Latin America & Caribbean Automotive Tire Market Analysis 2025-2033

Buy NowLatin America & Caribbean Automotive Tire Market Size and Forecast 2025-2033

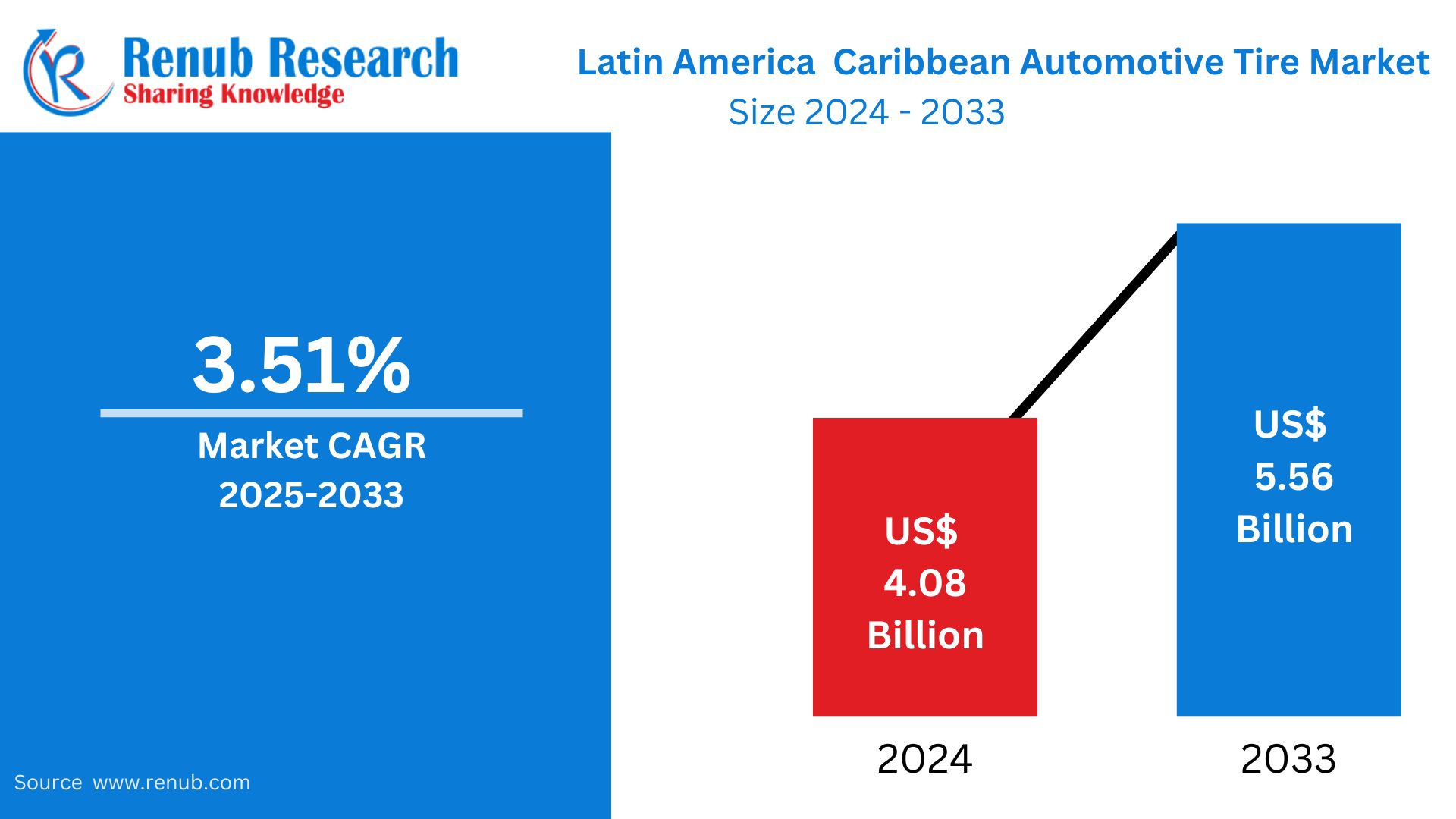

Latin America & Caribbean Automotive Tire Market is valued at USD 4.08 billion in 2024 and is expected to reach USD 5.56 billion by 2033, growing at 3.51% CAGR from 2025 to 2033. Increasing demand for commercial and passenger vehicles, growing transportation infrastructure, and rising ownership of vehicles in developing economies across the region are driving the market.

