Commercial Vehicle Market Size and Share Analysis - Growth Trends and Forecast Report 2025–2033

Buy NowCommercial Vehicle Market Size and Forecast 2025-2033

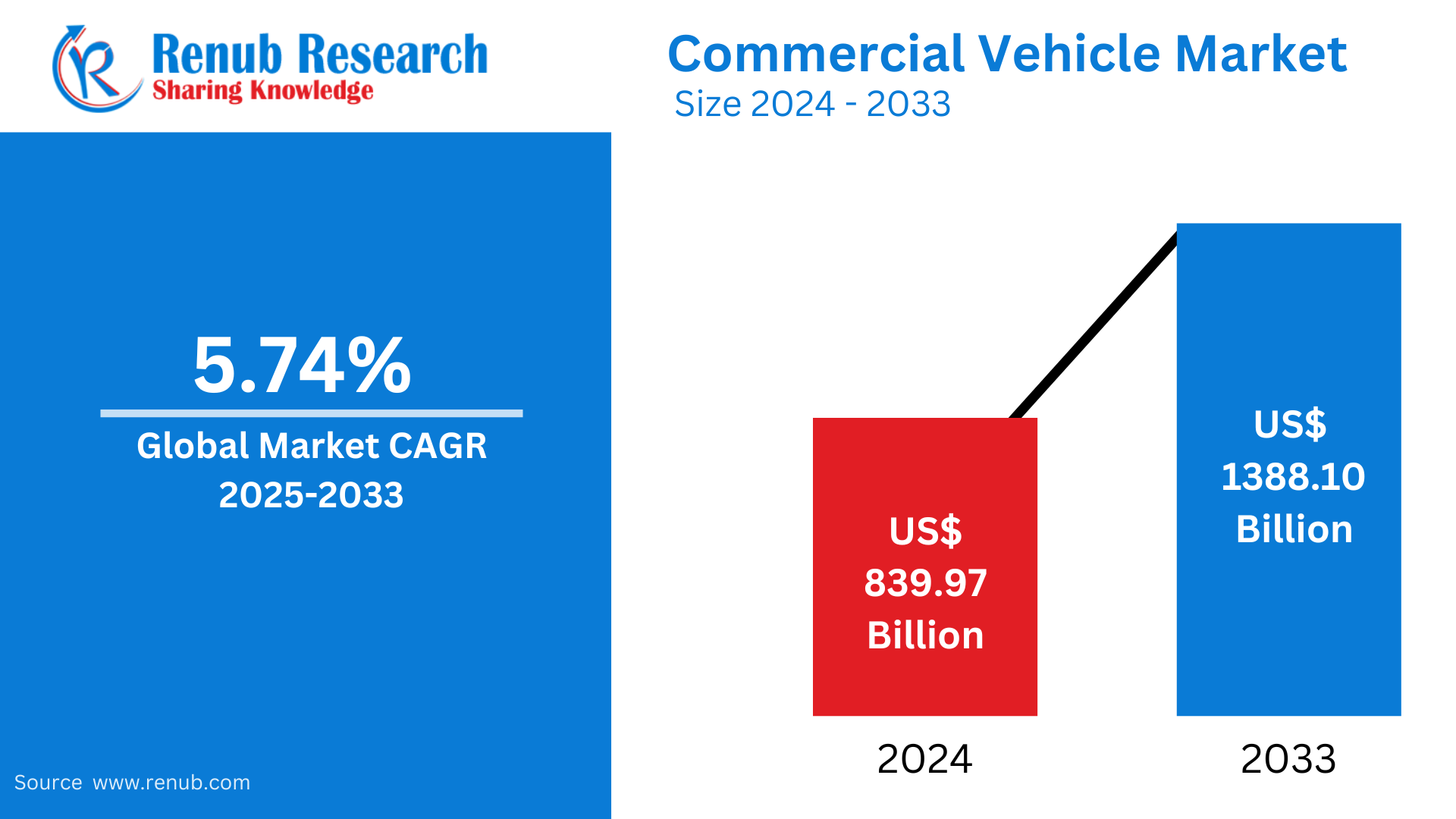

The commercial vehicle market is expected to reach US$ 1388.10 billion by 2033, growing from US$ 839.97 billion in 2024, with a CAGR of 5.74% between 2025 and 2033. This growth is driven by increasing demand for efficient logistics, expanding e-commerce activities, and rising construction and infrastructure projects globally. Government investments in transportation and advancements in electric and autonomous commercial vehicles further contribute to market expansion.

