Asia Pacific Soup Market Size, Share, Growth Forecast 2025-2033

Buy NowAsia Pacific Soup Market Size and Forecast 2025-2033

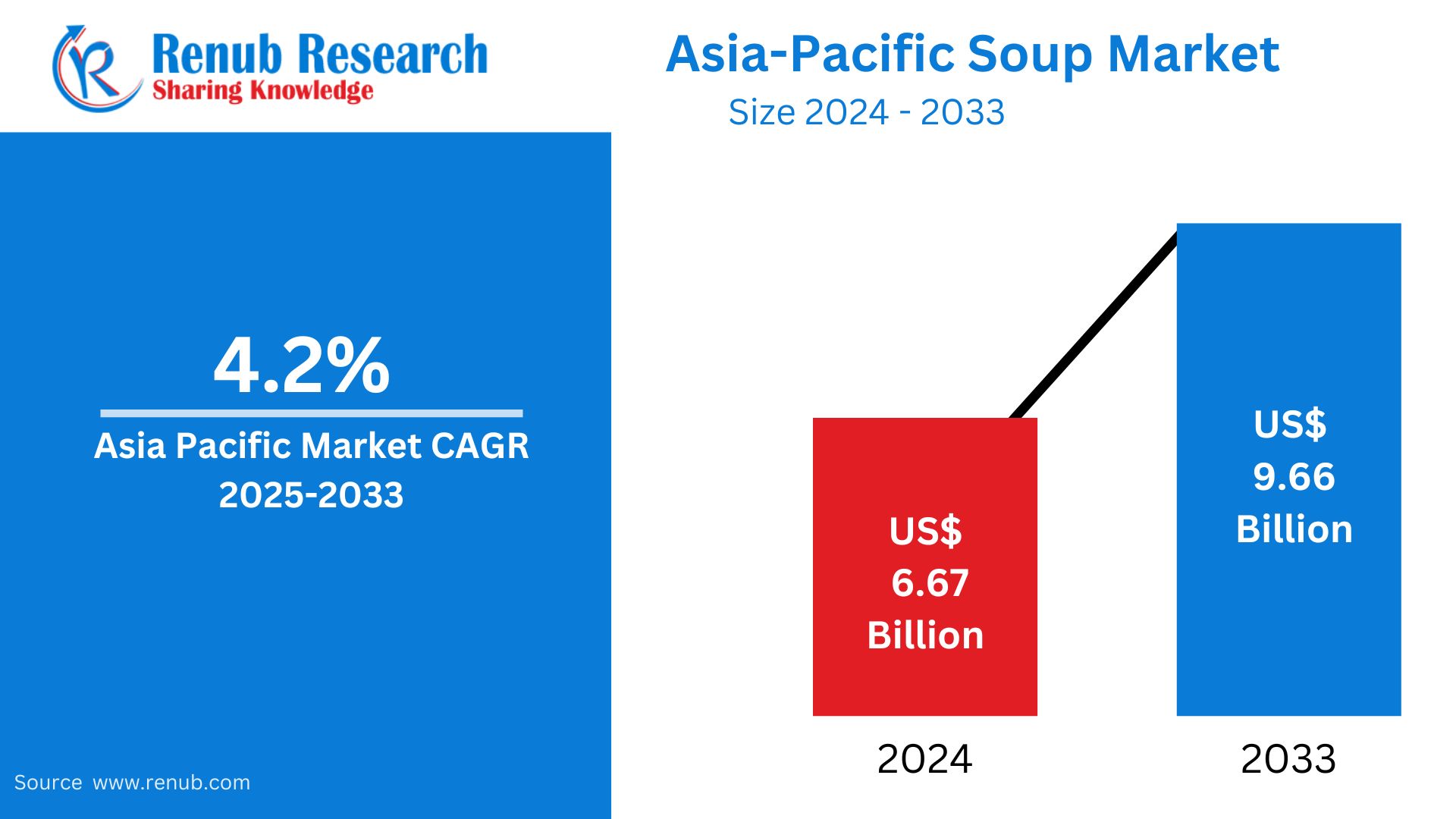

The Asia Pacific soup market stood at USD 6.67 billion in 2024 and is expected to reach USD 9.66 billion by 2033, growing at a CAGR of 4.2% from 2025 to 2033. This rise is attributed to rising demand for convenient foods, enhanced urbanization, and improving popularity of ready-to-eat and nutritious soup forms among emerging economies within the region.

