Dental Insurance Market – Forecast & Growth Trends 2025–2033

Buy NowDental Insurance Market Size, Growth & Forecast 2025–2033 | Renub Research

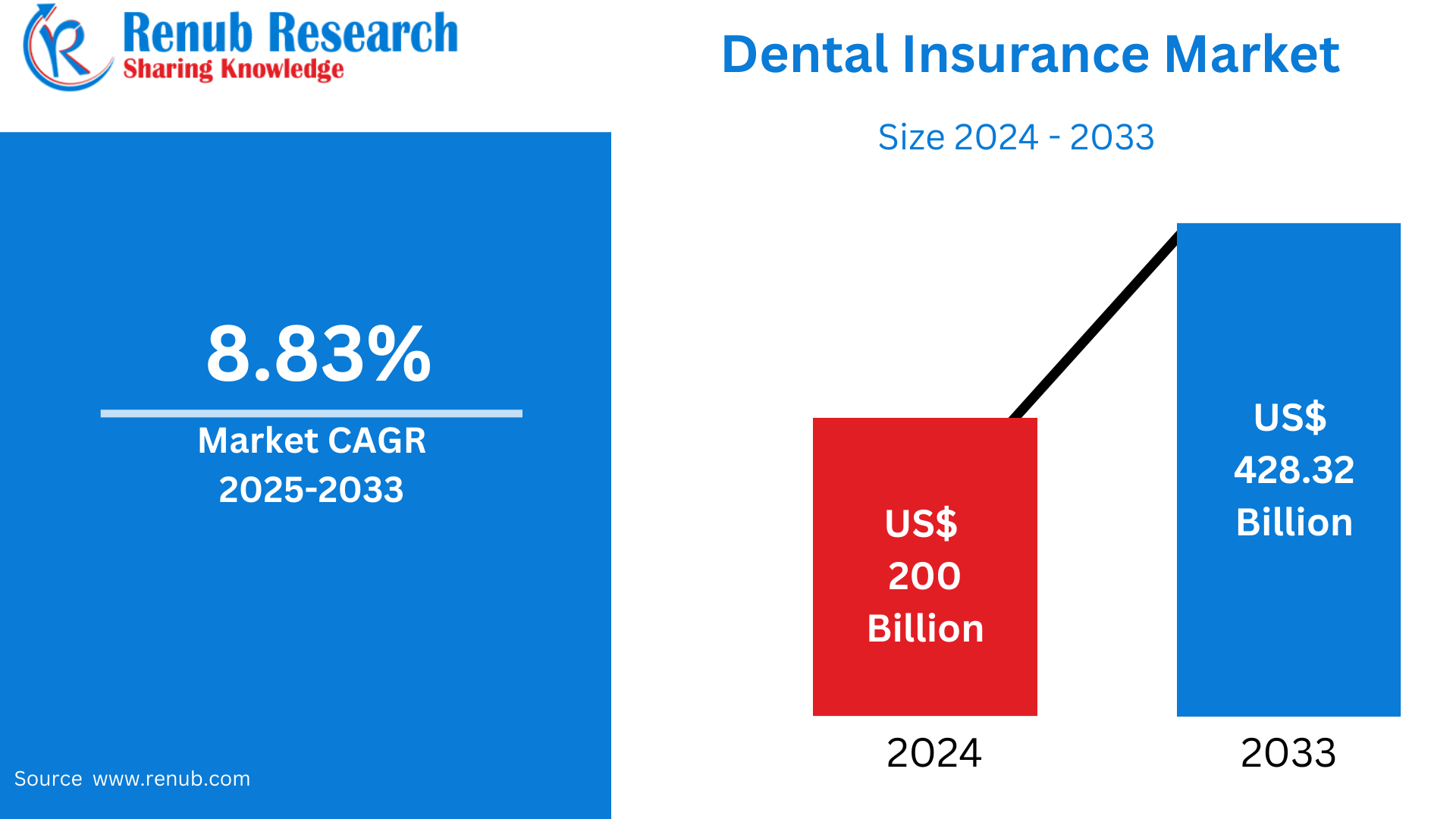

The Dental Insurance Market size was at US$ 200 billion in 2024 and is expected to grow to US$ 428.32 billion by 2033 at a CAGR of 8.83% from 2025 to 2033. Increased awareness of oral health, mounting dental care expenses, and wider employer-sponsored protection are prime drivers of market growth in both developed and developing economies.

Dental Insurance Market Outlooks

Dental insurance is a type of health coverage that is intended to assist people in paying for dental care. It will usually pay for preventive care such as cleanings and exams, and a percentage of more major procedures like fillings, root canals, crowns, and occasionally orthodontics. Policies can differ by carrier but typically function on a network model with fixed premiums, deductibles, and coverage caps.

Popularity of dental insurance is increasing in the world with greater awareness towards oral health and its relationship to overall health. Increased costs associated with dental care make insurance increasingly popular among people and families to ensure financial cover. Many companies across the world, particularly in the U.S., provide dental coverage as one of the benefits for employees, which further propels adoption. Increased levels of income and health literacy in emerging economies are widening the scope of the insured population. The ease of combining health and dental coverages is also helping to push demand for dental insurance protection higher.

