Chile Salmon Market Size and Trends 2025–2033

Buy NowChile Salmon Market Size

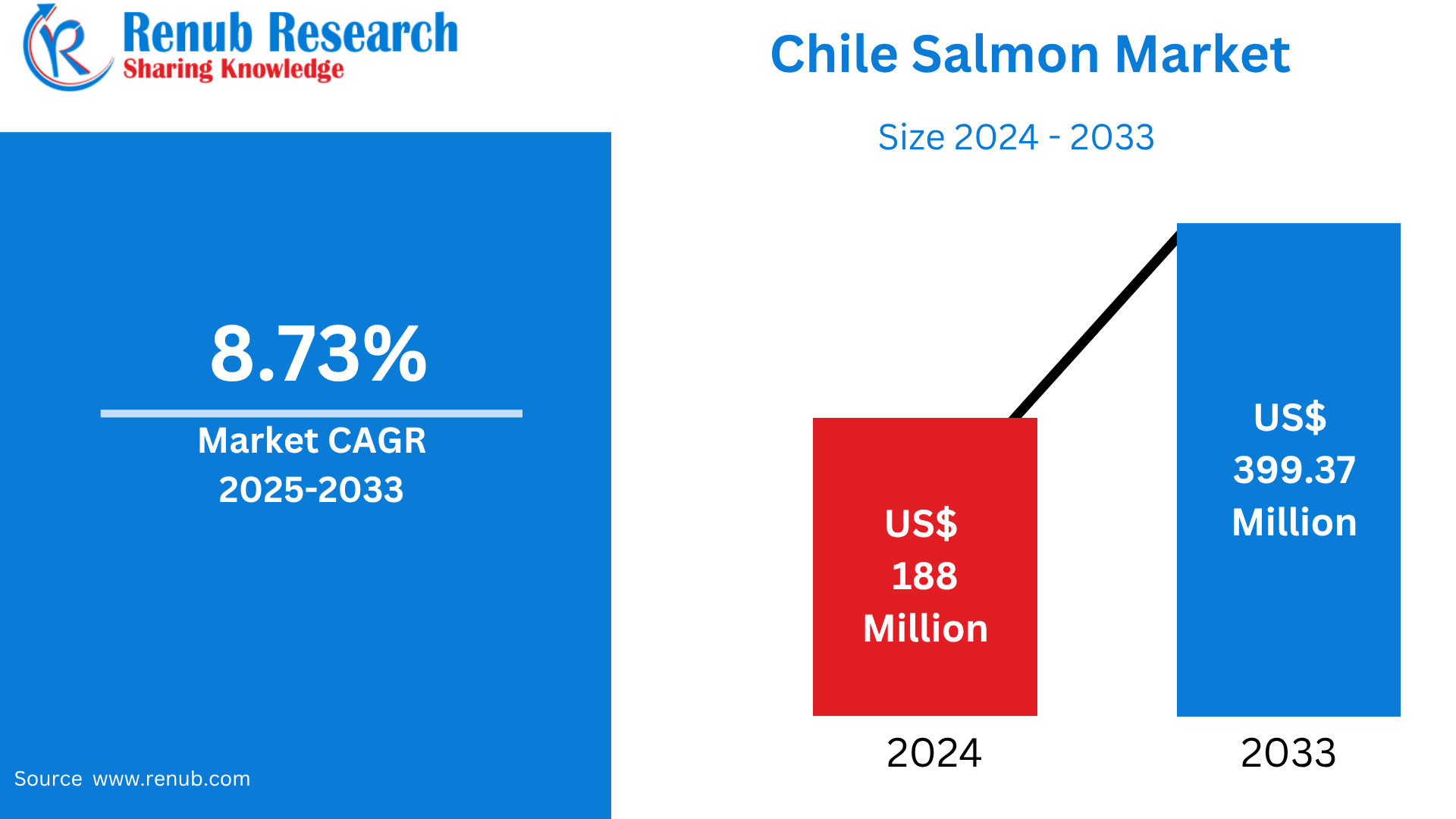

Chile Salmon Market is expected to reach US$ 399.37 million by 2033 from US$ 188 million in 2024, with a CAGR of 8.73% from 2025 to 2033. Increasing global demand for seafood, increasing export markets, eco-friendly aquaculture practices, governmental encouragement, technological advances, improved logistics, increased investment in production facilities to satisfy international standards of quality and safety, and increased health awareness are the key drivers of the Chilean salmon market.

