Fiberglass Pipes Market – Global Industry Analysis & Forecast 2025–2033

Buy NowFiberglass Pipes Market Size and Forecast 2025-2033

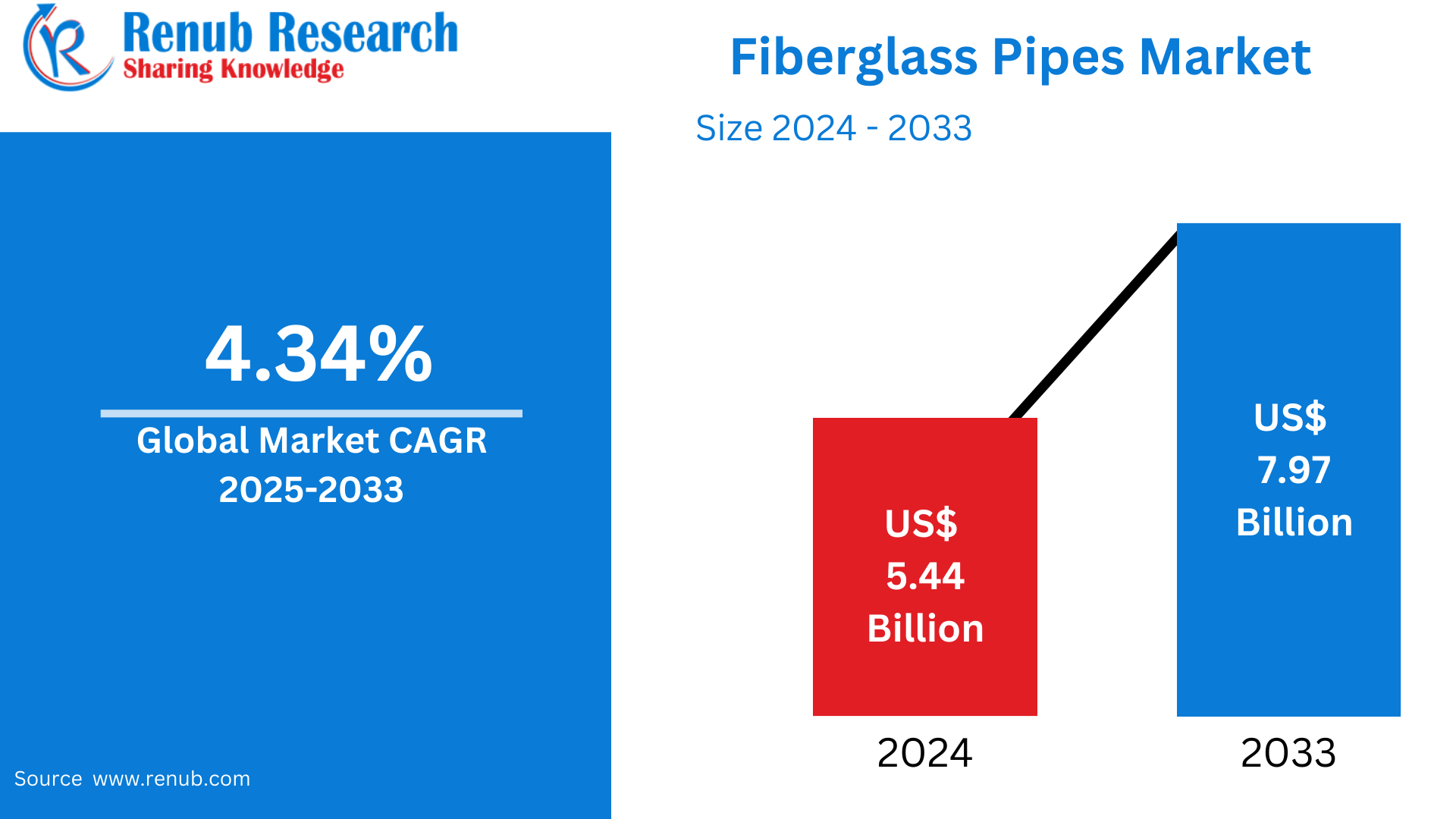

Global Fiberglass Pipes Market had a value of US$ 5.44 billion in 2024 and is estimated to reach US$ 7.97 billion by the year 2033, with a CAGR of 4.34% from 2025 to 2033. This is attributed to rising demand in oil & gas, chemical, and water treatment industries owing to corrosion resistance, reduced weight, and strength of fiberglass pipes in severe conditions.

Fiberglass Pipes Market Forecast Report by Product (GRE Pipes, GRP Pipes, Others), Fiber (E-Glass, T-Glass/S-Glass/R-Glass, Others), End Use (Oil & Gas, Chemicals, Sewage, Irrigation, Others), Country and Company Analysis 2025-2033.

