Italy In-Vitro Diagnostics (IVD) Market Forecast 2025–2033

Buy NowItaly IVD Market Size and Forecast 2025-2033

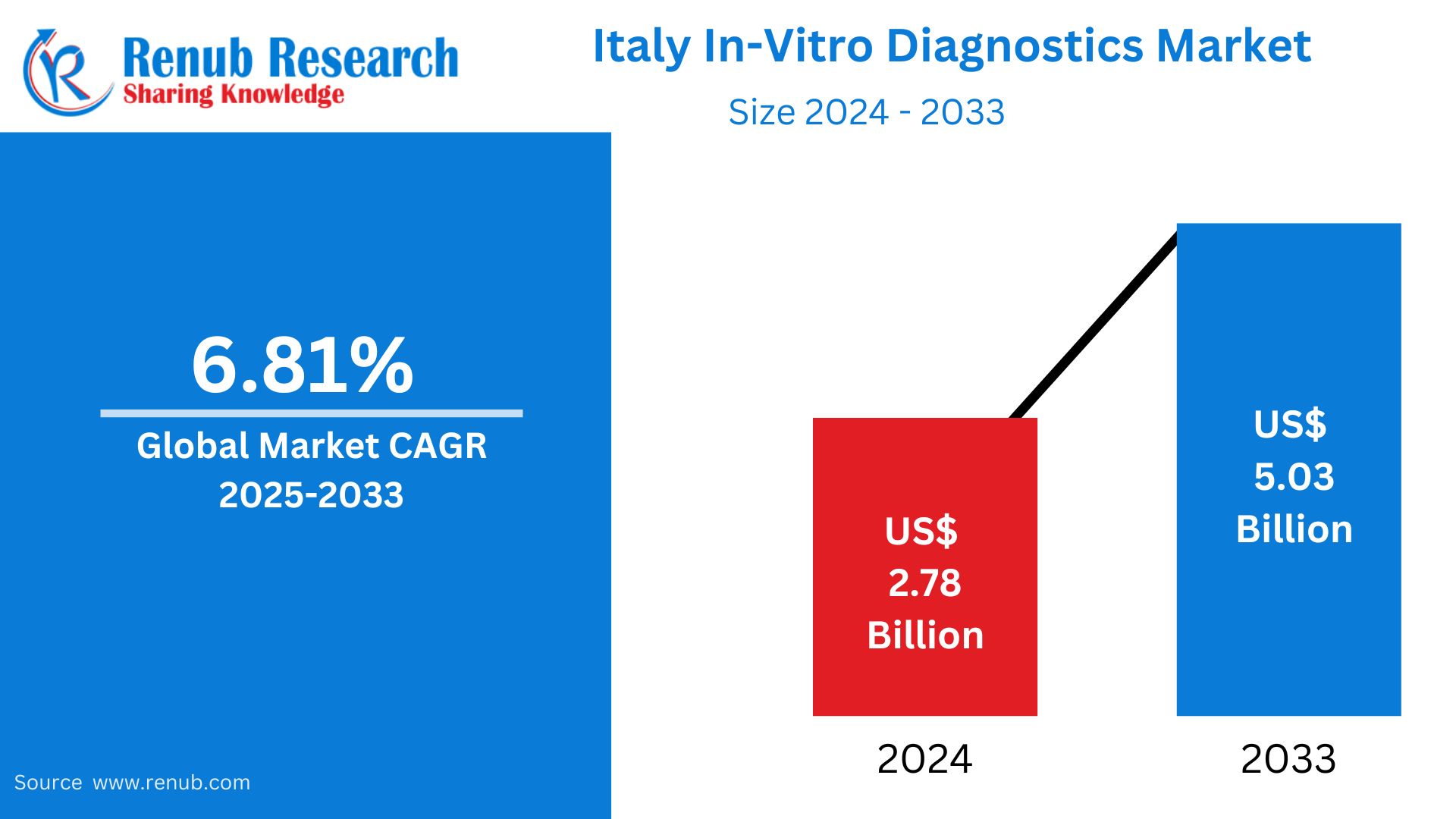

The Italy In-Vitro Diagnostics (IVD) Market was worth USD 2.78 billion in 2024 and is expected to reach USD 5.03 billion by 2033, growing at a CAGR of 6.81% during the period from 2025 to 2033. Italy's IVD market is backed by a well-developed public healthcare system, an aging population, and rising demand for early and precise disease diagnosis. The nation continues to invest in laboratory infrastructure, automation, and molecular testing technologies

