Colonoscopy Devices Market Size and Share Analysis - Growth Trends and Forecast Report 2025–2033

Buy NowColonoscopy Devices Market Size and Forecast 2025-2033

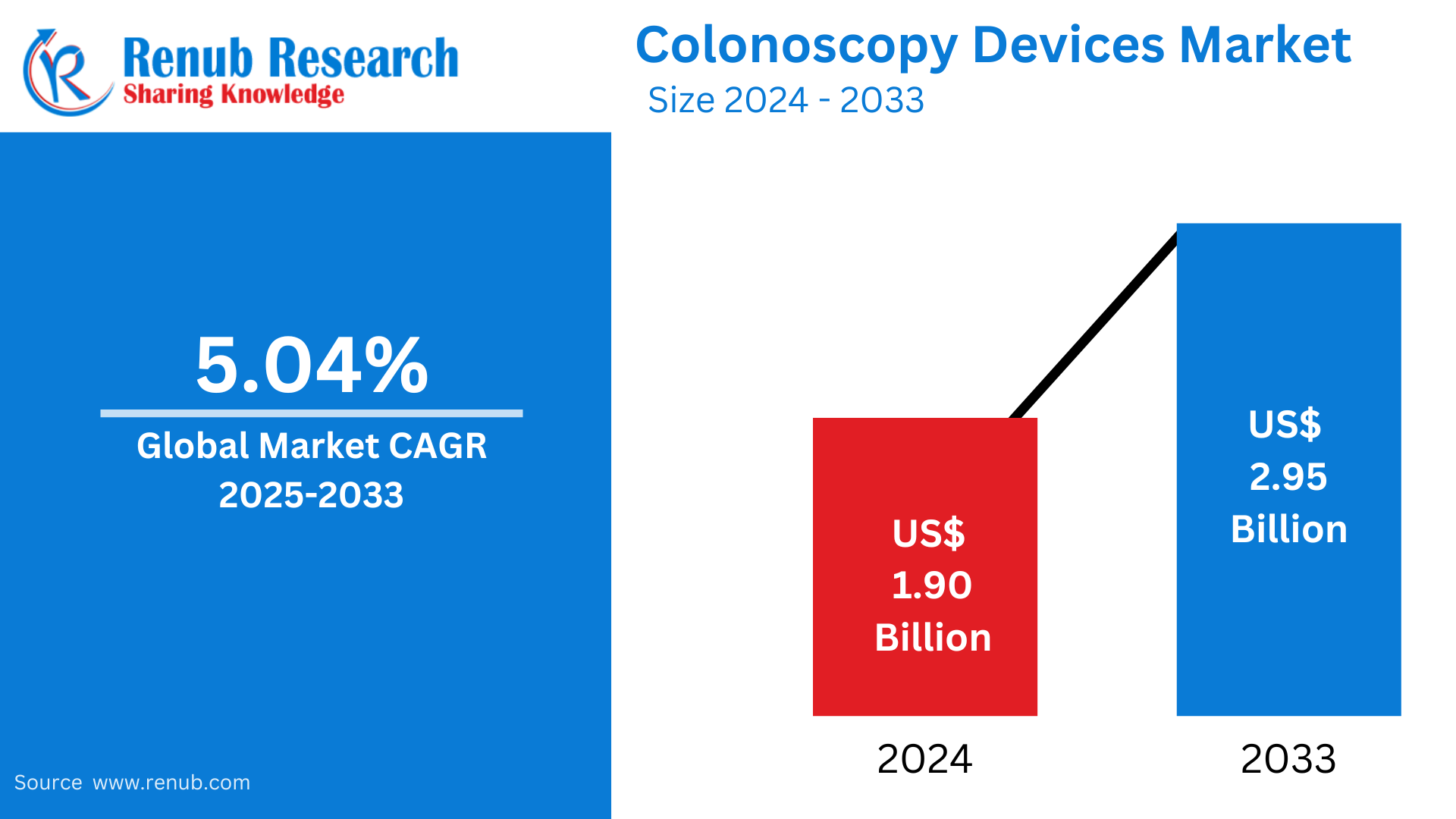

The global colonoscopy devices market is expected to reach around US$ 2.95 billion by 2033, up from US$ 1.90 billion in 2024. This growth is attributed to the increasing prevalence of colorectal diseases, advancement in imaging technologies, and the increasing adoption of minimally invasive procedures. With a compound annual growth rate (CAGR) of 5.04% from 2025 to 2033, the market reflects the growing demand for effective diagnostic solutions.