The report Latin America & Caribbean Automotive Tire Market Forecast covers by Vehicle Types (Passenger Vehicle, Commercial Vehicle, Electric Vehicle), Rim Size (Less Than 15 Inches, 15 To 20 Inch, More Than 20 Inches), Sales Channels Oem (Original Equipment Manufacturer), Aftermarket), Country and Company Analysis 2025-2033.

Latin America & Caribbean Automotive Tire Market Overview and Key Insights

An automotive tire is a very important part of any vehicle. It is engineered to deliver traction, cushion road shocks, carry the vehicle's load, and keep the direction of travel. Tires are usually composed of rubber and strengthened with steel, nylon, or polyester for added durability and performance.

In Latin America & the Caribbean, auto tires are on the rise owing to higher ownership of vehicles, increasing road networks, and rising middle class. Tires are used for varied transportation purposes across urban and rural areas, ranging from passenger cars and motorcycles to buses and commercial vehicles. The market comprises original equipment tires for new vehicles as well as replacement tires for vehicles already in service. With mobility rising and tourism booming in island nations and mainland states, the market for affordable and trustworthy tires has also seen a spike. The use of all-terrain and environmentally friendly tire models is also increasing, which shows consumer preference for durability, fuel efficiency, and eco-friendliness in the region.

Growth Drivers and Market Dynamics

Growing Automotive Fleet and Increasing Vehicle Ownership

Growing demand for personal and commercial vehicles is driving tire consumption in Latin America & the Caribbean. Increased disposable incomes, urbanization, and enhanced road infrastructure have spurred increased vehicle ownership levels in Brazil, Mexico, and Argentina. As the region continues to experience steady growth in new vehicle sales, there is a parallel increase in demand for original equipment manufacturer (OEM) tires and replacement tires. The market for used cars is also growing, further increasing the demand for cost-effective, long-lasting replacement tires in urban and rural regions. Jun 2024, The International Organization of Motor Vehicle Manufacturers (OICA) states that New vehicle registrations in Latin America rose by 7.65% in 2023, reaching 5.35 million cars. The main contributors were Brazil, at 2.30 million registrations (43%), and Mexico, at 1.41 million (27%), accounting for a combined 70% of the region's total.

Expansion of E-commerce and Tire Retail Channels

The development of digital platforms and e-commerce has revolutionized the tire retail environment in the region. Customers are now able to access a range of tire brands and specifications through online marketplaces, ensuring competitive prices and increased convenience. This change in purchasing behavior, combined with higher internet penetration, is enabling the uptake of technologically superior tires. The increasing trend of buying tires online also prompts manufacturers and distributors to invest in digital infrastructure and last-mile delivery networks, particularly in rural or underserved markets. Nov. 2022,L Catterton, the world's largest consumer-focused private equity firm, said its Latin America fund will invest heavily in CantuStore, Brazil's largest omnichannel aftermarket tire retailer and distributor. The terms of the deal were not disclosed.

Demand for Fuel-Efficient and All-Terrain Tires

Increased fuel prices and poor road conditions in the region have increased demand for high-performance, fuel-efficient, and all-terrain tires. Consumers demand durable tires that perform in varying conditions—from hilly roads in Colombia to seaside roads in the Caribbean. The emphasis on environmental driving also spurs demand for low-rolling-resistance tires, which improve fuel efficiency. Tire manufacturers are reacting by introducing new products customized to local needs, further driving adoption in the personal and commercial vehicle markets. August 2024, The Latin Auto Parts Expo & Latin American Caribbean Tyre (Latin Tyre Expo) opened its doors at the Amador Convention Center in Panama. Prinx Chengshan presented its high-performance products, namely Prinx, Chengshan, Austone, and Fortune. The expo put a spotlight on the company's technology innovations in commercial, passenger, and special tyres, drawing an encouraging response for its performance products and quality services.

Challenges in the Latin America & Caribbean Automotive Tire Market

Economic Instability and Currency Fluctuations

Most of the nations in the region experience macroeconomic instability, such as high inflation, political instability, and exchange rate volatility. These conditions heavily influence tire import prices, raw material costs, and consumer purchasing power. Consequently, price-conscious customers tend to postpone tire replacement or switch to lower-quality products, affecting revenue for premium tire manufacturers. In addition, currency devaluation in countries such as Argentina and Venezuela has hindered manufacturers from establishing stable pricing and profitability.

