Africa Condom Market, Size, Forecast 2022-2030, Industry Trends, Growth, Share, Impact of COVID-19, Opportunity Company Analysis

Buy NowAfrica Condom Market Outlook

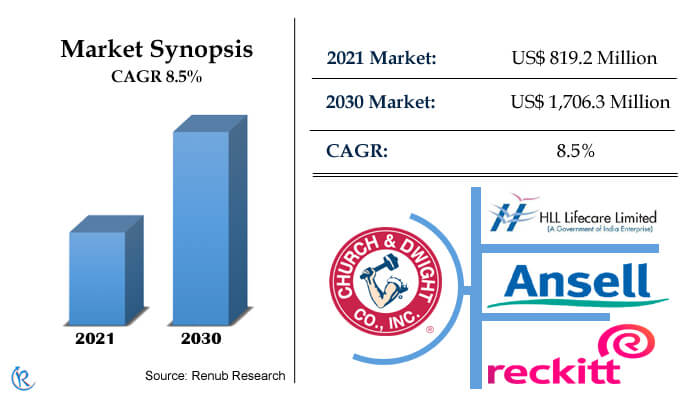

Africa Condom Market is expected to reach US$ 1,706.3 Million by 2030. Male and female condoms are the contraception to protect from SIT/ HIV diseases and unwanted pregnancies. In the Africa, most of countries are impoverished, and the awareness level of HIV/SIT diseases is negligible especially in its rural and semi-urban places. However the good news is that things are improving quickly, as UNAIDS, WHO, and many government agencies are raising awareness programs. Due to these initiatives and awareness among the African population the use of condoms are rising year on year.

If used correctly male condoms are 98% effective in preventing pregnancy and Sexually Transmitted Infections (STIs). Primarily due to these reasons male condoms for sexual intercourse is promoted by most government and healthcare organizations in African countries. Other than African government agencies, International healthcare bodies such as the Centers for Disease Control and Prevention (CDC) and World Health Organization (WHO) play a crucial role in creating awareness regarding safe sex and the advantages of products.

Africa Condom Industry to grow with a CAGR of 8.5% during 2021-2030

The rise of online sales channels if further expected to increase access and distribution of condoms in African countries. With rising internet penetration and smartphones, the e-commerce industry has experienced prominent growth in various markets. Companies working in the sexual wellness industry are also growing their presence on online retail channels. Suppliers, Distributors, and Retailers are optimizing their websites to reach a larger customer base.

36 African Countries Condom Market & Volume Covered in the Report

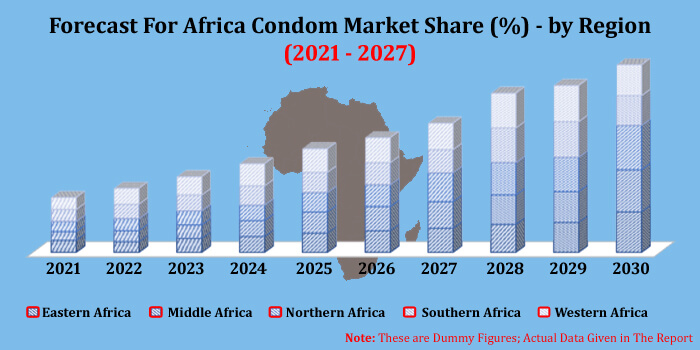

The report has divided the Africa condom market into 5 Regions: Eastern Africa, Middle Africa, Northern Africa, Southern Africa and Western Africa regions. All these 5 regions have been further sub-divided into 36 countries. African countries like Mozambique, Uganda, United Republic of Tanzania, Nigeria and South African countries are the prominent market for condoms into the African region. The market has shown pretty much impressive growth during the forecast period. The number of condom pieces sold among the countries mentioned above has surged and will surge over time.

Africa Condom Market Size was valued US$ 819.2 Million in the year 2021

Based on Material, in this report we have covered the condom market from 2 types of material Latex Condom Market and Non-Latex Condom Market. The driving forces towards the Africa condom market growth are surging awareness about the benefits of use of condoms and its vast population base in the region. Apart from sex education and protection against STDs, the introduction of innovative condom designs, changes in packaging style, promotional activities, and surged marketing are some of the other major factors that further boosts the market growth.

COVID-19 Impact on African Condom Growth Trends

COVID-19 pandemic outbreak has hit harder on every sector worldwide and at the same times that has also impacted condom industry as well. Many company’s condoms sales dropped due to restrictions, lockdowns and social distancing norms. People in African regions and the whole world had less sex during the period. However, once the lockdown was over and the vaccination procedure started, we have seen a surge in sales of condoms and sex-related products.