The report Global Colonoscopy Devices Market & Forecast covers by Products (Colonoscope, Visualization system, and Others), Application (Colorectal Cancer, Ulcerative Colitis, Crohns Disease, and Others), End-User (Hospitals, Clinics & Ambulatory surgical centers, and Others), Region and Company Analysis 2025-2033

Global Colonoscopy Devices Market Overviews

Colonoscopy devices are medical equipment used to visualize the inside of the colon and rectum. The colonoscope is the primary instrument used in colonoscopy, a long, flexible tube with a camera and light source at its tip. This equipment enables doctors to visualize the intestinal mucosa, detect abnormalities, and perform diagnostic or therapeutic procedures. Colonoscopes play a crucial role in the diagnosing and treating gastrointestinal conditions including colorectal cancers, polyps, ulcers, and inflammatory bowel diseases including Crohn's and ulcerative colitis.

During the procedure, physicians can take biopsy samples, extract polyps, or cauterize bleeding sites with a colonoscopy. Colorectal cancer can be better diagnosed and treated early, making a huge difference in patient prognosis. Advancements in colonoscopy devices, such as high-definition imaging and robotic-assisted technology, have increased the accuracy and efficiency of the procedure. Overall, colonoscopy devices are vital for maintaining gastrointestinal health and preventing serious diseases through timely diagnosis and treatment. Despite advancements in screening and treatment, around 20%-25% of CRC patients are still diagnosed with metastatic disease.

Growth Drivers in the Colonoscopy Devices Market

Rising Incidence of Colorectal Diseases

The market for colonoscopy devices is significantly impacted by the growing prevalence of colorectal disorders, particularly colorectal cancer. Each year, an increasing number of colorectal cancer cases are reported, solidifying its status as a leading cause of cancer-related fatalities worldwide. Given the rising incidence and the aging global population, the importance of regular screening and early diagnosis has reached new heights. Many people undertake colonoscopy procedures to find polyps or tumors at a very early stage of development, which is critical for better treatment. This has also led to the increased demand for sophisticated colonoscopy technology across the globe. Jan-2024, In 2020, an estimated 1,931,590 people worldwide were diagnosed with colorectal cancer, which gives a rate of 19.5 cases per 100,000 people. The disease also led to around 935,173 deaths globally, with a mortality rate of 9.0 per 100,000.

Technological Advancements in Colonoscopy Devices

Technological developments in medicine have significantly increased the accuracy and efficacy of colonoscopy operations. Advancements include wireless capsule endoscopy, 3D colonoscopy, and high-definition imaging, which make it possible to see the colon more clearly, which improves patient outcomes and diagnostic precision. These advancements in technology also make colonoscopies less uncomfortable for patients due to reduced chances of procedure complications. Colonoscopy devices become more in demand with the development of minimally invasive techniques and artificial intelligence for automatic detection. These developments are critical to meeting the demand for useful, superior diagnostic tools. June 2023, Virtua Health, South Jersey’s most extensive health system, has introduced artificial intelligence (A.I.) to assist doctors in detecting precancerous lesions during colonoscopies. It is the first in the Greater Philadelphia region and New Jersey to implement the GI Genius™ intelligent endoscopy module at all five of its hospitals in Burlington and Camden counties.

Increasing Healthcare Awareness and Preventive Screenings

The value of early disease identification and preventive healthcare, particularly in high-risk populations, has become much more widely recognized. Governments, healthcare institutions, and advocacy groups use national screening programs and educational campaigns to encourage colorectal cancer screenings. There is an increasing trend for early screening and routine checkups as people become more conscious of the dangers of colorectal disorders. Colonoscopy equipment is becoming increasingly in demand as healthcare becomes more proactive. The market is growing because people are looking for fast diagnostic tools to identify problems before they become more serious. October 2024, The US Preventive Services Task Force advises that adults aged 45 to 75 undergo screening for colorectal cancer. For those between the ages of 76 and 85, the choice to screen should be based on individual circumstances and discussions with healthcare providers.

Colonoscopy Devices Market Challenges

High Procedure Costs and Accessibility

A major obstacle confronting the market for colonoscopy equipment is the high expense of these procedures and equipment. Colonoscopies can be costly because of the specialized equipment and advanced imaging technologies, which sometimes restrict patient access, especially in developing nations. The gadgets include the expenditures, follow-up treatment, facility fees, and hiring qualified medical personnel. This cost barrier may deter people from getting routine exams, ultimately impeding the broad use of colonoscopy equipment. Further exacerbating the accessibility issues is the expense of educating and retaining medical staff to use these devices.

