Australia Organic Fertilizer Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowAustralia Organic Fertilizer Market Size and Forecast 2025-2033

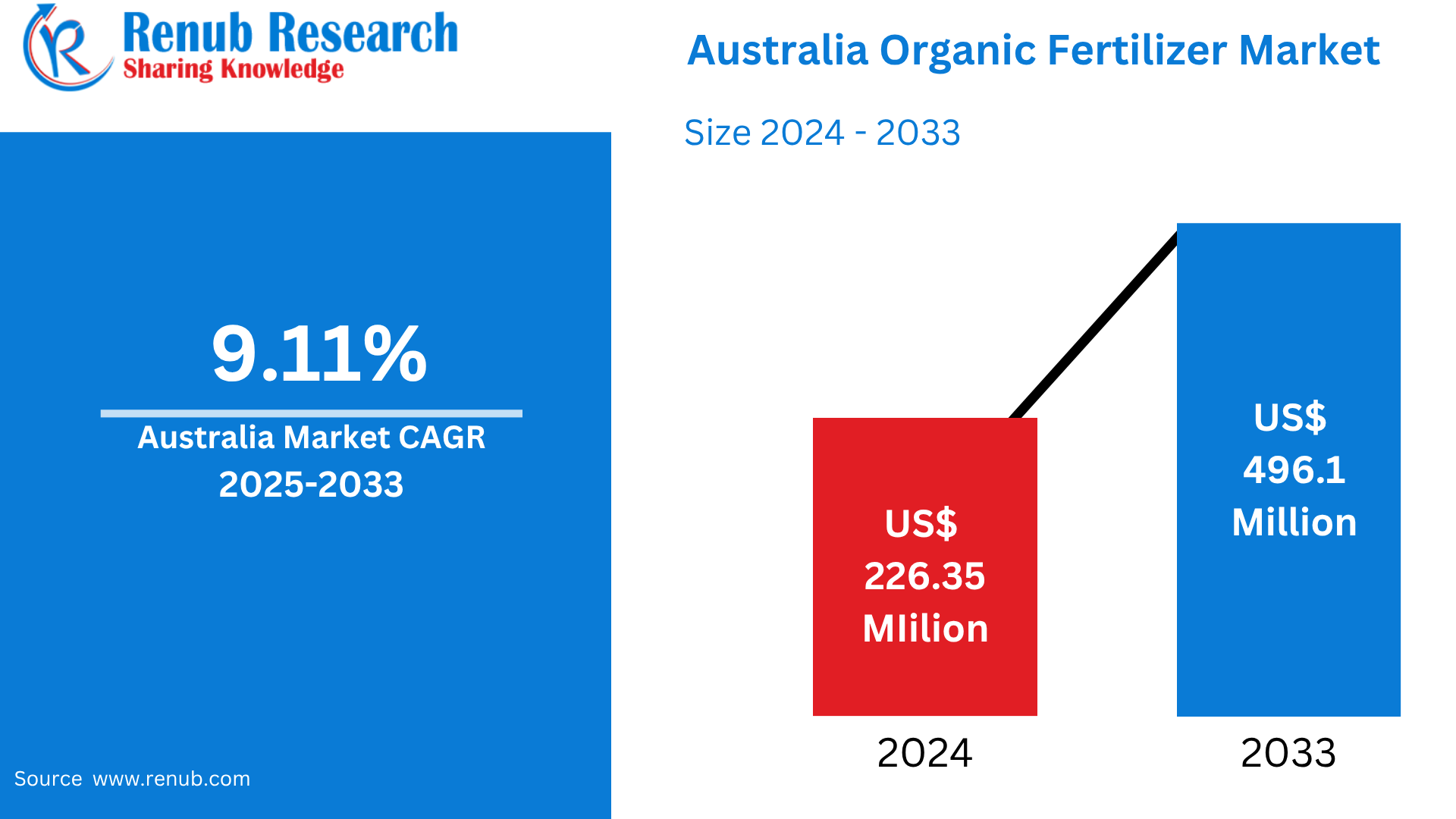

Australia Organic Fertilizer Market is expected to reach US$ 496.1 million by 2033 from US$ 226.35 million in 2024, with a CAGR of 9.11% from 2025 to 2033. Increasing demand for organic food from consumers, government policies that support green-friendly practices, increasing concern for soil health, increasing demand for sustainable agriculture, and advancements in green-friendly fertilizer technology and production methods are the primary drivers driving the organic fertilizers market in Australia.

Australia Organic Fertilizer Market Report by Source (Plant Based, Animal Based, Synthetic Based), Mode of Application (Seed Treatment, Soil Treatment, Root Dripping), Product Type (Microorganism, Azospirillum, Cyanobacteria, Phospate – Solublizing Bacteria, Azolla, Aulosira, Rhizobium, Azotobacter, Other), Organic Residues (Farm Yard Manure, Crop Residue, Green Manure, Other Products), Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Others), Form (Dry, Liquid) and Company Analysis 2025-2033.

