Global Colon Screening Market Size and Growth Trends and Forecast Report 2025-2033

Buy NowColon Screening Market Size and Forecast

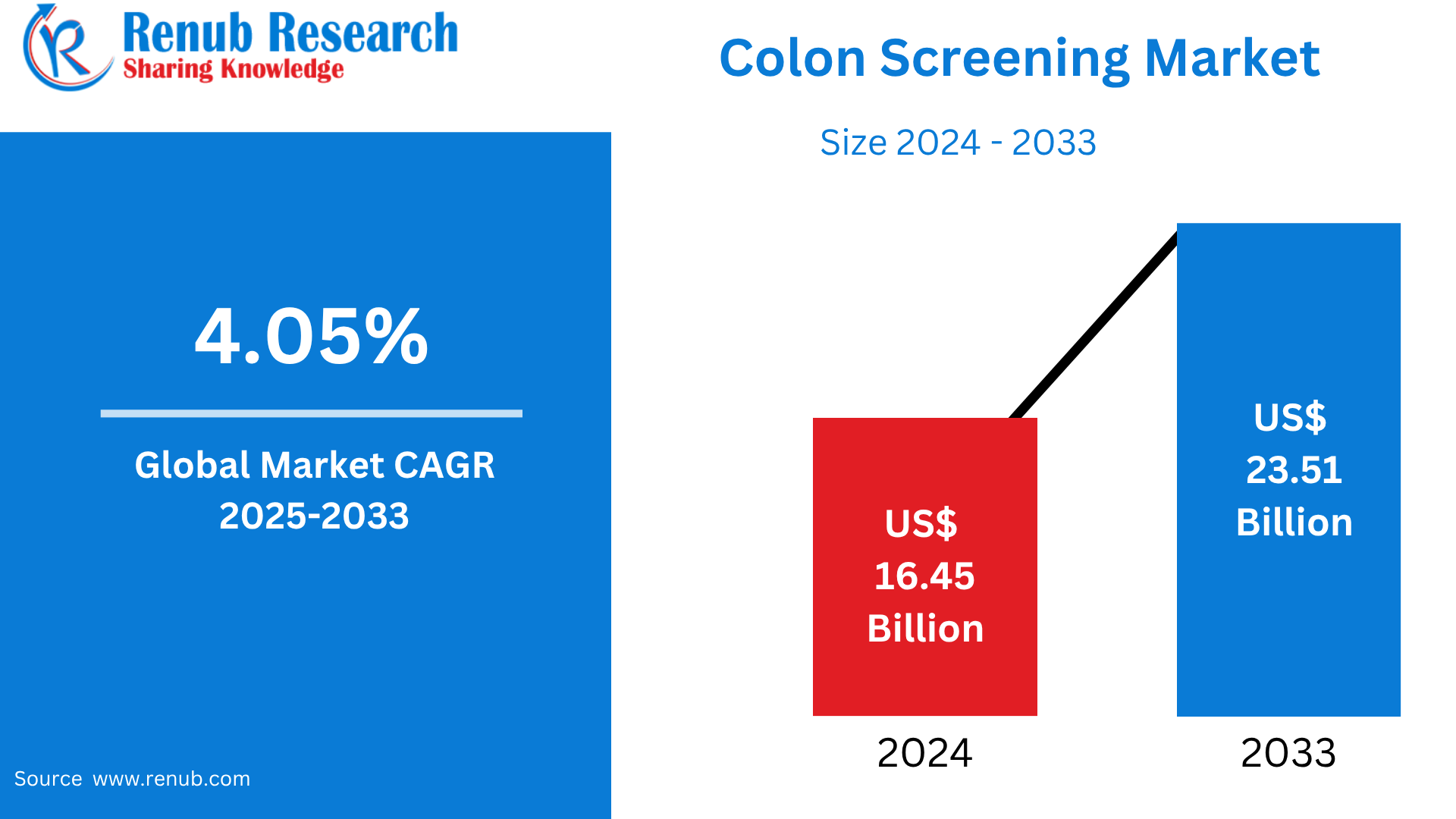

Global Colon Screening Market is expected to reach US$ 23.51 billion by 2033 from US$ 16.45 billion in 2024, with a CAGR of 4.05% from 2025 to 2033. Major drivers propelling this market's growth include the rising incidence of colorectal cancer, the expansion of government programs to promote cancer screening, and continuous technical improvements.