Risk of Complications and Patient Concerns

Although technology has advanced, patients may still be anxious about colonoscopy operations because of the possibility of bleeding, infection, or perforation. Concerns about possible discomfort or consequences from the screening process may cause many people to postpone or avoid it. Furthermore, some patients could find the preparation procedure, which frequently entails colon cleansing, painful or bothersome. The market may be challenged if these worries result in decreased patient compliance and a reluctance to get regular examinations. The general acceptability of colonoscopy instruments is still hampered by risk perception despite the development of newer, less invasive procedures.

Colonoscope Devices Market

The colonoscopy devices market is witnessing significant growth, driven by the increasing prevalence of colorectal diseases and the rising demand for early diagnostic tools. Colonoscope devices, essential for detecting conditions like colorectal cancer, polyps, and inflammatory bowel diseases, are widely adopted in healthcare facilities. Technological advancements, such as high-definition imaging and minimally invasive designs, enhance diagnostic accuracy and patient comfort. Factors like growing awareness of colorectal health, an aging population, and government initiatives for cancer screening programs further fuel market expansion. The market is poised for steady growth as demand for advanced gastrointestinal diagnostic solutions continues to rise.

Colorectal Cancer Devices Market

The colorectal cancer devices market is experiencing rapid growth due to the increasing prevalence of colorectal cancer worldwide. These devices include diagnostic tools such as colonoscopes, biopsy systems, imaging technologies, and therapeutic equipment like surgical instruments, radiation therapy systems, and ablation devices. Rising awareness of early cancer detection, advancements in minimally invasive technologies, and government initiatives promoting cancer screening programs are driving the market. Additionally, innovations in imaging systems, robotic-assisted surgical devices, and personalized treatment options contribute to the market's expansion. With the aging population and growing emphasis on preventive healthcare, the colorectal cancer devices market is poised for significant advancement.

Colonoscopy Devices Hospitals Market

The colonoscopy devices hospital market is expanding due to the rising demand for advanced diagnostic and therapeutic procedures for gastrointestinal conditions. Hospitals play a crucial role in adopting cutting-edge colonoscopy devices, including high-definition colonoscopes, endoscopic imaging systems, and biopsy tools, to diagnose and treat conditions like colorectal cancer, polyps, and inflammatory bowel diseases. The increasing prevalence of colorectal disorders, coupled with government initiatives promoting cancer screening programs, is driving hospital investments in these devices. Advancements in minimally invasive technology and enhanced imaging capabilities further boost their adoption. This market is expected to grow steadily, with hospitals emphasizing early detection and improved patient outcomes.

United States Colonoscopy Devices Market

The United States leads the global colonoscopy devices market due to its strong healthcare infrastructure, advanced technology use, and high demand for preventive services. Colorectal cancer is a significant cause of cancer-related deaths, prompting national screening programs that boost colonoscopy demand. Increased awareness of early diagnosis and an aging population contribute to market growth. Innovative devices, like high-definition imaging and wireless capsule endoscopy, enhance diagnostic accuracy and patient comfort. According to The American Cancer Society, the 5-year relative survival rate for early-stage colorectal cancer is around 90%, but only 40% of cases are diagnosed at this stage.

Germany Colonoscopy Devices Market

Germany is a key player in the European colonoscopy devices market, known for its advanced healthcare system and strong emphasis on medical technology. The country has seen a rise in demand for early detection and preventive screening, supported by national health policies encouraging colorectal cancer screenings for individuals over a certain age. As colorectal diseases become more prevalent with an aging population, the adoption of colonoscopy procedures is increasing. Furthermore, integrating advanced technologies like 3D imaging, artificial intelligence, and minimally invasive techniques has improved the diagnostic capabilities of colonoscopy devices in Germany, contributing to the overall market growth.

Japan Colonoscopy Devices Market

Japan's aging population and advanced healthcare system make it one of the Asia-Pacific region's top markets for colonoscopy equipment. Japan has emphasized preventive healthcare by implementing several programs that encourage the screening of colorectal cancer, which has increased demand for colonoscopy treatments. Further propelling market expansion are technological innovations like high-definition endoscopes and capsule endoscopy, which have enhanced patient comfort and diagnostic precision. Innovative colonoscopy gadgets have been widely adopted because Japan's healthcare system guarantees access to state-of-the-art medical technologies. Japan is positioned to play a significant role in expanding the colonoscopy devices market in the area due to these factors.

Brazil Colonoscopy Devices Market

Brazil is a leading country in the Latin American colonoscopy devices market, driven by its growing healthcare investments and rising awareness about colorectal diseases. The government has seen a gradual increase in colorectal cancer cases, which has led to higher demand for diagnostic procedures such as colonoscopies. Public health campaigns focusing on early detection and screening programs have increased acceptance of colonoscopy procedures. Brazil's expanding healthcare infrastructure and improved access to advanced medical technologies encourage the adoption of innovative colonoscopy devices, such as high-definition imaging systems and minimally invasive tools. This growth trend is expected to continue in the coming years.

