Japan E-commerce Payment Market is expected to grow with a CAGR of 7% from 2022-2026, Propelled by Mobile Payment & COVID-19

12 Jan, 2022

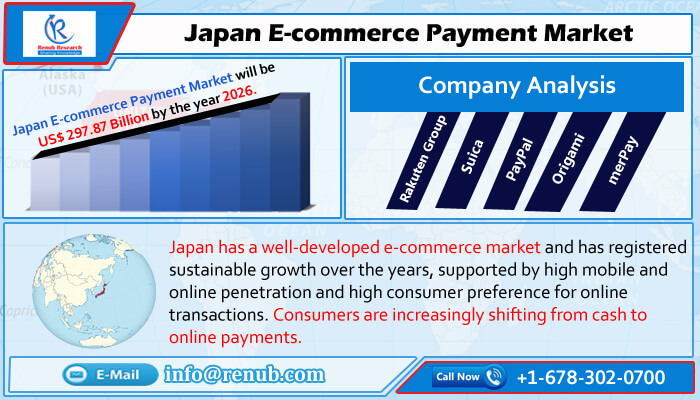

According to the report by Renub Research, titled “Japan E-commerce Payment Market Forecast 2021-2026, Industry Trends, Share, Insight, Growth, Impact of COVID-19, Opportunity Company Analysis” the Japan E-commerce Payment Market Size is projected to reach US$ 297.87 Billion by 2026. E-Commerce payment importance is growing in Japan modern economy. It implements a commodity way for consumers to acquire goods and services through electronic means as they are easy, quick, and convenient. E-Payment is a method that provides tools for the payment of services or goods carried on the internet. It is the ease of transaction processing in e-commerce between consumers and sellers. Japan e-commerce market presents an opportunity for international merchants to E-court an audience with money to spend and an appetite for consumer electronics and fashion.

Furthermore, the Japanese e-commerce payment industry is undergoing tremendous growth and is proposed to stimulate as the trend moves toward mobile purchases and online shopping. Without cash or cheques, this digital payment method is considered an e-commerce pay system and is often viewed as an online or mobile payment network. Paperless e-commerce Japan has revolutionized payment processing by reducing documentation, delivery costs and staffing costs. These platforms are user-friendly, increase their customer presence and take less time than manual methods. According to Renub Research findings, Japan is among the countries with the highest number of internet users in the world. The number of internet users in Japan amounted to around 116 million as of 2020.

How COVID-19 is benefiting the Japan's e-Commerce Payment Industry

The outbreak of coronavirus, which has compelled to impose lockdowns and travel restrictions, is encouraging the expanded use of e-commerce platforms in Japan. The coronavirus outbreak is transforming the way Japanese consumers shop and how they pay for their purchases. Contactless payments took an unprecedented boost during the pandemic, seen by Japanese consumers as a cleaner way to pay in-store. Users are also trying out new payment methods while purchasing from E-Commerce websites and favor methods with the most robust security against fraud losses.

In an attempt to make e-commerce payments faster and more straightforward, more Japanese companies such as Rakuten Group, Suica, PayPal, Origami, and merPay are creating multiple payment channels. These key Japanese companies are introducing various new payment systems to attract more customers and appeal to existing ones. The change helps multiple types of customers to pay by their conventional methods. For instance, in 2020, Rakuten, Inc. established a new company to support brick-and-mortar retailers in Japan to implement digital transformation*1 by introducing multiple initiatives to merge offline and online retail (OMO*2.)

Debit Cards & Credit Cards are most Used for Online Payment in Japan

Based on the payment method, Japan e-commerce payment market includes Card, Cash, Bank transfers, Digital wallets, and others became the most commonly used e-commerce payment mechanisms in Japan. Credit cards remain the most common form of payment for e-commerce transactions; Japanese people prefer to use their debit and credit cards online. JCB, the domestic card brand, accompanies VISA, MasterCard and American Express. Cards, there is an option, local pay system called 'Konbini.

Moreover, Japanese consumers use a wide breadth of Bank transfers payment methods, known as furikomi, Japan's second-most utilized e-commerce payment method. PayEasy, a modern domestic bank transfer service, offers the ability for shoppers to pay at post offices, banks and automated teller machines. The Japanese e-commerce industry received a strong growth in 2020.

Single Language & Internet Savvy Customers Driving Japanese e-Commerce Payment Market

Segments like food & personal care, furniture & application, toys, hobby, DIY, electronics & media and fashion are the most significant purchases by Japanese customers. These retailers benefit from urban density, technically advanced customers, expanding economies, and a single language is being used for Japan's purposes. As user behavior and shopping beahviour continue to change, online services centered on e-commerce and cashless payments are becoming a fundamental part of the food & personal care, furniture & application, toys, hobbies, DIY, electronics & media, and fashion.

Besides, Japan's fashion segment is highly developed, and the small size of the country makes shipping and product delivery much convenient. A wide range of customers paying through e-wallets, net banking, mobile payments, cash-on-delivery and other methods, which is also boosting the e-commerce payment industry in Japan.

Report Summary

- Payment Method – We have covered by Payment Method in the Japan E-commerce Payment Market breakup by 5 viewpoints (Card, Cash, Bank Transfer, Digital Wallet and Other)

- Segment – Renub Research Report coveres by segment in the Japan E-commerce Payment Market breakup by 5 viewpoints (Food & Personal Care, Furniture & Application, Toys, Hobby, DIY, Electronics & Media and Fashion)

- All the key players have been covered from 2 Viewpoints (Overview, Recent Development) Rakuten Group, Suica, PayPal, Origami, and merPay.

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com