Renub Research new report “Africa Condom Market By Materials (Latex & Non- Latex), Distribution Channels (Drugs Stores, Mass Merchandisers, E-commerce & Others), Regions {(Eastern Africa – Burundi, Comoros, Eritrea, Ethiopia, Kenya, Madagascar, Malawi, Mozambique, Rwanda, South Sudan, Uganda, United Republic of Tanzania, Zambia, Zimbabwe), Region (Middle Africa- Angola, Cameroon, Central African Republic, Chad, Congo, Democratic Republic of the Congo, Gabon], Northern Africa – Egypt, Morocco, Southern Africa – Botswana, Lesotho, Namibia, South Africa, Swaziland, Western Africa – Benin, Burkina Faso, Côte d'Ivoire, Ghana, Guinea, Nigeria, Senegal, Togo), Key Players (Church & Dwight Co. Inc., Reckitt Benckiser Group PLC., Ansell Ltd, HLL Life care Ltd)" provides complete insight on Africa Condom Industry.

Africa Condom Analysis

1. Market

2. Users

Region - Market & Volume breakup 5 Regions with 36 countries

A. Eastern Africa

1. Burundi

2. Comoros

3. Eritrea

4. Ethiopia

5. Kenya

6. Madagascar

7. Malawi

8. Mozambique

9. Rwanda

10. South Sudan

11. Uganda

12. United Republic of Tanzania

13. Zambia

14. Zimbabwe

B. Middle Africa

1. Angola

2. Cameroon

3. Central African Republic

4. Chad

5. Congo

6. Democratic Republic of the Congo

7. Gabon

C. Northern Africa

1. Egypt

2. Morocco

D. Southern Africa

1. Botswana

2. Lesotho

3. Namibia

4. South Africa

5. Swaziland

E. Western Africa

1. Benin

2. Burkina Faso

3. Côte d'Ivoire

4. Ghana

5. Guinea

6. Nigeria

7. Senegal

8. Togo

Material Types - Market breakup from 2 viewpoints

1. Latex

2. Non-Latex

Distribution Channel - Market breakup from 4 viewpoints

1. Drug Stores

2. Mass- Merchandiser

3. E-Commerce

4. Others

All the Key players have been covered from 3 viewpoints

• Overviews

• Recent Developments

• Revenues

Key Players

1. Church & Dwight Co. Inc.

2. Reckitt Benckiser Group PLC.

3. Ansell Ltd

4. HLL Life care Ltd

Report Details:

| Report Features | Details |

| Base Year | 2021 |

| Historical Period | 2016 - 2021 |

| Forecast Period | 2022-2030 |

| Market | US$ Million |

| Segment Covered | Materials, Distribution Channels, Regions (36 countries) |

| Regions Covered | Eastern Africa, Middle Africa, Northern Africa, Southern Africa, Western Africa |

| Companies Covered | Church & Dwight Co. Inc., Reckitt Benckiser Group PLC., Ansell Ltd, HLL Life care Ltd |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Addressed by the Report:

- What is the current size of the Africa Condom Market?

- Which regions will gain maximum Condoms Market?

- Which country /Region has maximum sold pieces of condoms?

- Who are the leading market players active in the Africa Condom Market?

- What are the current trends that will influence the market in the forecast year?

- What are the projections for the future that would help in taking further strategic steps?

- What has been the impact of COVID-19 on the Africa Condom Market?