The report Asia Pacific Soup Market & Forecast covers by Type (Instant, Canned, Dehydrated, Chilled, Others) Category (Vegetarian, Non-Vegetarian), Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online), Countries and Company Analysis 2025-2033.

Asia Pacific Soup Market Overview

A soup is a liquid or semi-liquid dish that blends vegetables, meats, seafood, or legumes with water, broth, or stock. It is eaten as an appetizer and a main dish and may be served hot or cold, depending on the recipe and season. In the Asia Pacific, soup has great cultural and culinary significance, with every country having its own special variations—Japan's miso soup and China's hot and sour soup to Thailand's tom yum and Korea's kimchi jjigae.

Soup is well-liked for its health benefits, digestibility, and soothing qualities, and thus it is the preferred option while falling ill or during winter. As urbanization increases and lives become hectic, instant and ready-to-eat soup products have been in the fast lane of increasing popularity throughout Asia Pacific. Improving health awareness among consumers further fuels demand for low-sodium, organic, and plant-based soup products, contributing further to the growth of the market among different demographic segments.

Growth Driver in the Asia Pacific Soup Market

Increasing Urbanization and Active Lifestyles

Accelerated urbanization in nations such as China, India, and Southeast Asia has profoundly changed consumer lifestyles. As more individuals work long hours and look for easy meal options, demand for easy-to-prepare foods such as soup is on the rise. Instant and ready-to-eat soups are picking up as time-saving substitutes for cooking. This transition towards high-speed urban lifestyles is anticipated to drive demand for different formats of soup in the Asia Pacific region. Cities in Asia in 2023 are growing fast, with close to 55 percent of the population in the region anticipated to reside in cities by 2030. This change will greatly impact urban food security and nutrition, as noted in a report published by four United Nations agencies.

Growing Health Awareness

Asian consumers are increasingly becoming health-conscious and deliberately looking for nutrient-rich, low-calorie, and low-sodium foods. Soups, particularly with herb, vegetable, and functional additions, are regarded as healthy foods. Increasing prevalence of lifestyle ailments like obesity, hypertension, and diabetes has driven consumers towards consuming lighter meals, fueling the demand for soups based on health. It increases innovation among organic, vegetarian, and enriched soup offerings. May 2023, Herbalife surveyed the Asia Pacific market and found that 77% of those polled stated that they were more health-oriented because of the pandemic. Of the various markets surveyed, each country's subjects had the highest awareness in this regard: in Thailand, it was 93%, Indonesia stood at 92%, the Philippines at 87%, and Vietnam at 86%.

Growth of Organized Retail and Online Sales

The expansion of supermarkets, hypermarkets, and internet portals in the Asia Pacific has dramatically enhanced the availability and visibility of packaged soups. Organized retail stores provide different soup products with competitive prices and offer promotion schemes. In addition, online grocery websites have facilitated consumers' access to international and local soup brands. The shelf presence and promotional campaigns through digital media further boost consumer interaction and product adoption. November 2023: The Peninsular Export Company has recently introduced SAARRU, India's first indigenous soup with local flavors. The brand sells three variants of soup mixes according to regional food culture and will be expanding its portfolio in the near future by introducing more flavors. In the B2C as well as B2B marketplaces in Tamil Nadu, SAARRU offers these soups through its online site and on online sites like Flipkart and Jiomart.

Challenge in the Asia Pacific Soup Market

Preference for Traditional Home-Cooked Meals

In spite of the convenience offered by ready-to-eat soups, there remains a strong section of consumers in the Asia Pacific region that still favors home-cooked food, particularly in rural and semi-urban locations. Cultural food habits and traditional dietary patterns tend to favor freshly cooked food over packaged food. This consumer behavior poses a hindrance to market penetration, especially for canned and processed soup types, restricting growth in certain regional markets.

