Global Auto Parts Manufacturing Market – Forecast & Analysis 2025–2033

Buy NowAuto Parts Manufacturing Market Size and Forecast 2025-2033

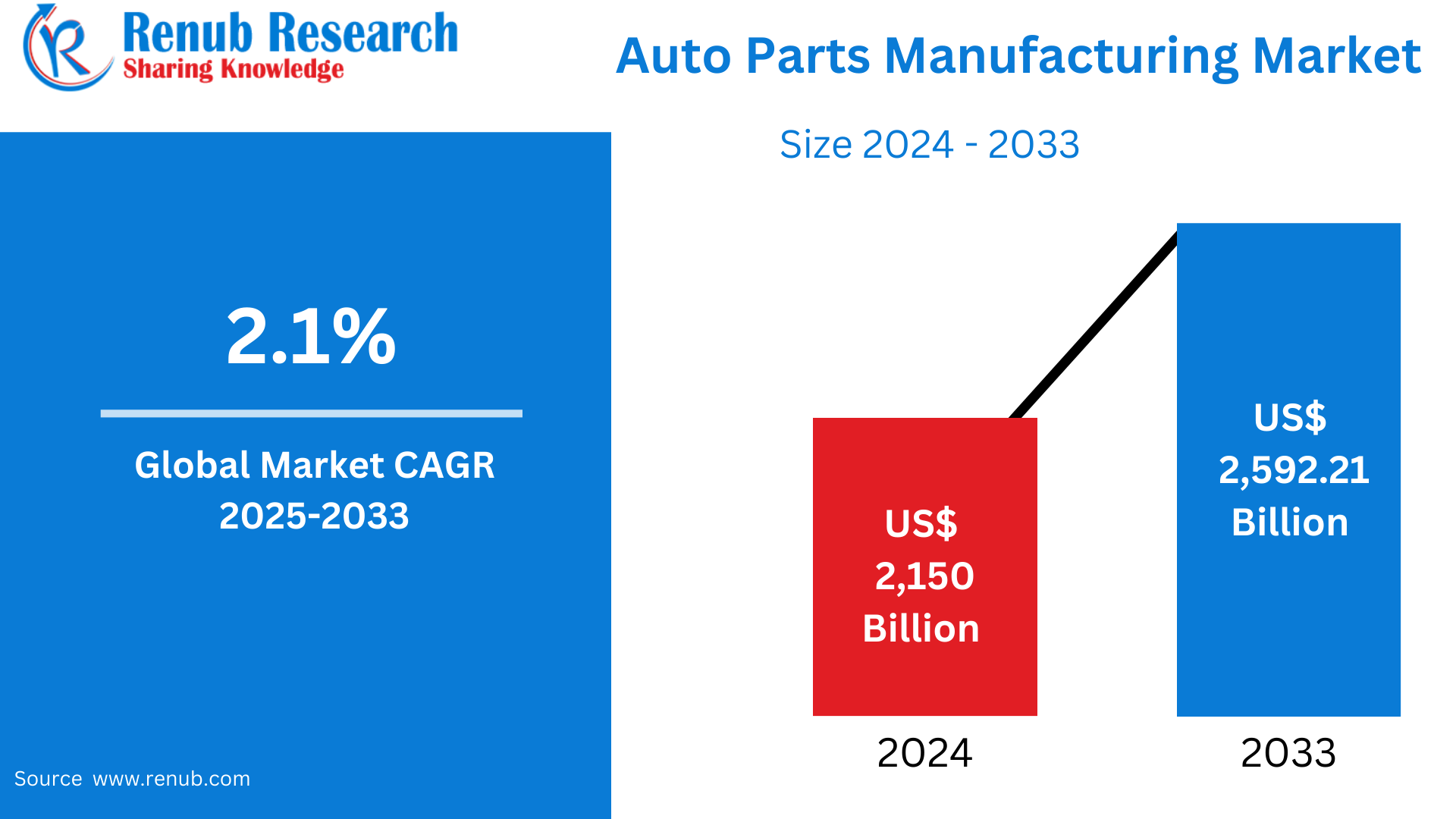

Global Auto Parts Manufacturing Market is expected to reach US$ 2,592.21 billion by 2033 from US$ 2,150 billion in 2024, with a CAGR of 2.1% from 2025 to 2033. The market is being driven by a number of factors, including the growing demand for cars worldwide, government initiatives and incentives encouraging the growth and sustainability of the automotive industry, and consumer demand for more comfort, connectivity, and convenience features in cars.

Auto Parts Manufacturing Global Market Report by Type (Battery, Cooling System, Underbody Component, Automotive Filter, Others), End User (OEMs, Aftermarket), Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Others), Countries and Company Analysis, 2025-2033.

Global Auto Parts Manufacturing Industry Overview

One important industry that is essential to the automotive sector is the manufacture of car components. It entails manufacturing a range of systems and parts necessary for cars to operate and perform. Manufacturers of car components use cutting-edge technology, such computer-aided design and production, to create premium parts that satisfy the exacting specifications of the automobile sector. They specialize in manufacturing a variety of parts, such as electrical systems, suspension systems, brakes, engines, and gearboxes. To guarantee that their components are seamlessly integrated into automobiles, these producers collaborate closely with automakers. The global demand for automobiles is pushing innovation, efficiency, and quality in the auto parts industry, which is thriving in response to the changing demands of the automotive market.

The growing focus on vehicle safety and regulations is the main factor propelling the global market. Accordingly, the market is being greatly influenced by the quick developments in automobile technology. Additionally, the market is being favorably impacted by the growing customer desire for more fuel-efficient vehicles as well as the rising demand for automobiles. In addition, the market is being stimulated by the growth of the electric car industry as well as the increasing use of autonomous and advanced driver-assistance