Europe Ultrasound Devices Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowForecast for Europe's ultrasound devices market 2025-2033

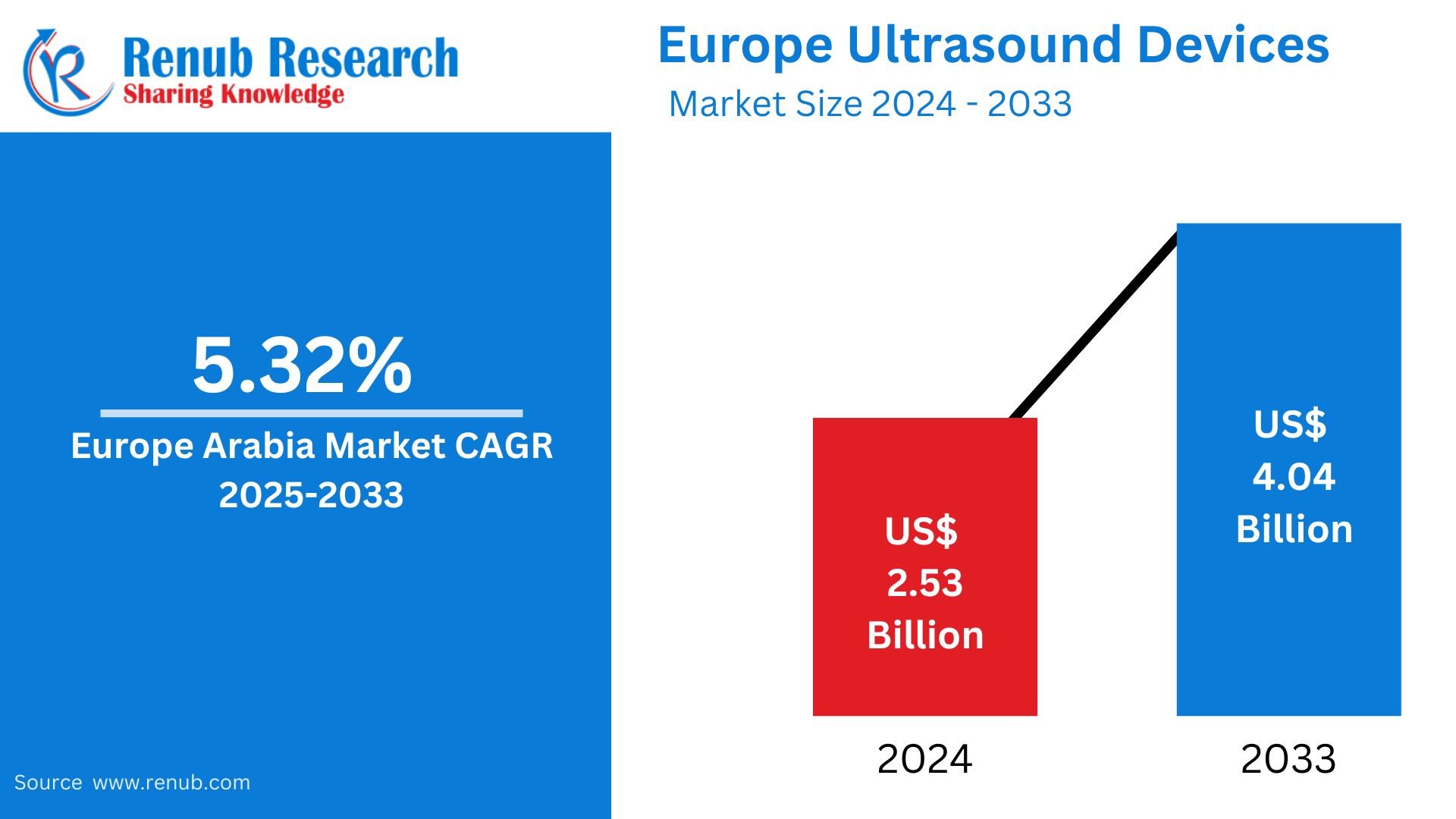

Europe Ultrasound Device Market was worth USD 2.53 billion in 2024 and is anticipated to grow to USD 4.04 billion by 2033 at a CAGR of 5.32% during the forecast period of 2025-2033. The market is induced by the growth in ultrasound imaging technology, rise in demand for minimal invasive diagnostic processes, and growing chronic diseases prevalence.