South Africa Colonoscopy Devices Market

South Africa's growing use of cutting-edge medical technologies and bettering healthcare infrastructure have made it a major player in the Middle East and Africa's market for colonoscopy instruments. Preventive screenings and early diagnosis are becoming more and more necessary as people become more aware of colorectal illnesses. South Africa has started adopting nationwide screening programs to detect colorectal cancer, which has increased the usage of colonoscopy equipment. Additionally, improvements in diagnostic technology, like flexible colonoscopes and high-definition imaging, and the nation's growing healthcare investments are improving operation accuracy and propelling market expansion. This increased trend is also a result of the growing private healthcare industry.

Colonoscopy Devices Market Segments

Products – Market breakup in 4 viewpoints:

- Colonoscope

- Visualization system

- Other

Application – Market breakup in 4 viewpoints:

- Colorectal Cancer

- Ulcerative Colitis

- Crohns Disease

- Others

End-User – Market breakup in 3 viewpoints:

- Hospitals

- Clinics & Ambulatory surgical centers

- Others

Country – Market breakup of 25 Countries:

- United States

- Canada

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

- Brazil

- Mexico

- Argentina

- South Africa

- Saudi Arabia

- UAE

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Company Analysis:

- Boston Scientific Corporation

- Fujifilm Holdings Corporation

- Hoya Corporation

- Medtronic plc,

- Olympus Corporation

- Stryker Corporation

- Steris Corp.

- Merit Medical Systems Inc.

- Getinge AB

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product, Application, End User and Countries |

| Countries Covered |

|

| Companies Covered |

1. Boston Scientific Corporation |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in Report:

-

What is the projected size of the global colonoscopy devices market by 2033, and what is its CAGR from 2025 to 2033?

-

Which major factors are driving the growth of the colonoscopy devices market globally?

-

How are technological advancements such as AI, 3D imaging, and capsule endoscopy impacting the colonoscopy devices market?

-

What are the primary challenges faced by the colonoscopy devices market, including cost and patient-related concerns?

-

What are the leading applications for colonoscopy devices (e.g., colorectal cancer, ulcerative colitis, Crohn’s disease)?

-

Which end-user segments (e.g., hospitals, clinics, ambulatory surgical centers) dominate the colonoscopy devices market?

-

How is the colonoscopy devices market performing in key regions such as the United States, Germany, Japan, Brazil, and South Africa?

-

What government initiatives and preventive screening programs are boosting demand for colonoscopy procedures?

-

Which product segment (e.g., colonoscope, visualization systems) holds the largest share in the colonoscopy devices market?

-

What is the role of hospitals in adopting advanced colonoscopy technologies, and how does this influence market trends?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Colonoscopy Device Market

6. Market Share

6.1 By Products

6.2 By Application

6.3 By End User

6.4 By Countries

7. Products

7.1 Colonoscope

7.2 Visualization system

7.3 Other

8. Application

8.1 Colorectal Cancer

8.2 Ulcerative Colitis

8.3 Crohns Disease

8.4 Others

9. End User

9.1 Hospitals

9.2 Clinics & Ambulatory surgical centers

9.3 Others

10. Countries

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 South Korea

10.3.5 Thailand

10.3.6 Malaysia

10.3.7 Indonesia

10.3.8 Australia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 United Arab Emirates

10.5.3 South Africa

11. Porter's Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Competition

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threats

13. Key Players Analysis

13.1 Boston Scientific Corporation

13.1.1 Overview

13.1.2 Recent Development

13.1.3 Revenue

13.2 Fujifilm Holdings Corporation

13.2.1 Overview

13.2.2 Recent Development

13.2.3 Revenue

13.3 Hoya Corporation

13.3.1 Overview

13.3.2 Recent Development

13.3.3 Revenue

13.4 Medtronic plc

13.4.1 Overview

13.4.2 Recent Development

13.4.3 Revenue

13.5 Olympus Corporation

13.5.1 Overview

13.5.2 Recent Development

13.5.3 Revenue

13.6 Stryker Corporation

13.6.1 Overview

13.6.2 Recent Development

13.6.3 Revenue

13.7 Steris Corp.

13.7.1 Overview

13.7.2 Recent Development

13.7.3 Revenue

13.8 Merit Medical Systems Inc.

13.8.1 Overview

13.8.2 Recent Development

13.8.3 Revenue

13.9 Getinge AB

13.9.1 Overview

13.9.2 Recent Development

13.9.3 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com