly on-the-go lifestyle add momentum to this growth. The other important factors are the emerging markets and premium offerings that contribute strongly to the sector's robust growth trajectory.

Meat Snacks Market Overview

Meat snacks are ready-to-eat protein-rich food products that come from a variety of types of meat, including beef, pork, chicken, or even turkey. Most of the time, they are cured and dried, smoked, or seasoned in order to improve their flavor and longer shelf life. Some examples are jerky, meat sticks, sausages, biltong, or small chunks of meat. Typically, they are seasoned with spices, herbs, and marinades to add flavors that vary from traditional smoky or savory to some bold spicy profiles. Meat snacks are versatile, which fulfills different needs in contemporary diets. They are highly used as ready-to-go snacks; the moment they are opened, these meat snacks will immediately satisfy with an energy boost. Their high content of protein makes them favorite for individuals engaging in workouts since they consume it right after their workouts to promote recovery at the muscle level. With them being very portable and durable over time, they have become favorites in the practice of hiking, camping, or traveling. Besides, they act as appetizers, party bites, or even accompany charcuterie boards. Increased demand for low-carb and high-protein healthy snacks has further redefined their position in modern diets.

Meat Snacks Industry Growth Drivers

High-Protein Snacks Demand

Increased concern about health and wellness prompts demand for high-protein snack consumption, thereby making meat snack consumption more in demand. Consumers seek nutrient-dense options to fuel their active lifestyles, and meat snacks provide a convenient, satiating solution. Fitness enthusiasts’ value them as a source of lean protein, essential for muscle repair and energy. The popularity of low-carb and keto diets has further boosted demand, as meat snacks align perfectly with these dietary trends. With protein content front and center on packaging, meat snacks are gaining popularity as a healthier alternative to traditional chips and sugary snack products. In October 2024, The UK's best-selling pork pie brand is launching Meateors, a new meat-snacking brand specializing in ready-to-eat, protein-packed pork meatballs to add variety and excitement.

Convenience and On-the-Go Lifestyles

Modern lifestyles emphasize convenience, driving the growth of portable and ready-to-eat food options like meat snacks. As more consumers opt for quick snacks during work, travel, or outdoor activities, meat snacks' long shelf life, easy portability, and minimal preparation make them an ideal choice. Retailers and manufacturers are capitalizing on this trend by offering single-serve packs, resealable bags, and innovative packaging. These products will satisfy the on-the-go consumerist who needs to snack quickly but is still satisfied, making meat snacks an essential part of the booming market for convenient food products. Country Archer Provisions will feature its new Ancestral Beef Blend Meat Sticks and Pasture-Raised Bison Jerky at Natural Products Expo West 2024, set for March 2024. These new additions will add more options to its premium, high-protein snacks line.

Product Innovation and Flavor Diversification

Product innovation and flavor diversification are key drivers in the meat snacks market. Manufacturers are continually introducing new flavors, like teriyaki, spicy chili, and honey barbecue, for changing consumer tastes. More than flavor, innovation also includes healthy options such as low-sodium, organic, grass-fed meat snacks, and plant-based alternatives to attract flexitarians and vegetarians. Including global and regional spices also expands the appeal. These innovations fuel consumer interest and help establish meat snacks as an open, vibrant product category to consumers of various dietary preference and cultural tastes. September 2024 is when Chomps introduces its first LTF offering: Smoky BBQ Beef with natural hardwood smoke, evoking a woodfire flavor. It will have no sugar and live up to the requirements Chomps has of no sugar added.

Meat Snacks in Jerky

Jerky Products is expected to lead the global meat snacks market because of their convenience, portability, and extended shelf life. Protein bars have cast a spell on athletes and busy professionals because they can be enjoyed as a quick snack, versatile and enjoyable. Additionally, the different flavors and textures jerky provides are suited to varied tastes, and therefore, solidifies its status. With increasing demand for on-the-go protein-packed options, Jerky Merchandise is the first port of call for snack lovers everywhere.

Traditional Meat Snacks Market

Conventional meat snacks are predicted to maintain the largest share within the market. This can be attributed to their customer base installed and full-size availability. Although the upward push for alternative options, conventional meat snacks persist with long-term appeal based on familiarity and convenience. They offer a sense of indulgence, pleasure, comfort and several flavor choices. This entrenched market presence and continuous innovation to adapt to changing customer alternatives guarantee that conventional meat snacks are leading in the global market.

Supermarkets and Hypermarkets Meat Snacks Market

Supermarkets and hypermarkets are expected to have a solid footing in the global meat snacks market. This is because of their convenience and huge product offerings. These retail giants offer various meat snack options, making them readily available to consumers. Furthermore, their strategic share in city and suburban areas ensures high accessibility. With the ability to avail economies of scale and having adequate promotion and promotion plans, supermarkets and hypermarkets are expected to maintain their strong market share in the meat snacks business.

United States Meat Snacks Market

The United States is expected to lead the global meat snacks market. With a tradition that favors protein-rich snacks and a vast populace of on-the-go purchasers, the demand for meat snacks always remains excessive. For example, the Food and Health Survey Spotlight 2022 found that nearly 73% of clients snack once a day, and 14% tend to snack more than twice daily. Additionally, the United States has a robust meat manufacturing and distribution infrastructure, which ensures ample delivery. Multiple tastes and flavors are also available in various formats to support the market. Such factors position the United States at the forefront of the global meat snacks market.