The report Commercial Vehicle Market & Forecast covers by Vehicle Type (Heavy-duty Commercial Trucks, Light Commercial Pick-up Trucks, Light Commercial Vans, Medium-duty Commercial Trucks) Propulsion Type (Hybrid and Electric Vehicles, BEV, FCEV, HEV, PHEV), ICE (CNG, Diesel, Gasoline, LPG), End User (Industrial, Mining & Construction, Logistics, Passenger Transportation, Others), Country and Company Analysis 2025-2033.

Commercial Vehicle Market Overview

A commercial vehicle is any motor vehicle designed and used for transporting goods, passengers, or performing specialized functions, primarily for business purposes. These vehicles are classified into various types, including trucks, buses, vans, trailers, and heavy-duty equipment such as dump trucks and tankers. Commercial vehicles play a vital role in multiple industries, including logistics, construction, agriculture, retail, and public transportation.

Commercial vehicles are mainly used to transport goods from one location to another either within the country or internationally. Other uses include transporting passengers; public buses, for example, or private charter buses. Commercial vehicles, for instance, refrigerated trucks, are used for perishable products. Heavy-duty vehicles are mainly used in construction and mining operations. Additionally, the rise of e-commerce has fueled the demand for light commercial vehicles (LCVs) for last-mile delivery. Overall, commercial vehicles are indispensable for facilitating economic activities, supporting industries, and ensuring supply chain efficiency.

SWOT analysis of the Commercial Vehicle Market

Strengths

- High Demand in Logistics and E-Commerce: The fast growth of logistics and last-mile delivery services drives strong, steady demand for commercial vehicles, particularly light and medium-duty trucks.

- Established Global Players: Dominant manufacturers such as Daimler, Volvo, Tata Motors, and PACCAR provide strong R&D, economies of scale, and strong brand trustworthiness.

- Product Diversification: From light vans to heavy trucks and buses, the market caters to various industries—construction, mining, transport, public transport—providing diversified revenue streams.

- Service and Aftermarket Ecosystem: Robust maintenance, parts, and finance infrastructure enhances customer retention and lifecycle profitability for OEMs.

- Technological Innovation: Higher adoption of telematics, safety, and driver assistance systems improves performance, safety, and fleet management efficiency.

Weaknesses

- High Initial Costs: New technology commercial vehicles (EV, ADAS) are very costly to buy, which makes it difficult for small businesses.

- Fuel Dependency: Even with improved EVs, most of the market is still dependent on diesel, subjecting it to fuel price shocks and emissions laws.

- Slow Adoption of Electric and Smart Vehicles in Emerging Markets: Deficiencies in infrastructure, few incentives, and low digital literacy hinder the adoption of electric and smart vehicles in emerging markets.

- Over-Regulation: Complying with rigid emissions regulation, safety standards, and regulatory compliance adds manufacturing complexity and operating costs.

- Driver Shortage and Labor Challenges: Global scarcity of qualified commercial vehicle drivers and increasing labor costs pose risks to fleet usage and logistics efficiency.

Opportunities

- Fleets' Electrification: Fleet owners are being forced to minimize carbon footprints, generating demand for electric trucks, vans, and buses, primarily in urban regions.

- Government Initiatives and Infrastructure Spend: Government policies encouraging clean energy, public transportation, and smart cities are driving sales of new types of commercial vehicles.

- Autonomous Vehicle Development: Investment in autonomous delivery vehicles and trucks is unlocking future-proof market segments with long-term potential.