Fiberglass Pipes Market Outlooks

Fiberglass pipes, or fiberglass-reinforced plastic (FRP) pipes, are composite pipes that consist of a plastic resin (most commonly polyester, vinyl ester, or epoxy) reinforced with glass fibers. Fiberglass pipes have a high strength-to-weight ratio, excellent corrosion resistance, low maintenance, and long life. They are especially beneficial where metal pipes would corrode or deteriorate with time.

Fiberglass pipes find extensive applications in various industries owing to their hardness and versatility. In the oil and gas industry, they are used for carrying corrosive fluids and hydrocarbons. In chemical processing, they carry aggressive chemicals and high-temperature liquids. They are used by the water and wastewater treatment industry in pipelines carrying treated or raw water. They also prevail in marine, power generation, and irrigation systems where corrosion-resistance piping with low weight is essential. Their capability to sustain tough conditions while being cost-efficient in installation makes fiberglass pipes a necessary solution for contemporary infrastructure developments.

Growth Driver in the fiberglass pipes market

Increased Demand in the Oil & Gas Sector

Oil & gas is one of the major users of fiberglass pipes because of their resistance to corrosion, light weight, and high strength. Fiberglass pipes are particularly useful in offshore and onshore drilling where there are difficult weather conditions. With increasing energy consumption across the world, exploration and drilling operations are increasing, and the demand for robust pipe line solutions is increasing. Fiberglass pipes are superior to conventional metal options based on longevity and maintenance. This demand is also being driven by increasing investments in energy infrastructure and mounting emphasis on ecologically friendly materials in hydrocarbon transport and storage.

Emerging Economies Infrastructure Development

Urbanization and infrastructure growth at a fast pace in emerging economies, particularly in Asia-Pacific and the Middle East, are driving the market for fiberglass pipes. These pipes are increasingly used in sewage systems, water supply networks, and industrial pipelines due to their long service life, ease of installation, and resistance to chemical degradation. Government initiatives aimed at improving sanitation and water management are contributing significantly to this growth. The ability of fiberglass pipes to withstand aggressive environments with minimal maintenance makes them an ideal choice for infrastructure projects where durability and cost-efficiency are critical. India's oil and gas industry continues to be the world's third largest oil consumer, based on industry reports, as of 2023. With 100% FDI permitted in numerous segments, the sector is likely to draw $25 billion in exploration and production. Production of crude oil was 4.89 MMT in April-May 2024. Owing to the expanding demand for robust and efficient infrastructure, the oil and gas industry is now using refined materials like fiberglass pipes on a large scale.

Technological Innovations and Product Development

Improvement in manufacturing technologies and materials science has resulted in the creation of improved fiberglass pipe types like GRE (Glass Reinforced Epoxy) and GRP (Glass Reinforced Plastic) pipes. These innovations enhance performance parameters like pressure strength, thermal resistance, and operation life. In addition, production process automation lowered costs and improved consistency. Innovation also caters to industry-specific needs, making bespoke solutions available for industries such as desalination, power generation, and chemicals. Increased demand towards customization and intelligent pipeline systems will further continue to spur fiberglass piping system adoption. August 2024, Harrington Process Solutions bought Cortrol Process Systems to expand its flow control solutions. Cortrol is a company that deals in non-metallic corrosion resistant goods such as fiber-reinforced plastic systems for many industries. More environmental regulations are promoting the use of non-corrosive and durable materials such as fiberglass.

Challenge in the fiberglass pipes industry

High Initial Cost and Installation Complexity

One of the biggest challenges of the fiberglass pipes market is the initial cost, which is much higher than for conventional pipe materials such as steel or PVC. Even though they provide long-term cost savings by minimizing maintenance and having better durability, the initial expense can be a deterrent for small projects or price-conscious markets. Additionally, installation entails qualified labor and special equipment, increasing the complexity and cost. In areas where technical know-how is scarce or cost competitiveness is essential, this can slow down market penetration despite the long-term advantages of fiberglass pipes.

Environmental and Recycling Issues

Although fiberglass pipes are resistant to chemicals and have a long life, their environmental impact is problematic. Production includes the utilization of non-renewable material and the release of volatile organic compounds (VOCs). Furthermore, recycling of fiberglass pipes is complicated owing to the composite condition of the material, which restricts end-of-life reuse and disposal capacities. With tighter environmental impact regulations on a global scale, the sector is under pressure to evolve innovative sustainable manufacturing practices and establish workable recycling or reprocessing processes to minimize ecological issues.