systems (ADAS). Additionally, the industry is being driven by the world's fast infrastructural expansion and urbanization. Additionally, the industry is being supported by the growing global automotive aftermarket and the rising need for replacements for aged cars. The market is also being helped by the increased emphasis on energy-efficient components and lightweight materials.

Key Factors Driving the Auto Parts Manufacturing Market Growth

Electrification of Vehicles

One of the main factors propelling the market for auto parts manufacturing is the electrification of automobiles. Specialized parts including batteries, electric drivetrains, and power electronics are in high demand as the global automobile industry transitions to electric vehicles (EVs). The functionality, dependability, and efficiency of EVs depend on these components. In order to provide durable, effective, and high-quality parts that meet the requirements of electric cars, manufacturers are spending more money on research and development. This change not only raises the need for new components but also creates new avenues for innovation, allowing producers to gain a bigger piece of the quickly expanding EV market. The need for these specialist parts is anticipated to keep growing as EV adoption picks up speed.

Sustainability and Eco-friendly Materials

The production of vehicle parts is increasingly reliant on sustainability and the usage of environmentally friendly materials. Manufacturers are employing more recycled materials and concentrating on lowering their carbon footprints as a result of tighter waste and emissions restrictions as well as growing consumer demand for products that are environmentally friendly. The move toward recyclable, long-lasting, and lightweight materials reduces environmental impact while enhancing vehicle performance and fuel economy. This pattern is in line with the industry's larger drive to create automobiles that are more sustainable and energy-efficient. In addition to satisfying legal requirements, using eco-friendly materials improves a brand's reputation and marketability, particularly with people who care about the environment. The auto parts sector is adopting green practices as a crucial part of its growth and innovation strategy as the emphasis on sustainability increases.