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Africa Condom Analysis

5.1 Market

5.2 Users

6. Market Share

6.1 Material

6.2 Distribution Channel

7. Eastern Africa – Condom Market & Volume

7.1 Burundi

7.1.1 Market

7.1.2 Volume

7.2 Comoros

7.2.1 Market

7.2.2 Volume

7.3 Eritrea

7.3.1 Market

7.3.2 Volume

7.4 Ethiopia

7.4.1 Market

7.4.2 Volume

7.5 Kenya

7.5.1 Market

7.5.2 Volume

7.6 Madagascar

7.6.1 Market

7.6.2 Volume

7.7 Malawi

7.7.1 Market

7.7.2 Volume

7.8 Mozambique

7.8.1 Market

7.8.2 Volume

7.9 Rwanda

7.9.1 Market

7.9.2 Volume

7.10 South Sudan

7.10.1 Market

7.10.2 Volume

7.11 Uganda

7.11.1 Market

7.11.2 Volume

7.12 United Republic of Tanzania

7.12.1 Market

7.12.2 Volume

7.13 Zambia

7.13.1 Market

7.13.2 Volume

7.14 Zimbabwe

7.14.1 Market

7.14.2 Volume

8. Middle Africa – Condom Market & Volume

8.1 Angola

8.1.1 Market

8.1.2 Volume

8.2 Cameroon

8.2.1 Market

8.2.2 Volume

8.3 Central African Republic

8.3.1 Market

8.3.2 Volume

8.4 Chad

8.4.1 Market

8.4.2 Volume

8.5 Congo

8.5.1 Market

8.5.2 Volume

8.6 Democratic Republic of the Congo

8.6.1 Market

8.6.2 Volume

8.7 Gabon

8.7.1 Market

8.7.2 Volume

9. Northern Africa – Condom Market & Volume

9.1 Egypt

9.1.1 Market

9.1.2 Volume

9.2 Morocco

9.2.1 Market

9.2.2 Volume

10. Southern Africa – Condom Market & Volume

10.1 Botswana

10.1.1 Market

10.1.2 Volume

10.2 Lesotho

10.2.1 Market

10.2.2 Volume

10.3 Namibia

10.3.1 Market

10.3.2 Volume

10.4 South Africa

10.4.1 Market

10.4.2 Volume

10.5 Swaziland

10.5.1 Market

10.5.2 Volume

11. Western Africa – Condom Market & Volume

11.1 Benin

11.1.1 Market

11.1.2 Volume

11.2 Burkina Faso

11.2.1 Market

11.2.2 Volume

11.3 Côte d'Ivoire

11.3.1 Market

11.3.2 Volume

11.4 Ghana

11.4.1 Market

11.4.2 Volume

11.5 Guinea

11.5.1 Market

11.5.2 Volume

11.6 Nigeria

11.6.1 Market

11.6.2 Volume

11.7 Senegal

11.7.1 Market

11.7.2 Volume

11.8 Togo

11.8.1 Market

11.8.2 Volume

12. Material – Africa Condom Market

12.1 Latex

12.2 Non-Latex

13. Distribution Channel – Africa Condom Market

13.1 Drug Stores

13.2 Mass Merchandisers

13.3 E-Commerce

13.4 Others

14. Porters Five Forces

14.1 Overview

14.2 Bargaining Power of Buyers

14.3 Bargaining Power of Suppliers

14.4 Degree of Competition

14.5 Threat of New Entrants

14.6 Threat of Substitutes

15. Company Analysis

15.1 Church & Dwight Co. Inc.

15.1.1 Overviews

15.1.2 Recent Developments

15.1.3 Revenues

15.2 Reckitt Benckiser Group PLC.

15.2.1 Overviews

15.2.2 Recent Developments

15.2.3 Revenues

15.3 Ansell Ltd

15.3.1 Overviews

15.3.2 Recent Developments

15.3.3 Revenues

15.4 HLL Life care Ltd

15.4.1 Overviews

15.4.2 Recent Developments

15.4.3 Revenues

List Of Figures:

Figure-01: Africa Condom Market (Million US$), 2016 – 2021

Figure-02: Forecast for – Africa Condom Market (Million US$), 2022 – 2030

Figure-03: Africa Condom Pieces Sold (Million), 2016 – 2021

Figure-04: Forecast for – Africa Condom Pieces Sold (Million), 2022 – 2030

Figure-05: Material – Latex Market (Million US$), 2016 – 2021

Figure-06: Material – Forecast for Latex Market (Million US$), 2022 – 2030

Figure-07: Material – Non-Latex Market (Million US$), 2016 – 2021

Figure-08: Material – Forecast for Non-Latex Market (Million US$), 2022 – 2030

Figure-09: Distribution Channel – Drug Stores Market (Million US$), 2016 – 2021

Figure-10: Distribution Channel – Forecast for Drug Stores Market (Million US$), 2022 – 2030

Figure-11: Distribution Channel – Mass Merchandisers Market (Million US$), 2016 – 2021

Figure-12: Distribution Channel – Forecast for Mass Merchandisers Market (Million US$), 2022 – 2030

Figure-13: Distribution Channel – E-Commerce Market (Million US$), 2016 – 2021

Figure-14: Distribution Channel – Forecast for E-Commerce Market (Million US$), 2022 – 2030

Figure-15: Distribution Channel – Others Market (Million US$), 2016 – 2021

Figure-16: Distribution Channel – Forecast for Others Market (Million US$), 2022 – 2030

Figure-17: Burundi – Condom Market (Million US$), 2016 – 2021

Figure-18: Burundi – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-19: Burundi – Condom Pieces Sold (Million), 2016 – 2021