Colon Screening Global Market Report by Type (Stool-based, Colonoscopy, Others), End Use (Hospitals & Clinics, Clinical Laboratories, Diagnostic Imaging Centers, Others), Countries and Company Analysis, 2025-2033.

Global Colon Screening Industry Overview

Due to growing awareness of the significance of early detection and the rising incidence of colorectal cancer, the global colon screening market is expanding significantly. In order to detect cancer in its early stages and improve treatment outcomes and survival rates, screening techniques like colonoscopy, stool-based testing, and newly developed blood-based testing are essential. The development of more effective and user-friendly screening instruments as a result of technological improvements has improved diagnostic accuracy and patient compliance. The market is growing as a result of government programs and healthcare regulations that encourage routine testing. The colon screening market is well-positioned for further development and expansion as the need for preventive healthcare increases, providing better options for the early identification and treatment of colorectal cancer.

One of the main factors propelling the expansion of the colon screening market is the rising incidence of colorectal disorders. The second most prevalent cause of cancer-related fatalities globally and the third most often diagnosed malignancy is colorectal cancer, a serious gastrointestinal disorder. Its increasing prevalence emphasizes how important early diagnosis and efficient screening techniques are. Colorectal cancer is one of the most common cancers, with an estimated 1.93 million new cases recorded worldwide in 2022, according to the World Cancer Research Fund. The World Health Organization further highlights that the greatest occurrence rates are seen in areas like Europe, Australia, and New Zealand, mostly as a result of aging populations, dietary habits, and lifestyle choices.

The value of colon cancer screening in enhancing public health and lowering cancer-related mortality has been acknowledged by governments all over the world. As a result, some nations have started programs aimed at preventing and detecting colorectal cancer (CRC) early on, with an emphasis on affordability, accessibility, and education to promote routine screenings.

Additionally, the industry has grown faster as a result of the incorporation of artificial intelligence (AI) into colonoscopy processes. Real-time video stream analysis using computer-assisted detection (CAD) systems with AI algorithms helps gastroenterologists spot anomalies like polyps that the human eye would miss. For example, CAD EYE and SCALE EYE, two cutting-edge endoscopic imaging technologies, were introduced by FUJIFILM in May 2024. An AI-powered tool called CAD EYE was created to improve colonoscopy's ability to detect colonic mucosal abnormalities like adenomas and polyps. However, the goal of SCALE EYE is to increase the precision and speed of lesion assessment during endoscopic treatments. In order to provide accurate measurements and provide more exact diagnosis and treatment planning, these technologies are essential.

Key Factors Driving the Colon Screening Market Growth

Increasing Prevalence of Colorectal Cancer

One of the main factors propelling the colon screening market is the increasing incidence of colorectal cancer. Early detection is becoming more and more important as the number of cases rises due to dietary changes, stress, and harmful lifestyle choices. One of the most prevalent malignancies in the world, colorectal cancer has a high death rate if detected early. In order to identify the illness early and enhance patient outcomes, this has increased the emphasis on preventative measures like routine screening. The demand for reliable and easily available screening methods is increasing as more people receive diagnoses at younger ages. The need for colon screening services and technology is growing as a result of this trend, which is forcing healthcare institutions to implement frequent tests.

Rising Awareness of Early Detection

The market for colon screening is expanding due in large part to growing awareness of the value of early diagnosis in preventing cancer. People now recognize that screening can identify colorectal cancer at earlier, more curable stages because to increased public education initiatives, medical experts, and media outlets. Regular screenings are a crucial component of preventive healthcare since early identification increases survival chances. In order to encourage people to be screened for colorectal cancer, even if they don't have any symptoms, public health organizations and advocacy groups have been working hard to educate the public about the disease's risk factors and symptoms. The demand for colon screening services has surged as a result of this greater awareness, spurring innovation and increasing access to screening devices.

