Global Rice Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowRice Market Trends & Summary

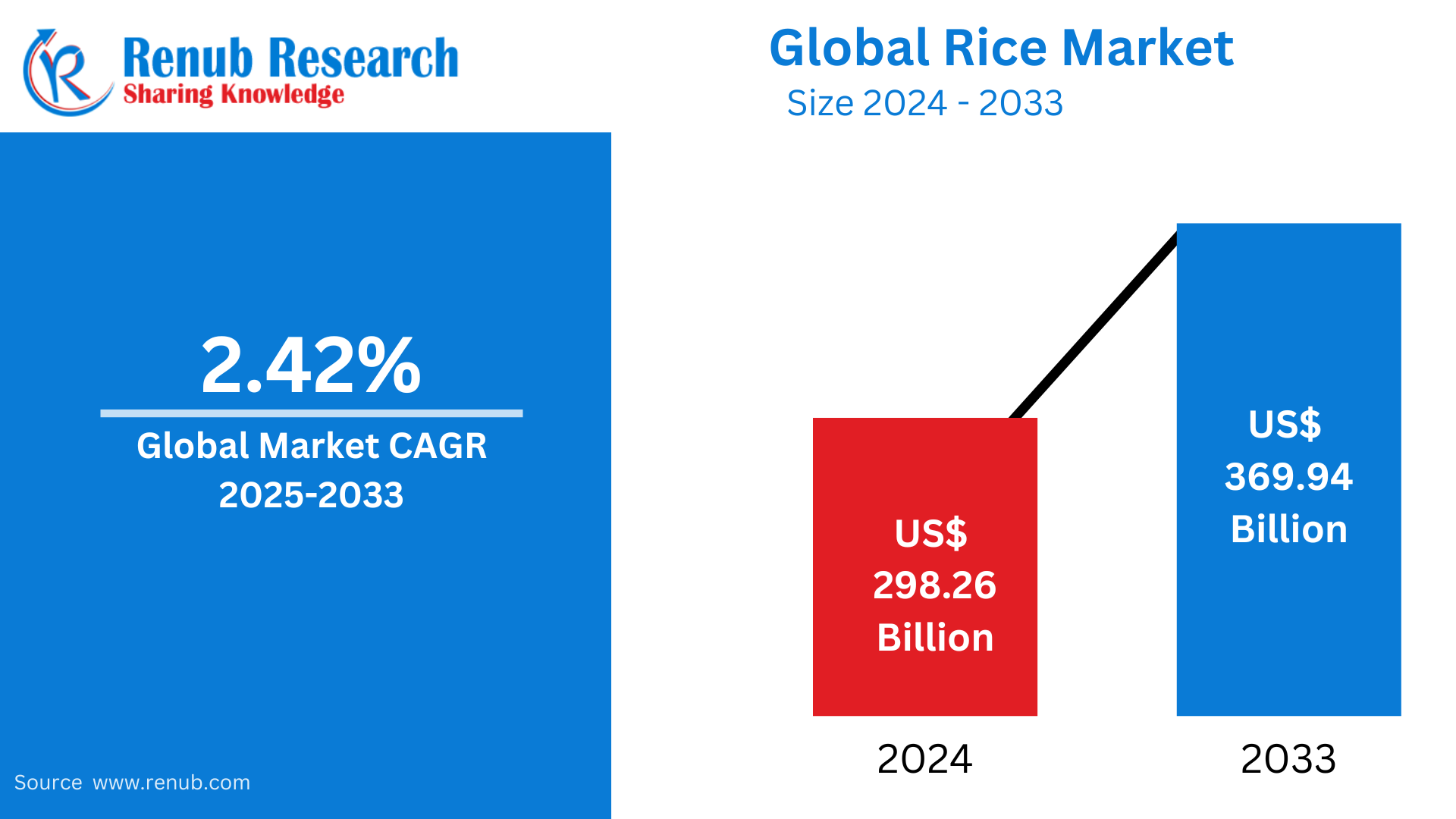

Rice Market is expected to reach US$ 378.41 billion by 2033 from US$ 305.14 billion in 2024, with a CAGR of 2.42% from 2025 to 2033. Population growth and changing dietary habits, globalization and the existence of international trade agreements, government programs and agricultural regulations, and the rising demand for convenience foods made from rice are all contributing factors to the market's steady expansion.