Growth Drivers in the Dental Insurance Market

Increasing Oral Health Awareness

Public awareness of the need for dental care and its association with general health has considerably fueled dental insurance demand. Oral problems are now widely seen as potential causes or signs of other conditions including heart disease and diabetes. More people are therefore looking for preventive dental treatment and routine check-ups, making insurance a viable and essential option. Awareness campaigns by governments and healthcare providers are also fueling market growth. Approximately 3.5 billion individuals worldwide live with oral diseases, with the most prevalent one being untreated tooth decay. World Oral Health Day on 20 March every year is a reminder of healthy gums and teeth. The 2025 campaign promotes higher awareness and action and prioritizes making small daily habits a necessity for good oral health.

Growing Cost of Dental Treatment

Dental procedures, particularly larger services such as implants, orthodontics, and surgeries, are expensive without insurance. As dental care costs keep increasing all over the world, insurance is now a desirable option for those who want financial security. Even simple procedures like cleanings and fillings add to high out-of-pocket expenses in the long run. Insurance policies spread these expenses through reasonable premiums, making dental services affordable and promoting regular visits. March 2025, Overjet, the global leader in dental AI, announces today the launch of the Dental Clarity Network (DCN). The DCN is an alliance of leading companies within the dental care system that are leveraging advanced technology to enhance the patient experience, while eliminating friction between payers and providers.

Employer-Sponsored Insurance Plans

One of the major drivers in the dental insurance sector is the growth in employer-sponsored dental insurance, particularly in industrialized nations such as the United States, Canada, and regions in Europe. Dental benefits are considered an important part of desirable compensation packages by employers. Such group cover generally includes lower premiums and extensive coverage, which promotes higher participation among employees. Growing corporate priorities about the health and retention of employees will likely increase the population covered.

Challenges Facing the Dental Insurance Market

Limited Benefits and High Out-of-Pocket Expenses

Most dental insurance policies have restrictions in the form of yearly coverage limits, waiting times, and partial payments, particularly for cosmetic or complicated procedures. Policyholders are thus left with considerable out-of-pocket costs even after having an insurance policy. Such restrictions might discourage some consumers from buying or renewing policies. Another factor that contributes to customer confusion and dissatisfaction is the absence of uniformity in plan benefits among providers.

Lack of Penetration in Developing Regions

In most developing nations, the dental insurance sector remains underdeveloped. Low levels of awareness, mistrust of insurance companies, and unaffordability limit market penetration. In areas where public health systems exclude dental care, individuals either do not seek treatment or pay in full out-of-pocket. This is a significant growth barrier. Increasing insurance literacy and affordability will be critical to accessing these large, underpenetrated markets.

Dental Insurance Preferred Provider Organizations (PPO) Market

Preferred Provider Organization (PPO) dental plans are the most sought-after types because they're flexible and have a vast network of providers. PPO plans provide partial benefits for out-of-network care but encourage using in-network providers by having reduced out-of-pocket expenses. PPO plans are appealing to individuals as well as employers because they're balanced in terms of cost and freedom of choice. The increasing popularity is because of self-referral possibilities and the option to select specialists without having to visit the primary care dentist.

Dental Insurance Indemnity Plans Market

Indemnity policies, or conventional dental insurance, enable policyholders to see any network-eligible dentist. Indemnity policies pay a proportion of the cost of care, usually after a deductible is reached. Indemnity policies are more costly than other varieties but provide maximum flexibility and are best for consumers who value flexibility over cost management. Although less prevalent in contemporary times, they continue to be popular with a niche market, especially among older generations or high-income individuals.

Dental Preventive Insurance Market

Preventive dental insurance emphasizes paying for services that prevent serious dental problems—like cleanings, X-rays, fluoride treatments, and examinations. It encourages routine visits to the dentist, early detection, and early intervention. With healthcare models increasingly leaning toward prevention rather than treatment, these policies are becoming more popular. Insurers reap lower claims expense, and consumers benefit from improved long-term oral health results. Preventive policies are particularly attractive to families with children and young adults.

Adults' Dental Insurance Market

The adult market commands the dental insurance space with a higher population base and a higher prevalence of dental problems such as gum disease, cavities, and tooth loss. Adults also have a higher tendency to need costly procedures such as crowns, root canals, and implants. As many adults have no public dental coverage after retirement, private insurance becomes unavoidable. Increased consciousness about oral-systemic health correlations fuels insurance penetration among adults further.

United States Dental Insurance Market

The United States is the biggest dental insurance market in the world, supported by a well-developed insurance framework, expensive dental care, and extensive employer-sponsored coverage. Dental coverage is extended to most American employees as part of their benefits package. Private insurers also provide extensive individual and family plans. Even with strong growth, there are issues, such as affordability, access disparities, and low coverage rates among low-income and retiree populations. March 2024, MetLife, one of the largest dental insurance providers, today announced the introduction of the MetLife SpotLite on Oral HealthSM, a new Preferred Dentist Program (PDP) designation program, to assist employees in finding designated dental providers through a proprietary assessment process and streamlined digital experience. This program represents MetLife's foray into value-based healthcare.