Government Initiatives and Screening Guidelines

The market for colon screening has grown significantly as a result of government initiatives and the development of screening standards. Numerous nations have put in place national colorectal cancer screening programs that specify the best times and methods for tests. Through promoting early identification and prevention, these programs seek to lower the death rate from cancer. Governments frequently provide funding to lower the cost of screenings, which raises participation rates. Furthermore, established standards that advocate for routine screenings for at-risk groups—especially those over 50 or with a family history of colorectal cancer—are increasingly being followed by healthcare practitioners. These regulations encourage broader screening availability, improving the routine and systematic identification of colon cancer and fostering market expansion.

Challenges in the Colon Screening Market

High Costs of Screening Procedures

Many people may find it difficult to obtain colon screening procedures, especially colonoscopies, due to their high cost, particularly in low-income areas. Patients frequently incur out-of-pocket expenditures for these procedures, including preparatory charges, consultations with doctors, and follow-up treatment, even if certain screenings are reimbursed by insurance. A significant section of the population may not be able to afford advanced diagnostic procedures like virtual colonoscopies or stool DNA testing due to their high cost. People are deterred from getting regular tests by this cost barrier, particularly in underprivileged areas where resources may be scarce. In nations with less extensive healthcare coverage, where people could put other medical needs ahead of screening, the cost problem is especially troubling.

Insufficient Reimbursement Policies

One major issue in many nations is the lack of adequate or uniform reimbursement rules for colon screening treatments. Many patients cannot afford routine screenings without full insurance coverage or government assistance, especially for more sophisticated testing like virtual colonoscopies or stool DNA. Although several nations compensate high-risk individuals for colonoscopies, these rules may not be uniform or may differ based on characteristics such as age, income, or risk factors. Therefore, even though tests might identify colorectal cancer early, people may decide to postpone or skip them. The problem is made worse by the underpayment of non-invasive screening methods, which restricts the use of more patient-friendly diagnostic equipment and ultimately impedes attempts to lower cancer death rates.

Colon Screening Market Overview by Regions

With North America and Europe leading the way in adoption, the colon screening industry is expanding internationally. Growth in Latin America and Asia-Pacific is fueled by improvements in healthcare and growing awareness. The following provides a market overview by region:

United States Colon Screening Market

The market for colon screening in the US is expanding rapidly due to rising awareness of colorectal cancer and the value of early diagnosis. Because colorectal cancer is so common, screening programs are becoming a crucial component of healthcare prevention. Additional factors driving the market's growth include government programs and healthcare regulations, such as those recommending screenings begin at age 50. Stool-based testing and virtual colonoscopies are examples of non-invasive screening technologies that have improved accessibility and patient compliance. Additionally, the need for screenings is increasing due to the aging population, which is more susceptible to colorectal cancer. The U.S. colon screening market keeps changing as healthcare systems place an emphasis on prevention, giving patients more choices for early detection and better results.

Germany Colon Screening Market

Due to a combination of strong healthcare infrastructure, aggressive government regulations, and high public awareness, Germany has one of the most developed colon screening markets in Europe. For people between the ages of 50 and 54, the National Cancer Plan recommends fecal immunochemical testing (FIT) every two years. For those above 55, a colonoscopy is recommended every ten years. More than 60% of the eligible population now participates in colorectal cancer screening as a result of this organized strategy. Adoption rates have also increased due to developments in non-invasive testing techniques as FIT-DNA and AI-assisted colonoscopies. Furthermore, groups like the Felix Burda Foundation are essential in encouraging early identification and increasing awareness via initiatives like "Colon Cancer Month." Germany leads Europe in colorectal cancer screening because to these combined efforts.

For example, the Robert Koch Institute estimates that in Germany, the colon is affected by around one in eight incident malignancies, and in 2022, there were about 24,650 women and 29,960 men who received a colon cancer diagnosis.

China Colon Screening Market

The necessity for early diagnosis and growing awareness of colorectal cancer are driving changes in the Chinese colon screening industry. Even while the nation has put in place a number of structured screening initiatives aimed at high-risk groups; the total screening coverage is still rather low. Conventional techniques such as colonoscopies and fecal occult blood tests are frequently employed, but obstacles including poor participation rates and limited resources prevent their broad usage. Fecal DNA methylation assays are one of the prospective substitutes offered by recent developments in molecular diagnostics. They combine excellent sensitivity and non-invasiveness, which may increase patient compliance. Despite these advancements, inequalities in healthcare access and infrastructure make it difficult for the market to achieve national adoption. Improving the efficacy of colon screening initiatives nationwide requires addressing these issues.