Global Rice Market Report by Product Type (Regular, and Aromatic), Type (Red Rice, Arborio Rice, Black Rice, Grain Fragrance Rice, Brown Rice, Rosematta Rice, Grain Parboiled Rice, Sushi Rice, and Others), Grain Size (Long Grain, Medium Grain, and Short Grain), Distribution Channel (Offline, and Online), Application (Food, Feed, and Others), Countries and Company Analysis 2025-2033

Global Rice Industry Overview

As a cereal grain, rice is the most widely consumed staple food for the majority of the world's population, particularly in Asia, where it accounts for nearly 90% of both production and consumption. Rice is grown in more than 120 countries, with China and India producing 50% of the world's total. It is the primary agricultural commodity with the third-highest production worldwide, after maize and sugarcane, and is consumed by more than half of the world's population, with those in Asia, sub-Saharan Africa, and South America being the biggest consumers. For example, according to the FAOSTAT, in 2022, there were approximately 165 million hectares of rice-cultivated area worldwide. According to estimates, India harvests over 48 million hectares of rice annually, making it the world's largest producer.

Due to rising demand for staple foods brought on by urbanization and the world's population growth, the rice market is expanding. Consumption is also increased in developing countries as incomes rise. Improved seeds and farming techniques are examples of technological advancements in rice agriculture that increase productivity and efficiency. Growth is aided by government assistance for food security and agriculture as well as increased export prospects. Demand and stability in the market are also influenced by customer preferences for processed rice products and climate-resilient rice types.

Growth Drivers for the Rice Market

Government programs and agricultural regulations

The worldwide rice market is mostly driven by agricultural policies and government efforts. In order to promote rice cultivation, maintain price stability, and guarantee food security for their citizens, many rice-producing nations put laws and initiatives into place. Increased output is encouraged by price support systems, subsidies, and incentives for rice growers. By shielding farmers from price swings and enticing them to invest in cutting-edge farming methods and technology, these policies stabilize the market. In order to increase rice yields, disease resistance, and drought tolerance, governments are now funding research and development (R&D) initiatives. As a result, high-yield rice varieties are being cultivated and sophisticated agricultural techniques are being adopted. The international rice trade can also be impacted by import quotas, export laws, and trade policies. Governing agencies may impose export restrictions during times of shortage or increase import quotas to meet domestic demand, affecting international rice prices and trade dynamics.

In February 2024: In response to a 15% increase in grain retail prices over the previous year, India's food ministry introduced "Bharat rice" at a discounted price of Rs 29 (USD 0.35), per kilogram.

Growing desire for convenience foods made with rice

Convenient lunch options are becoming more and more sought after by busy metropolitan populations. Customers have quick and easy options with rice-based ready-made meals, such as frozen rice bowls, instant rice noodles, and microwaveable rice pouches. Rice-based snacks, like rice chips and cakes, are becoming more popular as healthier substitutes for conventional munchies. Their low-fat and gluten-free content appeals to people who are health-conscious. The convenience of instant rice products, which require little cooking time, makes them popular. Customers that value speedy meal preparation are served by these products. In order to satisfy the wide range of palates in international markets, food producers are innovating by providing a variety of flavors and rice kinds.

Expanding prospects for exports

International trade agreements and growing globalization are making it easier for rice to go across borders. By lowering trade obstacles, these accords facilitate access to international markets for nations that produce rice. Long-grain, medium-grain, and short-grain rice are among the varieties available, each of which suits a certain culinary inclination. Because of this diversity, nations that export rice are able to satisfy the unique needs of different global marketplaces. Convenient and simple-to-prepare food items are becoming more and more popular as the world's population grows. This tendency is reflected in the demand for rice, a versatile staple that appeals to a diverse spectrum of customers globally. Strict certifications and quality control procedures guarantee that exported rice satisfies global safety and quality requirements, boosting importers' and customers' confidence.

Challenges in the Rice Market

Supply and Demand Imbalances

Inequalities in supply and demand provide a serious problem for the rice market. Due to shortages brought on by disease, pests, or weather-related delays, prices may rise. On the other hand, a glut brought on by overproduction can hurt farmers' profitability by lowering prices. Particularly in developing nations, these swings lead to market instability, which makes it hard for consumers to retain inexpensive access to rice and for producers to forecast income.

Price Volatility

Price fluctuations in the rice market are caused by supply-demand mismatches brought on by bad weather, pests, or crop failures, which can result in abrupt price increases. Global supply chains can also be disrupted by government policies like export limits or subsidies. Price swings are also influenced by market speculation, currency changes, and global economic situations like inflation or recessions. Uncertainty is brought about by these swings, which affect farmers' earnings and make it challenging for customers to budget or for companies to keep prices steady.