The report Italy In-Vitro Diagnostics (IVD) Market Forecast covers by Test Types (ELISA & CLIA, PCR, Rapid Test, Fluorescence Immunoassays (FIA), In Situ Hybridization, Transcription Mediated Amplification, Sequencing, Colorimetric Immunoassay, Radioimmunoassay (RIA), Isothermal Nucleic Acid Amplification Technology, Others), Product (Services, Instruments, Reagents), Application (Infectious Disease, Diabetes, Cardiology, Oncology, Nephrology, Autoimmune Diseases, Drug Testing, Other), Technology (Immunoassay, Clinical Chemistry, Molecular Diagnostics/Genetics, Hematology, Microbiology, Coagulation, Others), End User (Hospitals, Laboratories, Home Care, Others), Country and Company Analysis 2025-2033.

Italy In-Vitro Diagnostics (IVD) Market Overview

In-Vitro Diagnostics (IVD) are medical tests applied to biological specimens—like blood, urine, or tissue—outside the human body to detect, monitor, or prevent illness. IVD diagnostics are vital tools in medicine, used to identify infections, chronic diseases, genetic disorders, and even early cancer. Rapid tests, molecular diagnostics, immunoassays, and clinical chemistry analyzers are some of the IVD technologies that find broad application in laboratories, hospitals, and now at home.

In Italy, IVD has gained significant popularity due to the country’s strong public healthcare system and an aging population that requires frequent monitoring of chronic illnesses. The Italian healthcare sector prioritizes early diagnosis and prevention, making IVD essential in national health strategies. With increasing demand for high-quality diagnostics, Italy has also embraced innovations like automation and point-of-care testing. The COVID-19 pandemic also boosted the public's perception of IVD instruments, especially for infectious disease testing, cementing their place in day-to-day healthcare throughout the nation.

Drivers of Growth in the Italy In-Vitro Diagnostics (IVD) Market

Increasing Incidence of Chronic and Age-Related Diseases

Italy boasts one of the oldest populations in Europe, with a high incidence of chronic diseases like diabetes, cardiovascular diseases, and cancer. This demographic shift greatly boosts the demand for periodic diagnostic testing for early diagnosis and disease control. IVD instruments play a crucial role in tracking patient health, informing treatment decisions, and controlling long-term care. As awareness of preventative healthcare continues to grow, both private and public sectors in Italy are spending more on diagnostics, thus driving long-term demand in clinical laboratories and point-of-care settings. Italy, as per statistics from Eurostat, is the European Union's oldest nation with a median age of over 48. Italy, along with Portugal, also has the highest proportion of people aged over 65, standing at 24%. This translates to about one in every four residents being older than 65.

Government Investment and National Screening Programs

The government of Italy actively promotes public health through different national screening programs for cancers, infectious diseases, and genetic disorders. These programs are highly dependent on in-vitro diagnostics to facilitate early and correct detection. Increased funding for healthcare and harmonization with EU health directives have supported the growth of laboratory facilities and the incorporation of sophisticated diagnostic equipment. Government-sponsored awareness campaigns and free screening programs have greatly contributed to test volumes, making IVD a core element of Italy's healthcare system. December 2024,The Italian Senate has voted on the 2025 budget, which contains a financial package with incentives for innovative antibiotics. Article 49 of the budget law provides new and recently-approved anti-infectives, which are Reserve-classified by the WHO, with access to the national Fund for Innovative Medicines. The Fund will cover up to EUR 100 million annually for the reimbursement of these life-saving antibiotics.

Technological Advancements and Laboratory Automation

Italy's IVD market is undergoing a transition towards automation, digital diagnostics, and molecular testing. Clinical laboratories are embracing sophisticated instruments that enable high-throughput testing, real-time monitoring, and improved diagnostic accuracy. Technologies like CLIA, PCR, and next-generation sequencing are becoming increasingly popular, especially in oncology and infectious disease diagnostics. The push towards operational efficiency and rapid turnaround times is compelling private and public labs to upgrade. This increasing adoption of technology is fortifying the nation's diagnostic strength and boosting market demand. August 2022, DIESSE Diagnostica Senese and Grifols have entered into a partnership to distribute Grifols' Promonitor assays for biological drug monitoring, offered as point-of-care technology or ELISA microplate tests.