The report Europe Ultrasound Devices Market & Forecast covers by Application (Anaesthesiology, Cardiology, Gynaecology/Obstetrics, Musculoskeletal, Vascular, Other) Technology (2D Ultrasound Imaging, 3D and 4D Ultrasound Imaging, Doppler Imaging, High-intensity Focused Ultrasound) Types (Stationary Ultrasound, Portable Ultrasound) End User (Hospitals, Diagnostic Centers, Other End Users) Countries and Company Analysis, 2025-2033.

Europe Ultrasound Device Market Outlooks

An ultrasound machine is a medical imaging device that generates real-time images of the body's internal anatomy using high-frequency sound waves. It is most commonly used for diagnostics, aiding in medical interventions, and fetal monitoring during pregnancy. Unlike CT scans or X-rays, an ultrasound does not involve the use of radiation and is therefore a safer choice when repeated use is necessary.

In Europe, ultrasound machines are becoming more commonly used as a result of their non-invasive character and wide range of applications in cardiology, gynecology, urology, and musculoskeletal imaging. Growing incidences of chronic conditions, an aging population, and innovations in portable and 3D/4D ultrasound machines have also increased demand. Hospitals, clinics, and diagnostic facilities throughout Europe depend on ultrasound for effective and economical medical evaluation. Moreover, government programs favoring early disease detection and the growth of telemedicine are fueling adoption. With ongoing technological developments, ultrasound devices continue to be an integral part of Europe's healthcare system, providing precise and timely diagnoses.

Growth of portable ultrasound devices in Europe

Development in Ultrasound Technology

The Europe ultrasound device market is experiencing rapid growth owing to ongoing technological developments. The evolution of 3D/4D imaging, high-intensity focused ultrasound (HIFU), and artificial intelligence-based ultrasound systems has enhanced diagnostic precision and efficiency. These technologies have improved real-time imaging, improved visualization of internal organs, and aided early detection of diseases. The introduction of handheld and portable ultrasound devices has also increased accessibility, making ultrasound imaging more convenient in emergency and remote areas. The use of artificial intelligence in ultrasound equipment is further automating workflow and enhancing diagnostic results. Sept 2024, Sonio has achieved CE mark certification for its AI-enabled Sonio Detect, strengthening its ultrasound reporting software in France following FDA clearance and success in the US marketplace.

Increasing Prevalence of Chronic Diseases

The rising prevalence of chronic conditions like cardiovascular diseases, cancer, and kidney disease creates a high growth impetus for ultrasound device market in Europe. Non-invasive diagnosis facilitated by ultrasound imaging enables doctors to identify diseases early. With more people aging, along with rising awareness of health, hospitals, and diagnostic centres are purchasing new ultrasound machines for better patient results and minimizing the cost of health care. The European Commission estimates that in 2020, 318,327 new lung cancer cases and 257,293 deaths related to lung cancer occurred in Europe. This heavy burden of disease is likely to augment the demand for non-invasive diagnostic solutions, which will spur market growth.

Government Policies and Healthcare Spending

Governments in Europe are actively encouraging the uptake of innovative medical imaging technologies, such as ultrasound devices, through funding, research grants, and public healthcare policies. Germany, France, and the UK, among other countries, are ramping up investments in healthcare infrastructure to improve diagnosis capability. Regulatory agencies are also prioritizing enhanced patient access to quality ultrasound imaging, further fueling market growth. Growing coverage of telemedicine and remote diagnostics is also responsible for the surging demand for ultrasound machines in Europe. In 2022, Eurostat indicated that 7.7% of Europe's GDP, which was 1,334.7 billion USD, was spent on the healthcare sector. This increasing spending is propelling growth in the healthcare sector in the region and is likely to boost demand for technologically sophisticated solutions, including ultrasound devices, in the coming years.

Challenges in the Europe Ultrasound Device Market

High Cost of Advanced Ultrasound Systems

Although technological innovations enhance ultrasound imaging, they also increase the cost of healthcare for providers. The capital investment in 3D/4D ultrasound, AI-enabled systems, and HIFU equipment can be high, making it difficult to afford, particularly for small hospitals and clinics. Maintenance and training expenses also contribute to the cost, hindering adoption rates.