Dependence on Imports and Limited Local Manufacturing

The area heavily depends on tire imports, particularly high-end or niche segments including electric vehicle tires and run-flat tires. There is limited domestic manufacturing capacity, which generates longer lead times and higher prices. Tariffs, import charges, and logistics issues also impede the supply chain, particularly in island countries such as Cuba and the Dominican Republic. This excessive dependence on external suppliers also limits innovation and makes less diverse tire products unavailable to suit regional requirements.

Latin America & Caribbean Passenger Automotive Tire Market

The passenger automotive tire market has a high share of the total market with the growing number of privately owned cars. Urbanization and improved road connectivity propel the growth, particularly in Brazil, Mexico, and Chile. Consumers look for cost-effective, fuel-efficient, and long-lasting tires that are appropriate for everyday driving. Seasonal changes and diversity of terrain across regions impact demand for all-season and all-terrain tires. Moreover, the presence of tires both online and offline guarantees robust aftermarket replacement activity. With car sales only increasing in the post-pandemic environment, this segment shall be a long-term key revenue generator.

Latin America & Caribbean Electric Automotive Tire Market

With electric vehicle (EV) growth speeding up in Latin America & the Caribbean, demand for dedicated EV tires is increasing. These tires need low rolling resistance, improved durability, and lower noise to keep pace with EV performance demands. Governments in Chile, Colombia, and Brazil are encouraging EV adoption with subsidies and infrastructure development, which has a positive effect on tire demand. Tire makers are launching advanced compounds and intelligent tire technologies specific to EVs. Although still a niche market, it has high growth prospects as increasing numbers of manufacturers enter the EV space and customers adopt cleaner mobility solutions.

Latin America & Caribbean Automotive 15 To 20 Inch Rim Market

The 15 to 20-inch rim segment is the market leader in the region as it is commonly used in passenger vehicles, SUVs, and light commercial vehicles. This range of sizes optimizes performance, comfort, and cost, which makes it appropriate for urban and off-road use. The rising demand for SUVs and pickup trucks in Latin America, especially in Argentina and Brazil, has also supported this segment. Furthermore, 15–20-inch tires provide improved looks and road traction, improving consumer appeal. The aftermarket for this rim size is also strong, underpinned by availability, compatibility, and competitive prices.

Latin America & Caribbean OEM Automotive Tire Market

The OEM tire market in Latin America & the Caribbean is highly dependent on new vehicle manufacturing and assembly activities. Brazil and Mexico, being top automotive manufacturing destinations, are significant drivers of OEM tire demand. Automakers collaborate with tire manufacturers to supply new vehicles with superior quality, fuel-efficient, and safety-approved tires. OEM agreements offer volume business to manufacturers of tires and aid in building brand loyalty among consumers. Expansion in the production of EVs and hybrid models also impacts OEM tire specifications, compelling manufacturers to create tires with the new performance capabilities and environmental requirements.

Brazil Automotive Tire Market

Brazil boasts the biggest vehicle population in Latin America, fueling a steady demand for replacement and OEM tires. The vast network of roads in the country and high traffic volumes in cities cause regular tire wear and tear. Durable and economical tires for daily use are preferred by consumers. Government spending on transport and infrastructure development also boosts commercial vehicle usage, which further fuels tire demand. Brazil has various domestic and overseas tire factories, which minimize import dependency and provide sound supply security. Domestic production facilitates the production of tires customized to local road conditions. Large producers also invest in eco-friendly practices and intelligent tire technology to address changing consumer needs. April 2023, AGRITERRA 02 SP (Soil Protector) tire is introduced in Brazil and will be promoted at the Mitas Booth #E8B during the 28th Agrishow do Brasil from May 1st to 5th, 2023, in Ribeirão Preto, São Paulo. This radial tire, which is meant for new agricultural trucks and trailers, comes with Very High Flexion (VF) technology, which provides a 40% increase in load capacity with minimal soil compaction.

Mexico Automotive Tire Market

Mexico's position as a major vehicle manufacturing and export center drives strong OEM tire demand. Foreign automakers with operations in the country demand high-performance tires made to their specifications. Strategic alliances among tire manufacturers and original equipment makers underpin the OEM segment's growth. Mexico's high urbanization and heavy traffic conditions intensify tire wear, underpining a high-end replacement tire market. Access to middle-class consumers and e-commerce platforms further enhances consumer availability of good-quality tires. Fuel-efficient and all-weather tires are in increasing demand for city and rural driving. April 2024, The Yokohama Rubber Co., Ltd. recently marked a milestone for its new Mexican passenger car tire factory.