United States Rice Market

The growing use of rice as a basic component in many American cuisines is driving the industry in the United States. Additionally, the market is expanding as a result of growing product consumption brought on by shifting demographics and dietary choices. USDA data shows that the United States produced 9.89 million metric tons of rice in 2023, a 36% increase over 2022. The harvested area increased by 32% from the previous year to 1.15 million hectares. Favorable growing conditions, improved agricultural methods, and a greater emphasis on rice production are all credited with this increase in yield.

Furthermore, the desire for brown and wild rice, which are seen as healthier options, is being aided by Americans' growing health consciousness. The market is also growing as a result of the growing food service industry, which includes fast-food chains, restaurants, and caterers. In addition, the market is expanding due to the thriving food processing sector, which uses rice in many different items like snacks, beverages, and baby food.

Additionally, the market is expanding as a result of recent technological developments in agricultural operations that have produced greater yield cultivars and more effective farming techniques. The market expansion is also being positively impacted by the United States government's deployment of supporting policies to promote domestic rice production and support the agriculture sector through subsidies and advantageous trade policies.

India Rice Market

Rising export demand and population increase are the main drivers of India's rice market expansion. The country's population is expected to reach 152.2 Crores by 2036, according to the Ministry of Statistics & Programme Implementation, which will result in a persistently high demand for rice as a staple meal. For many people, rice is a crucial part of their diet, particularly in rural areas where it serves as their main source of sustenance. Growing affluence, urbanization, and shifting lifestyles have all contributed to a growth in the use of processed rice products, including rice flour, ready-to-eat meals, and snacks.

LT Foods Ltd. introduced DAAWAT® Jasmine Thai Rice to the Indian market in December 2024. This Thai rice, which is non-GMO certified, has a delicate texture and a pleasant scent that make it ideal for use in Thai and Asian cooking. It may be found on popular e-commerce sites, and Indians are becoming more interested in other cuisines. Additionally, with assistance from the Centre for Sustainable Agriculture, Diageo India began a regenerative agriculture initiative in November 2024 that focuses on sustainable rice production in Telangana. It provides 500 hectares of help to 220 farmers through water and carbon footprint reduction initiatives. In support of business supply chain goals, the AWD practice would further improve rice production's sustainability.

Germany Rice Market

Due to a lack of native production, Germany's rice market is mostly dependent on imports to meet demand. Long-grain rice is the primary type consumed in the nation, and processed and high-quality rice products are preferred. In Germany, rice is not a staple crop, but because of ethnic influences, demand for it is constant. Although it is still less volatile than other European markets, factors including EU trade rules, environmental concerns, and changing consumer tastes impact market dynamics.

United Arab Emirates Rice Market

The rice market in the United Arab Emirates (UAE) is mostly dependent on imports, coming from nations like Thailand, Pakistan, and India. Demand for rice is still high due to an increasing population and a varied, expat-driven market base, particularly for premium and Basmati types. Trade regulations, shifts in the global supply chain, and customer preferences for convenience foods all have an impact on the rice market in the United Arab Emirates. Water scarcity and climate variables also restrict domestic output.

Rice Market Segments:

Product Type

- Regular

- Aromatic

Type

- Red Rice

- Arborio Rice

- Black Rice

- Grain Fragrance Rice

- Brown Rice

- Rosematta Rice

- Grain Parboiled Rice

- Sushi Rice

- Others

Grain Size

- Long Grain

- Medium Grain

- Short Grain

Distribution Channel

- Offline

- Online

Application

- Food

- Feed

- Others

Country –Market breakup in 25 viewpoints:

North America

1. United States

2. Canada

Europe

1. France

2. Germany

3. Italy

4. Spain

5. United Kingdom

6. Belgium

7. Netherlands

8. Turkey

Asia Pacific

1. China

2. Japan

3. India

4. Australia

5. South Korea

6. Thailand

7. Malaysia

8. Indonesia

9. New Zealand

Latin America

1. Brazil

2. Mexico

3. Argentina

Middle East & Africa

1. South Africa

2. Saudi Arabia

3. United Arab Emirates

All companies have been covered from 4 viewpoints:

- Company Overview

- Key Persons

- Recent Development & Strategies

- Sales Analysis

Company Analysis

- KRBL Limited

- LT Food Ltd

- Kohinoor Foods

- Thai Wah

- Archer Daniels

- Tate & Lyle

- General Mills

- MGP limited

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Product Type, By Type, By Grain Size, By Distribution Channel, By Application and By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in Report:

-

What is the current market size and projected growth of the global rice market from 2025 to 2033?