Price Sensitivity in Developing Nations

Price-sensitive consumers in emerging economies like India and Vietnam may not be attracted to more expensive premium soup offerings. Expensive imported or specialty soup offerings do not fare well against locally made, affordable alternatives. Industry players need to meet the trade-off between quality, health, and pricing while coping with economic differences and varying affordability levels across Asian markets.

Asia Pacific Instant Soup Market

The convenience and short preparation time of instant soups, coupled with its suitability for busy professionals, students, and travelers, ensures its dominance in the market. Chicken, tomato, and mushroom flavors are most in demand, while Asian-themed flavors such as miso and tom yum are gaining popularity. Companies are spending to increase the nutritional quality and taste of instant soups. Advances in packaging, including cup and sachet, are also fueling consumption, particularly in urban and semi-urban segments.

Asia Pacific Canned Soup Market

Canned soups are prized for their shelf life and number of choices, making them an efficient pantry staple. While not as popular as instant soups, the canned category is gaining traction among health-aware and elderly consumers looking for nutrient-dense meal substitutes. Firms are concentrating on the provision of low-sodium, gluten-free, and organic canned soups to address shifting eating habits. However, issues of preservatives and packaging waste hamper mass use in environmentally conscious markets.

Asia Pacific Vegetarian Soup Market

Vegetarian soups are becoming increasingly popular in the Asia Pacific as a result of the growth of plant-based diets and enhanced sensitivity to sustainability concerns. Vegetarian soups, usually consisting of vegetables, legumes, herbs, and spices, are popular among both vegetarians and flexitarians. Vegetarian strongholds such as India and Thailand provide a robust consumer base for the vegetarian soup market. Clean-label formulations and local flavors are emphasized by brands to target the health- and environment-savvy consumer.

Asia Pacific Non-Vegetarian Soup Market

Non-vegetarian soups such as chicken, beef, seafood, and bone broths are commonly found in the cuisine of China, Japan, and South Korea. The rich flavor and protein-rich property of these soups make them popular for consumption as a main course or a side dish. The non-vegetarian soup demand is supported by cultural inclinations, particularly in colder climates where hot meat-based soups form a part of daily diets. High-end options with gourmet products are also catching up among higher-income consumers.

Asia Pacific Convenience Stores Soup Market

Convenience stores in Asia Pacific are a major channel for ready-to-eat soups. Increasing foot traffic in urban centers and strong demand for convenience meals have made these outlets a convenient option for consumers on the move. Single-serve soup cups and pouches are particularly favored in Japan, South Korea, and Taiwan. Retail chain partnerships and in-store aggressiveness have driven brands to enhance visibility and sales in this high-traffic store format.

Asia Pacific Online Soup Market

The Internet retail channel is fast changing the soup market across Asia Pacific with convenience, assortment, and tailor-made shopping experiences. As more people have gained access to the internet and are using mobiles, e-commerce websites have become a favorite to buy packaged soups. Promotions on websites, reviews from users, and subscription-based delivery of soups influence consumer interest. Websites such as Amazon, JD.com, and BigBasket play a vital role in extending access to local and global brands of soups.

China Soup Market

China is one of the Asia Pacific region's biggest and most diverse soup markets, with an ancient culinary culture based on medicinal and herbal soups. Packaged and instant soups are gaining traction, particularly among city youth and blue-collar consumers. As health awareness increases, companies are launching collagen-enriched broths and functional soups based on ingredients of traditional Chinese medicine. Internet sales and innovation in products are major growth drivers in China's vibrant soup industry.

Japan Soup Market

The soup market in Japan is highly rooted in its food culture, and miso soup is ubiquitous in virtually every meal. Convenience is a key driver, and instant noodle soups and miso lead retail shelves. The market also supports health-oriented consumers with low-sodium and additive-free products. High packaging and flavor innovation and Japan's aging population looking for convenient-to-digest meals keep supporting growth in modern and traditional soup forms. March 2024, Otsuka Foods Co., Ltd. has released two new products named "Bon Curry Umami wo Ajiwau Curry Udon no Moto" (Bon Curry Umami-Rich Curry Udon Noodles Topping). These are the first Bon Curry products to be specifically marketed for use in curry udon noodles.