- Intelligent Vehicle Technologies: IoT, AI-driven fleet analytics, predictive maintenance, and V2V communication enable new value-added service possibilities.

- Rural and Emerging Market Growth: Infrastructure and agriculture development in emerging economies creates demand for fundamental transport and utility vehicles.

Threats

- Worldwide Economic Uncertainty: Global recessions, inflation, or geopolitical conflicts can freeze investments in transportation and infrastructure, lowering demand.

- Intense Price Wars: Excessive competition, particularly from low-cost local manufacturers, results in lower margins and commoditization.

- Tough Environmental Regulations: Growing tighter emissions standards can lead to recalls, redesigns, or penalties, particularly for older diesel engines.

- Supply Chain Disruptions: Worldwide chip, metal, and parts shortages impact production schedules and drive input prices higher.

- Evolving Urban Mobility Models: Growth of shared mobility, micro-logistics, and small-sized delivery technology (e.g., drones, sidewalk robots) can cut long-term demand for conventional commercial vehicles.

Mergers and acquisitions (M&A) in the automotive sector

- Jun 2025, Daimler Truck, a German truck manufacturer, and Toyota, one of Japan's top automobile companies, have said they will merge the truck businesses of their respective subsidiaries, Mitsubishi Fuso and Hino. Both will retain 25% of the shares in a new publicly traded holding company, which will be launched in April 2026.

- May 2025, JOST Werke SE has disclosed the acquisition of Hyva in a USD 398 million transaction as a strategic step toward enhancing its product offerings and regional presence. The Hyva acquisition, which is a global market leader in hydraulic solutions, is going to enhance JOST's offerings in both On-Highway and Off-Highway segments and its global competitiveness. Most importantly, the transaction provides near-term depth to JOST's product offerings for India's changing commercial vehicle market.

- March 2024, The Board of Directors of Tata Motors Limited ("TML") have approved a Composite Scheme of Arrangement between TML, TML Commercial Vehicles Limited ("TMLCV"), Tata Motors Passenger Vehicles Limited ("TMPV"), and their respective shareholders ("Scheme"). This is pursuant to Sections 230-232 and other provisions of the Companies Act, 2013.

- May 2024, Cummins Inc., a global technology and power leader, acquired Meritor, Inc., a drivetrain and electric powertrain solutions supplier, in August 2022. Cummins has combined the business of Meritor since then, leveraging its large sales network and robust customer relationships.

Growth Drivers in the Commercial Vehicle Market

Expansion of E-commerce and Logistics Industry

The booming e-commerce sector has significantly fueled the demand for commercial vehicles. The increasing demand for light and medium-duty commercial vehicles for efficient transportation, warehousing, and last-mile delivery has increased sales. The logistic companies are expanding their fleets to meet the growing customer base, especially in urban and suburban areas. Same-day and next-day delivery services have also picked up momentum and further increased the adoption of delivery efficiency-optimized vehicles, hence driving market growth. Jan 2025, Eicher Trucks and Buses launched its Pro X range of electric vehicles for the small commercial vehicle segment at the Bharat Mobility Global Expo 2025. This move allows Eicher, a unit of VE Commercial Vehicles, to tap into the growing 2-3.5 tonne market, which is popular for last-mile delivery in e-commerce.

Rising Infrastructure Development and Urbanization

Infrastructure projects, like roads, bridges, and house developments, are on the rise, increasing the demand for heavy-duty commercial vehicles, including construction trucks and dumpers. Rapid urbanization in developing markets opens doors to transit buses and other public transportation vehicles. Infrastructural growth worldwide has led to governments investing in massive scale projects, which require infrastructure tools or vehicles in construction, mining, and other related industries. Currently, 55% of the world's population lives in urban areas and is expected to reach 68% by 2050. Urbanization and population growth might increase the population of cities to 2.5 billion people by then. The new data released by the United Nations suggest that nearly 90% of this increase is going to be seen in Asia and Africa.