-

Which product types (Regular vs Aromatic) dominate the rice market, and how are their trends evolving?

-

How do different rice types (e.g., Red, Black, Brown, Sushi, Arborio) contribute to market segmentation and growth?

-

What are the growth trends across various grain sizes – Long, Medium, and Short Grain?

-

How is the demand for rice being influenced by consumer trends such as convenience food and health-conscious eating?

-

What role do government policies, subsidies, and agricultural reforms play in shaping rice production and pricing globally?

-

How are global trade policies and international agreements impacting rice exports and imports, particularly in major markets like India, the U.S., and the UAE?

-

What are the major challenges faced by the global rice industry such as supply-demand imbalance, price volatility, and climate impacts?

-

Which distribution channels (Offline vs Online) are gaining traction in different regions and why?

-

Who are the major players in the rice industry, and what are their recent developments, strategies, and sales performance?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Rice Market

6. Market Share Analysis

6.1 By Product Type

6.2 By Type

6.3 By Grain Size

6.4 By Distribution Channel

6.5 By Application

6.6 By Countries

7. Product Type

7.1 Regular

7.2 Aromatic

8. Type

8.1 Red Rice

8.2 Arborio Rice

8.3 Black Rice

8.4 Grain Fragrance Rice

8.5 Brown Rice

8.6 Rosematta Rice

8.7 Grain Parboiled Rice

8.8 Sushi Rice

8.9 Others

9. Grain Size

9.1 Long Grain

9.2 Medium Grain

9.3 Short Grain

10. Distribution Channel

10.1 Online

10.2 Offline

11. Application

11.1 Food

11.2 Feed

11.3 Others

12. Countries

12.1 North America

12.1.1 United States

12.1.2 Canada

12.2 Europe

12.2.1 France

12.2.2 Germany

12.2.3 Italy

12.2.4 Spain

12.2.5 United Kingdom

12.2.6 Belgium

12.2.7 Netherlands

12.2.8 Turkey

12.3 Asia Pacific

12.3.1 China

12.3.2 Japan

12.3.3 India

12.3.4 South Korea

12.3.5 Thailand

12.3.6 Malaysia

12.3.7 Indonesia

12.3.8 Australia

12.3.9 New Zealand

12.4 Latin America

12.4.1 Brazil

12.4.2 Mexico

12.4.3 Argentina

12.5 Middle East & Africa

12.5.1 Saudi Arabia

12.5.2 UAE

12.5.3 South Africa

13. Porter’s Five Forces Analysis

13.1 Bargaining Power of Buyer

13.2 Bargaining Power of Supplier

13.3 Threat of New Entrants

13.4 Rivalry among Existing Competitors

13.5 Threat of Substitute Products

14. SWOT Analysis

14.1 Strength

14.2 Weakness

14.3 Opportunity

14.4 Threat

15. Key Players Analysis

15.1 KRBL Limited

15.1.1 Company overview

15.1.2 Key Persons

15.1.3 Recent Development & Strategies

15.1.4 Sales Analysis

15.2 LT Food Ltd

15.2.1 Company overview

15.2.2 Key Persons

15.2.3 Recent Development & Strategies

15.2.4 Sales Analysis

15.3 Kohinoor Foods

15.3.1 Company overview

15.3.2 Key Persons

15.3.3 Sales Analysis

15.3.4 Recent Development & Strategies

15.4 Thai Wah

15.4.1 Company overview

15.4.2 Key Persons

15.4.3 Recent Development & Strategies

15.4.4 Sales Analysis

15.5 Archer Daniels

15.5.1 Company overview

15.5.2 Key Persons

15.5.3 Recent Development & Strategies

15.5.4 Sales Analysis

15.6 Tate & Lyle

15.6.1 Company overview

15.6.2 Key Persons

15.6.3 Recent Development & Strategies

15.6.4 Sales Analysis

15.7 General Mills

15.7.1 Company overview

15.7.2 Key Persons

15.7.3 Recent Development & Strategies

15.7.4 Sales Analysis

15.8 MGP limited

15.8.1 Company overview

15.8.2 Key Persons

15.8.3 Recent Development & Strategies

15.8.4 Sales Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com