India Soup Market

The Indian soup market is rising steadily, driven by urbanization, increasing disposable incomes, and increasing exposure to global cuisine. Tomato, sweet corn, and mixed vegetable soups are leading in popularity. Though home food still leads, consumption of instant soups is growing, particularly among working individuals and students. Vegetarian soups are in high demand owing to food habits, although non-vegetarian choices are increasing. Economical costs and local taste modifications are responsible for increasing market penetration in the rest of India. Nov 2023, The Peninsular Export Company has introduced SAARRU, India's indigenous soup with local variants. Three soup mixes in the initial period, the brand is to expand its taste range. Sold both for B2C and B2B businesses in Tamil Nadu, the soups can also be bought from SAARRU's website and sites like Flipkart and Jiomart.

Australia Soup Market

Australia's soup market enjoys a high demand for organic, low-sodium, and plant-based soups. Seasonal consumption is prevalent, with higher sales in colder months. Consumers are drawn to canned and chilled fresh soups, and the health and wellness trend is generating demand for clean-label and gluten-free soups. Retail, especially supermarkets and online, plays a significant role in propelling sales. Local and international brands are competing fiercely, emphasizing innovation and sustainability.

Asia-Pacific Soup Market Overview

Type

- Instant

- Canned

- Dehydrated

- Chilled

- Others

Category

- Vegetarian

- Non-Vegetarian

Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online

Country-wise Market Analysis

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

- Rest of Asia Pacific

Companies have been covered from 4 viewpoints

- Overview

- Key Person

- Recent Development

- Revenue

Competitive Landscape

- The Campbell Soup Company

- Nestle S.A.

- General Mills Inc.

- Baxters Food Group Lmt.

- Conagra Brands, Inc.

- Hindustan Unilever Group

- Premier Foods

- Associated British Food Inc

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Type, Category, Distribution Channel and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Asia Pacific Soup Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share

6.1 By Type

6.2 By Category

6.3 By Distribution Channel

6.4 By Countries

7. Type

7.1 Instant

7.2 Canned

7.3 Dehydrated

7.4 Chilled

7.5 Others

8. Category

8.1 Vegeterian

8.2 Non-Vegeterian

9. Distribution Channel

9.1 Supermarkets & Hypermarkets

9.2 Convenience Stores

9.3 Online

10. Countries

10.1 China

10.2 Japan

10.3 India

10.4 South Korea

10.5 Thailand

10.6 Malaysia

10.7 Indonesia

10.8 Australia

10.9 New Zealand

10.10 Rest of Asia Pacific

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 The Campbell Soup Company

13.1.1 Overviews

13.1.2 Key Person

13.1.3 Recent Developments

13.1.4 Revenue

13.2 Nestle S.A.

13.2.1 Overviews

13.2.2 Key Person

13.2.3 Recent Developments

13.2.4 Revenue

13.3 General Mills Inc.

13.3.1 Overviews

13.3.2 Key Person

13.3.3 Recent Developments

13.3.4 Revenue

13.4 Baxters Food Group Lmt.

13.4.1 Overviews

13.4.2 Key Person

13.4.3 Recent Developments

13.4.4 Revenue

13.5 Conagra Brands, Inc.

13.5.1 Overviews

13.5.2 Key Person

13.5.3 Recent Developments

13.5.4 Revenue

13.6 Hindustan Unilever Group

13.6.1 Overviews

13.6.2 Key Person

13.6.3 Recent Developments

13.6.4 Revenue

13.7 Premier Foods

13.7.1 Overviews

13.7.2 Key Person

13.7.3 Recent Developments

13.7.4 Revenue

13.8 Asociated British Food inc.

13.8.1 Overviews

13.8.2 Key Person

13.8.3 Recent Developments

13.8.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com