Chile Salmon Market Report by Form (Fresh, Frozen, Smoked, Canned, Others), Species (Chinook Salmon, Coho Salmon, Pink Salmon, Red Salmon, Silverbrite Salmon, Salmon Salar), Distribution Channel (Retail, HoReCa & Wholesale, Processed Food Indistry, Other Institutional Customers) and Company Analysis 2025-2033.

Chile Salmon Industry Overview

Salmon is a popular fish due to its high nutritional value, pink-orange flesh, and tasty flavor. Salmon are anadromous, meaning they migrate to the sea after they have hatched in freshwater and migrate back to freshwater to spawn. They occur naturally in the North Atlantic and Pacific Oceans. They are a staple of healthy diets as they are a rich source of protein, vitamins, minerals, and omega-3 fatty acids. Salmon can be consumed in several ways: raw (as sashimi or sushi), smoked, tinned, and fresh.

The Chilean market for salmon is growing based on several key factors. Exports, particularly to the US, Japan, and China, have risen as a result of the worldwide demand for healthy, high-protein seafood products. Aquaculture productivity and sustainability have improved as a result of new technologies in breeding, feeding, and disease control. The sector has been complemented further by government support in the shape of favorable legislation and investment in infrastructures. Demand is also supplemented by increasing consumer awareness of the health benefits of high omega-3 fatty acids salmon. Global trade is also facilitated by increasing cold chain logistics as well as efficient supply chains. Long-term growth in the market is still being fueled by increasing investment interest and awareness of sustainability.

Growth Drivers for the Chile Salmon Market

Rising Global Demand

Increasing global demand for healthy, high-protein seafood is one of the key drivers fueling the growth of the Chilean salmon market. Due to its high omega-3 levels and versatility, salmon is a global favorite as consumers seek out healthier alternatives to red meat. Based on the Central Bank of Chile, farmed salmon has become Chile's second-largest industry to export after copper mining, generating USD 6.5 billion in 2023. Chilean salmon production rose by nearly 11% from 2019 to 2022 due to a new regulatory environment that hopes to make operations more efficient and sustainable. Conversely, difficult winters and fish health problems generated only 5% growth in Norway, the largest producing country. In contrast to increasing global conditions of supply, Chile's greater growth is an indication of its strategic position in meeting increasing demand and positioning itself as a leading world supplier.

Export Expansion

Chile's salmon industry is increasing mainly because of export growth, which indicates the sector's strategic significance to Chile's economy. Salmon accounts for 6.8% of all Chile's exports, ranking second only to copper. In 2022, Chile exported 821,288 metric tons of salmon worth USD 5.361 billion, according to the ITC Trade Map. The USA, Brazil, and Japan are significant export markets that primarily rely on Chile's consistent, high-quality supply. In 2024, eleven Chilean salmon producers further deepened this growth by introducing "Project Yelcho," a public-private initiative which seeks to enhance environmental sustainability, reduce dependency on antibiotics, and increase the use of vaccinations. By aligning with international standards, such initiatives contribute to maintaining access to international markets in the long term. Chile is strategically placed to expand its export base and meet expanding global demand due to its robust production, contributing 31% to the global salmon catch.

Government Support

Through promoting efficient and sustainable aquaculture practices, government support plays a crucial role in the growth of Chile's salmon market. Eleven salmon farm companies partnered with Chile's Agricultural and Livestock Service (SAG) and the National Fisheries and Aquaculture Service (Sernapesca) in March 2024, along with the Salmon Council, Intesal, and Aquabench. In an effort to enhance fish health and sustainability of the environment, this collaboration aims to reduce the consumption of antibiotics in salmon farming and enhance the supply of vaccines to prevent bacterial disease. These public-private collaborations demonstrate how committed the Chilean government is to developing biosecurity, industrial innovation, and regulatory progress that enables global access to markets and consumer trust. Such government-sponsored programs enhance industry robustness, align with international norms on sustainability, and increase Chilean salmon exports' long-term competitiveness.

Challenges in the Chile Salmon Market

Climate Change

The market for salmon in Chile is facing serious challenges due to climate change, which is changing the maritime habitat that is essential to salmon farming. Stressed fish are more susceptible to illnesses and parasites like sea lice due to rising water temperatures, which can lower yields and raise mortality rates. Growth cycles and agricultural management are disrupted by seasonal trends and changes in water quality. Extreme weather events can also hamper logistics and harm infrastructure. Producers are forced to quickly react to these environmental changes, frequently at great expense. Chile's salmon industry's long-term stability and profitability are under risk as climate change makes it harder to maintain sustainability and production.