Challenges in the Italy In-Vitro Diagnostics (IVD) Market

Regional Disparities in Healthcare Access

Italy's decentralized healthcare system has led to wide regional disparities in the quantity and quality of diagnostic services available. Northern provinces tend to enjoy greater access to sophisticated IVD technologies and properly equipped laboratories, whereas southern regions lack adequate infrastructure and resources. This disparity interferes with even healthcare delivery and limits the entire growth potential of the IVD market. Improvement of these discrepancies necessitates policy reforms and selective investment to allow equal access to diagnostics in every region.

Cost Limitations and Reimbursement Problems

While Italy boasts a publicly funded healthcare system, budget constraints frequently limit access to the most sophisticated and expensive diagnostic tests. Reimbursement is often slow, and not all IVD products are reimbursed in full, particularly new or niche technologies. Such cost-related issues deter wider use of innovative diagnostics and restrict the capacity of private laboratories to replace equipment. Sustaining market growth while balancing innovation with cost-efficiency is a primary challenge.

Italy ELISA & CLIA In-Vitro Diagnostics (IVD) Market

ELISA (Enzyme-Linked Immunosorbent Assay) and CLIA (Chemiluminescence Immunoassay) are crucial tools for testing in the IVD market of Italy and are used extensively to detect infectious diseases, hormones, and cancer markers. These technologies have high sensitivity, specificity, and automation potential, and they are best suited for routine and expert diagnostics. Italy's growing emphasis on early disease diagnosis, especially for diseases such as HIV, hepatitis, and cancer, has pushed the demand for immunoassays. CLIA platforms are being adopted in hospitals and labs throughout Italy to obtain quicker results and higher throughput, facilitating correct, large-scale diagnostic screening.

Italy In-Vitro Diagnostics (IVD) Rapid Test Market

Rapid tests are becoming very popular in Italy because they are convenient, quick, and well-suited to both clinical and home settings. These tests are used to play a significant part in controlling infectious diseases, chronic illnesses, and screening activities, particularly in rural or low-access populations. Accelerated adoption due to the COVID-19 pandemic introduced the population and healthcare professionals to rapid, efficient diagnostic devices. Italy's increasing elderly age population and increased demand for home care also favor this category, as patients prefer easy-to-use, self-administered tests that give accurate results without needing to visit healthcare centers.

Italy In-Vitro Diagnostics (IVD) Instruments Market

There is a growing demand for sophisticated IVD instruments in Italy due to the drive towards automation of laboratories and digitalization. IVD instruments like hematology analyzers, molecular diagnostic instruments, and clinical chemistry instruments are being implemented in public as well as private laboratories for the processing of tests efficiently. Italian healthcare institutes are investing in scalable high-throughput systems in order to cope with increasing diagnostic workloads. Equipment that provides connectivity with Laboratory Information Management Systems (LIMS) is in great demand, as laboratories seek to improve accuracy, reduce human error, and shorten turnaround times for a variety of test types.

Italy In-Vitro Diagnostics (IVD) Infectious Disease Market

Italy's infectious disease diagnostics market continues to be strong, fueled by ongoing demand for testing solutions for COVID-19, influenza, HIV, hepatitis, and sexually transmitted infections. Public health authorities have been focusing on early detection and control by conducting screening and prevention across the country. Molecular diagnostics and antigen tests are widely applied across centralized laboratories as well as at point-of-care facilities. Surveillance programs by government and the mounting requirement for syndromic test panels are propelling the growth of the market in the long term, keeping Italy ahead in the management of infectious diseases.

Italy In-Vitro Diagnostics (IVD) Clinical Chemistry Market

Clinical chemistry is the core of Italy's healthcare diagnostics, including tests for blood sugar, electrolytes, enzymes, and metabolic panels. All these tests are crucial in the control of chronic disease such as diabetes, cardiovascular disease, and kidney disease. Italian laboratories value automation and stability, and clinical chemistry analyzers have become more advanced and space-saving, enabling high-volume processing with minimal maintenance. Hospitals and diagnostic centers in Italy rely on these tests on a consistent basis for monitoring purposes, lending support to the stability and sustained viability of the clinical chemistry segment of the Italian IVD market.

Italy In-Vitro Diagnostics (IVD) Laboratories Market

Italy boasts a combination of private and public laboratories that are situated at the heart of performing diagnostic tests throughout Italy. These labs are increasingly becoming automated with the adoption of automated systems, hospitals using AI-assisted diagnostics, and lab information systems. Hospital and centralized laboratories account for most test volumes, mostly in urban areas. Regional healthcare in Italy enables customized lab networks but introduces variability in accessing tests. Laboratory services are tackling challenges through increased throughput and quality control to keep up with growing demand, particularly for chronic disease care and public health screening programs.