France Dental Insurance Market

Dental insurance in France is usually a supplement to the public healthcare system, which reimburses dental care only partially. Private supplemental policies, or mutuelles, cover the extra expenses, and hence they are crucial for complete care. The demand for these top-up policies is growing as customers want higher rates of reimbursement and coverage for orthodontics and prosthetics. A well-regulated insurance climate and high healthcare consciousness underpin steady growth in the French market. AXA Global Healthcare, the international medical insurance arm of French multinational insurance company AXA Group, has launched a digital platform combining insurance services and healthcare provision. The platform, introduced in December 2024, includes virtual consultations, policy management and tracking of wellness through a mobile app.

India Dental Insurance Market

India’s dental insurance market is at a nascent stage but shows immense growth potential due to its large population, rising income levels, and increasing awareness about oral health. Most dental expenses are currently out-of-pocket, creating demand for affordable, comprehensive plans. Insurers are beginning to offer standalone dental coverage and dental riders within health policies. Educational campaigns and online insurance platforms are likely to fuel adoption in urban as well as semi-urban areas. March 2025 : Toothlens, together with Star Health, Allied Insurance Company and Vizza Broking Services, launched India's first cashless Dental OPD insurance programme, demystifying dental care in mainstream health insurance for the first time. Millions of Indians have no access to dental care at affordable rates, resulting in untreated dental diseases and high out-of-pocket costs.

Saudi Arabia Dental Insurance Market

Saudi Arabia is experiencing growing demand for dental insurance fueled by increasing healthcare spending, government incentives for private health insurance, and increased concern for dental hygiene. Employers often have dental coverage included in their health plans, particularly in urban areas. Through the Vision 2030 program, insurance sector reforms and healthcare privatization are promoting increased insurance uptake. Western cultural influences and a youth population that is image-conscious also drive demand for cosmetic dental insurance. June 2024, Bupa Arabia for Cooperative Insurance has introduced a new service, the first in Saudi Arabia, enabling employees under the company's client insurance policies to upgrade their maternity coverage easily and choose hospital room categories using the Bupa Arabia mobile application.

Dental Insurance Market Segmentation

Coverage

- Dental Preferred Provider Organizations

- Dental Health Maintenance Organizations

- Dental Indemnity Plans

- Others

Type

- Preventive

- Basic

- Major

Demographics

- Senior Citizens

- Adults

- Minors

Countries

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

All companies have been covered with 4 Viewpoints

- Overview

- Key Persons

- Recent Development & Strategies

- Revenue Analysis

Key Players Analysis

- Cigna

- AXA

- AFLAC Inc

- Allianz SE

- Aetna

- Ameritas Life Insurance Corp

- United HealthCare Services Inc.

- Metlife Services & Solutions

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Coverage, Type, Demographics and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Dental Insurance Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Dental Insurance Market Share Analysis

6.1 By Coverage

6.2 By Type

6.3 By Demographics

6.4 By Countries

7. Coverage

7.1 Dental Preferred Provider Organizations

7.2 Dental Health Maintenance Organizations

7.3 Dental Indemnity Plans

7.4 Others

8. Type

8.1 Preventive

8.2 Basic

8.3 Major

9. Demographics

9.1 Senior Citizens

9.2 Adults

9.3 Minors

10. Countries

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 South Korea

10.3.5 Thailand

10.3.6 Malaysia

10.3.7 Indonesia

10.3.8 Australia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 UAE

10.5.3 South Africa

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 Cigna

13.1.1 Overview

13.1.2 Key Persons

13.1.3 Recent Development & Strategies

13.1.4 Revenue Analysis

13.2 AXA

13.2.1 Overview

13.2.2 Key Persons

13.2.3 Recent Development & Strategies

13.2.4 Revenue Analysis

13.3 AFLAC Inc

13.3.1 Overview

13.3.2 Key Persons

13.3.3 Recent Development & Strategies

13.3.4 Revenue Analysis

13.4 Allianz SE

13.4.1 Overview

13.4.2 Key Persons

13.4.3 Recent Development & Strategies

13.4.4 Revenue Analysis

13.5 Aetna

13.5.1 Overview

13.5.2 Key Persons

13.5.3 Recent Development & Strategies

13.5.4 Revenue Analysis

13.6 Ameritas Life Insurance Corp

13.6.1 Overview

13.6.2 Key Persons

13.6.3 Recent Development & Strategies

13.6.4 Revenue Analysis

13.7 United HealthCare Services Inc.

13.7.1 Overview

13.7.2 Key Persons

13.7.3 Recent Development & Strategies

13.7.4 Revenue Analysis

13.8 Metlife Services & Solutions

13.8.1 Overview

13.8.2 Key Persons

13.8.3 Recent Development & Strategies

13.8.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com