Global Expansion and Market Access

One of the main factors propelling the growth of the auto parts manufacturing market is the globalization of the automotive sector into developing regions. The demand for automobiles and car parts has increased as middle-class populations grow in nations like China, India, and Southeast Asia, urbanization picks up speed, and disposable incomes rise. The demand for car components is directly boosted by the rise in vehicle manufacturing and sales. Manufacturers are setting up manufacturing facilities in these areas to take advantage of this expansion and make sure they can more effectively service local demand. They can also increase supply chain resilience and lower logistical expenses by doing this. In addition to enhancing manufacturers' visibility, this entry into new markets helps the global automotive supply chain grow and diversify.

Challenges in the Auto Parts Manufacturing Market

Labor Shortages and Skill Gaps

Skilled labor is in limited supply in the auto parts manufacturing sector, particularly in sectors that need sophisticated production processes and technological integration. The need for personnel with specific skills is expanding as the sector embraces cutting-edge technology like automation, robots, and 3D printing. But the number of skilled engineers, technicians, and operators who can manage these complex systems is limited. This lack of skills might raise the possibility of mistakes, decrease operational effectiveness, and delay output. In order to stay up with technological changes, manufacturers must both hire fresh personnel and upskill their current workers. In a market that is changing quickly, addressing this labor deficit is essential to preserving competitiveness and guaranteeing seamless operations.

Competition and Price Pressure

The market for car parts production is becoming more competitive, especially from low-cost producers in developing nations. These producers may sell goods at much lower rates since they frequently have lesser labor and operating expenses. Established firms are compelled by this pricing pressure to reduce manufacturing costs without sacrificing quality requirements. It's getting more and harder to strike a balance between cutting costs and the need to innovate and preserve product quality. Furthermore, maintaining high profit margins is difficult due to price sensitivity among customers and automakers. In order to stay competitive in a market where price tactics are essential to success, businesses are searching for methods to optimize supply chains, simplify processes, and integrate cost-effective technology.

Auto Parts Manufacturing Market Overview by Regions

With North America and Europe concentrating on advanced technology integration and electric vehicle components, the worldwide market for auto parts production is expanding across all regions. In the meantime, the fast industrialization and growing automobile manufacturing in Asia-Pacific, particularly in China and India, is increasing demand. The following provides a market overview by region:

United States Auto Parts Manufacturing Market

The thriving automotive sector, rising demand for electric vehicles (EVs), and technological improvements are all contributing to the continuous expansion of the US auto parts manufacturing market. American businesses are responding to the trend toward electric vehicles (EVs) by manufacturing specialized parts like batteries, electric drivetrains, and power electronics, all while putting a heavy emphasis on innovation. Another factor driving the industry is customer desire for better, more customisable parts, which has resulted in an increase in aftermarket services. Additionally, in an effort to increase productivity and save expenses, firms are progressively implementing automation and innovative production processes. With constant investments in sustainability and technology, the United States continues to be a major participant in the global auto parts manufacturing industry despite obstacles including labor shortages and supply chain disruptions.

United Kingdom Auto Parts Manufacturing Market

Technology breakthroughs, changing customer tastes, and changing regulatory environments are all contributing to the substantial evolution of the UK car parts manufacturing industry. Production of specialist parts like batteries and electric drivetrains has expanded as a result of the rising demand for electric vehicles (EVs). The UK government has made significant investments in the industry to help with this transition, including a £1 billion plan to build a new EV battery "gigafactory" in Sunderland with the capacity to make batteries for up to 100,000 EVs a year. The automotive industry has also benefited from a trade agreement that the UK has obtained with the US that lowers tariffs on auto exports. Notwithstanding these encouraging advancements, problems such a lack of experienced personnel in innovative manufacturing processes, supply chain interruptions, and labor shortages still exist. However, the UK's regulatory actions and strategic investments set up the auto parts manufacturing industry for long-term development and innovation.