Transition to Sustainable Mobility Solutions

Commercial hybrid and electric vehicles have experienced an increased demand with the growing urge for greener technologies. Governments are offering subsidies and incentives to fleet operators transitioning to cleaner fuel vehicles like electric and CNG models. The focus on reducing carbon emissions and fuel costs has also prompted technological advancements in commercial vehicles, including autonomous systems, advanced telematics, and improved fuel efficiency. February 2024, VE Commercial Vehicles showcased Made-in-India and Future Ready mobility solutions at the Bharat Mobility Global Expo 2024.

Challenges in the Commercial Vehicle Market

Rising Operational Costs

The commercial vehicle market faces challenges due to escalating operational costs, including fuel prices, maintenance, and insurance expenses. These costs significantly affect profit margins for fleet operators. Additionally, stricter emission norms require upgrading existing fleets, adding a financial burden on businesses. High initial investment costs for electric and hybrid commercial vehicles further limit adoption in price-sensitive markets.

Supply Chain Disruptions

The global supply chain crisis, fueled by geopolitical tensions and the COVID-19 pandemic, has impacted the availability of raw materials and vehicle components. Semiconductor shortages have delayed production timelines for commercial vehicles, leading to extended delivery periods and increased vehicle prices. Such disruptions challenge manufacturers and fleet operators in meeting growing market demands efficiently.

Heavy-Duty Commercial Trucks Vehicle Market

Heavy-duty trucks are crucial for industries like mining, construction, and long-haul logistics. These trucks are designed to handle massive payloads and operate in challenging terrains. Their adoption is driven by infrastructure development and industrial growth. Countries investing in large-scale construction projects and trade expansion rely heavily on these vehicles. Additionally, advancements in heavy-duty trucks, including better fuel efficiency, load management, and enhanced safety features, further drive market growth.

Commercial Hybrid and Electric Vehicles Market

The commercial hybrid and electric vehicle market is expanding rapidly due to the global emphasis on sustainability. Governments worldwide are incentivizing fleet operators to switch to electric or hybrid models to reduce greenhouse gas emissions. These vehicles offer lower operating costs and reduced dependency on fossil fuels. Technological advancements in battery performance and charging infrastructure are accelerating adoption. Delivery fleets, public transport systems, and urban utility services are key segments driving this market.

Commercial CNG Vehicle Market

Commercial CNG vehicles are gaining traction as an eco-friendly and cost-effective alternative to diesel and petrol vehicles. Compressed natural gas is widely available and offers lower emissions, making it a preferred choice for fleet operators in public transport, logistics, and urban delivery. Governments in various regions are supporting the transition to CNG through subsidies and expanded fueling infrastructure. This market is particularly strong in regions with stringent emission regulations.

Mining & Construction Commercial Vehicle Market

Commercial vehicles used for mining and construction are crucial to the development of infrastructure and resource extraction. The vessels, such as dumpers, loaders, and special trucks, are fabricated to withstand the harsh environments and deliver excellent performance. The factors contributing to growth in the market include increased investment in infrastructure and energy projects, especially in developing countries. Technological advancements such as autonomous vehicles and sophisticated telematics are further improving operational efficiency.

Logistics Commercial Vehicle Market

The logistics commercial vehicle market is central to the supply chain, ensuring timely delivery of goods. With the growth of e-commerce and globalization of trade, demand for logistics vehicles has surged. Both light-duty and heavy-duty vehicles are required for urban deliveries and long-haul transportation, respectively. Fleet operators are investing in advanced technologies like GPS tracking and fuel-efficient engines to optimize operations, meeting the growing demand for faster and reliable deliveries.

United States Commercial Vehicle Market

The United States commercial vehicle market is spurred by a solid logistics sector and increased demand from e-commerce. The adoption is supported by improved infrastructure and incentives offered by the government for electric and CNG commercial vehicles. The focus on sustainability and reducing emissions leads to innovation in hybrid and electric models. As the technology advances, and the movement of freight increases, the United States will remain a world leader in the commercial vehicle industry. June 2024, Nippon Express USA, Inc has as part of its climate change initiatives introduced its first electric vehicle (EV) truck that emits no CO2 or pollutants while running. The truck has been in operation at the San Antonio Sales Office in Texas.