Reputation and Sustainability Concerns

Sustainability and Reputation The Chilean salmon market faces significant obstacles due to concerns. Concerns over the industry's sustainability and moral behavior have been highlighted by previous problems such as illness outbreaks, antibiotic overuse, and environmental degradation. Transparency, traceability, and certifications to guarantee ethical farming are becoming more and more sought after by importers and global consumers. Prices and market access can be impacted by bad press, particularly in environmentally aware markets like North America and Europe. Chilean farmers need to make investments in sustainable techniques, lessen their impact on the environment, and enhance animal welfare in order to remain competitive. Ignoring these issues runs the danger of harming the industry's standing and reducing prospects for future expansion.

Recent Developments in Chile Salmon Industry

- In March 2024, Eleven salmon farmers in Chile have teamed up with government and industry organizations to increase the availability of vaccines for salmon farming. The Salmon Council and Chilean authorities are working together to tackle bacterial illnesses and decrease the use of antibiotics in salmon production. The project promotes sustainable salmon farming practices in Chile by enhancing disease prevention techniques.

- In Oct 2023, In order to export Coho salmon to China, Chile teamed up with the Chinese president. The nation is the world's top producer of Coho salmon, making up over 89% of the worldwide production.

- In March 2023, Chilean salmon producer Aqua Chile announced that it would invest $120 million in land-based salmon farming projects in the United States. This move is a step toward more sustainable and environmentally friendly aquaculture practices.

Chile Salmon Market Segmentation:

Form

- Fresh

- Frozen

- Smoked

- Canned

- Others

Species

- Chinook Salmon

- Coho Salmon

- Pink Salmon

- Red Salmon

- Silverbrite Salmon

- Salmon Salar

Distribution Channel

- Retail

- HoReCa & Wholesale

- Processed Food Industry

- Other Institutional Customers

All companies have been covered from 4 viewpoints:

- Company Overview

- Key Persons

- Recent Development & Strategies

- Sales Analysis

Key Players Analysis

- Sea trade

- Atlantic Capes Fisheries, Inc.

- Atalanta Corporation

- Ideal Foods Ltd

- Sea Delights

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Form, Species and Distribution Channel |

| Distribution Channel Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Source

2.1.2 Secondary Source

2.2 Research Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challengers

5. Chile Salmon Fish Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Form

6.2 By Species

6.3 By Distribution Channel

7. Form

7.1 Fresh

7.1.1 Historical Market Trends

7.1.2 Market Forecast

7.2 Frozen

7.2.1 Historical Market Trends

7.2.2 Market Forecast

7.3 Smoked

7.3.1 Historical Market Trends

7.3.2 Market Forecast

7.4 Canned

7.4.1 Historical Market Trends

7.4.2 Market Forecast

7.5 Others

7.5.1 Historical Market Trends

7.5.2 Market Forecast

8. Species

8.1 Chinook Salmon

8.1.1 Historical Market Trends

8.1.2 Market Forecast

8.2 Coho Salmon

8.2.1 Historical Market Trends

8.2.2 Market Forecast

8.3 Pink Salmon

8.3.1 Historical Market Trends

8.3.2 Market Forecast

8.4 Red Salmon

8.4.1 Historical Market Trends

8.4.2 Market Forecast

8.5 Silverbrite Salmon

8.5.1 Historical Market Trends

8.5.2 Market Forecast

8.6 Salmon Salar

8.6.1 Historical Market Trends

8.6.2 Market Forecast

9. Distribution Channel

9.1 Retail

9.1.1 Historical Market Trends

9.1.2 Market Forecast

9.2 HoReCa & Wholesale

9.2.1 Historical Market Trends

9.2.2 Market Forecast

9.3 Processed Food Indistry

9.3.1 Historical Market Trends

9.3.2 Market Forecast

9.4 Other Institutional Customers

9.4.1 Historical Market Trends

9.4.2 Market Forecast

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Company Analysis

12.1 Sea trade

12.1.1 Key Persons

12.1.2 Overviews

12.1.3 Recent Developments & Strategies

12.2 Atlantic Capes Fisheries, Inc.

12.2.1 Key Persons

12.2.2 Overviews

12.2.3 Recent Developments & Strategies

12.3 Atalanta Corporation

12.3.1 Key Persons

12.3.2 Overviews

12.3.3 Recent Developments & Strategies

12.4 Ideal Foods Ltd

12.4.1 Key Persons

12.4.2 Overviews

12.4.3 Recent Developments & Strategies

12.5 Sea Delights

12.5.1 Key Persons

12.5.2 Overviews

12.5.3 Recent Developments & Strategies

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com