France Meat Snacks Market

Meat Snacks market in France is also experiencing an increasing trend as the consumer trends for the availability of a high protein-rich convenient snack. Traditionally, France is charcuterie country, yet today the younger and more urbanized consumer is buying its meat snacks, especially those with modern labels such as jerky, meat sticks, or even salami. Low-fat and high-protein or organic meat snacks align very well with lifestyles focused on wellness, but this is also true about snacking on the go; there are more supermarkets and more convenience stores that offer this option. Flavor innovations and premium offerings, including artisanal and sustainably sourced meat snacks, are driving market growth further.

China Meat Snacks Market

The meat snacks market in China is growing rapidly, driven by rising consumer demand for convenient, protein-rich snacks. Traditional Chinese dried meat products, such as pork jerky and preserved sausages, have long been popular. However, Western-style meat snacks like beef jerky and meat sticks have gained popularity, especially among young, urban consumers. Increased consumption of healthier foodstuffs has led to the rise of low-fat and high-protein food products, while new flavors and premium products are catering to changing tastes. Growing the e-commerce sector in China expands market access, as online portals enhance the availability and visibility of various meat snack products.

Saudi Arabia Meat Snacks Market

The meat snacks market in Saudi Arabia is growing constantly, driven by increasing consumer demand for convenient and protein-enriched snack options. According to religious dietary requirements, the sale of halal-certified meat snacks, such as beef jerky, meat sticks, and dried sausages, dominates the market. As these products particularly, appeal to more youthful consumers and busy professionals seeking on-the-go nutrition, this increases their demand. Rising popularity of healthy diets, including high protein and low carbohydrate diets also contributes to demand. Flavor innovations, such as spicy and herb-infused, are also aligned with consumer preferences. Moreover, through the expansion of retail channels and e-commerce, the convenience will increase, and thus customers will prefer meat snacks for their purposes of quick and satisfying snacks.

Key Players in the Global Meat Snacks Market

- Nestlé S.A., Hormel Foods, Conagra Brands, Bridgford Foods, Hershey, Associated British Foods plc, Tyson Foods, Inc., Danish Crown, and Kerry Group plc.

- In April 2023, a New Delhi startup, Doki Foods, launched chicken chips and buffalo jerky in India. These products are available in various flavors, including Korean Gochujang, Tokyo Teriyaki, and Telicherry pepper.

- In March 2023, Chomps Company launched two new flavors of meat snacks in the beef category in the United States. The company said that the latest products are Taco Beef and Habanero Beef, packed with 10 grams of protein, 100 calories, and no added sugar.

Meat Snacks Market Segmentation

Product

- Jerky

- Sticks

- Sausages

- Others

Nature

- Conventional

- Organic

Distribution Channels

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail Stores

- Others

Regional Analysis

North America

- United States

- Canada

- Mexico

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Switzerland

Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Australia

South America

- Brazil

- Argentina

Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

Rest of World

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Company Analysis:

- Nestlé S.A.

- Hormel Foods

- Conagra Brands

- Bridgford Foods

- Hershey

- Associated British Foods plc,

- Tyson Foods, Inc.

- Danish Crown

- Kerry Group plc

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product, Nature, Distribution Channel, and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Meat Snacks Market

6. Market Share

6.1 By Products

6.2 By Nature

6.3 By Distribution Channels

6.4 By Countries

7. Products

7.1 Jerky

7.2 Sticks

7.3 Sausages

7.4 Others

8. Nature

8.1 Conventional

8.2 Organic

9. Distribution Channels

9.1 Supermarkets/Hypermarkets

9.2 Convenience Stores

9.3 Online Reatail Stores

9.4 Others

10. Countries

10.1 North America

10.1.1 United States

10.1.2 Canada

10.1.3 Mexico

10.2 Europe

10.2.1 Germany

10.2.2 United Kingdom

10.2.3 France

10.2.4 Italy

10.2.5 Spain

10.2.6 Switzerland

10.3 Asia Pacific

10.3.1 Japan

10.3.2 China

10.3.3 India

10.3.4 South Korea

10.3.5 Indonesia

10.3.6 Australia

10.4 South America

10.4.1 Brazil

10.4.2 Argentina

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 United Arab Emirates

10.5.3 South Africa

10.6 Rest of World

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 Nestlé S.A.

13.1.1 Overview

13.1.2 Recent Development

13.1.3 Revenue Analysis

13.2 Hormel Foods

13.2.1 Overview

13.2.2 Recent Development

13.2.3 Revenue Analysis

13.3 Conagra Brands

13.3.1 Overview

13.3.2 Recent Development

13.3.3 Revenue Analysis

13.4 Bridgford Foods

13.4.1 Overview

13.4.2 Recent Development

13.4.3 Revenue Analysis

13.5 Hershey

13.5.1 Overview

13.5.2 Recent Development

13.5.3 Revenue Analysis

13.6 Associated British Foods plc

13.6.1 Overview

13.6.2 Recent Development

13.6.3 Revenue Analysis

13.7 Tyson Foods, Inc.

13.7.1 Overview

13.7.2 Recent Development

13.7.3 Revenue Analysis

13.8 Danish Crown

13.8.1 Overview

13.8.2 Recent Development

13.8.3 Revenue Analysis

13.9 Kerry Group plc

13.9.1 Overview

13.9.2 Recent Development

13.9.3 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com