Germany Commercial Vehicle Market

Germany’s commercial vehicle market benefits from its robust manufacturing base and advanced technology. The country’s emphasis on green mobility has accelerated the adoption of electric and hybrid commercial vehicles. With a strong logistics sector and ongoing infrastructure projects, the demand for light, medium, and heavy-duty vehicles continue to rise. Germany also serves as a hub for innovative solutions, such as autonomous vehicles and smart fleet management systems. Sept 2024, Chinese automotive manufacturer BYD introduced two new electric commercial vehicles for Europe at the IAA Transportation 2024 in Hannover, Germany: the BYD E-VALI, a pure-electric light commercial vehicle, and the BYD EYT 2.0, an electric yard tractor.

India Commercial Vehicle Market

India’s commercial vehicle market is expanding due to rapid urbanization, growing e-commerce, and increased infrastructure projects. Government emphasis on road development and public transportation is further driving demand for buses and construction vehicles. Also, increasing environmental awareness is leading to the use of CNG and electric commercial vehicles. India, though plagued with high cost and regulatory compliance, is still an attractive market, given technological advancement. Mar 2024 Daimler India Commercial Vehicles (DICV) adopts a segment-selective approach, where it will concentrate on less price-sensitive and more technologically advanced markets. The company plans to launch 14 new products in 2024, consisting of a heavy-duty rigid range, trucks equipped with Automated Manual Transmission (AMT), and a heavy-duty range for construction and mining.

Brazil Commercial Vehicle Market

Commercial vehicle market of Brazil is strong due to a robust agricultural and mining sector. The demand for heavy-duty commercial vehicles, like trucks and dumpers, increases due to transportation requirements for natural resources. Infrastructure development and urbanization are also driving growth. However, economic challenges and high operational costs pose hurdles. Despite this, Brazil continues to see a steady rise in the adoption of more efficient and sustainable vehicle models. Oct 2024, BYD is making waves in Brazil in 2024 with the launch of six new vehicles, including the Shark. This drive has already forced competitors to shift their strategy and cut the price significantly of electric as well as combustion versions.

Saudi Arabia Commercial Vehicle Market

The commercial vehicle market in Saudi Arabia is highly developing, considering extensive infrastructure development and industrial activities through the Saudi Vision 2030. Vehicle demand mainly arises from construction, logistics, and oil and gas industries. Moreover, government initiatives for environmentally friendly transportation have ensured that electric and hybrid commercial vehicles have indeed been accepted. Lastly, policies for developing trade and a program to diversify the economy are ensuring robust growth in the market. November 2024, Tata Motors introduced its first automated manual transmission truck, Tata Prima 4440.S AMT, in Saudi Arabia.

Commercial Vehicle launches around the world

- February 2024, Tata Motors along with Tata Africa Holdings Limited has introduced its Ultra T.9 and Ultra T.14 heavy-duty trucks in South Africa. As part of safer and more environmentally friendly cargo mobility, the Ultra range is well-suited for diverse logistics usage like bakery, FMCG, agriculture, and construction. High productivity is the result of designing it to deliver best-in-class power, torque, and fuel efficiency along with the lowest total cost of ownership.

- Feb 2024, Hyundai Motor Company and Iveco Group have signed a supply agreement for an IVECO-badged all-electric light commercial vehicle for Europe, based on Hyundai’s Global eLCV platform. This vehicle will expand Iveco Group’s electric light commercial vehicle lineup, complementing the IVECO Daily.

- February 2024, EKA Mobility, together with Mitsui Co., Ltd. and VDL Groep, has unveiled its 1.5-tonne electric Light Commercial Vehicles (LCVs) at the Bharat Mobility Global Expo. The launch reflects the company's focus on revolutionizing the commercial vehicle industry through sustainable options.