Key Segments in the Italy IVD Market

Test Types

- ELISA & CLIA

- PCR

- Rapid Test

- Fluorescence Immunoassays (FIA)

- In Situ Hybridization

- Transcription Mediated Amplification

- Sequencing

- Colorimetric Immunoassay

- Radioimmunoassay (RIA)

- Isothermal Nucleic Acid Amplification Technology

- Others

Product

- Services

- Instruments

- Reagents

Application

- Infectious Disease

- Diabetes

- Cardiology

- Oncology

- Nephrology

- Autoimmune Diseases

- Drug Testing

- Other Applications

Technology

- Immunoassay

- Clinical Chemistry

- Molecular Diagnostics/Genetics

- Hematology

- Microbiology

- Coagulation

- Others

End User

- Hospitals

- Laboratories

- Home Care

- Others

Companies have been covered from 5 viewpoints

- Overviews

- Key Person

- Recent Developments

- Product Portfolio

- Revenue

Competitive Landscape and Key Players

- Roche Diagnostics

- Abbott Diagnostics

- Siemens Healthineers

- Danaher Corporation

- Thermo Fisher Scientific

- Sysmex Corporation

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Test Type, Products Type, Technology, Application, and End User |

| Test Type Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamic

4.1 Growth Drivers

4.2 Challenges

5. Italy In-Vitro Diagnostics (IVD) Market

6. Market Share

6.1 By Test Types

6.2 By Products

6.3 By Technology

6.4 By Application

6.5 By End User

7. Test Types

7.1 ELISA & CLIA

7.2 PCR

7.3 Rapid Test

7.4 Fluorescence Immunoassays (FIA)

7.5 In Situ Hybridization

7.6 Transcription Mediated Amplification

7.7 Sequencing

7.8 Colorimetric Immunoassay

7.9 Radioimmunoassay (RIA)

7.10 Isothermal Nucleic Acid Amplification Technology

7.11 Others

8. Product Types

8.1 Services

8.2 Instruments

8.3 Reagents

9. Technology

9.1 Immunoassay

9.2 Clinical Chemistry

9.3 Molecular Diagnostics/Genetics

9.4 Hematology

9.5 Microbiology

9.6 Coagulation

9.7 Others

10. Application

10.1 Infectious Disease

10.2 Diabetes

10.3 Cardiology

10.4 Oncology

10.5 Nephrology

10.6 Autoimmune Diseases

10.7 Drug Testing

10.8 Other Applications

11. End User

11.1 Hospitals

11.2 Laboratories

11.3 Home - Care

11.4 Others

12. Porter’s Five Forces

12.1 Bargaining Power of Buyer

12.2 Bargaining Power of Supplier

12.3 Threat of New Entrants

12.4 Rivalry among Existing Competitors

12.5 Threat of Substitute Products

13. SWOT Analysis

13.1 Strengths

13.2 Weaknesses

13.3 Opportunities

13.4 Threats

14. Government Rules & Regulation

15. Reimbursement

15.1 Public

15.2 Private & Insurance

16. Key Players Analysis

16.1 Roche Diagnostics

16.1.1 Overviews

16.1.2 Key Person

16.1.3 Recent Developments

16.1.4 Product Portfolio

16.1.5 Revenue

16.2 Abbott Diagnostics

16.2.1 Overviews

16.2.2 Key Person

16.2.3 Recent Developments

16.2.4 Product Portfolio

16.2.5 Revenue

16.3 Siemens Healthineers

16.3.1 Overviews

16.3.2 Key Person

16.3.3 Recent Developments

16.3.4 Product Portfolio

16.3.5 Revenue

16.4 Danaher Corporation

16.4.1 Overviews

16.4.2 Key Person

16.4.3 Recent Developments

16.4.4 Product Portfolio

16.4.5 Revenue

16.5 Thermo Fisher Scientific

16.5.1 Overviews

16.5.2 Key Person

16.5.3 Recent Developments

16.5.4 Product Portfolio

16.5.5 Revenue

16.6 Sysmex Corporation

16.6.1 Overviews

16.6.2 Key Person

16.6.3 Recent Developments

16.6.4 Product Portfolio

16.6.5 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com