Saudi Arabia Colon Screening Market

As the prevalence of colorectal cancer (CRC) rises and public awareness grows, the market for colon screening in Saudi Arabia is changing. In 2020, colorectal cancer (CRC) accounted for 12.3% of all reported cancer cases, making it the most prevalent cancer among Saudi males and the third most common among Saudi women. More than 62% of Saudis have never had a colorectal cancer screening, even though screening techniques including colonoscopies and fecal immunochemical testing (FIT) are available. Two major obstacles to screening are a lack of medical referral and a fear of the process. Targeting both ordinary and high-risk groups, the Saudi Ministry of Health has put into effect recommendations that urge CRC screening for anyone between the ages of 45 and 75. However, widespread adoption is still hampered by the lack of a national screening program and low public awareness. Reducing CRC-related mortality in the Kingdom and increasing early detection rates depend on addressing these issues.

Recent Developments in Colon Screening Industry

- A new digital health initiative to increase colorectal cancer screening was introduced by UC Davis Health in April 2024. This program is a component of initiatives to enhance early identification and lower the risk of colon cancer, which is on the rise among younger people.

- The GI Alliance and Medtronic partnered to introduce the GI Genius AI Technology for improved colon polyp identification to the Alliance's more than 400 site locations in October 2024.

Market Segmentations

Type

- Stool-based

- Colonoscopy

- Others

End Use

- Hospitals & Clinics

- Clinical Laboratories

- Diagnostic Imaging Centers

- Others

Regional Outlook

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

All the Key players have been covered

- Overview

- Key Persons

- Recent Development & Strategies

- Revenue Analysis

Company Analysis:

- Olympus Corporation

- FUJIFILM Holdings Corporation

- Medtronic

- Ambu A/S

- Bracco

- Varay Laborix

- EndoFresh (Daichuan medical)

- Baxter (Hillrom & Welch Allyn)

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Type, End Use and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Colon Screening Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Colon Screening Market Share Analysis

6.1 By Type

6.2 By End Use

6.3 By Countries

7. Type

7.1 Stool-based

7.2 Colonoscopy

7.3 Others

8. End Use

8.1 Hospitals & Clinics

8.2 Clinical Laboratories

8.3 Diagnostic Imaging Centers

8.4 Others

9. Countries

9.1 North America

9.1.1 United States

9.1.2 Canada

9.2 Europe

9.2.1 France

9.2.2 Germany

9.2.3 Italy

9.2.4 Spain

9.2.5 United Kingdom

9.2.6 Belgium

9.2.7 Netherlands

9.2.8 Turkey

9.3 Asia Pacific

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 South Korea

9.3.5 Thailand

9.3.6 Malaysia

9.3.7 Indonesia

9.3.8 Australia

9.3.9 New Zealand

9.4 Latin America

9.4.1 Brazil

9.4.2 Mexico

9.4.3 Argentina

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.2 UAE

9.5.3 South Africa

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 Olympus Corporation

12.1.1 Overview

12.1.2 Key Persons

12.1.3 Recent Development & Strategies

12.1.4 Revenue Analysis

12.2 FUJIFILM Holdings Corporation

12.2.1 Overview

12.2.2 Key Persons

12.2.3 Recent Development & Strategies

12.2.4 Revenue Analysis

12.3 Medtronic

12.3.1 Overview

12.3.2 Key Persons

12.3.3 Recent Development & Strategies

12.3.4 Revenue Analysis

12.4 Ambu A/S

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Recent Development & Strategies

12.4.4 Revenue Analysis

12.5 Bracco

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Recent Development & Strategies

12.5.4 Revenue Analysis

12.6 Varay Laborix

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Recent Development & Strategies

12.6.4 Revenue Analysis

12.7 EndoFresh (Daichuan medical)

12.7.1 Overview

12.7.2 Key Persons

12.7.3 Recent Development & Strategies

12.7.4 Revenue Analysis

12.8 Baxter (Hillrom & Welch Allyn)

12.8.1 Overview

12.8.2 Key Persons

12.8.3 Recent Development & Strategies

12.8.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com