Figure-20: Burundi – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-21: Comoros – Condom Market (Million US$), 2016 – 2021

Figure-22: Comoros – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-23: Comoros – Condom Pieces Sold (Million), 2016 – 2021

Figure-24: Comoros – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-25: Eritrea – Condom Market (Million US$), 2016 – 2021

Figure-26: Eritrea – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-27: Eritrea – Condom Pieces Sold (Million), 2016 – 2021

Figure-28: Eritrea – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-29: Ethiopia – Condom Market (Million US$), 2016 – 2021

Figure-30: Ethiopia – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-31: Ethiopia – Condom Pieces Sold (Million), 2016 – 2021

Figure-32: Ethiopia – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-33: Kenya – Condom Market (Million US$), 2016 – 2021

Figure-34: Kenya – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-35: Kenya – Condom Pieces Sold (Million), 2016 – 2021

Figure-36: Kenya – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-37: Madagascar – Condom Market (Million US$), 2016 – 2021

Figure-38: Madagascar – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-39: Madagascar – Condom Pieces Sold (Million), 2016 – 2021

Figure-40: Madagascar – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-41: Malawi – Condom Market (Million US$), 2016 – 2021

Figure-42: Malawi – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-43: Malawi – Condom Pieces Sold (Million), 2016 – 2021

Figure-44: Malawi – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-45: Mozambique – Condom Market (Million US$), 2016 – 2021

Figure-46: Mozambique – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-47: Mozambique – Condom Pieces Sold (Million), 2016 – 2021

Figure-48: Mozambique – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-49: Rwanda – Condom Market (Million US$), 2016 – 2021

Figure-50: Rwanda – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-51: Rwanda – Condom Pieces Sold (Million), 2016 – 2021

Figure-52: Rwanda – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-53: South Sudan – Condom Market (Million US$), 2016 – 2021

Figure-54: South Sudan – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-55: South Sudan – Condom Pieces Sold (Million), 2016 – 2021

Figure-56: South Sudan – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-57: Uganda – Condom Market (Million US$), 2016 – 2021

Figure-58: Uganda – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-59: Uganda – Condom Pieces Sold (Million), 2016 – 2021

Figure-60: Uganda – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-61: United Republic of Tanzania – Condom Market (Million US$), 2016 – 2021

Figure-62: United Republic of Tanzania – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-63: United Republic of Tanzania – Condom Pieces Sold (Million), 2016 – 2021

Figure-64: United Republic of Tanzania – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-65: Zambia – Condom Market (Million US$), 2016 – 2021

Figure-66: Zambia – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-67: Zambia – Condom Pieces Sold (Million), 2016 – 2021

Figure-68: Zambia – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-69: Zimbabwe – Condom Market (Million US$), 2016 – 2021

Figure-70: Zimbabwe – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-71: Zimbabwe – Condom Pieces Sold (Million), 2016 – 2021

Figure-72: Zimbabwe – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-73: Angola – Condom Market (Million US$), 2016 – 2021

Figure-74: Angola – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-75: Angola – Condom Pieces Sold (Million), 2016 – 2021

Figure-76: Angola – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-77: Cameroon – Condom Market (Million US$), 2016 – 2021

Figure-78: Cameroon – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-79: Cameroon – Condom Pieces Sold (Million), 2016 – 2021

Figure-80: Cameroon – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-81: Central African Republic – Condom Market (Million US$), 2016 – 2021

Figure-82: Central African Republic – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-83: Central African Republic – Condom Pieces Sold (Million), 2016 – 2021

Figure-84: Central African Republic – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-85: Chad – Condom Market (Million US$), 2016 – 2021

Figure-86: Chad – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-87: Chad – Condom Pieces Sold (Million), 2016 – 2021

Figure-88: Chad – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-89: Congo – Condom Market (Million US$), 2016 – 2021

Figure-90: Congo – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-91: Congo – Condom Pieces Sold (Million), 2016 – 2021

Figure-92: Congo – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-93: Democratic Republic of the Congo – Condom Market (Million US$), 2016 – 2021

Figure-94: Democratic Republic of the Congo – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-95: Democratic Republic of the Congo – Condom Pieces Sold (Million), 2016 – 2021

Figure-96: Democratic Republic of the Congo – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-97: Gabon – Condom Market (Million US$), 2016 – 2021

Figure-98: Gabon – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-99: Gabon – Condom Pieces Sold (Million), 2016 – 2021

Figure-100: Gabon – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-101: Egypt – Condom Market (Million US$), 2016 – 2021