Fiberglass GRE Pipes Market

Glass Reinforced Epoxy (GRE) pipes are a niche product of fiberglass pipes, characterized by corrosion resistance, thermal stability, and high-pressure strength. GRE pipes have widespread applications in oil & gas, marine, and chemical processing sectors. Their resistance to high heat and corrosive chemicals makes them best suited for offshore platforms and harsh industrial conditions. GRE pipes are light in weight, minimizing transport and installation expenses while providing higher strength. They are increasingly being used in markets with emphasis on high-performance piping systems for severe applications where metal pipes can fail or need excessive maintenance. February 2024, Rice University scientists created an energy-efficient process to recycle glass fiber reinforced plastic (GFRP) into silicon carbide, a precious material utilized by various industries.

E-Glass Fiberglass Pipes Market

E-glass fiberglass pipes make use of electrical-grade glass fibers, which provide superior insulation and mechanical strength. They are commonly used in electrical, telecommunications, and chemical processing industries. Their corrosion resistance and non-conductivity features make them perfect for applications where both chemical exposure and electrical insulation are factors. E-glass fibers also play a part in the overall light weight and toughness of the pipe structure. Since industries need more efficient and low-maintenance piping systems, E-glass fiberglass pipes are now considered a better option compared to metallic and conventional composite materials.

Oil & Gas Fiberglass Pipes Market

In the oil & gas sector, fiberglass pipes are appreciated for being corrosion resistant, long-lasting, and having low maintenance needs. These features are particularly critical in conveying corrosive materials such as saltwater, crude oil, and gas. Fiberglass pipes are utilized in applications including gathering lines, injection lines, and offshore platform piping. Being lightweight makes handling easier in remote or offshore areas. As oil & gas exploration extends to deeper, more severe conditions, demand for corrosion-resistant, high-performance pipe systems such as fiberglass continues to increase, fueling market growth in upstream as well as downstream segments.

Sewage Fiberglass Pipes Market

Sewage and wastewater treatment systems take full advantage of fiberglass pipes because of their long duration of service and durability to microbial and chemical degradation. Fiberglass pipes are able to resist aggressive waste flows without corroding, lowering maintenance and replacement costs. Their smooth interior surface also keeps sediment from accumulating, improving flow efficiency. In urban infrastructure construction, particularly in the developing world, fiberglass pipes are gaining popularity because of their low cost of ownership and resistance to continuous flow and fluctuating pH conditions. Environmental authorities are also promoting similar green materials in wastewater treatment solutions.

Irrigation Fiberglass Pipes Market

Fiberglass pipes present a good and long-lasting solution for irrigation pipes, particularly in agricultural-dominated areas. Due to their high strength-to-weight ratio and resistance to chemical fertilizers and UV radiation, they are also suitable for long-term usage in outdoor conditions. They reduce water loss through leakage and corrosion to a large extent, enhancing overall irrigation efficiency. They also require easy installation and less maintenance compared to metal or concrete pipes. With rising global food demand and precision agriculture on the increase, fiberglass piping solutions are ever more critical to modern irrigation infrastructure.

United States Fiberglass Pipes Market

The United States market for fiberglass pipes is advanced technologically and mature, with substantial uses in oil & gas, chemical processing, water management, and industrial infrastructure. The regulatory drive and emphasis of the country to replace old infrastructure and promote corrosion-resistant, long-term materials fuel demand. Fiberglass pipes also register growth in the renewable energy and water recycling markets. Robust R&D strength and the presence of major manufacturers add further to the market's power. Government investment in infrastructure, including water and wastewater, underpins ongoing expansion, with growing awareness of sustainability driving the uptake of fiberglass pipe technology. April 2024: Hobas Pipe USA expanded its production capacity by 50% with a new manufacturing line operational by October 1, 2024. The upgrade supports growing demand for large-diameter, corrosion-resistant fiberglass pipes in water and wastewater infrastructure.

France Fiberglass Pipes Market

France's fiberglass pipes market is driven by strong demand from municipal water supply, wastewater treatment, and energy sectors. For its emphasis on sustainable city development, the nation is investing in corrosion-resistant, long-life piping systems. Fiberglass pipes are being incorporated in smart water networks and renewable energy infrastructure like geothermal and hydropower. The focus of the French government on green construction and energy efficiency provides a boost to the use of advanced composite materials. Furthermore, regulatory requirements that support environmental conservation and industrial safety also ensure long-term utilization of fiberglass piping solutions. March 2025, Amiblu was appointed as an official partner for UNESCO World Engineering Day for Sustainable Development (WED) 2025, which was initiated in Paris. Amiblu is a global market leader in the production of glass fibre reinforced plastic (GRP) pipes. This occasion, happening in Paris, can indirectly bring attention to the application of fiberglass pipes in France.