Australia Organic Fertilizer Market Overview

An eco-friendly alternative to man-made fertilizers, organic fertilizer is derived from a natural source such as a plant, an animal, or a mineral. Besides improving soil structure, water retention, and microbial population, it adds essential nutrients such as potassium, phosphorus, and nitrogen to the soil. Unlike synthetic fertilizers, organic fertilizers release nutrients slowly, reducing the potential for overfertilization and environmental destruction. Compost, manure, bone meal, and seaweed are some of the most common types. Since they are eco-friendly, promote long-term soil health without the use of dangerous chemicals or additives, promote healthier crops, and enhance diversity, organic fertilizers are often selected in organic agriculture.

The demand for organic fertilizers in Australia is on the rise because of several significant factors. Increasing health awareness is boosting demand for organic crops, and consequently, demand for organic fertilizers is increasing. Market growth is also assisted by government incentives in terms of subsidies and legislation favoring organic production. Organic farming is increasingly viable due to advances in microbial and bio-based fertilizers that improve yield and efficiency. Additionally, the focus on soil health and sustainable agriculture helps to promote organic fertilizers. By promoting circular economy practices and reducing their adverse impact on the environment, waste management methods such as the application of calf dung also contribute.

Growth Drivers for the Australia Organic Fertilizer Market

Consumer Demand for Organic Produce

Consumer demand for organic produce is one of the key drivers fuelling the growth of the Australian organic fertilizer market. The need for organic foods is greater now as health-conscious individuals seek food that is free of chemicals and pesticides. To ensure that sustainable practices are adopted, the trend towards organic farming requires organic fertilizers to be used. Consumers are more aware of the long-term benefits of chemical-free food in preventing lifestyle diseases, and they feel that organic foods are healthier. The Australian Institute of Health and Welfare puts that in 2024, cardiovascular disease accounted for nearly 12% of total diseases in Australia, highlighting the nation's rising health challenges. Organic product demand, supported by organic fertilizers, is projected to keep on increasing as individuals become more aware of the relationship between nutrition and well-being. The organic fertilizer market is expanding because of this trend, which compels farmers to adopt environmentally sound practices.

Government Support and Regulations

The Australian market for organic fertilizer is increasing thanks in large measure to government support and policies. The Australian government has initiated several schemes aimed at promoting organic fertilizers and sustainable agriculture practices. The Natural Heritage Trust's (NHT) USD 302.1 million Climate-Smart Agriculture Program, launched in 2023–2024, is a prime example. The 'Partnerships and Innovation grant,' providing USD 45 million for four years (2024–2028) to fund medium-to-large-scale projects to develop climate-smart farm practices and tools, forms part of the program. By offering incentives to farmers to adopt eco-friendly practices, like the use of organic fertilizers, such programs promote sustainable agriculture in the long term. The adoption of organic fertilizers is expected to rise as laws favor sustainable processes more and more, which will further increase the sector and contribute towards environmental and climate objectives.

Retail Sector Expansion

More consumers can now buy organic produce due to the broader choice provided by large supermarket chains such as Woolworths and Coles.Growing demand and consumer education for organic produce due to increased availability has led farmers to adopt organic farming practices, including the use of organic fertilizers. Farmers' markets and specialty organic stores also provide customers with direct access to organic products, which supports the utilization of organic fertilizers. Expansion of the retail sector is a fundamental driver for Australia's usage of organic fertilizers, as consumer demand for organic products continues to emerge.

Challenges in the Australia Organic Fertilizer Market

High Production Costs

One of the biggest obstacles to the organic fertilizer market in Australia is the high cost of manufacture. Costs are increased by the need for more time-consuming and labor-intensive production procedures for organic fertilizers, such as composting or obtaining raw materials like manure. Costs are further increased by the requirement for specialist equipment and quality monitoring. Furthermore, there may be fluctuations in the supply of raw materials, which could result in shortages and increased costs. Because of these high prices, organic fertilizers are more costly than synthetic ones, which discourages price-conscious farmers from using them and limits market expansion overall, particularly in highly competitive agricultural industries.

Supply Chain Issues

Issues with the supply chain pose a serious threat to the Australian market for organic fertilizer. Production process interruptions can result from irregular raw material supply, including manure, compost, and organic waste. Sourcing organic materials is made more difficult by their regional dispersion and seasonal fluctuations. Logistical challenges including inadequate infrastructure and transportation expenses can also raise costs and delay deliveries. Organic fertilizer shortages brought on by these supply chain issues may make it difficult for farmers to maintain their farming methods and obtain steady supplies, which would impede the market's expansion.