Figure-102: Egypt – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-103: Egypt – Condom Pieces Sold (Million), 2016 – 2021

Figure-104: Egypt – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-105: Morocco – Condom Market (Million US$), 2016 – 2021

Figure-106: Morocco – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-107: Morocco – Condom Pieces Sold (Million), 2016 – 2021

Figure-108: Morocco – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-109: Botswana – Condom Market (Million US$), 2016 – 2021

Figure-110: Botswana – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-111: Botswana – Condom Pieces Sold (Million), 2016 – 2021

Figure-112: Botswana – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-113: Lesotho – Condom Market (Million US$), 2016 – 2021

Figure-114: Lesotho – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-115: Lesotho – Condom Pieces Sold (Million), 2016 – 2021

Figure-116: Lesotho – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-117: Namibia – Condom Market (Million US$), 2016 – 2021

Figure-118: Namibia – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-119: Namibia – Condom Pieces Sold (Million), 2016 – 2021

Figure-120: Namibia – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-121: South Africa – Condom Market (Million US$), 2016 – 2021

Figure-122: South Africa – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-123: South Africa – Condom Pieces Sold (Million), 2016 – 2021

Figure-124: South Africa – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-125: Swaziland – Condom Market (Million US$), 2016 – 2021

Figure-126: Swaziland – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-127: Swaziland – Condom Pieces Sold (Million), 2016 – 2021

Figure-128: Swaziland – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-129: Benin – Condom Market (Million US$), 2016 – 2021

Figure-130: Benin – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-131: Benin – Condom Pieces Sold (Million), 2016 – 2021

Figure-132: Benin – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-133: Burkina Faso – Condom Market (Million US$), 2016 – 2021

Figure-134: Burkina Faso – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-135: Burkina Faso – Condom Pieces Sold (Million), 2016 – 2021

Figure-136: Burkina Faso – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-137: Côte d'Ivoire – Condom Market (Million US$), 2016 – 2021

Figure-138: Côte d'Ivoire – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-139: Côte d'Ivoire – Condom Pieces Sold (Million), 2016 – 2021

Figure-140: Côte d'Ivoire – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-141: Ghana – Condom Market (Million US$), 2016 – 2021

Figure-142: Ghana – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-143: Ghana – Condom Pieces Sold (Million), 2016 – 2021

Figure-144: Ghana – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-145: Guinea – Condom Market (Million US$), 2016 – 2021

Figure-146: Guinea – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-147: Guinea – Condom Pieces Sold (Million), 2016 – 2021

Figure-148: Guinea – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-149: Nigeria – Condom Market (Million US$), 2016 – 2021

Figure-150: Nigeria – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-151: Nigeria – Condom Pieces Sold (Million), 2016 – 2021

Figure-152: Nigeria – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-153: Senegal – Condom Market (Million US$), 2016 – 2021

Figure-154: Senegal – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-155: Senegal – Condom Pieces Sold (Million), 2016 – 2021

Figure-156: Senegal – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-157: Togo – Condom Market (Million US$), 2016 – 2021

Figure-158: Togo – Forecast for Condom Market (Million US$), 2022 – 2030

Figure-159: Togo – Condom Pieces Sold (Million), 2016 – 2021

Figure-160: Togo – Forecast for Condom Pieces Sold (Million), 2022 – 2030

Figure-161: Church & Dwight Co. Inc. – Global Revenue (Million US$), 2017 – 2021

Figure-162: Church & Dwight Co. Inc. – Forecast for Global Revenue (Million US$), 2022 – 2027

Figure-163: Reckitt Benckiser Group PLC. – Global Revenue (Million US$), 2017 – 2021

Figure-164: Reckitt Benckiser Group PLC. – Forecast for Global Revenue (Million US$), 2022 – 2027

Figure-165: Ansell Ltd – Global Revenue (Million US$), 2017 – 2021

Figure-166: Ansell Ltd – Forecast for Global Revenue (Million US$), 2022 – 2027

Figure-167: HLL Life care Ltd – Global Revenue (Million US$), 2017 – 2021

Figure-168: HLL Life care Ltd – Forecast for Global Revenue (Million US$), 2022 – 2027

List Of Tables:

Table-1: Africa – Condom Market Share by Material Type (Percent), 2016 – 2021

Table-2: Africa – Forecast for Condom Market Share by Material Type (Percent), 2022 – 2030

Table-3: Africa – Condom Market Share by Distribution Channel (Percent), 2016 – 2021

Table-4: Africa – Forecast for Condom Market Share by Distribution Channel (Percent), 2022 – 2030

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com