India Fiberglass Pipes Market

India is experiencing fast growth in the market of fiberglass pipes, driven by infrastructure development, urbanization, and agricultural growth. Smart Cities, Jal Jeevan Mission, and irrigation improvement projects are government initiatives that are driving the growth heavily. The demand is tremendous in water supply, sewage, and oil & gas industries. Fiberglass pipes provide an affordable and long-lasting alternative to conventional materials, particularly in the face of difficult climatic and soil conditions in certain areas. Domestic production is growing, and collaborations with international players are contributing to greater product access and affordability. India's emphasis on green and resilient infrastructure underpins future market growth. Aug 2024, Ahead of the curve in green technology, Inpipe Sweden AB will launch its innovative UVcured GRP liners into the Indian market with a new strategic alliance. The partnership, heralded by a recent signing of an MOU, seeks to upgrade conventional pipe replacement technologies with innovative, no-dig technologies.

Saudi Arabia Fiberglass Pipes Market

Saudi Arabia is an important market for fiberglass pipes, especially in oil & gas and water infrastructure projects. The desert conditions make corrosion-resistant, light, and long-lasting fiberglass pipes well suited. With Vision 2030 pushing diversification and infrastructure expansion, there is more investment in industrial, utility, and desalination projects—sectors where fiberglass pipes perform best. The region's emphasis on lowering maintenance costs and improving efficiency adds strength to this market. Domestic production facilities are also increasing with the assistance of government incentives and from both private and public sector developments. February 2022, Future Pipe Industries has expanded its Dammam, Saudi Arabia manufacturing plant by adding two new FlexstrongTM – High Pressure Spoolable Pipe production lines, with a diameter of up to 6 inches. The plant is capable of producing an additional 600km per year. These two new manufacturing lines were opened by Mr. Fouad Makhzoumi, Chairman and CEO of Future Pipe Group, with dignitaries and Future Pipe, KSA staffs.

Market Segmentations

Product

- GRE Pipes

- GRP Pipes

- Others

Fiber

- E-Glass

- T-Glass/S-Glass/R-Glass

- Others

End Use

- Oil & Gas

- Chemicals

- Sewage

- Irrigation

- Others

Countries

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

All companies have been covered with 4 Viewpoints

- Overview

- Key Persons

- Recent Development & Strategies

- Revenue Analysis

Key Players Analysis

- PPG Industries, Inc.

- Future Pipe Industries

- Chemical Process Piping Pvt.Ltd.

- Saudi Arabian Amiantit Co

- Russel Metals Inc.

- Amiblu Holding GmbH

- ANDRONACO INDUSTRIES

- Gruppo Sarplast

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Product, By Fiber, By End Use and By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Fiberglass Pipes Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Fiberglass Pipes Market Share Analysis

6.1 By Product

6.2 By Fiber

6.3 By End Use

6.4 By Countries

7. Product

7.1 GRE Pipes

7.2 GRP Pipes

7.3 Others

8. Fiber

8.1 E-Glass

8.2 T-Glass/S-Glass/R-Glass

8.3 Others

9. End Use

9.1 Oil & Gas

9.2 Chemicals

9.3 Sewage

9.4 Irrigation

9.5 Others

10. Countries

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 South Korea

10.3.5 Thailand

10.3.6 Malaysia

10.3.7 Indonesia

10.3.8 Australia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 UAE

10.5.3 South Africa

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 PPG Industries, Inc.

13.1.1 Overview

13.1.2 Key Persons

13.1.3 Recent Development & Strategies

13.1.4 Revenue Analysis

13.2 Future Pipe Industries

13.2.1 Overview

13.2.2 Key Persons

13.2.3 Recent Development & Strategies

13.2.4 Revenue Analysis

13.3 Chemical Process Piping Pvt.Ltd.

13.3.1 Overview

13.3.2 Key Persons

13.3.3 Recent Development & Strategies

13.3.4 Revenue Analysis

13.4 Saudi Arabian Amiantit Co

13.4.1 Overview

13.4.2 Key Persons

13.4.3 Recent Development & Strategies

13.4.4 Revenue Analysis

13.5 Russel Metals Inc.

13.5.1 Overview

13.5.2 Key Persons

13.5.3 Recent Development & Strategies

13.5.4 Revenue Analysis

13.6 Amiblu Holding GmbH

13.6.1 Overview

13.6.2 Key Persons

13.6.3 Recent Development & Strategies

13.6.4 Revenue Analysis

13.7 ANDRONACO INDUSTRIES

13.7.1 Overview

13.7.2 Key Persons

13.7.3 Recent Development & Strategies

13.7.4 Revenue Analysis

13.8 Gruppo Sarplast

13.8.1 Overview

13.8.2 Key Persons

13.8.3 Recent Development & Strategies

13.8.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com