Shortage of Skilled Ultrasound Technicians

Special training and experience are needed for the effective application of ultrasound machines. Europe has a lack of trained sonographers and radiologists, which holds back the full utilization of modern ultrasound technology. Inexperienced operators can provide inconsistent diagnostic outputs, which can decrease the efficiency of ultrasound imaging in patient management. Governments and healthcare facilities must invest in medical training and education programs to correct this problem.

Europe Cardiology Ultrasound Device Market

The growing incidence of cardiovascular diseases in Europe is fueling the demand for echocardiography ultrasound devices. The devices offer real-time imaging of the heart, allowing early detection of heart diseases, valve disorders, and arterial blockages. With an aging population and increased obesity, cardiovascular ultrasound imaging has emerged as a critical diagnostic tool in hospitals and specialized cardiology clinics.

Europe Anesthesiology Ultrasound Device Market

Ultrasound technology is widely employed in anesthesiology for techniques involving nerve blocks, vascular access, and regional anesthesia injection. The use of ultrasound-guided anesthetic techniques is growing as it can improve accuracy, lower the risk of complications, and increase patient safety. Moreover, with growing interest in minimally invasive surgical procedures, ultrasound equipment in anesthesiology is increasingly being sought after by healthcare institutions in Europe.

Europe 3D/4D Ultrasound Imaging Market

The adoption of 3D and 4D ultrasound imaging is increasing in Europe at a very fast pace, especially in obstetrics, gynecology, and oncology. These imaging technologies have high-definition, real-time images of fetal development and tumor morphology. The increasing demand for better diagnostic capabilities, coupled with patients' desire for advanced imaging solutions, is fueling the market for 3D and 4D ultrasound devices.

Europe HIFU Ultrasound Device Market

High-Intensity Focused Ultrasound (HIFU) is gaining rapid popularity in Europe for its therapeutic applications without invasiveness, particularly in oncology and neurology. It is utilized in different treatments like cancer therapy, prostate therapy, and fibroid removal, thereby reducing the requirement for surgery. The demand for HIFU is increasing owing to an enhanced demand for radiation-free and non-invasive therapies.

Europe Portable Ultrasound Device Market

Portable ultrasound machines are revolutionizing point-of-care diagnostics by allowing healthcare professionals to conduct imaging at the bedside, in ambulances, and in distant healthcare facilities. The demand for wireless, AI-based, and compact portable ultrasound machines is increasing, particularly in areas like emergency medicine, sports medicine, and home healthcare.

Europe Diagnostic Centers Ultrasound Device Market

Diagnostic centers play a crucial role in the European ultrasound market, with specialized imaging facilities. The growth of independent diagnostic centers and outpatient imaging centers has generated an increasing demand for high-end ultrasound systems that can diagnose a broad range of medical conditions. Moreover, government policies supporting early disease detection and technological advancements are fueling additional growth in the market.

Germany Ultrasound Device Market

Germany is one of the biggest ultrasound device markets in Europe due to its strong healthcare infrastructure, high healthcare expenditure, and advanced medical research. The presence of leading ultrasound manufacturers and ongoing innovation in medical imaging technology propel the growth of the German market. March 2024: Berlin-based Insighttec was granted NUB status 1 for its MR-guided focused ultrasound (MRgFUS) treatment of essential tremor in Germany, increasing access to advanced ultrasound treatment even further.

France Ultrasound Device Market

The French ultrasound market is expanding, spurred by government healthcare reforms, more investment in diagnostic imaging, and growing demand for 3D/4D and portable ultrasound devices. France's focus on improving maternal healthcare and controlling chronic diseases is also driving this market growth. In December 2022, Siemens Healthineers AG revealed the launch of its first European ultrasound manufacturing plant. With a production capacity of 120 systems a week, the plant is designed to produce parts of all general imaging and cardiovascular ultrasound systems.

United Kingdom Ultrasound Device Market

The UK ultrasound equipment market is favorably impacted by government healthcare spending, advances in technology, and an increasing use of telemedicine. The National Health Service (NHS) contributes to the increased demand for ultrasound imaging in diagnostic centers and hospitals. In May 2022, Clarius Mobile Health launched high-performance wireless ultrasound scanners in the UK and European Union. The scanners are portable and compatible with Apple and Android devices.