India Auto Parts Manufacturing Market

Growing domestic demand, rising vehicle production, and a burgeoning automotive aftermarket are all contributing to India's auto parts manufacturing market's notable expansion. The need for additional automotive components is being driven by the nation's strong industrial infrastructure, urbanization, and growing middle class. By encouraging innovation and the production of cutting-edge components, particularly those for electric cars, government programs like the Production Linked Incentive (PLI) scheme are helping the industry even more. Since Indian manufacturers are supplying car components to international markets, the sector is also benefiting from more export prospects. But issues including a lack of workers, supply chain interruptions, and the requirement for technology advancements continue to be crucial factors for the industry's sustained expansion.

United Arab Emirates Auto Parts Manufacturing Market

The market for auto parts production in the United Arab Emirates (UAE) is expanding significantly due to a number of factors, such as rising car ownership, advances in technology, and an increase in demand for auto parts and services. The "Make it in the Emirates" program is one of the government's strategic programs that aims to promote indigenous manufacturing and lessen dependency on imports. This project is a component of the larger "Operation 300bn" plan, which aims to increase the industrial sector's GDP contribution to the nation. Furthermore, the UAE's advantageous position as a trade center makes it easier to reach both domestic and foreign markets, which supports the car parts manufacturing industry even more. Innovation, sustainability, and the use of cutting-edge technology are becoming more and more important as the market develops in order to satisfy the expanding needs of the automotive sector.

Market Segmentations

Type

- Battery

- Cooling System

- Underbody Component

- Automotive Filter

- Others

End User

- OEMs

- Aftermarket

Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Others

Regional Outlook

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

All the Key players have been covered

- Overview

- Key Persons

- Recent Development & Strategies

- Revenue Analysis

Company Analysis:

- Aisin Corporation

- Akebono Brake Industry Co. Ltd.

- Brembo S.p.A.

- Continental AG

- DENSO Corporation

- Faurecia SE

- General Motors Company

- Magna International Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Product, By Service Provider, By End User, By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Auto Parts Manufacturing Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Auto Parts Manufacturing Market Share Analysis

6.1 By Type

6.2 By End User

6.3 By Vehicle Type

6.4 By Countries

7. Type

7.1 Battery

7.2 Cooling System

7.3 Underbody Component

7.4 Automotive Filter

7.5 Others

8. End User

8.1 OEMs

8.2 Aftermarket

9. Vehicle Type

9.1 Passenger Cars

9.2 Light Commercial Vehicles

9.3 Heavy Commercial Vehicles

9.4 Others

10. Countries

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 South Korea

10.3.5 Thailand

10.3.6 Malaysia

10.3.7 Indonesia

10.3.8 Australia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 UAE

10.5.3 South Africa

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 Aisin Corporation

13.1.1 Overview

13.1.2 Key Persons

13.1.3 Recent Development & Strategies

13.1.4 Revenue Analysis

13.2 Akebono Brake Industry Co. Ltd.

13.2.1 Overview

13.2.2 Key Persons

13.2.3 Recent Development & Strategies

13.2.4 Revenue Analysis

13.3 Brembo S.p.A.

13.3.1 Overview

13.3.2 Key Persons

13.3.3 Recent Development & Strategies

13.3.4 Revenue Analysis

13.4 Continental AG

13.4.1 Overview

13.4.2 Key Persons

13.4.3 Recent Development & Strategies

13.4.4 Revenue Analysis

13.5 DENSO Corporation

13.5.1 Overview

13.5.2 Key Persons

13.5.3 Recent Development & Strategies

13.5.4 Revenue Analysis

13.6 Faurecia SE

13.6.1 Overview

13.6.2 Key Persons

13.6.3 Recent Development & Strategies

13.6.4 Revenue Analysis

13.7 General Motors Company

13.7.1 Overview

13.7.2 Key Persons

13.7.3 Recent Development & Strategies

13.7.4 Revenue Analysis

13.8 Magna International Inc.

13.8.1 Overview

13.8.2 Key Persons

13.8.3 Recent Development & Strategies

13.8.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com