Argentina Automotive Tire Market

Macro-economic instability in Argentina, such as inflation and currency devaluation, affects tire imports and production costs. Consumers become more price-conscious, and demand for low-cost or retreaded tires increases. These trends open up opportunities for local manufacturers to provide cost-effective alternatives. Argentina's large agricultural industry and transport-reliant economy fuel robust demand for truck and tractor tyres. In spite of general economic woes, rural mobility and road freight needs to maintain the commercial tyre market in good shape. Heavy-duty, long-lived tyres are needed to cover long distances and traverse off-road conditions. In Oct 2024, Giti inaugurated its first official outlet in Mendoza, Argentina, within a three-month timeframe. The company retails Giti car and SUV tires and provides services such as tire repair, balancing, and alignment. Covering approximately 300m2, it has new equipment and qualified staff to service different customer demands.

Cuba Automotive Tire Market

Cuba boasts one of the oldest vehicle fleets in the region because of import restrictions and limited availability of new vehicles. Consequently, there is high demand for replacement tires to maintain older vehicles in use. Buyers tend to purchase retreaded or used imported tires because of cost limitations. Logistical problems and trade barriers limit the availability of tires in Cuba. The market is highly dependent on imports from allied nations with a tendency to create uneven supply. Such problems reduce access to high-quality tire manufacturers and promote informal distribution networks. Nevertheless, the demand is high because of the requirement of tire upkeep for movement.

Latin America & Caribbean Automotive Tire Market Segmentation by Vehicle Type and Rim Size

Vehicle Types

- Passenger Vehicle

- Commercial Vehicle

- Electric Vehicle

Rim Size

- Less Than 15 Inches

- 15 To 20 Inch

- More Than 20 Inches

Sales Channels

- Oem (Original Equipment Manufacturer)

- Aftermarket

Country-wise Market Analysis

- Brazil

- Mexico

- Argentina

- Haiti

- Cuba

- Dominican Republic

- Bahamas

- Guatemala

- Panama

- Rest of Latin America and Caribbean

Companies have been covered from 5 viewpoints

- Overviews

- Key Person

- Recent Developments

- Product Portfolio

- Revenue

Competitive Landscape and Key Players

- Hankook Tire & Technology Co., Ltd.

- Continental corporation

- Michelin

- Pirelli Tyre C. S.p.A. (China National Chemical Corporation)

- The Yokohama Rubber Co., Ltd.

- Bridgestone Corporation

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Vehicle Type, Rim Size, Sales Channel and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Driver

4.2 Challenges

5. Latin America & Caribbean Automotive Tire Market

6. Market Share Analysis

6.1 Vehicle Types

6.2 Rim Size

6.3 Sales Channels

6.4 Country

7. Vehicle Types

7.1 Passenger Vehicle

7.2 Commercial Vehicle

7.3 Electric Vehicle

8. Rim Size

8.1 Less Than 15 Inches

8.2 15 To 20 Inch

8.3 More Than 20 Inches

9. Sales Channels

9.1 Oem (Original Equipment Manufacturer)

9.2 Aftermarket

10. Country

10.1 Brazil

10.2 Mexico

10.3 Argentina

10.4 Haiti

10.5 Cuba

10.6 Dominican Republic

10.7 Bahamas

10.8 Guatemala

10.9 Panama

10.10 Rest of Latin America and Caribbean

11. Porter’s Five Forces

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 Hankook Tire & Technology Co., Ltd.

13.1.1 Overviews

13.1.2 Key Person

13.1.3 Recent Developments

13.1.4 Product Portfolio

13.1.5 Revenue

13.2 Continental corporation

13.2.1 Overviews

13.2.2 Key Person

13.2.3 Recent Developments

13.2.4 Product Portfolio

13.2.5 Revenue

13.3 Michelin

13.3.1 Overviews

13.3.2 Key Person

13.3.3 Recent Developments

13.3.4 Product Portfolio

13.3.5 Revenue

13.4 Pirelli Tyre C. S.p.A. (China National Chemical Corporation)

13.4.1 Overviews

13.4.2 Key Person

13.4.3 Recent Developments

13.4.4 Product Portfolio

13.4.5 Revenue

13.5 The Yokohama Rubber Co., Ltd.

13.5.1 Overviews

13.5.2 Key Person

13.5.3 Recent Developments

13.5.4 Product Portfolio

13.5.5 Revenue

13.6 Bridgestone Corporation

13.6.1 Overviews

13.6.2 Key Person

13.6.3 Recent Developments

13.6.4 Product Portfolio

13.6.5 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com