Russia Ultrasound Device Market

The Russian ultrasound device market is expanding driven by increasing health investments, growth in chronic diseases, and a growing access to diagnostic imaging. Government programs towards the modernization of healthcare structures and the embracing of high-level ultrasound technologies are driving market demand. November 2022 – Glavkosmos JSC, which belongs to Roscosmos, will export Russian medical ultrasound scanners on the international markets. The company has listed equipment from JSC "Research and Production Association "Scanner" (NPO "Skaner”) under the brand “RuSkan” on its Unified Product and Component Portal.

Europe Ultrasound Device Market Segments

Application

- Anesthesiology

- Cardiology

- Gynecology/Obstetrics

- Musculoskeletal

- Vascular

- Other

Technology

- 2D Ultrasound Imaging

- 3D and 4D Ultrasound Imaging

- Doppler Imaging

- High-intensity Focused Ultrasound

Types

- Stationary Ultrasound

- Portable Ultrasound

End User

- Hospitals

- Diagnostic Centers

- Other End Users

Country

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Russia

- Poland

- Greece

- Norway

- Romania

- Portugal

- Row of Europe

All the Key players have been covered from 5 Viewpoints:

- Overviews

- Key Person

- Recent Developments

- Product Portfolio

- Revenue

Company Analysis

- Fujifilm Holdings Corporation

- GE Healthcare

- Hitachi Medical Corporation

- Philips Healthcare

- Samsung

- Siemens Healthcare

- Canon Medical Systems Corporation

- Mindray Medical International Limited

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Application, Technology, Type, End User and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamic

4.1 Growth Drivers

4.2 Challenges

5. Europe Ultrasound Device Market

6. Market Share Analysis

6.1 By Application

6.2 By Technology

6.3 By Type

6.4 By End User

6.5 By Country

7. Application

7.1 Anesthesiology

7.2 Cardiology

7.3 Gynecology/Obstetrics

7.4 Musculoskeletal

7.5 Vascular

7.6 Other

8. Technology

8.1 2D Ultrasound Imaging

8.2 3D and 4D Ultrasound Imaging

8.3 Doppler Imaging

8.4 High-intensity Focused Ultrasound

9. Types

9.1 Stationary Ultrasound

9.2 Portable Ultrasound

10. End User

10.1 Hospitals

10.2 Diagnostic Centers

10.3 Other End Users

11. Country

11.1 France

11.2 Germany

11.3 Italy

11.4 Spain

11.5 United Kingdom

11.6 Belgium

11.7 Netherlands

11.8 Russia

11.9 Poland

11.10 Greece

11.11 Norway

11.12 Romania

11.13 Portugal

11.14 Row of Europe

12. Porter's Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Competition

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threats

14. Key Players Analysis

14.1 Fujifilm Holdings Corporation

14.1.1 Overviews

14.1.2 Key Person

14.1.3 Recent Developments

14.1.4 Product Portfolio

14.1.5 Revenue

14.2 GE Healthcare

14.2.1 Overviews

14.2.2 Key Person

14.2.3 Recent Developments

14.2.4 Product Portfolio

14.2.5 Revenue

14.3 Hitachi Medical Corporation

14.3.1 Overviews

14.3.2 Key Person

14.3.3 Recent Developments

14.3.4 Product Portfolio

14.3.5 Revenue

14.4 Philips Healthcare

14.4.1 Overviews

14.4.2 Key Person

14.4.3 Recent Developments

14.4.4 Product Portfolio

14.4.5 Revenue

14.5 Samsung

14.5.1 Overviews

14.5.2 Key Person

14.5.3 Recent Developments

14.5.4 Product Portfolio

14.5.5 Revenue

14.6 Siemens Healthcare

14.6.1 Overviews

14.6.2 Key Person

14.6.3 Recent Developments

14.6.4 Product Portfolio

14.6.5 Revenue

14.7 Canon Medical Systems Corporation

14.7.1 Overviews

14.7.2 Key Person

14.7.3 Recent Developments

14.7.4 Product Portfolio

14.7.5 Revenue

14.8 Mindray Medical International Limited

14.8.1 Overviews

14.8.2 Key Person

14.8.3 Recent Developments

14.8.4 Product Portfolio

14.8.5 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com