Recent Developments in Australia Organic Fertilizer Industry

- Oct 2024: The Regional Economic Futures Fund (REFF) and Backing Business in the Bush Fund (BBBF) fertilizer project winners were announced by the Queensland government. While awards under REFF ranged from USD 50,000 to USD 12.75 million, the BBBF offered financial support for each project that ranged from USD 500,000 to USD 2 million. Mort & Co. will receive an undisclosed amount to build extra granulators and an automated batching system to improve the amount of organic fertilizer it currently produces near its Grassdale feedlot south of Dalby. Another beneficiary is DataFarming, a precision agriculture company that intended to use the funds to create digital infrastructure that links farmers and fertilizer manufacturers directly.

- Oct 2024: Good Fruit & Vegetables magazine featured Flamingro, a superb certified organic chitin-based biostimulant for optimal plant growth and a healthier root system. Its debut in the Australian market was covered in the article "Bio-Stimulant Ticks Aussie Organic Box." With experiments showing a 26% increase in root mass, it is available to farmers across Australia. Given that 70–80% of wine grape plants nowadays are self-rooted, it seeks to offer crucial protection that might significantly reduce losses across the industry.

Australia Organic Fertilizer Market Segmentation:

Source

- Plant Based

- Animal Based

- Synthetic Based

Mode of Application

- Seed Treatment

- Soil Treatment

- Root Dripping

Product Type

- Microorganism

- Azospirillum

- Cyanobacteria

- Phospate – Solublizing Bacteria

- Azolla

- Aulosira

- Rhizobium

- Azotobacter

- Other

Organic Residues

- Farm Yard Manure

- Crop Residue

- Green Manure

- Other Products

Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

Form

- Dry

- Liquid

All companies have been covered from 4 viewpoints:

- Company Overview

- Key Persons

- Recent Development & Strategies

- Sales Analysis

Key Players Analysis

- National Fertilizers

- Madras Fertilizers

- Seek Biotechnology Co. Ltd

- Coromandel International

- Nagarujuna fertilizers and Chemicals Ltd

- T Stanes& Company Limited

- Novozymes

- Kribhco

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

By Source, By Mode of Application, By Product Type, By Organic Residues, By Crop Type and By Form |

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Australia Organic Fertilizer Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Source

6.2 By Mode of Application

6.3 By Product Type

6.4 By Organic Residues

6.5 By Crop Type

6.6 By Form

7. Source

7.1 Plant Based

7.2 Animal Based

7.3 Synthetic Based

8. Mode of Application

8.1 Seed Treatment

8.2 Soil Treatment

8.3 Root Dripping

9. Product Type

9.1 Microorganism

9.2 Azospirillum

9.3 Cyanobacteria

9.4 Phospate – Solublizing Bacteria

9.5 Azolla

9.6 Aulosira

9.7 Rhizobium

9.8 Azotobacter

9.9 Other

10. Organic Residues

10.1 Farm Yard Manure

10.2 Crop Residue

10.3 Green Manure

10.4 Other Products

11. Crop Type

11.1 Cereals & Grains

11.2 Oilseeds & Pulses

11.3 Fruits & Vegetables

11.4 Others

12. Form

12.1 Dry

12.2 Liquid

13. Porter’s Five Forces Analysis

13.1 Bargaining Power of Buyers

13.2 Bargaining Power of Suppliers

13.3 Degree of Rivalry

13.4 Threat of New Entrants

13.5 Threat of Substitutes

14. SWOT Analysis

14.1 Strength

14.2 Weakness

14.3 Opportunity

14.4 Threat

15. Key Players Analysis

15.1 National Fertilizers

15.1.1 Overviews

15.1.2 Key Person

15.1.3 Recent Developments

15.1.4 Revenue

15.2 Madras Fertilizers

15.2.1 Overviews

15.2.2 Key Person

15.2.3 Recent Developments

15.2.4 Revenue

15.3 Seek Biotechnology Co. Ltd

15.3.1 Overviews

15.3.2 Key Person

15.3.3 Recent Developments

15.3.4 Revenue

15.4 Coromandel International

15.4.1 Overviews

15.4.2 Key Person

15.4.3 Recent Developments

15.4.4 Revenue

15.5 Nagarujuna fertilizers and Chemicals Ltd

15.5.1 Overviews

15.5.2 Key Person

15.5.3 Recent Developments

15.5.4 Revenue

15.6 T Stanes& Company Limited

15.6.1 Overviews

15.6.2 Key Person

15.6.3 Recent Developments

15.6.4 Revenue

15.7 Novozymes

15.7.1 Overviews

15.7.2 Key Person

15.7.3 Recent Developments

15.7.4 Revenue

15.8 Kribhco

15.8.1 Overviews

15.8.2 Key Person

15.8.3 Recent Developments

15.8.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com