- October 2023 saw Stellantis unveil Pro One as a strategic project for its Commercial Vehicles Business with a vision of global leadership through the professional brands of six stalwarts: Citroën, FIAT, Opel, Peugeot, Ram, and Vauxhall.

Commercial Vehicle Market Segments

Vehicle Type

- Heavy-duty Commercial Trucks

- Light Commercial Pick-up Trucks

- Light Commercial Vans

- Medium-duty Commercial Trucks

Propulsion Type

- Hybrid and Electric Vehicles

- BEV

- FCEV

- HEV

- PHEV

ICE

- CNG

- Diesel

- Gasoline

- LPG

End User

- Industrial

- Mining & Construction

- Logistics

- Passenger Transportation

- Others

Countries

- United States

- Canada

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

- Brazil

- Mexico

- Argentina

- South Africa

- Saudi Arabia

- UAE

All the key players have been covered from 4 Viewpoints:

- Overview

- Key Person

- Recent Development

- Revenue

Key Players Analysis

- AB Volvo

- Ford Motor Company

- General Motors Company

- Hyundai Motor Company

- Mahindra & Mahindra Limited

- Mercedes-Benz Group AG

- Mitsubishi Motors Corporation

- Robert Bosch GmbH

- Tata Motors Limited

- Toyota Motor Corporation

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Vehicle Type, Propulsion Type, End User and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Commercial Vehicle Market

6. Market Share Analysis

6.1 By Vehicle Type

6.2 By Propulsion Type

6.3 By End User

6.4 By Countries

7. Vehicle Type

7.1 Heavy-duty Commercial Trucks

7.2 Light Commercial Pick-up Trucks

7.3 Light Commercial Vans

7.4 Medium-duty Commercial Trucks

8. Propulsion Type

8.1 Hybrid and Electric Vehicles

8.1.1 BEV

8.1.2 FCEV

8.1.3 HEV

8.1.4 PHEV

8.2 ICE

8.2.1 CNG

8.2.2 Diesel

8.2.3 Gasoline

8.2.4 LPG

9. End User

9.1 Industrial

9.2 Mining & Construction

9.3 Logistics

9.4 Passenger Transportation

9.5 Others

10. Countries

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 Australia

10.3.5 South Korea

10.3.6 Thailand

10.3.7 Malaysia

10.3.8 Indonesia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 South Africa

10.5.2 Saudi Arabia

10.5.3 UAE

11. Porter's Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Competition

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threats

13. Key Players Analysis

13.1 AB Volvo

13.1.1 Overview

13.1.2 Key Person

13.1.3 Recent Development

13.1.4 Revenue

13.2 Ford Motor Company

13.2.1 Overview

13.2.2 Key Person

13.2.3 Recent Development

13.2.4 Revenue

13.3 General Motors Company

13.3.1 Overview

13.3.2 Key Person

13.3.3 Recent Development

13.3.4 Revenue

13.4 Hyundai Motor Company

13.4.1 Overview

13.4.2 Key Person

13.4.3 Recent Development

13.4.4 Revenue

13.5 Mahindra & Mahindra Limited

13.5.1 Overview

13.5.2 Key Person

13.5.3 Recent Development

13.5.4 Revenue

13.6 Mercedes-Benz Group AG

13.6.1 Overview

13.6.2 Key Person

13.6.3 Recent Development

13.6.4 Revenue

13.7 Mitsubishi Motors Corporation

13.7.1 Overview

13.7.2 Key Person

13.7.3 Recent Development

13.7.4 Revenue

13.8 Robert Bosch GmbH

13.8.1 Overview

13.8.2 Key Person

13.8.3 Recent Development

13.8.4 Revenue

13.9 Tata Motors Limited

13.9.1 Overview

13.9.2 Key Person

13.9.3 Recent Development

13.9.4 Revenue

13.10 Toyota Motor Corporation

13.10.1 Overview

13.10.2 Key Person

13.10.3 Recent Development

13.10.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com